Canine Arthritis Treatment Market Size 2025-2029

The canine arthritis treatment market size is forecast to increase by USD 826 million at a CAGR of 6.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising prevalence of arthritis in dogs. According to various studies, arthritis affects approximately 20% of dogs over the age of one, making it a common health concern for pet owners. Advancements in treatment options, such as the development of novel therapies and the increasing popularity of alternative treatments like acupuncture and hydrotherapy, are further fueling market expansion. However, the market faces challenges, including regulatory hurdles that impact adoption and the adverse effects of new treatments. Moreover, increasing awareness about the importance of pet insurance and the need for comprehensive healthcare coverage is another major growth driver.

- For instance, some medications used to treat canine arthritis can have side effects, such as gastrointestinal issues and liver damage. Additionally, supply chain inconsistencies and the high cost of certain treatments temper growth potential. To capitalize on market opportunities and navigate challenges effectively, companies must focus on developing safe and efficacious treatments, ensuring regulatory compliance, and addressing affordability concerns through various pricing strategies. Pharmaceutical businesses play a significant role in this market, providing animal vaccines for various diseases, including Nipah infection and zoonotic illnesses, as well as treatments for food-borne illnesses.

What will be the Size of the Canine Arthritis Treatment Market during the forecast period?

- The market is witnessing significant advancements, driven by the integration of technology and holistic approaches in veterinary care. Genetic testing is becoming increasingly popular for early detection and personalized treatment plans. Online communities and arthritis support groups provide valuable resources for pet owners seeking information and advice. Remote monitoring tools, such as pain assessment scales and home care instructions, enable effective arthritis management protocols. Veterinary education and telemedicine are transforming the industry, making specialized care more accessible. Functional foods, nutritional supplements, and regenerative therapies offer cost-effective treatments for managing canine arthritis. Veterinary diagnostics and public awareness campaigns are essential for early detection and prevention. The COVID-19 pandemic has also accelerated the adoption of telemedicine, health apps, and other digital solutions for animal care.

- Canine rehabilitation and post-surgical care are crucial components of comprehensive arthritis treatment. Therapeutic modalities, including pain scale development and behavior modification, contribute to improved quality of life for affected dogs. Holistic approaches, including joint mobility exercises and veterinary education, empower pet owners to actively participate in their pets' care. The market continues to evolve, with a focus on innovative treatments and affordable options for pet owners. Feed additives and preventive measures are also essential components of the market, as they help maintain animal health and reduce the risk of chronic conditions.

How is this Canine Arthritis Treatment Industry segmented?

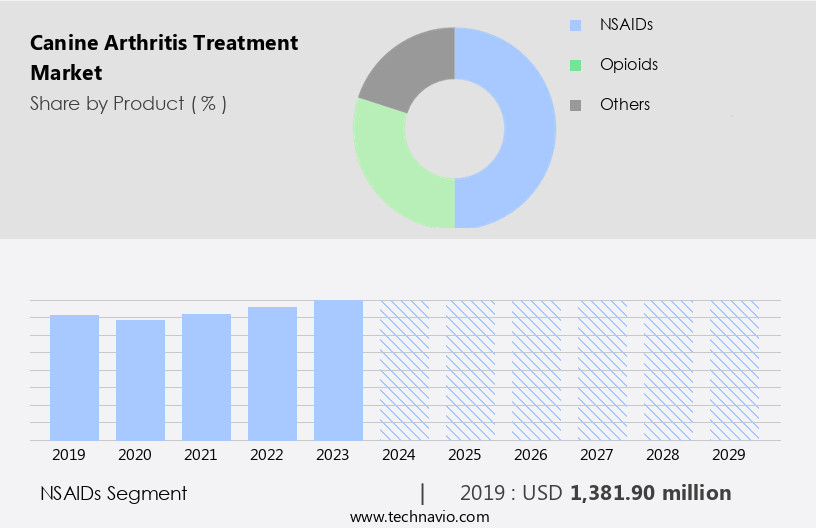

The canine arthritis treatment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- NSAIDs

- Opioids

- Others

- Route Of Administration

- Oral

- Injectables

- Intra-articular injection

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The NSAIDs segment is estimated to witness significant growth during the forecast period. Canine arthritis, a common condition in aging dogs, causes mobility issues and significant discomfort through inflammation and pain in the joints. Veterinary clinics play a crucial role in diagnosing and treating this condition through various methods, including personalized medicine tailored to specific canine breeds. Over-the-counter medications, such as non-steroidal anti-inflammatory drugs (NSAIDs), are frequently prescribed due to their proven efficacy in managing arthritis symptoms. NSAIDs, like carprofen, meloxicam, and firocoxib, inhibit the production of prostaglandins, reducing inflammation and alleviating pain. Veterinary research and clinical trials contribute significantly to the development of new treatments and therapies for canine arthritis.

Pain management strategies, such as laser therapy and acupuncture, can also provide relief for dogs suffering from arthritis. Veterinary pharmaceuticals and online retailers offer a range of options for dog owners, while pet stores and animal hospitals provide additional resources and support. Patient compliance and adherence to treatment plans are crucial for optimal outcomes. Side effects and drug interactions are potential concerns with prescription medications, making it essential for dog owners to consult with their veterinarian before starting any new treatment. Diagnostic imaging, such as X-rays and blood tests, can help veterinarians assess the severity of arthritis and determine the most effective treatment approach. The future outlook is positive, with opportunities in urbanization, emerging economies, and advanced medical technologies.

In summary, the market is characterized by a diverse range of options, from over-the-counter medications to advanced therapies like gene therapy and regenerative medicine. Veterinary research, clinical trials, and regulatory approvals play a crucial role in advancing the field and ensuring the safety and efficacy of treatments. Dog owners and veterinarians must work together to choose the best treatment approach for each individual dog, considering factors like breed predispositions, lifestyle changes, and cost.

The NSAIDs segment was valued at USD 1.38 billion in 2019 and showed a gradual increase during the forecast period. Gene therapy, regenerative medicine, and stem cell therapy are emerging areas of research, offering potential long-term solutions for managing arthritis. Joint health supplements, such as chondroitin sulfate and omega-3 fatty acids, are also popular choices for dog owners seeking natural alternatives to prescription medications. Veterinary product approvals and safety assessments ensure the efficacy and safety of these treatments. Prescription medications, including NSAIDs and other arthritis pain relievers, require regulatory approval before they can be sold to veterinarians and pet owners. Insurance coverage for veterinary care costs varies, making affordability a concern for some dog owners. Exercise programs, physical therapy, and weight management are essential components of arthritis treatment, helping to maintain joint health and improve mobility.

Regional Analysis

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market experiences significant growth due to increasing pet ownership, advanced veterinary infrastructure, and consumer demand for innovative solutions. In 2023, approximately 86.9 million US families owned pets, with dogs being the most popular choice. The pet industry expenditure in the US reached an impressive USD 145 billion. Canada, meanwhile, had a pet dog population of 8.3 million. This substantial pet population fuels the demand for veterinary care, including treatments for arthritis. Personalized medicine and gene therapy are emerging trends, with veterinary research and clinical trials providing scientific evidence for their efficacy. Over-the-counter medications, joint health supplements, and prescription medications are widely used.

Veterinary product approvals ensure safety and quality, while medical diagnostic imaging and blood tests aid in accurate diagnoses. Veterinary clinics and animal hospitals offer various treatments, from anti-inflammatory medications and laser therapy to physical therapy and weight management programs. Joint replacement surgery and stem cell therapy are advanced options for severe cases. Breed predispositions influence treatment approaches for specific canine breeds. Side effects and drug interactions are closely monitored, emphasizing patient compliance and adherence to treatment. Insurance coverage and cost-effective solutions, such as omega-3 fatty acids, are essential considerations for dog owners. Regenerative medicine and research and development continue to advance, offering promising solutions for canine arthritis treatment. Online retailers and pet stores provide easy access to these treatments, ensuring convenience for pet owners.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Canine Arthritis Treatment market drivers leading to the rise in the adoption of Industry?

- The increasing prevalence of canine arthritis serves as the primary market driver, significantly expanding the market scope. The market is experiencing significant growth due to the increasing prevalence of osteoarthritis (OA) in dogs. Approximately 40% of dogs over eight years old exhibit signs of OA in their shoulders, hips, elbows, or stifle joints. This condition, characterized by the degeneration of joint cartilage and underlying bone, causes pain, stiffness, and mobility issues in affected dogs. With the aging pet population, the incidence of arthritis is anticipated to rise, necessitating effective treatment solutions. Veterinary clinics are diagnosing arthritis in dogs more frequently, driven by heightened awareness among pet owners. Personalized medicine approaches, such as gene therapy, are emerging as potential treatment options for canine arthritis.

- Over-the-counter medications and lifestyle changes, including weight management and exercise, are also commonly used to manage the condition. Veterinary research and clinical trials are ongoing to develop new treatments and improve existing ones. Scientific evidence supports the use of various therapies, including blood tests for diagnosis and monitoring disease progression. Veterinary product approvals ensure the safety and efficacy of these treatments for dogs. By focusing on improving mobility and quality of life for dogs with arthritis, the market continues to evolve, providing hope for pet owners and their beloved companions.

What are the Canine Arthritis Treatment market trends shaping the Industry?

- Canine arthritis treatment advancements represent the current market trend. Notable progress is being made in developing more effective therapies for this condition. The market is experiencing notable progress, with novel therapies emerging to effectively manage osteoarthritis (OA) in dogs and enhance their overall wellbeing. Although traditional treatments like nonsteroidal anti-inflammatory drugs (NSAIDs) and joint supplements remain popular, advanced therapies are gaining traction. Regenerative medicine, specifically stem cell therapy and platelet-rich plasma (PRP) therapy, is a promising area of research and development. These therapies focus on encouraging the body's natural healing processes to regenerate cartilage, restore joint function, and reduce inflammation. Efficacy studies are underway to assess the safety and efficacy of these treatments, ensuring optimal patient outcomes.

- While these therapies hold great promise, it is essential to consider potential side effects, drug interactions, and patient compliance when evaluating their use. Adherence to treatment plans is crucial for achieving optimal results and improving the quality of life for dogs with arthritis.

How does Canine Arthritis Treatment market faces challenges during its growth?

- The adverse effects of new treatments pose a significant challenge to the growth of the industry, requiring continuous research and development efforts to mitigate potential risks and ensure patient safety. The market in the US is driven by the growing awareness of canine arthritis and the need for effective treatment options to improve the quality of life for affected dogs. Insurance coverage for arthritis treatments is increasingly common, making these therapies more accessible to pet owners. Some popular treatment methods include exercise programs, joint health supplements, and pain management techniques. Omega-3 fatty acids, for instance, have shown promise in reducing inflammation and improving mobility in dogs with arthritis. Prescription medications, such as nonsteroidal anti-inflammatory drugs (NSAIDs) and disease-modifying osteoarthritis drugs (DMARDs), are also used to manage pain and inflammation.

- However, these treatments come with potential risks and adverse effects, including gastrointestinal issues and kidney damage. Regulatory approval is essential for ensuring the safety and efficacy of new treatments. For instance, the FDA's approval of Librela (bedevinetmab injection) for osteoarthritis pain in dogs was followed by reports of serious adverse effects, including neurological symptoms and renal issues. Safety assessments and diagnostic imaging are crucial in monitoring the progression of arthritis and evaluating the effectiveness of treatment methods. Online retailers offer a convenient way for pet owners to access a wide range of arthritis relief products, from supplements to prescription medications. However, it's essential to consult with a veterinarian before starting any new treatment regimen to ensure the best possible outcome for the dog's health. While advancements in canine arthritis treatment offer hope for improved quality of life for affected dogs, it's crucial to consider the potential risks and benefits of each treatment option and to work closely with a veterinarian to develop a personalized care plan.

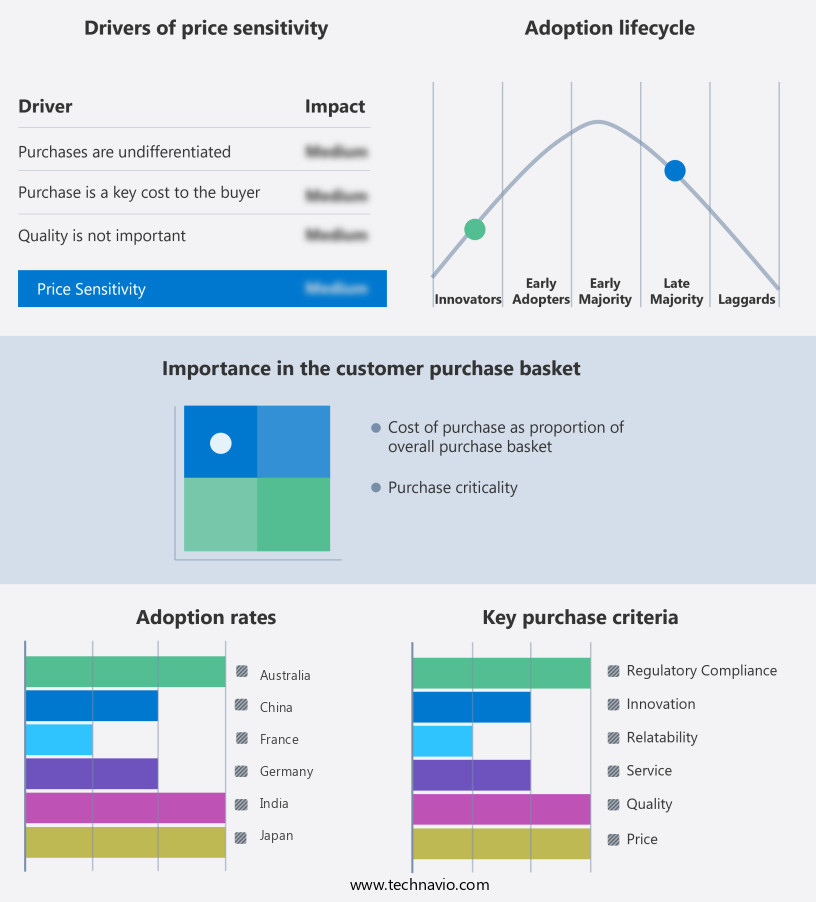

Exclusive Customer Landscape

The canine arthritis treatment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the canine arthritis treatment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, canine arthritis treatment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

American Regent Animal Health - The company offers canine arthritis treatment, such as Adequan, which helps to alleviate pain, improve range of motion, and reduce limpness associated with arthritis in dogs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Regent Animal Health

- Bayer AG

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Compana Pet Brands LLC

- Dechra Pharmaceuticals Plc

- Elanco Animal Health Inc.

- Jurox Pty Ltd.

- NexGen Pharmaceuticals

- Norbrook Laboratories Ltd.

- Nutramax Laboratories Inc.

- Thorne Vet.

- Vetoquinol SA

- VetStem Biopharma

- Virbac Group

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Canine Arthritis Treatment Market

- In February 2024, Elanco Animal Health introduced Flexadin Max, an advanced chewable tablet for dogs with arthritis and joint health issues. This new product, which contains glucosamine, chondroitin, and MSM, aims to provide improved joint mobility and comfort for canines (Elanco Animal Health, 2024).

- In October 2024, Merck Animal Health completed the acquisition of MSD Animal Health, significantly expanding its portfolio in the animal health sector. This acquisition included MSD Animal Health's arthritis treatment portfolio, which includes Previcox and Onsior, further solidifying Merck Animal Health's presence in the market (Merck KGaA, 2024).

- In March 2025, the US Food and Drug Administration (FDA) approved Boehringer Ingelheim's Rimadyl CR (carprofen extended-release tablets) for the management of pain and inflammation associated with osteoarthritis in dogs. This approval marked a significant milestone in the development of long-acting arthritis treatments for canines, offering improved compliance and convenience for pet owners (Boehringer Ingelheim, 2025).

Research Analyst Overview

The market continues to evolve, driven by the growing number of aging dogs and the increasing awareness of mobility issues in various canine breeds. Veterinary pharmaceuticals play a significant role in managing arthritis symptoms, with ongoing research and development leading to new efficacy studies and prescription medications. Joint replacement surgery and regenerative medicine, including platelet-rich plasma (PRP), offer alternative treatment options for severe cases. Breed predispositions and lifestyle changes are key considerations in the prevention and management of canine arthritis. Personalized medicine approaches, such as gene therapy and blood tests, are gaining traction in the veterinary industry, providing tailored treatment plans for individual dogs.

Over-the-counter medications, joint health supplements, and pain management solutions offer additional options for dog owners. Veterinary research and clinical trials contribute to the scientific evidence supporting these treatments, ensuring the safety and efficacy of available options. Patient compliance and adherence to treatment are crucial factors in managing canine arthritis. Insurance coverage, weight management, and exercise programs can help improve compliance and enhance the quality of life for affected dogs. Diagnostic imaging and safety assessments are essential components of the veterinary care process, ensuring accurate diagnoses and effective treatment plans. Veterinary product approvals and regulatory compliance are integral to the market's continuous growth. Regulatory requirements for animal healthcare products are stringent, ensuring the safety and efficacy of vaccines, diagnostics, feed additives, and other animal health solutions. Online retailers, pet stores, animal hospitals, and laser therapy centers offer various access points for pet owners seeking arthritis pain relief. The ongoing unfolding of market activities and evolving patterns highlights the importance of staying informed about the latest advancements and treatment options in canine arthritis care.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Canine Arthritis Treatment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 826 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, India, Germany, France, Mexico, Japan, UK, Australia, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Canine Arthritis Treatment Market Research and Growth Report?

- CAGR of the Canine Arthritis Treatment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the canine arthritis treatment market growth of industry companies

We can help! Our analysts can customize this canine arthritis treatment market research report to meet your requirements.