Autonomous Bus Market Size 2025-2029

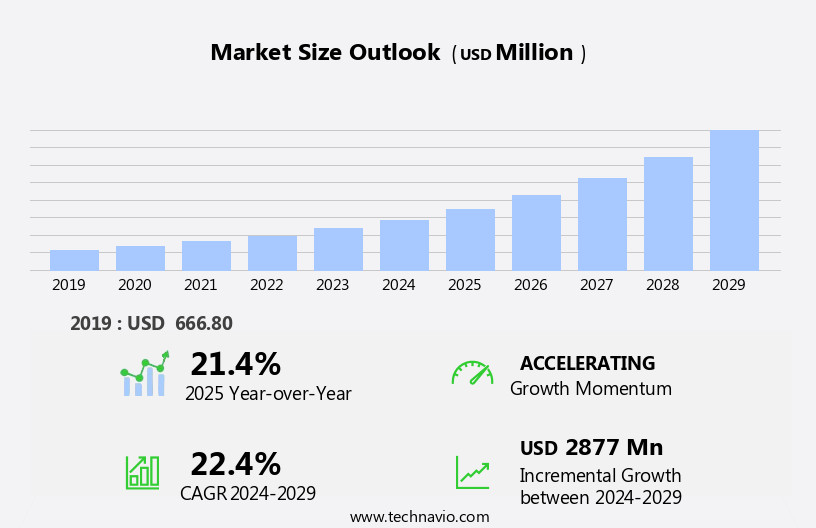

The autonomous bus market size is forecast to increase by USD 2.88 billion at a CAGR of 22.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing launch of new autonomous buses and the development of autonomous vehicle corridors. The number of autonomous buses in operation is on the rise, indicating a strong market demand. This trend is further fueled by the establishment of dedicated hybrid and autonomous vehicle corridors, which provide a safe and regulated environment for the deployment of these vehicles. However, the market also faces challenges, primarily in the form of cybersecurity threats. The input data highlights that autonomous buses are vulnerable to cyberattacks, which could compromise the safety and reliability of these vehicles.

- This issue poses a significant challenge for market players, requiring them to invest in robust cybersecurity measures to protect their systems and maintain consumer trust. Companies seeking to capitalize on the opportunities presented by the market must address these challenges effectively to ensure the safe and efficient deployment of their vehicles.

What will be the Size of the Autonomous Bus Market during the forecast period?

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Autonomous fleets are revolutionizing mass transit, with hybrid buses and electric vehicles leading the charge towards emission reduction and fuel efficiency. Route optimization and adaptive cruise control enable seamless passenger experience, while machine learning and sensor fusion enhance path planning and vehicle health monitoring. Autonomous driving is a key focus, with virtual testing and cloud computing facilitating the development of software-defined vehicles. Autonomous shuttle services and shared mobility solutions are gaining traction in urban mobility, addressing the last-mile delivery challenge. Regulatory frameworks are evolving to accommodate these innovations, with human-machine interface and passenger safety at the forefront.

- On-demand transportation and predictive maintenance are essential components of fleet management, ensuring optimal performance and passenger experience. Autonomous navigation and obstacle detection are critical safety standards, with emergency braking and vehicle-to-vehicle communication further enhancing safety. Public acceptance is a crucial factor, with passenger information systems and vehicle-to-infrastructure communication playing a role in building trust. Continuous testing and validation, deep learning, and artificial intelligence are driving improvements in performance and reliability. The market's dynamics are ever-changing, with ongoing deployment strategies and evolving patterns shaping the future of autonomous buses.

How is this Autonomous Bus Industry segmented?

The autonomous bus industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Semi-autonomous

- Fully-autonomous

- Propulsion

- Diesel

- Electric

- Hybrid

- End-user

- Public transportation

- Private shuttle services

- Logistics and goods transport

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

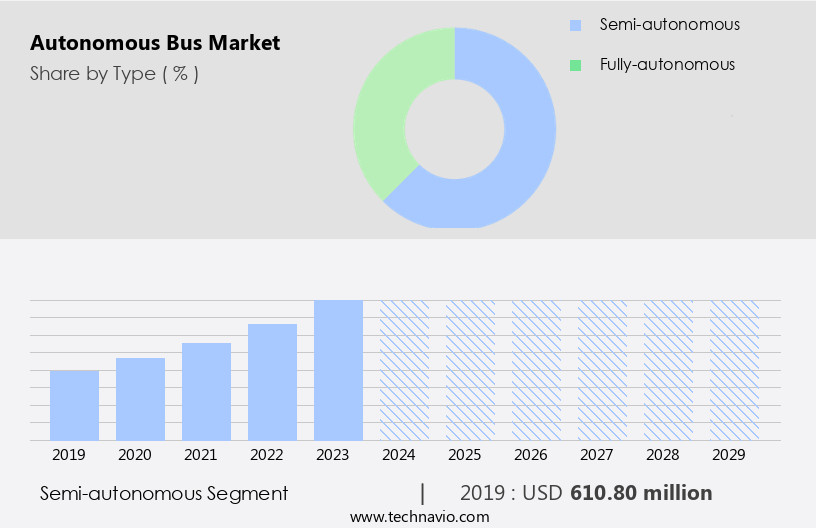

The semi-autonomous segment is estimated to witness significant growth during the forecast period.

The market encompasses the development and implementation of buses with advanced technologies, including lane keeping, user experience, hybrid buses, last-mile delivery, fuel efficiency, route optimization, passenger safety, mass transit, path planning, software-defined vehicles, adaptive cruise control, camera systems, shared mobility, emission reduction, urban mobility, edge computing, over-the-air updates, vehicle health monitoring, electric buses, corporate transportation, autonomous shuttle, sensor fusion, fleet management, school transportation, vehicle-to-vehicle communication, machine learning, deployment strategies, passenger capacity, autonomous driving, virtual testing, cloud computing, automated guided vehicle, public transportation, regulatory framework, human-machine interface, passenger experience, on-demand transportation, safety standards, testing and validation, deep learning, public acceptance, passenger information system, predictive maintenance, artificial intelligence, emergency braking, obstacle detection, shuttle services, vehicle-to-infrastructure communication, and data analytics.

The semi-autonomous segment, which includes buses with driving automation at Level 3 or below, as defined by the Society of Automotive Engineers (SAE), is currently dominating the market. The growth of this segment can be attributed to the reduced cost of operations and the increasing availability of infrastructure supporting Level 3 autonomy in public transportation. As a result, the semi-the market is anticipated to expand significantly during the forecast period.

The Semi-autonomous segment was valued at USD 610.80 billion in 2019 and showed a gradual increase during the forecast period.

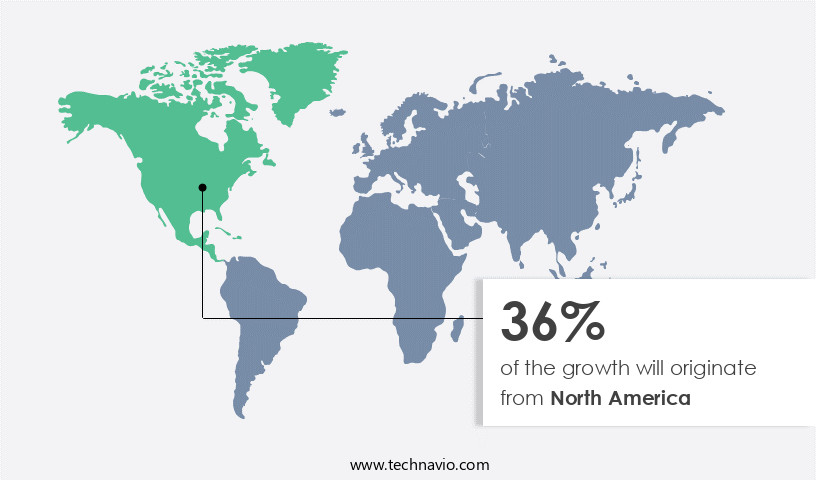

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is experiencing notable growth, driven by the presence of leading technology companies and collaborations in the field of vehicle autonomy. Autonomous fleet expansion, including buses, is a significant trend, with advancements in lane keeping, path planning, and sensor fusion. These technologies enhance user experience, improve fuel efficiency, and optimize routes for mass transit and last-mile delivery. Electric buses and shared mobility solutions, such as autonomous shuttle services, are also gaining traction due to their emission reduction capabilities and contribution to urban mobility. Moreover, the integration of edge computing, over-the-air updates, and vehicle health monitoring ensures fleet management efficiency and passenger safety.

Autonomous driving technologies, including adaptive cruise control, emergency braking, and obstacle detection, are crucial safety standards. Regulatory frameworks and testing and validation processes are essential for public acceptance and the successful deployment of autonomous buses. The market is further enriched by advancements in machine learning, deep learning, and artificial intelligence, which enable predictive maintenance and passenger information systems. Public transportation providers are adopting these technologies to enhance the overall passenger experience, ensuring a harmonious and immersive journey. Additionally, vehicle-to-vehicle and vehicle-to-infrastructure communication, data analytics, and automated guided vehicles are shaping the future of public transportation.

In conclusion, the market in the US is witnessing significant growth, fueled by technological advancements, collaborations, and the need for efficient, safe, and sustainable transportation solutions. The market's evolution is shaped by a focus on passenger experience, safety standards, and regulatory frameworks, ensuring a harmonious and immersive journey for passengers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Autonomous Bus Industry?

- The significant advancements in autonomous vehicle technology, particularly in the creation of dedicated corridors, are the primary catalyst fueling market growth.

- Autonomous buses are gaining momentum in the mass transit sector, with lane keeping technology and user experience at the forefront of their development. BYD and All Nippon Airways (ANA) recently conducted a successful ten-day trial run of an autonomous driving bus at Haneda Airport in Japan. This marks ANA's initiative to enhance airport transportation and is a global first for BYD, showcasing their autonomous bus in real-world scenarios. The bus, equipped with advanced features such as adaptive cruise control, camera systems, path planning software, and route optimization, offers improved fuel efficiency and passenger safety.

- The deployment of autonomous vehicle corridors facilitates the testing, development, and implementation of these innovative buses, contributing to the growth of the autonomous fleet market. Additionally, the integration of software-defined vehicles and hybrid buses in last-mile delivery services further enhances the market's potential.

What are the market trends shaping the Autonomous Bus Industry?

- The launch of new autonomous buses is a notable trend in the market. This increasing trend signifies a significant shift towards advanced public transportation solutions.

- The market is experiencing significant advancements, fueled by the growing emphasis on shared mobility and emission reduction in urban areas. Edge computing, sensor fusion, and vehicle-to-vehicle communication technologies are driving the development of autonomous buses. Electric buses are gaining popularity due to their environmental benefits and the integration of autonomous driving technology. Corporate transportation and school transportation sectors are increasingly adopting autonomous shuttles for cost-effective, efficient, and sustainable mobility solutions. Over-the-air updates and vehicle health monitoring systems ensure the continuous improvement of vehicle performance and safety. Fleet management systems enable operators to optimize routes, reduce downtime, and enhance passenger experience.

- These trends are expected to propel the growth of the market during the forecast period. For instance, recent developments include the launch of the UK's first full-sized self-driving bus as part of a government-backed initiative, and the operation of five autonomous buses in Edinburgh as part of a connected and autonomous vehicles experiment.

What challenges does the Autonomous Bus Industry face during its growth?

- The growth of the autonomous bus industry is significantly impacted by the escalating cybersecurity challenges, with potential threats posing potential risks to the safety and reliability of these vehicles.

- Autonomous buses, a subset of autonomous vehicles, employ machine learning algorithms and advanced sensors to ensure self-driving capabilities. Deployment strategies for these buses focus on enhancing passenger capacity and improving public transportation efficiency. Virtual testing and cloud computing facilitate the development and optimization of autonomous driving systems. However, the integration of these advanced technologies raises safety concerns, necessitating stringent regulatory frameworks. Passenger experience is a critical factor, with human-machine interface design playing a pivotal role in ensuring a harmonious and immersive experience.

- On-demand transportation is a significant trend, with autonomous buses offering potential solutions to traffic congestion and reduced environmental impact. Despite these benefits, cybersecurity remains a challenge due to the increased connectivity and computational requirements. Ensuring data security and system integrity is essential to mitigate potential risks. The market is poised for growth, with continued innovation in automated guided vehicle technology and safety standards.

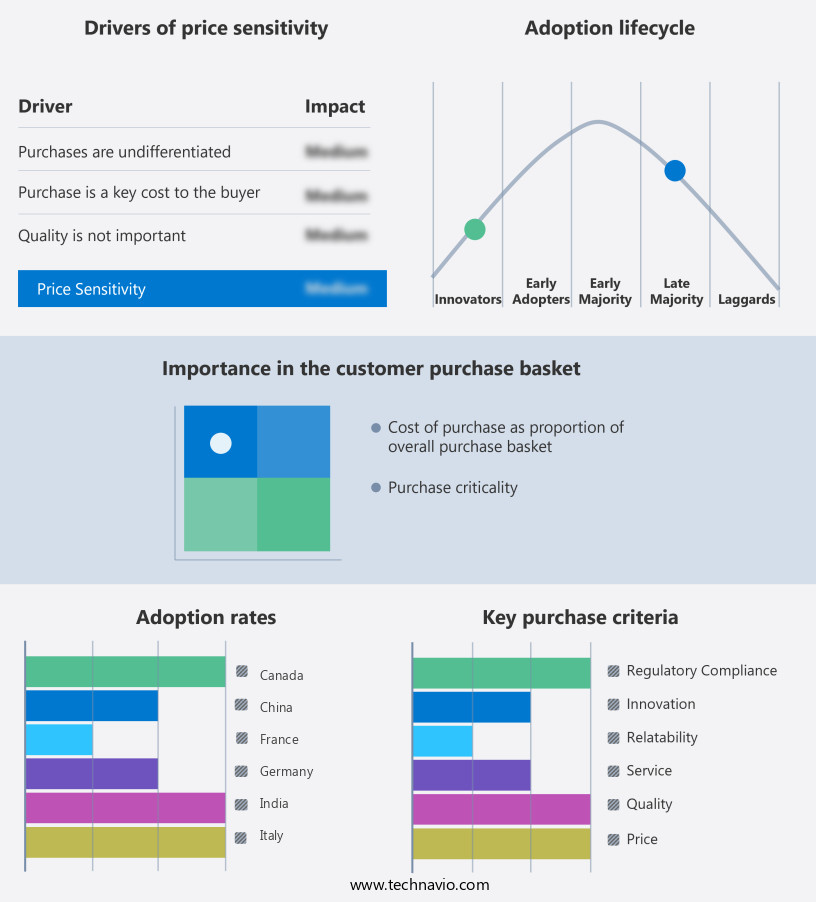

Exclusive Customer Landscape

The autonomous bus market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the autonomous bus market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, autonomous bus market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - The company introduces Volvo 7900 Electric buses, outfitted with advanced sensors and navigation controls. Powered by Volvo's Autonomous Research Platform, this AI system manages bus operations, ensuring safety and efficiency. Equipped with cutting-edge technology, these buses represent the future of public transportation. The comprehensive AI system processes real-time data, enabling the buses to navigate complex environments and adapt to various situations. With a commitment to innovation, the company continues to push the boundaries of autonomous transportation solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Aptiv Plc

- Aurrigo International plc

- Baidu Apollo Network Beijing Limited

- BYD Co. Ltd.

- Coast Autonomous Inc.

- Continental AG

- DeepBlue Technology Shanghai Co. Ltd.

- Easymile SAS

- Lilee Technology Inc.

- Mercedes Benz Group AG

- Navya SA

- NFI Group Inc.

- Proterra Inc.

- Robert Bosch GmbH

- Toyota Motor Corp.

- Transdev Group SA

- Xiamen King Long United Automotive Industry Co. Ltd.

- Yutong Bus Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Autonomous Bus Market

- In March 2024, TransDev, a leading mobility provider, announced the launch of the world's first autonomous electric bus line in the Netherlands, marking a significant stride in the integration of autonomous buses into public transportation systems (TransDev Press Release, 2024). In October 2024, Waymo, Alphabet's autonomous vehicle subsidiary, entered into a strategic partnership with Volvo Buses to integrate Waymo's self-driving technology into Volvo buses, expanding their reach beyond ride-hailing services (Waymo Press Release, 2024).

- In January 2025, NVIDIA, a leading technology company, secured a strategic investment of USD200 million from SoftBank Vision Fund 2 to accelerate the development and deployment of its autonomous driving platform, Drive AGX (NVIDIA Press Release, 2025). In May 2025, the European Union announced a â¬2.5 billion (USD2.8 billion) investment in autonomous bus projects, aiming to make Europe a global leader in autonomous public transportation (European Commission Press Release, 2025). These developments underscore the growing momentum in the market, driven by technological advancements, strategic partnerships, and significant investments.

Research Analyst Overview

In the realm of urban planning, the integration of autonomous buses into transportation systems is a significant trend. The development of autonomous vehicle technology relies heavily on big data and advanced sensor suites to ensure safe and efficient operation. Autonomous vehicle infrastructure, including smart cities and connected vehicles, plays a crucial role in enabling real-time information exchange and data-driven decision making. The future of transportation lies in the fusion of autonomous vehicle development and smart infrastructure. Autonomous vehicle simulation and open source software enable continuous improvement and innovation in this field. The reduction of carbon footprint is a key consideration, as the transportation sector contributes significantly to global emissions.

Autonomous vehicle platforms, including hardware and software, are essential components of the mobility ecosystems. Geospatial data and traffic management systems facilitate seamless integration of autonomous buses into urban transportation networks. The Internet of Things and clean energy are integral to the development of sustainable transportation solutions. AV testing and infrastructure development are ongoing processes that require collaboration between various stakeholders. Autonomous vehicle simulation and smart infrastructure enable efficient testing and optimization of AV technology. Infrastructure development, including sensor data and real-time information, is essential for ensuring safe and efficient AV operation. The integration of autonomous buses into urban transportation systems represents a major shift towards sustainable and efficient mobility solutions.The future of transportation is data-driven, and the development of AV infrastructure and technology is a critical component of this transition.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Autonomous Bus Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.4% |

|

Market growth 2025-2029 |

USD 2877 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

21.4 |

|

Key countries |

US, Canada, China, Japan, India, Germany, South Korea, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Autonomous Bus Market Research and Growth Report?

- CAGR of the Autonomous Bus industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the autonomous bus market growth of industry companies

We can help! Our analysts can customize this autonomous bus market research report to meet your requirements.