Boron Nitride Market Size 2025-2029

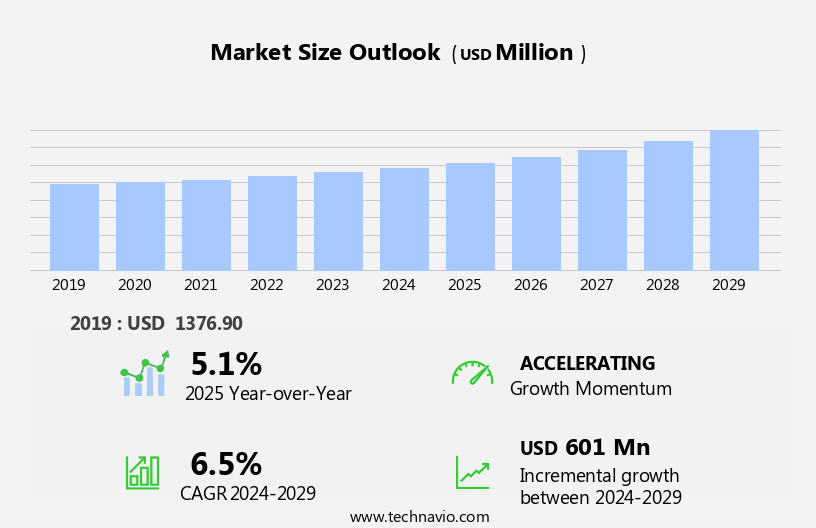

The boron nitride market size is forecast to increase by USD 601 million, at a CAGR of 6.5% between 2024 and 2029.

The market is experiencing significant growth due to the increasing demand for electronics and semiconductors. This trend is driven by the continuous advancements in technology and the growing need for miniaturization and high performance in electronic devices. Another key factor fueling market growth is the shift toward sustainable and eco-friendly materials. Boron Nitride, with its unique properties, such as high thermal conductivity, electrical insulation, and chemical inertness, is an ideal candidate for replacing traditional materials in various industries. However, the high cost of hexagonal boron nitride remains a challenge for market growth. Despite this, the potential applications of Boron Nitride in various industries, including electronics, energy, and healthcare, are vast, making it a promising market for investors and manufacturers.

What will be the Size of the Boron Nitride Market During the Forecast Period?

- The market is experiencing significant growth due to its unique properties and applications in various industries. Boron Nitride, a high-performance ceramic, offers exceptional corrosion resistance, making it an ideal choice for machining and tooling in harsh environments. In the realm of future technology, Boron Nitride is utilized in high-frequency applications, such as CBN powder for semiconductor packaging and 3D printing of high-temperature coatings. As an electrical insulator, Boron Nitride is essential In the manufacturing of high-performance ceramics, semiconductors, and advanced materials. Its high dielectric strength and electrical insulation properties make it indispensable In the semiconductor industry, while its electrical conductivity is crucial in high-frequency electronics.

- Boron Nitride nanomaterials are revolutionizing material science with their superior thermal stability, optical properties, and wear resistance. These nanomaterials are increasingly used in energy storage, orthopedic surgery, and bio-compatible materials, providing enhanced performance and efficiency. The versatility of Boron Nitride extends to its applications in industrial automation, friction reduction, and surface engineering. Its role as a high-performance ceramic and advanced material in various industries continues to evolve, driven by the ongoing pursuit of energy efficiency, chemical stability, and advanced manufacturing processes.

How is this Boron Nitride Industry segmented and which is the largest segment?

The boron nitride industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- Electronics

- Aerospace

- Metallurgy

- Others

- Type

- Hexagonal

- Cubic

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

Boron nitride (BN), a synthetic ceramic material composed of boron and nitrogen atoms in a hexagonal lattice structure, is gaining significance In the automotive industry, particularly In the context of electric vehicles (EVs). This advanced material offers unique properties such as high thermal conductivity, electrical insulation, and chemical inertness, making it an essential component in various automotive applications. In the automotive sector, BN is extensively used as a thermally conductive filler in various plastic components, including encapsulation resins, thermal interface materials (TIMs), and thermoplastic composites. By enhancing the thermal management of these components, BN contributes to the improved performance and longevity of electronic systems within vehicles. Boron nitride's unique properties make it a valuable addition to the electronics sector, where energy-efficient gadgets, nozzles, and refractory materials require superior thermal conductivity and insulation properties.

Get a glance at the Boron Nitride Industry report of share of various segments Request Free Sample

The automotive segment was valued at USD 380.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

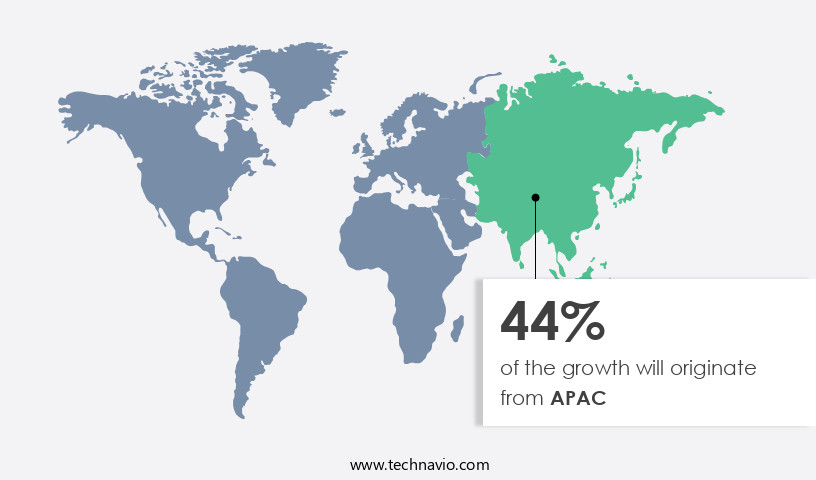

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific (APAC) region is a significant contributor to The market, driven by industrial advancements and a strong manufacturing sector. According to the UN Industrial Development Organization (UNIDO), Asia accounted for approximately half of the world's manufacturing value-added in 2022. China, as the world's largest manufacturing hub, accounted for nearly 40% of China's gross domestic product (GDP) in 2023. This industrial base supports various applications for boron nitride, particularly in electronics, automotive, and aerospace industries. Boron nitride-based nanomaterials are used in various sectors due to their high thermal conductivity, making them suitable for applications in spacecraft, drug delivery systems, protective coatings, and nanotechnology.

Market Dynamics

Our boron nitride market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Boron Nitride Industry?

Increasing demand for electronics and semiconductors is the key driver of the market.

- The market is witnessing notable expansion, primarily driven by the escalating demand In the electronics and semiconductor sectors. Cubic boron nitride (c-BN), a semiconductor with a wide bandgap, is gaining significant attention due to its exceptional properties, such as the highest breakdown field among semiconductors. This attribute makes c-BN a promising material for enhancing the efficiency of power devices, thereby fueling market growth. Recent technological advancements have led to the successful growth and fabrication of high-quality c-BN thin films using unique heteroepitaxial techniques. These films exhibit superior properties, making them suitable for high-performance electronic applications, including electronic components, semiconductors, and thermal management systems.

- Moreover, hexagonal boron nitride (h-BN) is another form of boron nitride that has gained popularity due to its unique properties, such as high thermal conductivity and electrical insulation. It is extensively used as a thermal interface material, a protective layer in LEDs, and a coating for various applications, including wearable devices, smartphones, tablets, and electronic equipment. Boron nitride-based nanomaterials, such as nanotubes and nanoparticles, are also gaining traction due to their high thermal conductivity, lubricating abilities, and high-temperature stability. These materials are used in various industries, including aerospace, automotive, and defense, as well as in cosmetics, lubricants, and coatings.

- The increasing demand for energy-efficient gadgets, advanced materials, and sustainable thermal management systems is further driving the market growth. Boron nitride is also used in biomedical engineering, such as in dental implants, surgical tools, and implantable substances, due to its biocompatibility and excellent mechanical properties. In summary, the market is experiencing significant growth due to the increasing demand for high-performance electronic devices, thermal management materials, and advanced materials in various industries. The recent technological advancements In the growth and fabrication of high-quality boron nitride films and nanomaterials are further fueling market growth.

What are the market trends shaping the Boron Nitride Industry?

Shift toward sustainable and eco-friendly materials is the upcoming market trend.

- Boron nitride (BN), a versatile advanced material, is gaining prominence in various industries due to its unique properties, including high thermal conductivity, chemical inertness, and excellent lubricating abilities. In the electronics sector, BN is utilized In the production of high-performance electronic devices, semiconductors, and electronic components. Cubic boron nitride (c-BN) and hexagonal boron nitride (h-BN) are the primary forms of BN used In these applications. BN's thermal management qualities make it an ideal material for thermal interface materials in electronic equipment and thermal management systems. Its high thermal conductivity enables efficient heat dissipation, enhancing the performance and longevity of electronic devices such as tablets, smartphones, and wearable devices.

- In addition, BN's high-temperature lubricant properties make it suitable for use in nozzles and mold release agents in various industries, including plastics and composites. Moreover, BN's use extends to the aerospace industry, where it is used as a protective layer in space aircraft and as refractory materials in high-temperature applications. In the medical field, boron nitride-based nanomaterials are being explored for use in drug delivery systems, dental implants, and surgical tools. The innovation in BN synthesis methods, such as plasma technology and solvothermal processes, is advancing, making it a more sustainable and eco-friendly alternative to traditional materials.

What challenges does the Boron Nitride Industry face during its growth?

The high cost of hexagonal boron nitride is a key challenge affecting the industry growth.

- The market faces a significant challenge due to the high cost of hexagonal boron nitride (h-BN), a high-performance material with unique thermal management qualities and lubricant properties. Compared to alternative materials such as graphite, molybdenum disulfide, and tungsten disulfide, h-BN is more expensive. The price range for standard-grade h-BN used in industrial applications is between USD 55 and USD 130 per kilogram, while premium-grade h-BN, used in specialized applications like cosmetics, costs between USD 350 and USD 800 per kilogram. This substantial price difference makes h-BN less appealing for various industries, leading to the preference for more cost-effective alternatives. The high cost of h-BN acts as a major restraint on market growth, limiting the adoption of this material in sectors such as electronics, aerospace, and biomedical engineering, where its advanced properties, including high thermal conductivity and electrical insulation, are highly valued.

- Boron nitride-based nanomaterials, such as cubic boron nitride and amorphous boron nitride, are gaining popularity due to their lower cost and similar properties. However, the development and production of these materials still require significant investment and technological advancement. The market for boron nitride is expected to grow as the demand for energy-efficient gadgets, high-performance electronic devices, and advanced materials continues to rise. Applications in paints, nozzles, thermal management systems, semiconductor manufacturing processes, and coatings are also driving market growth. The use of boron nitride in dental implants, surgical tools, and drug delivery systems is a promising area of research, with potential applications in wearable devices and protective layers for electronic equipment.

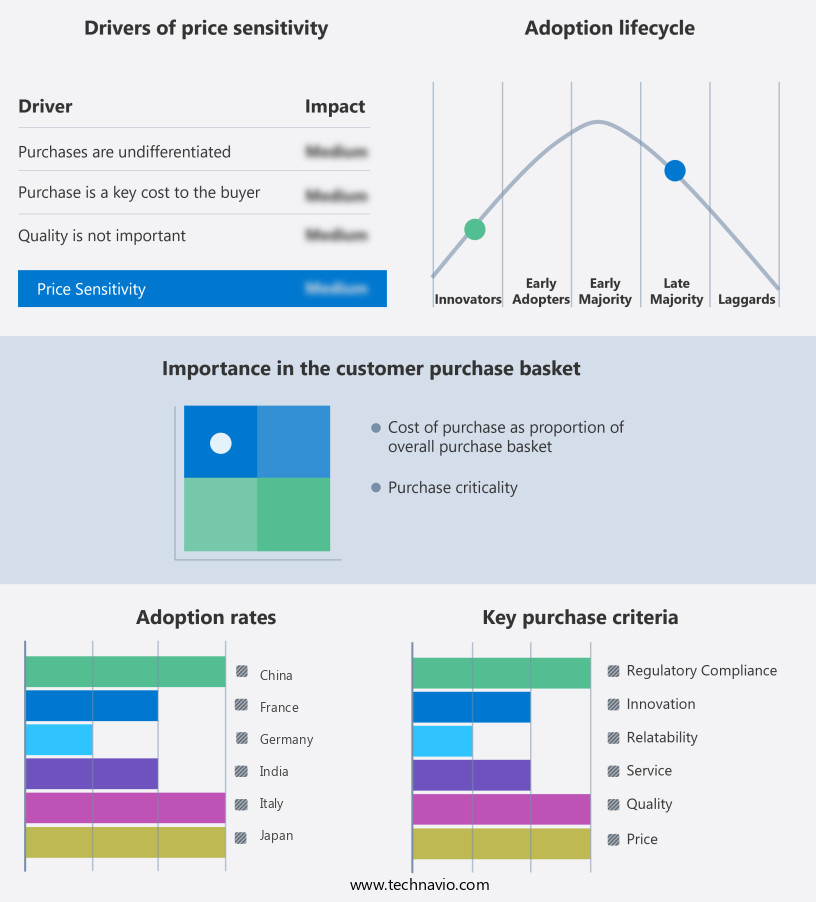

Exclusive Customer Landscape

The boron nitride market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the boron nitride market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, boron nitride market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3M Co. - The company offers boron nitride solutions such as 3M Boron Nitride Cooling Fillers for thermally conductive and electrically insulating plastics and adhesives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Elements

- Compagnie de Saint-Gobain SA

- Denka Co. Ltd.

- Grolltex Inc.

- HENZE Boron Nitride Products AG

- Hoganas AB

- Hyperion Materials and Technologies

- Kennametal Inc.

- KYOCERA Corp.

- Momentive Performance Materials

- Otto Chemie Pvt. Ltd.

- Precision Ceramics USA

- Resonac Holdings Corp.

- Shin Etsu Chemical Co. Ltd.

- Stanford Advanced Materials

- Supervac Industries LLP

- UK Abrasives Inc.

- Vizag Chemical International

- XIAMEN UNIPRETEC CERAMIC TECHNOLOGY CO. LTD

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Boron nitride, a versatile inorganic compound, has gained significant attention in various industries due to its unique properties. This non-metallic, crystalline material exists in two primary forms: hexagonal boron nitride (h-BN) and cubic boron nitride (c-BN). Both forms offer distinct advantages, making boron nitride an essential component in numerous applications. Hexagonal boron nitride, with its layered structure, is known for its excellent thermal conductivity, electrical insulation, and high-temperature stability. In the electronics sector, h-BN is utilized as a thermal interface material in high-performance electronic devices, enabling efficient heat dissipation and enhancing the overall performance of these gadgets. Moreover, its high thermal conductivity makes it an ideal material for thermal management systems in energy-efficient gadgets such as tablets and smartphones.

Cubic boron nitride, on the other hand, is recognized for its exceptional lubricating abilities. In the manufacturing sector, it is used as a mold release agent in various industries, including plastics and composites, metalworking, and aerospace. Its high durability and soft texture make it an excellent choice for wearable devices, cosmetics, and even in some surgical tools. Additionally, it is employed as a high-temperature lubricant in defense equipment and space aircraft due to its ability to withstand extreme temperatures. Boron nitride-based nanomaterials have been at the forefront of technological advancement, with applications in various industries. In the electronics sector, these nanomaterials are used in semiconductors, providing improved electrical insulation and thermal management qualities.

In addition, in biomedical engineering, boron nitride is being explored for its potential use as implantable substance, offering enhanced durability and biocompatibility. In the field of coatings, boron nitride is used for its excellent thermal management and protective qualities. For instance, it is used as a coating in LEDs to improve their efficiency and longevity. In the field of nanotechnology, boron nitride-based materials are used in controlled-release systems for drugs and pesticides, providing sustained release and improved efficacy. Boron nitride's unique properties make it an essential material in various industries. Its high thermal conductivity, electrical insulation, and lubricating abilities are just a few of the reasons it is in high demand.

|

Boron Nitride Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market Growth 2025-2029 |

USD 601 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, South Korea, Germany, India, UK, France, Russia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Boron Nitride Market Research and Growth Report?

- CAGR of the Boron Nitride industry during the forecast period

- Detailed information on factors that will drive the Boron Nitride Market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the boron nitride market growth of industry companies

We can help! Our analysts can customize this boron nitride market research report to meet your requirements.