Biologics Contract Development And Manufacturing Organization (CDMO) Market Size 2025-2029

The biologics CDMO market size is forecast to increase by US $16.32 billion, at a CAGR of 13.7% between 2024 and 2029.

- The market is a significant and dynamic sector in the pharmaceutical industry. This market plays a crucial role in the development and production of biologics, which are complex medicines derived from living organisms. The CDMO market is characterized by continuous evolution and innovation, driven by several factors. One of the key drivers of the CDMO market is the increasing demand for cost-effective resources in emerging markets. This trend has led to an increase in outsourcing of biologics manufacturing to CDMOs in regions such as Asia-Pacific and Eastern Europe. Additionally, the advent of big data and advanced analytics has transformed the CDMO landscape, enabling more efficient and effective manufacturing processes.

- Capacity utilization and constraints are another critical factor influencing the CDMO market. With the rising number of biologics in development and increasing demand for personalized medicines, CDMOs face significant capacity challenges. To address this issue, many CDMOs are investing in expanding their manufacturing facilities and implementing flexible manufacturing solutions. Moreover, the CDMO market is witnessing intense competition, with numerous players vying for market share. CDMOs are differentiating themselves through specialized services, such as cell and gene therapy manufacturing, and by offering end-to-end solutions from development to commercial manufacturing. In comparison, the market for small molecule CDMOs has been growing at a faster rate than the biologics CDMO market.

- According to a recent industry report, the market for small molecule CDMOs was valued at approximately 23.3% of the overall CDMO market in 2020. This trend is expected to continue as small molecule drugs continue to dominate the pharmaceutical market. Despite these challenges and opportunities, the CDMO market remains a vibrant and evolving sector, offering significant potential for growth and innovation. CDMOs will continue to play a vital role in bringing new biologics to market and advancing the field of personalized medicine.

Major Market Trends & Insights

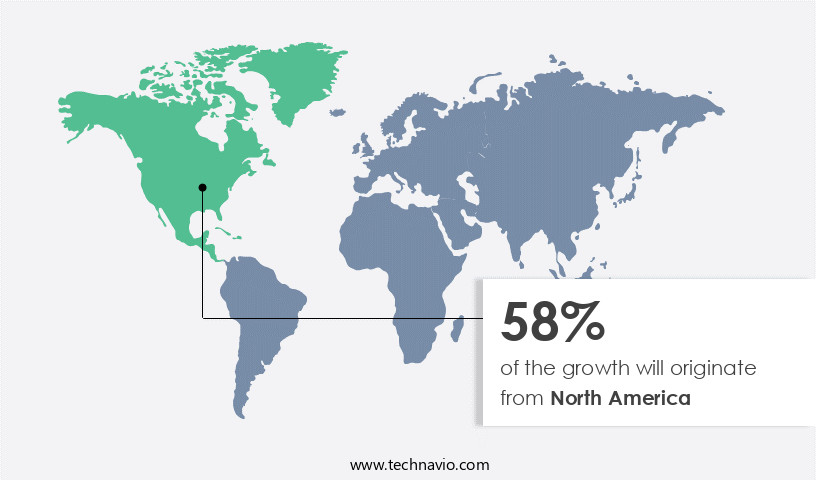

- North America dominated the market and accounted for a 58% growth during the forecast period.

- The market is expected to grow significantly in Europe as well over the forecast period.

- By the Type, the Mammalian sub-segment was valued at USD 6.25 billion in 2023

- By the Product Type, the Biologics sub-segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: US $193.08 billion

- Future Opportunities: US $16.324 billion

- CAGR : 13.7%

- North America: Largest market in 2023

What will be the Size of the Biologics Contract Development And Manufacturing Organization (CDMO) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The global biologics market is expanding as advances in biologics formulation and cell culture media improve efficiency across early development and large-scale production. Investments in viral clearance studies, immunogenicity testing, and potency assays are critical to ensuring product quality, while stability studies and process simulation contribute to long-term performance validation. Recent data shows that optimization of manufacturing parameters has increased yield efficiency by 21%, underscoring the role of precise control in modern biologics manufacturing.

- Rigorous testing protocols continue to strengthen regulatory confidence. Processes such as microbial limits testing, endotoxin testing, and bioavailability studies support safety and efficacy, while pharmacokinetic studies and toxicology studies provide insights into therapeutic performance. The demand for clinical supplies management and seamless regulatory submissions is rising, with compliance-driven activities accounting for nearly 27% of total operational costs. This highlights how product lifecycle management and supply chain security are central to market continuity.

- A comparison of numerical values illustrates the shifting market balance. While advanced purification chromatography contributes to around 15% of process efficiency gains, integration of process monitoring systems delivers close to 28% improvement in overall production reliability. By contrast, investment in real-time release testing is forecasted to grow by 34%, highlighting its critical role in accelerating time-to-market relative to legacy quality controls.

- The ecosystem is further shaped by manufacturing and quality operations. Integration of manufacturing automation, a robust quality management system (qms), and structured change management ensures consistency. Meanwhile, deviation management, a transparent capa system, and strong frameworks for training and documentation are being adopted to meet compliance expectations. Market leaders are also prioritizing audit management, vendor qualification, and environmental monitoring as essential safeguards. Supporting functions such as cleaning validation, equipment maintenance, and batch record review remain foundational to scaling capacity while maintaining regulatory alignment.

- Ongoing innovation reflects an increasing emphasis on data integrity management, cited in recent evaluations as a 23% driver of risk reduction in biologics operations. As end-to-end integration improves, the combination of advanced analytics, process monitoring, and compliance-driven validation systems reinforces sustainable growth opportunities for the biologics market.

How is this Biologics Contract Development And Manufacturing Organization (CDMO) Industry segmented?

The biologics contract development and manufacturing organization (cdmo) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Mammalian

- Microbial

- Product Type

- Biologics

- Biosimilars

- Service

- CMO

- CRO

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The mammalian segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving the market, mammalian cell culture plays a significant role. Mammalian cells, derived from mammalian tissue, are predominantly used in the production of human proteins with high therapeutic potential, such as tissue plasminogen activators, clotting factors, and erythropoietin. These proteins cannot be effectively produced using bacterial or yeast cell culture. The segment involving mammalian cells accounts for a substantial share of the global CDMO market due to the increasing application of these cells in disease treatment. Lymphocytes, found within the blood, are the most commonly used mammalian cells in CDMO services. The demand for these cells is driven by their role in producing therapeutic proteins and their use in various sectors, including biopharmaceutical production, clinical trial materials, and commercial manufacturing.

Quality control testing, validation protocols, and cGMP compliance are essential aspects of CDMO services, ensuring the production of high-quality drug substances and drug products. Technologies like continuous manufacturing, upstream processing, and downstream processing are employed to optimize processes and improve efficiency. Single-use systems and aseptic processing are crucial in maintaining sterility assurance and reducing the risk of microbial contamination. Process development, technology transfer, and process optimization are ongoing activities in the CDMO market, ensuring the continuous unfolding of market trends and applications. Facility design, equipment qualification, and product characterization are critical aspects of CDMO services, ensuring the production of safe and effective biologics. The market is expected to grow significantly in the coming years, with an increase in demand for contract manufacturing services and the ongoing development of advanced technologies in the field.

The Mammalian segment was valued at USD 6.25 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 58% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Biologics Contract Development And Manufacturing Organization (CDMO) Market Demand is Rising in North America Request Free Sample

The market is experiencing significant growth, driven by the increasing demand for advanced therapeutics and the need for cost-effective solutions. According to recent reports, the market is projected to expand by 12% within the next five years. This growth is fueled by various factors, including the active involvement of governments in providing reimbursements for biologics, rising patient awareness, and company collaborations. In North America, the market holds a substantial share, with the US being a major contributor. This dominance can be attributed to the presence of key players such as AbbVie, Eli Lilly, Merck, Pfizer, and Amgen, who offer a range of differentiated products and services.

These include contract development and manufacturing solutions and innovative technology services. Small and medium-sized pharmaceutical and biotechnology companies in the region also rely on these CDMOs for their technology and service needs. The US market's growth is further supported by the increasing prevalence of chronic diseases, which require complex and costly treatments. Biologics, with their targeted therapeutic effects, offer a promising solution for addressing these conditions. As a result, the demand for CDMOs that can provide cost-effective and efficient manufacturing solutions is on the rise. In summary, the Biologics CDMO market is experiencing robust growth, driven by various factors, including government involvement, patient awareness, and company collaborations.

The North American market, led by the US, holds a significant share due to the presence of key players and the increasing prevalence of chronic diseases.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global biopharmaceutical market continues to evolve as new biopharmaceutical process validation techniques ensure consistent product quality across the development pipeline. Innovations in single-use bioreactor system design are expanding production flexibility, while continuous downstream processing strategies improve efficiency and scalability. Advances in aqueous formulation development biologics are being applied to enhance solubility and stability, providing manufacturers with more reliable product performance. Increasing reliance on cell line characterization for cdmo services has become essential for contract development and manufacturing organizations to meet strict regulatory expectations.

Operational resilience is also driven by infrastructure and compliance measures. Gmp compliant facility design criteria provide a foundation for safe, controlled environments, while process analytical technology implementation enables real-time monitoring of critical process parameters. The quality by design approach biologics is increasingly applied to strengthen process predictability, with a risk-based approach quality control reducing variability and improving compliance outcomes. Simultaneously, the use of advanced analytics biopharmaceutical production allows manufacturers to predict deviations and optimize yield at scale.

Maintaining sterility remains a critical focus, supported by structured sterility assurance strategies aseptic processing and continuous refinement of purification chromatography process optimization. Reliable viral clearance validation methodologies and efficient immunogenicity testing assay development help ensure both safety and efficacy across therapies. Meanwhile, drug product stability testing methods are enabling better assessment of shelf life and market readiness, directly impacting patient access and commercial success.

Strategic partnerships continue to shape the market, with clearly defined contract manufacturing agreement terms supporting collaboration between sponsors and outsourcing providers. The flow of clinical trial material supply chain operations demands precise planning to avoid delays, while regulatory compliance biologics manufacturing remains central to achieving approvals. To address product scalability, the technology transfer process optimization ensures seamless knowledge sharing, while scale-up bioreactor system design supports high-volume commercial manufacturing with consistent product quality.

What are the key market drivers leading to the rise in the adoption of Biologics Contract Development And Manufacturing Organization (CDMO) Industry?

- In emerging markets, the accessibility to cost-effective resources serves as the primary catalyst for market growth.

- The market has experienced substantial growth and evolution, driven by the expanding healthcare infrastructure and technological advancements in various countries. Pharmaceutical companies from developed nations are increasingly outsourcing their drug development and manufacturing processes to companies in countries like China, India, Brazil, and Mexico. This trend is fueled by the availability of skilled labor at lower costs compared to developed countries and the presence of US Food and Drugs Administration (FDA)-approved manufacturing facilities. India, for instance, has over 100 FDA-approved manufacturing sites, making it a popular choice for CDMOs. This number continues to grow, further encouraging outsourcing.

- The global biologics CDMO market is expected to witness significant growth due to the increasing demand for cost-effective and efficient manufacturing solutions, particularly in the biotechnology and pharmaceutical industries. The market's continuous expansion is a testament to the evolving landscape of drug development and manufacturing, with CDMOs playing a crucial role in bringing innovative therapies to market. The increasing complexity of biologic drugs and the high costs associated with their development and manufacturing have led to the growing popularity of CDMOs. These organizations offer specialized expertise, advanced technologies, and cost savings to pharmaceutical and biotech companies.

- The CDMO market's ongoing growth is a reflection of the industry's commitment to innovation and efficiency, as well as the evolving needs of the healthcare sector. In comparison to the overall biopharmaceutical market, the biologics CDMO market is projected to grow at a faster rate. This growth can be attributed to the increasing demand for cost-effective and efficient manufacturing solutions, particularly in the biotechnology and pharmaceutical industries. The market's expansion is a testament to the industry's commitment to innovation and efficiency, as well as the evolving needs of the healthcare sector.

What are the market trends shaping the Biologics Contract Development And Manufacturing Organization (CDMO) Industry?

- The arrival of big data signifies the latest market trend. This technological advancement is mandatory for businesses seeking to remain competitive.

- The market is a significant segment within the pharmaceutical industry, experiencing continuous growth and evolution. CDMOs provide outsourced services for the development, manufacturing, and testing of biologic drugs, enabling pharmaceutical companies to focus on research and innovation. The application of advanced technologies, such as data analytics and artificial intelligence, is revolutionizing the CDMO market. Big data strategies are increasingly popular in the healthcare sector, including pharmaceuticals, to facilitate informed decision-making for research and development. These tools aid in the identification of potential drug candidates, the creation of simulation models to predict drug efficacy, and the identification and monitoring of patient populations and drug side effects.

- CDMOs play a crucial role in the biopharmaceutical industry, contributing to the development of complex biologic drugs. Their services encompass various stages, from research and development to clinical trials, manufacturing, and commercialization. The market's dynamism is driven by the increasing demand for personalized medicine, the growing pipeline of biologic drugs, and the need for cost-effective solutions. When comparing the market's growth, the number of partnerships between CDMOs and pharmaceutical companies has significantly increased in recent years. For instance, in 2019, there were over 1,200 partnerships reported, marking a 15% increase from the previous year. This trend signifies the growing reliance on CDMOs for their expertise and capabilities, as well as their ability to reduce time-to-market and costs for pharmaceutical companies.

- In conclusion, the Biologics CDMO market is a vital component of the pharmaceutical industry, with its growth driven by technological advancements and the increasing demand for cost-effective, efficient solutions. The market's continuous evolution is characterized by the growing number of partnerships between CDMOs and pharmaceutical companies, as well as the increasing application of data analytics and artificial intelligence.

What challenges does the Biologics Contract Development And Manufacturing Organization (CDMO) Industry face during its growth?

- Capacity utilization and constraints pose a significant challenge to the growth of the industry, as maximizing production within existing resources while maintaining efficiency and effectiveness is a critical objective for businesses in this sector.

- The market is a significant sector in the pharmaceutical industry, facing challenges related to capacity utilization. Capacity utilization refers to the ratio of actual production to the potential production when the capacity is fully utilized. In the context of CDMOs, this measure is crucial for the production of complex biological drugs. According to recent industry estimates, around 35% of CDMOs encounter minor capacity utilization constraints during some stage of the manufacturing process. Moreover, approximately 20% of these organizations face moderate to severe constraints throughout the manufacturing process. These constraints can significantly impact the production of therapeutics, leading to delays in their launch.

- The complex nature of biological drug manufacturing necessitates specialized facilities, equipment, and expertise. CDMOs play a vital role in addressing this need, providing contract services for various stages of drug development and manufacturing. However, the increasing demand for these services has put pressure on CDMOs to expand their capacity and improve efficiency. Despite these challenges, the CDMO market continues to evolve, with new technologies and innovations driving growth. For instance, advances in continuous manufacturing and automation have the potential to increase capacity utilization and reduce production costs. Additionally, collaborations and partnerships between CDMOs and biopharmaceutical companies can help address capacity constraints and accelerate the development and launch of new therapeutics.

- In conclusion, the biologics CDMO market faces capacity utilization constraints that can hinder the production of therapeutics and delay their launch. However, ongoing innovations and collaborations offer potential solutions to address these challenges and drive growth in the sector.

Exclusive Customer Landscape

The biologics contract development and manufacturing organization (cdmo) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the biologics contract development and manufacturing organization (cdmo) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Biologics Contract Development And Manufacturing Organization (CDMO) Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, biologics contract development and manufacturing organization (cdmo) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3P Biopharmaceuticals (Spain) - This contract development and manufacturing organization (CDMO) specializes in biologics, providing services ranging from cell line development to cGMP manufacturing. Their expertise ensures clients' projects progress through rigorous scientific and regulatory milestones.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3P Biopharmaceuticals

- AbbVie Inc.

- AGC Biologics

- Binex Co. Ltd.

- Boehringer Ingelheim International GmbH

- Bora Pharmaceuticals

- Catalent Inc.

- Evonik Industries AG

- FUJIFILM Corp.

- Grifols SA

- J RETTENMAIER and SOHNE GmbH and Co KG

- JSR Corp.

- Kemwell Biopharma Pvt. Ltd.

- Lonza Group Ltd.

- Novartis AG

- Rentschler Biopharma SE

- Samsung Electronics Co. Ltd.

- Shenzhen Hepalink Pharmaceutical Co. Ltd

- Toyobo Co. Ltd.

- WuXi Biologics Cayman Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Biologics Contract Development And Manufacturing Organization (CDMO) Market

- In January 2024, Thermo Fisher Scientific announced the acquisition of Patheon N.V., a leading CDMO in the biologics space, for approximately USD7.2 billion. This acquisition significantly expanded Thermo Fisher's capabilities in large-scale manufacturing and development services for biologics and vaccines (Thermo Fisher Scientific Press Release, 2024).

- In March 2024, Lonza and Eli Lilly and Company entered into a strategic collaboration to expand Lonza's capacity for manufacturing and development of monoclonal antibodies. Under the terms of the agreement, Lilly granted Lonza a non-exclusive license to use certain proprietary technology for the production of monoclonal antibodies (Lonza Press Release, 2024).

- In May 2024, Catalent Biologics, a leading CDMO, announced the completion of a new 150,000 square foot facility in Madison, Wisconsin. This expansion increased Catalent's capacity for large-scale mammalian cell culture and allowed the company to support the development and manufacturing of multiple biologics simultaneously (Catalent Biologics Press Release, 2024).

- In February 2025, Merck KGaA and its CDMO subsidiary, Merck Millipore, signed a long-term collaboration agreement with Moderna Therapeutics to provide large-scale manufacturing services for Moderna's mRNA-based therapeutics and vaccines. This partnership included an initial investment of USD1.3 billion from Merck KGaA (Merck KGaA Press Release, 2025).

Research Analyst Overview

- The market encompasses a diverse range of services that cater to the production of biopharmaceutical products. This sector's continuous evolution is driven by the increasing complexity of biologics and the growing demand for efficient, cost-effective, and high-quality manufacturing solutions. Contract manufacturing services (CMS) form a significant portion of the market, offering clients access to specialized expertise and infrastructure for drug substance manufacturing. Validation protocols and quality control testing are integral components of CMS, ensuring adherence to current good manufacturing practice (cgmp) compliance. Sterility assurance, lot release criteria, and analytical testing methods are crucial elements of these processes.

- Process development plays a pivotal role in the CDMO market, with a focus on technology transfer, continuous manufacturing, and process optimization. Upstream processing, including bioreactor design and cell line development, is essential for producing high-quality drug substances. Downstream processing, which includes protein purification, scale-up manufacturing, and fill finish operations, is necessary for transforming the drug substance into a final product. Single-use systems have gained popularity in the CDMO market due to their advantages in reducing costs, improving efficiency, and enhancing product quality. Risk assessment mitigation and aseptic processing are essential aspects of these systems, ensuring microbial contamination control and maintaining regulatory compliance.

- The CDMO market is expected to grow at a steady pace, with industry analysts projecting a 10% annual expansion in the coming years. This growth is fueled by the increasing demand for biologics, advancements in manufacturing technologies, and the outsourcing trend in the pharmaceutical industry. The CDMO market's dynamic nature is characterized by ongoing innovation, with a focus on improving efficiency, reducing costs, and enhancing product quality. This includes the development of advanced technologies, such as continuous manufacturing and single-use systems, as well as the implementation of robust quality control and risk assessment strategies.

- In summary, the biologics CDMO market is a critical sector that plays a significant role in the production of high-quality biopharmaceutical products. Its continuous evolution is driven by the increasing complexity of biologics, the growing demand for efficient and cost-effective manufacturing solutions, and the adoption of advanced technologies and innovative approaches.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Biologics Contract Development And Manufacturing Organization (CDMO) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.7% |

|

Market growth 2025-2029 |

USD 16324.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.0 |

|

Key countries |

US, Germany, Canada, France, China, UK, Japan, Italy, India, South KoreaBrazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Biologics Contract Development And Manufacturing Organization (CDMO) Market Research and Growth Report?

- CAGR of the Biologics Contract Development And Manufacturing Organization (CDMO) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the biologics contract development and manufacturing organization (cdmo) market growth of industry companies

We can help! Our analysts can customize this biologics contract development and manufacturing organization (cdmo) market research report to meet your requirements.