5G IoT Roaming Market Size 2024-2028

The 5G IoT roaming market size is forecast to increase by USD 4.39 billion, at a CAGR of 66.04% between 2023 and 2028.

- The market is experiencing significant growth, driven by the development of advanced wireless technologies and the emergence of private networks. These trends are enabling seamless connectivity for Internet of Things devices across different networks and geographies. However, the lack of standardization in IoT protocols poses a challenge to market growth. To address this issue, industry players are collaborating to establish common standards and interoperability frameworks. Additionally, the increasing adoption of edge computing and the integration of AI and machine learning technologies are expected to create new opportunities in the market. Overall, these factors are shaping the future growth trajectory of the market.

What will be the size of the 5G IoT Roaming Market During the Forecast Period?

- The market is experiencing significant growth as the global population of IoT devices continues to expand. Operators are seeking to provide seamless connectivity for IoT devices across borders through roaming agreements, enabling businesses to expand their reach and enhance their value proposition. Standalone 5G networks offer improved network functionality, including faster network speeds and reduced latency, making them ideal for supporting IoT roaming connections. Roaming models for 5G IoT devices vary, with some operators offering dedicated 5G roaming strategies while others leverage existing 4G networks. Network cores and roaming analytics tools, powered by AI, play a crucial role in optimizing network performance and reducing revenue leakage.

- As 5G becomes more prevalent, the importance of 5G IoT roaming will only grow, offering businesses increased flexibility and efficiency in managing their global IoT deployments. 5G roaming strategies provide a valuable business model for operators, enabling them to tap into new revenue streams while ensuring high-quality service for their customers. With the increasing number of IoT users, the demand for reliable and efficient roaming solutions is expected to remain strong.

How is this 5G IoT Roaming Industry segmented and which is the largest segment?

The 5g IoT roaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Consumer

- Enterprise

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By End-user Insights

- The consumer segment is estimated to witness significant growth during the forecast period.

The market refers to the ability for Internet of Things (IoT) devices to seamlessly connect and access associated services across multiple countries and mobile networks, even when moving out of their home network's geographical coverage area. This market encompasses Low Power Wide Area (LPWA) technologies such as LTE-M and NB-IoT. NB-IoT, with its low bandwidth range of up to 10 km, is ideal for devices installed in areas beyond the typical reach of cellular networks, such as indoors and deep indoors. Roaming agreements enable IoT subscribers to maintain connectivity using their service provider's SIM, ensuring uninterrupted access to IoT services.

Standalone 5G networks and network cores provide improved network functionality, including network performance, latency, and network speeds, enhancing the overall IoT user experience. Roaming models and 5G roaming strategies enable operators to minimize revenue leakage and optimize roaming analytics through AI and real-time data. Key verticals, including autonomous vehicles, fleet management, and M2M communications, benefit from the data-centric nature of 5G networks and the availability of platforms and network operators for reconciliation.

Get a glance at the 5G IoT Roaming Industry report of share of various segments Request Free Sample

The consumer segment was valued at USD 82.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

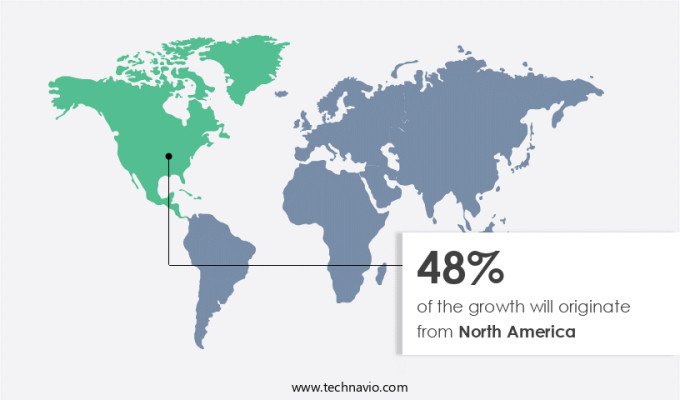

- North America is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America, specifically in the US and Canada, is experiencing significant growth due to the increasing adoption of wireless technologies in the US. With the US being a major market in the region, the telecom sector is anticipated to undergo substantial expansion during the forecast period. The demand for high-speed and high-bandwidth networks to manage the escalating data traffic is a primary driver for the growth of the market in North America. The region, particularly the US, is at the vanguard of technology adoption. This trend underscores the necessity of advanced network functionality, including network cores, network performance, and roaming agreements, to ensure seamless connectivity for IoT devices. Network operators are focusing on 5G roaming strategies, such as Standalone networks, to cater to the evolving demands of IoT users. The market's growth is further fueled by the data-centric nature of IoT applications in key verticals like autonomous vehicles, fleet management, and M2M communications.

Roaming revenues, a critical aspect of the market, are expected to increase due to real-time roaming analytics tools powered by AI and machine learning. Network operators are also focusing on reconciliation and SLAs to mitigate revenue leakage. Operators are exploring roaming/interconnect agreements and edge computing to enhance network performance and reduce latency for UHD Video streaming, AR/VR, and other data-intensive services. WiFi and public networks, in addition to 5G, are also playing a crucial role in providing connectivity to IoT devices. The market's business model is expected to evolve as the number of subscribers increases, with potential opportunities for OTTs and Telegram to enter the fray.

Market Dynamics

Our 5g IoT roaming market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the 5G IoT Roaming Industry?

The development of wireless technologies is the key driver of the market.

- The Internet of Things (IoT) market is witnessing significant growth as the global population of connected IoT devices continues to increase. The demand for IoT devices is driving the need for advanced wireless technologies, such as 5G, to support the increased data exchange rate among a vast number of connected devices. With its low latency and high-speed capabilities, 5G is becoming a key driver for IoT, enabling communication between data centers, mobile and IoT devices, and public or private cloud platforms. 5G networks offer several advantages for IoT roaming connections. They provide high network performance, ensuring reliable and consistent service for IoT users.

- Roaming agreements between network operators are essential for seamless connectivity across home markets and international borders. These agreements enable IoT devices to switch between networks while maintaining uninterrupted service. Network functionality, such as home network selection, International Roaming packs, and roaming operator selection, plays a crucial role in the IoT roaming market. Network cores, such as Home Location Register (HLR), Home Subscriber Server (HSS), and Interconnect Exchange (GRX), are essential components of roaming agreements. These network cores enable real-time roaming analytics tools, powered by AI, to optimize roaming revenue and reduce revenue leakage. Key verticals, such as fleet management, autonomous vehicles, UHD Video streaming, and M2M communications, are expected to benefit significantly from the deployment of 5G networks.

What are the market trends shaping the 5G IoT Roaming Industry?

The emergence of private networks is the upcoming market trend.

- The market is experiencing significant growth as home markets continue to value the proposition of roaming agreements with network operators for Standalone networks. These networks offer enhanced network functionality, including network cores, network speeds, and reduced latency, which are essential for IoT roaming connections. Roaming models, such as 5G Roaming Strategies, enable seamless connectivity for IoT users across different networks, providing a business model opportunity for operators to generate roaming revenue. Roaming analytics tools, including AI, are essential for network operators to manage and reconcile roaming data in real-time, ensuring service performance and minimizing revenue leakage.

- Key verticals, such as autonomous vehicles, fleet management, and M2M communications, require high-performance networks for real-time data processing and UHD Video streaming. Network operators must ensure SLAs, QoS, and AR/VR experiences for their subscribers, necessitating the need for roaming/interconnect agreements. Edge computing plays a crucial role in enhancing network performance, enabling IoT devices to process data locally and reducing the need for extensive roaming. WiFi and public networks also contribute to the 5G IoT roaming ecosystem, providing additional connectivity options for IoT devices. Overall, the market presents a significant opportunity for network operators to capitalize on the data-centric nature of IoT platforms and deliver innovative services to their customers

What challenges does the 5G IoT Roaming Industry face during its growth?

Lack of standardization in IoT protocols is a key challenge affecting the industry growth.

- The IoT roaming market is a significant aspect of the 5G era, enabling seamless connectivity for IoT devices as they travel across home markets and international borders. With the increasing number of IoT users and the data-centric nature of these devices, value proposition for roaming agreements between operators becomes crucial. Standalone networks and network functionality, including network cores, network speeds, and latency, are key considerations for IoT roaming connections. Roaming models, such as home network-based and international roaming packs, play a vital role in managing roaming revenue and preventing revenue leakage. 5G roaming strategies are essential for operators to provide optimal network performance and ensure service continuity for IoT devices.

- Roaming analytics tools, including AI and real-time data, help operators reconcile roaming data and maintain SLAs and QoS. Key verticals, including autonomous vehicles, fleet management, and M2M communications, require reliable and high-performance IoT roaming connections. Roaming/Interconnect agreements and edge computing platforms enable seamless integration of IoT devices across networks. Network operators must address the IoT interoperability challenge by facilitating communication between various devices, sensors, and remote server interfaces. Existing interoperability standards, such as MTConnect, MCS-DCS Interface Standardization (MDIS), Ethernet for Control Automation Technology (EtherCAT), Master Control System (MCS), Distributed Control System (DCS), and Interface Standardization, provide a foundation for data interchange across disparate domains and industries.

Exclusive Customer Landscape

The 5g iot roaming market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 5g iot roaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 5g IoT roaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AT and T Inc.

- China Mobile Ltd.

- Cisco Systems Inc.

- Deutsche Telekom AG

- Huawei Technologies Co. Ltd.

- Neoway Technology Co. Ltd

- Nokia Corp.

- Orange SA

- Quectel Wireless Solutions Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sierra Wireless Inc.

- SIMCom Wireless Solutions Ltd.

- SK Inc.

- Telefonaktiebolaget LM Ericsson

- Telefonica SA

- Telit

- Thales Group

- Verizon Communications Inc.

- Vodafone Group Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant growth opportunity for network operators and IoT device manufacturers alike. As the global population of connected devices continues to expand, the need for seamless and reliable roaming capabilities becomes increasingly crucial. In this context, 5G technology offers several advantages over previous generations, enabling faster network speeds, lower latency, and improved network functionality. The home markets for 5G IoT roaming are diverse, encompassing various industries and applications. The hi-tech communications sector, for instance, is expected to benefit significantly from the deployment of 5G networks due to the data-centric nature of its services. Autonomous vehicles, a key vertical in this sector, require real-time connectivity and low latency to ensure safe and efficient operations.

Further, network operators are exploring various strategies to capitalize on the market. One approach involves standalone networks, which offer dedicated infrastructure for IoT devices, ensuring optimal network performance and reducing revenue leakage. Another strategy is the implementation of roaming agreements, which allow IoT devices to connect to other networks when roaming internationally. The 5G roaming model presents unique challenges for network operators. Roaming agreements must be carefully managed to ensure seamless connectivity and interoperability between networks. Network cores, HLRs (Home Location Registers), HSSs (Home Subscriber Servers), IMSI (International Mobile Subscriber Identity), UE (User Equipment), GRX (Gateway Router), IPX (IP Exchange), SLAs (Service Level Agreements), QoS (Quality of Service), AR (Autonomous Response), and VR (Virtual Reality) are essential components of the roaming ecosystem that require careful consideration.

In addition, the market is expected to grow significantly in the coming years, driven by the increasing number of IoT users and the growing importance of roaming revenues for network operators. The market is also influenced by the adoption of roaming analytics tools, which enable operators to monitor and optimize their roaming performance in real-time. The market is not limited to traditional cellular networks. Wifi and public networks also play a role in providing connectivity for IoT devices, especially in densely populated areas. Subscribers expect seamless connectivity across all networks, creating a need for effective roaming/interconnect agreements between network operators. The market is a complex and dynamic ecosystem. Network operators must navigate a range of challenges, from managing roaming agreements to optimizing network performance and ensuring interoperability between networks.

|

5G IoT Roaming Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 66.04% |

|

Market Growth 2024-2028 |

USD 4.39 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

47.71 |

|

Key countries |

US, Japan, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 5G IoT Roaming Market Research and Growth Report?

- CAGR of the 5G IoT Roaming industry during the forecast period

- Detailed information on factors that will drive the 5G IoT Roaming Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 5g iot roaming market growth of industry companies

We can help! Our analysts can customize this 5g iot roaming market research report to meet your requirements.