Automotive Window Power Sunshade Market Size 2025-2029

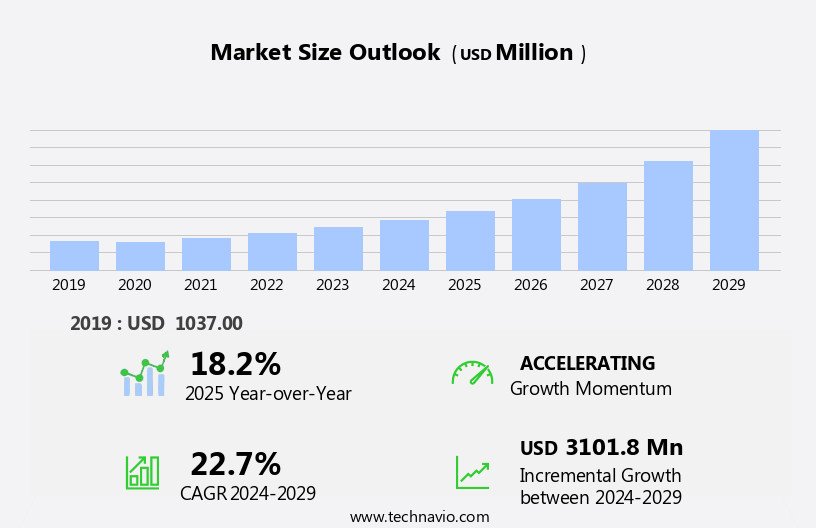

The automotive window power sunshade market size is forecast to increase by USD 3.1 billion at a CAGR of 22.7% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing demand for enhanced comfort and energy efficiency in vehicles. Automatic down retraction of sunshades upon reverse gear engagement is a key feature driving market expansion, as it optimizes heating, ventilation, and air conditioning (HVAC) system performance. However, reliability issues related to window power sunshades pose a challenge to market growth. Regulatory hurdles, such as stringent safety standards, also impact adoption, necessitating continuous innovation and investment in research and development. To capitalize on market opportunities and navigate challenges effectively, industry participants must focus on addressing these concerns through technological advancements and robust supply chain management. Power sunshades help regulate the temperature inside vehicles by blocking sunlight, thereby reducing the workload on the HVAC system.

- By prioritizing product reliability, regulatory compliance, and customer satisfaction, companies can differentiate themselves and seize the potential of this dynamic market. Another trend influencing market growth is the automatic down retraction of sunshades upon reverse gear engagement, ensuring passenger safety and convenience.

What will be the Size of the Automotive Window Power Sunshade Market during the forecast period?

- The market encompasses sunshade manufacturing, retailers, online sales, and distribution channels. Tinted windows, a key product within this industry, have gained popularity due to their heat rejection properties, contributing to vehicle comfort and energy efficiency. Solar film, a type of sunshade technology, is in high demand for its ability to block solar rays and improve interior cooling. Sunshade certification and safety standards are crucial in ensuring product quality and consumer safety. The sunshade industry growth is driven by increasing awareness of the benefits of sunshades, including improved vehicle comfort and energy savings. Sunshade functionality extends beyond temperature control, with design trends focusing on aesthetic appeal and innovation. Furthermore, the trend toward vehicle electrification and the rise of autonomous vehicles are driving demand for advanced power window motors.

- Sunshade technology advancements continue to shape the market, with new materials and manufacturing processes improving performance and sustainability. Window tinting and sunshade testing are essential components of the sunshade supply chain, ensuring compliance with regulations and maintaining high standards. Sunshade regulations and safety standards continue to evolve, reflecting the industry's commitment to innovation and consumer protection. The market is a critical component of passenger cars, enabling seamless glass platform movement with the push of a button.

How is this Automotive Window Power Sunshade Industry segmented?

The automotive window power sunshade industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Luxury passenger vehicle

- Mid-size passenger vehicle

- Product

- Conventional sunshade

- LCD sunshade

- Distribution Channel

- OEM

- Aftermarket

- Product Type

- Side window sunshades

- Rear window sunshades

- Windshield sunshades

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

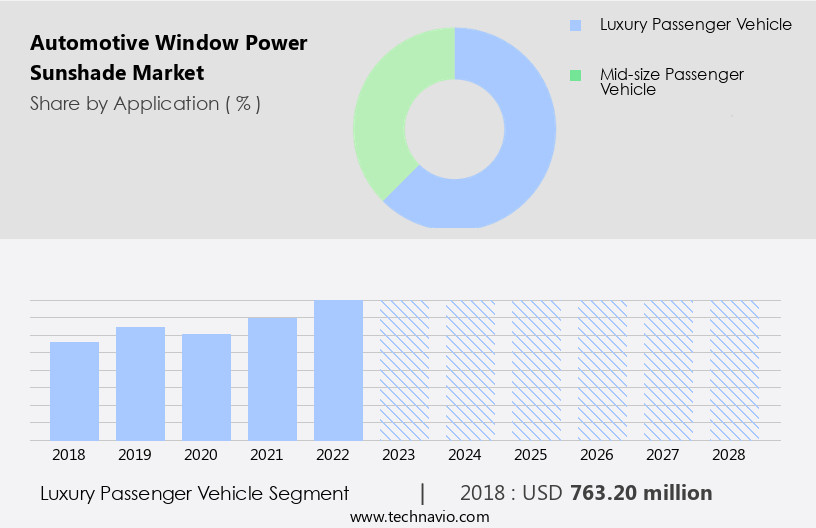

The luxury passenger vehicle segment is estimated to witness significant growth during the forecast period. In the automotive industry, luxury vehicles lead the market in advanced sunshade technology, with motorized sunshades becoming increasingly popular. These sunshades offer features such as remote control, automatic activation, and integration with temperature sensors and light sensors for optimal interior comfort. Sunshade sensors also ensure reliable operation and extend the lifespan of the shade. Rear window sunshades and side window sunshades are common in luxury vehicles, providing glare reduction and heat protection. Connected vehicles and autonomous vehicles are also integrating sunshade technology, enhancing passenger safety and convenience. Sunshade actuators and motors power these advanced systems, enabling automatic activation and retractability. Furthermore, the trend toward vehicle electrification and the rise of autonomous vehicles are driving demand for advanced power window motors.

While manual sunshades remain an option, electric and motorized sunshades offer convenience and added benefits. Sunshade cost is a factor for some buyers, but the value of improved comfort and convenience often outweighs the investment. In summary, the automotive sunshade market is evolving, with a focus on advanced technology, passenger safety, and interior comfort. Luxury vehicles continue to lead the way, setting trends and offering premium features, while sunshades for passenger cars cater to a wider audience with various customization options.

The Luxury passenger vehicle segment was valued at USD 872.10 billion in 2019 and showed a gradual increase during the forecast period. Sunroof sunshades and window sunshades are essential for maintaining interior comfort in various weather conditions. Sunshade materials, such as fabric and UV-protective films, offer varying benefits. Electric sunshades are gaining popularity due to their ease of use and durability. Sunshade customization and aftermarket installation options cater to individual preferences and vehicle aesthetics. Manufacturers invest in sunshade design and innovation, focusing on passenger safety, comfort, and convenience. OEM integration of sunshade control units and systems, such as ADAS, further enhances vehicle functionality. Heat protection and UV protection are crucial considerations for sunshades, especially in hybrid vehicles. Sunshade maintenance is essential to ensure proper functioning and longevity. These systems require semiconductors, switches, cables, gears, and other components, which are increasingly being sourced from lightweight materials such as composites, plastics, and rubber to reduce vehicle weight and improve fuel efficiency.

Regional Analysis

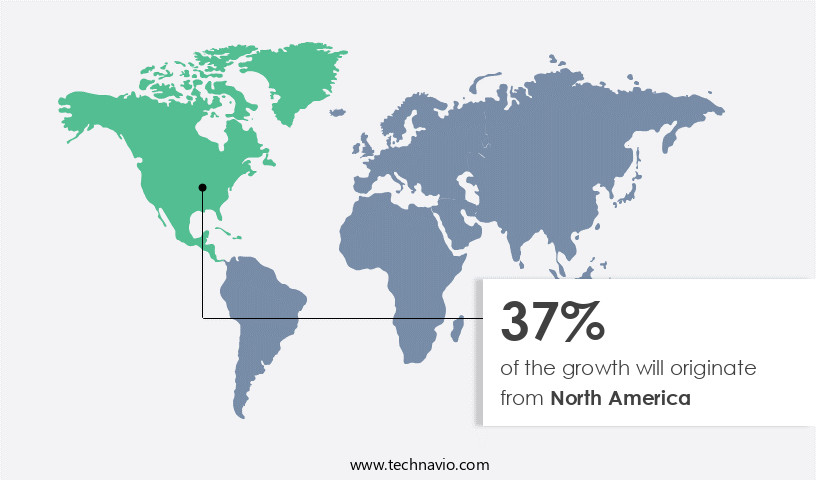

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. StartFragment The Automotive Window Power Sunshade Market is advancing with innovations in manual sunshade, retractable sunshade, and electric sunshade technologies. Vehicles integrate sunroof sunshade, rear window sunshade, and side window sunshade for enhanced comfort and UV protection. Motorized sunshade systems utilize precise sunshade control unit, sunshade actuator, and sunshade motor for automated operation. The selection of fabric material and shade material influences durability and aesthetics. Efficient sunshade installation ensures seamless integration into modern vehicle designs.

In the US market, the demand for automotive window power sunshades continues to escalate in 2024, fueled by consumers' preference for personal vehicles and the desire for comfort-enhancing technologies. Power sunshades contribute significantly to HVAC efficiency by blocking sunlight and reducing the burden on climate control systems. The luxury vehicle segment is a significant driver, with high disposable income consumers and seniors favoring premium vehicles. Government initiatives to bolster the automotive component industry further propel market expansion. Mexico's growing role as an automotive production hub in the Americas adds to regional growth. Sunshade technology advancements include motorized sunshades, remote control, automatic, and retractable options, as well as integration with connected vehicles, smart technology, and autonomous driving systems. Additionally, the integration of batteries into electric vehicles presents new opportunities for power window motor manufacturers.

Sunshade materials, such as fabric and UV-protective films, offer durability and heat protection. Hybrid vehicles and passenger cars also utilize electric sunshades for energy efficiency. OEM integration, customization, and aftermarket installation options cater to diverse consumer needs. Sunshade sensor technology, temperature sensors, and light sensors enable advanced automation and control. Market trends include increasing sunshade lifespan, reliability, and customization, as well as integration with ADAS systems for passenger safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Automotive Window Power Sunshade market drivers leading to the rise in the adoption of Industry?

- Window power sunshades significantly enhance HVAC (Heating, Ventilation, and Air Conditioning) system efficiency, making them a key market driver. Window power sunshades are gaining popularity in the automotive industry due to their ability to enhance interior comfort and reduce the need for excessive use of heating, ventilation, and air conditioning (HVAC) systems. These sunshades effectively block the sun's glare and heat transfer into the vehicle, thereby preserving a cooler and more comfortable interior environment. By minimizing the dependence on HVAC systems, these sunshades contribute to energy savings and cost reduction. Sunshade designs incorporate advanced features such as sunshade actuators, temperature sensors, and sunshade motors to provide automatic operation and optimal performance. Sunroof and side window sunshades are common applications of this technology.

- Connected vehicles are also integrating these sunshades to offer additional convenience and enhanced driving experience. The primary benefits of window power sunshades include improved interior comfort, glare reduction, and energy efficiency. These benefits contribute to a more enjoyable and comfortable driving experience for vehicle occupants. Additionally, the integration of advanced features such as sensors and automatic operation enhances the overall functionality and convenience of these sunshades. The automotive industry's shift towards vehicle electrification and automation further boosts the market's growth.

What are the Automotive Window Power Sunshade market trends shaping the Industry?

-

A key factor shaping the market growth is the growing popularity of power sunshades in sunroof applications. In the realm of modern automotive manufacturing, sunshades have emerged as a crucial component in enhancing comfort and energy efficiency for passengers. Ultraviolet (UV) rays, a significant concern for both drivers and passengers, are effectively mitigated through advanced sunshade systems. These innovations are driven by the fusion of electronics and technology in the automotive sector, particularly in luxury vehicles.

Moreover, the market encompasses a wide array of products, ranging from conventional roller/retractable and suction-cup designs to more sophisticated LCD sunshades. These sunshades are not only integral to providing comfortable car interiors but also contribute to fuel economy by reducing the workload on heating, ventilation, and air conditioning (HVAC) systems. Lightweight materials like aluminum, plastic, rubber, and composites are increasingly used to reduce vehicle weight and improve fuel efficiency. OEM collaboration plays a pivotal role in the growth of the sunshade market, with luxury passenger vehicle manufacturers and mid-size passenger vehicle providers increasingly integrating these systems into their offerings. Hence, such factors are expected to drive market growth during the forecast period.

How does Automotive Window Power Sunshade market faces challenges face during its growth?

- The reliability concerns surrounding window power sunshades represent a significant challenge to the industry's growth trajectory. The market encompasses advanced electronic components, including controller units, switches, and motors. As vehicles become increasingly reliant on electronic systems, the risk of faults and malfunctions in these units increases. Functional safety is a significant challenge for component manufacturers and tier-1 suppliers, as a fault in one unit can impact the entire system. For instance, some consumers using power sunshades have reported issues with the rear sunshade clicking when it reaches the top or bottom due to problems with the autosensing switch or switch detents. UV protection and customization are essential factors driving the demand for window power sunshades in passenger cars.

- Both manual and electric sunshades are available in the market, with electric sunshades gaining popularity due to their convenience. Sunshade durability is another crucial consideration for consumers, as these products are subjected to harsh environmental conditions. Furthermore, the use of 3D printers and advanced materials like composites is enabling the production of more durable and cost-effective window regulators. Aftermarket installation and customization are also prevalent in the market, catering to the unique needs of hybrid vehicles and passenger cars. Proper sunshade maintenance is essential to ensure their longevity and optimal performance.

Exclusive Customer Landscape

The automotive window power sunshade market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive window power sunshade market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive window power sunshade market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ashimori Industry Co. Ltd. - The company specializes in providing automotive window power sunshades, catering to both passenger cars and commercial vehicles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashimori Industry Co. Ltd.

- BOS GmbH and Co. KG

- CIE Automotive SA

- Eclipse SunShades

- Honda Motor Co. Ltd.

- Inalfa Roof Systems Group B.V.

- Inteva Products LLC

- KK Motors Inc.

- MACAUTO INDUSTRIAL Co. Ltd.

- Vaccess India Pvt. Ltd.

- Webasto SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Window Power Sunshade Market

- In January 2024, Magna International, a leading automotive supplier, introduced its new Electrically Operated Roll-up Sunshade (EORS) for commercial vehicles. This innovative sunshade system, which can be controlled via a smartphone app, aims to enhance driver comfort and reduce interior temperature (Magna International Press Release, 2024).

- In March 2024, Aptiv, a global technology company, completed the acquisition of Arilou Technologies, a leading provider of advanced driver assistance systems (ADAS) and smart glass solutions. This acquisition strengthened Aptiv's position in the automotive market by expanding its product portfolio and enhancing its capabilities in power sunshades and other smart glass technologies (Aptiv Press Release, 2024).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Smart technology integrations, such as light sensors and temperature sensors, enable sunshades to automatically respond to environmental conditions, enhancing interior comfort and glare reduction. Autonomous vehicles and connected cars are incorporating sunshades as essential features, ensuring passenger safety and convenience. Power sunshades, available in retractable and fixed options, offer versatility and customization for various vehicle types, including passenger cars, SUVs, and commercial vehicles. OEM integration and aftermarket installation options cater to diverse consumer needs and preferences. Retractable sunshades, with their sleek designs and seamless integration, have gained popularity for their aesthetic appeal.

Sunshade control units, offering remote control functionality, add to the convenience and ease of use. UV protection and heat insulation are additional benefits, making sunshades an essential component in vehicle comfort systems. Sunshade materials, ranging from fabric to polymer, are continually evolving to offer better durability, reliability, and cost-effectiveness. Market dynamics remain fluid, with ongoing research and development in sunshade automation, sunroof sunshades, side window sunshades, and shade actuators. Heat protection and ADAS system integration are emerging trends, as sunshades become more sophisticated and multifunctional. Sunshade maintenance and customization options further enhance their value, ensuring a long lifespan and optimal performance. Overall, the market continues to unfold, offering numerous opportunities for innovation and growth.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Window Power Sunshade Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.7% |

|

Market growth 2025-2029 |

USD 3.10 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

18.2 |

|

Key countries |

US, Canada, Germany, China, UK, France, Brazil, India, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Window Power Sunshade Market Research and Growth Report?

- CAGR of the Automotive Window Power Sunshade industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive window power sunshade market growth of industry companies

We can help! Our analysts can customize this automotive window power sunshade market research report to meet your requirements.