Cardiac Restoration Systems Market Size 2025-2029

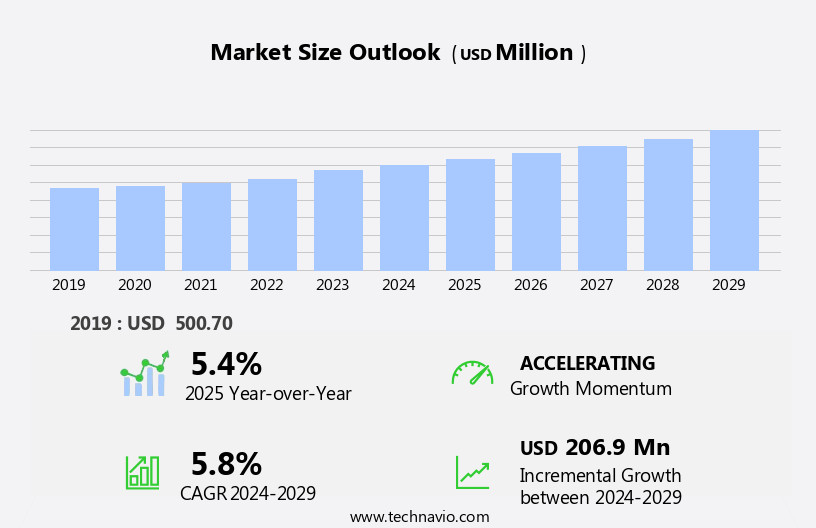

The cardiac restoration systems market size is forecast to increase by USD 206.9 million at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing healthcare expenditure worldwide. This trend is particularly notable in developing economies, where the burden of cardiovascular diseases is escalating. A key development in the market is the advancement of mitral valve restoration systems using tissue engineering approaches. These innovative solutions offer the potential for more effective and less invasive treatments, addressing the unmet needs of patients with mitral valve diseases. However, the market faces challenges that require careful navigation. Regulatory hurdles impact adoption, as stringent regulatory requirements and lengthy approval processes can delay market entry for new technologies. To address this issue, there is a growing demand for less invasive therapies that can effectively restore the functionality of the heart. Trained specialists are developing advanced solutions using tissue engineering approaches to create more natural and durable cardiac restoration systems. Additionally, the availability of alternatives to traditional surgeries is driving market growth.

- Furthermore, supply chain inconsistencies temper growth potential, as the need for reliable and consistent supply of raw materials and components is crucial for maintaining production and meeting demand. Companies seeking to capitalize on market opportunities must address these challenges effectively, ensuring regulatory compliance and establishing robust supply chain management strategies. By doing so, they can differentiate themselves in the competitive landscape and position themselves for long-term success.

What will be the Size of the Cardiac Restoration Systems Market during the forecast period?

- The market encompasses digital health solutions, medical technology advancements, and regulatory approvals that aim to address ventricular dysfunction and heart rhythm management. Device revisions and upgrades are common due to the evolving clinical guidelines and clinical research, which prioritize value-based care and long-term patient outcomes. However, device failures and recalls can pose challenges, necessitating data analysis and reporting to ensure patient safety and ethical considerations. Precision medicine and minimally invasive surgical techniques, such as transcatheter procedures and device implantation, are driving innovation in the market. These systems are integral to the healthcare industry, catering to an extensive range of cardiac cases, including those related to coronary artery bypass, mitral valve repair, cryoablation, and endocardiectomy.

- Heart function restoration and patient satisfaction are key indicators of success, with evidence-based medicine and data collection playing crucial roles in optimizing clinical outcomes. Medical device regulations continue to shape market dynamics, with a focus on improving patient safety and minimizing device complications. Technology innovation, including emerging technologies, is expected to further transform the cardiac restoration systems landscape.

How is this Cardiac Restoration Systems Industry segmented?

The cardiac restoration systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Hospitals

- ASCs

- Others

- Product

- Mitral valve restoration systems

- Left ventricular restoration systems

- Application

- Heart Failure

- Surgical ventricular restoration

- Percutaneous ventricular restoration

- Cardiac arrhythmias

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals segment is estimated to witness significant growth during the forecast period. Hospitals, as specialized healthcare institutions, play a pivotal role in the delivery of advanced cardiac care to patients with complex conditions, including cardiovascular diseases (CVDs). Hospitals encompass multispecialty and government institutions, offering both inpatient and outpatient services. The cardiology department within hospitals is staffed with cardiologists, cardiac surgeons, and equipped with advanced cardiac devices, such as implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy (CRT-D) devices, and pacemakers. Hospitals procure these cardiac restoration systems in bulk through competitive bidding with manufacturers and suppliers, ensuring cost-effective solutions. Cardiac surgeons utilize machine learning algorithms and electrophysiology studies to optimize ICD therapy and improve device efficacy. Hospitals are the primary consumers of these systems, as they provide essential healthcare services to a large and diverse patient population.

Bioresorbable leads and wireless technology are advancing to address these needs. Reimbursement models are evolving to support the adoption of advanced cardiac restoration systems. Cardiac electrophysiology focuses on the diagnosis and treatment of heart rhythm disorders, including atrial fibrillation and ventricular tachycardia. Quality of life is a key consideration, with a focus on device safety and patient education. Clinical trials and regulatory approvals are essential steps in bringing new cardiac restoration systems to market.

The Hospitals segment was valued at USD 227.80 million in 2019 and showed a gradual increase during the forecast period. Drug development and delivery systems are integrated into ICDs, enabling the delivery of therapeutic agents directly to the heart. Primary care physicians collaborate with cardiology departments to manage patient care, while home monitoring and remote monitoring enable continuous patient monitoring. Minimally invasive procedures, such as catheter ablation, are increasingly popular, reducing the need for open-heart surgery. Stem cell therapy and gene therapy are emerging areas of research, offering potential for personalized medicine. Artificial intelligence and data analytics are transforming cardiac care, improving device programming, patient compliance, and predictive analytics. Healthcare costs are a significant concern, driving the need for longer device longevity and miniaturized devices. Hospitals and ambulatory surgical centers in the US rely on cardiac restoration systems to provide effective cardiac care through various surgical reconstructive approaches.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for cardiac restoration systems experiences significant growth due to the region's advanced healthcare infrastructure, extensive insurance coverage, and a large pool of skilled professionals. Companies in this sector invest heavily in research and development, leading to the adoption of technologically advanced products such as machine learning-enabled devices, leadless pacemakers, and home monitoring systems. These innovations cater to less invasive procedures, including catheter ablation and electrophysiology studies, which improve patient quality of life and device safety. Cardiac surgeons and primary care physicians collaborate to optimize ICD therapy and cardiac resynchronization therapy, ensuring device efficacy and patient compliance. The region's well-established healthcare infrastructure, skilled medical professionals, and extensive healthcare insurance coverage are key drivers. Additionally, increasing research and development expenditures by market companies, the adoption of advanced technologies, and the availability of less invasive treatments are contributing to market expansion.

Hospitals and cardiology departments increasingly employ remote monitoring and predictive analytics to enhance device management and improve patient outcomes. Advancements in drug delivery systems, drug development, and gene therapy offer new avenues for treatment, while biocompatible materials and miniaturized devices ensure device longevity and patient safety. The integration of artificial intelligence and data analytics enables personalized medicine and cost-effective reimbursement models. Healthcare costs remain a critical factor, with wireless technology and device programming playing essential roles in reducing costs and improving accessibility. The market also witnesses the emergence of regenerative medicine and clinical trials, paving the way for novel therapies and treatments. The United States is the primary revenue generator in the North American market, largely due to extensive insurance coverage from organizations like Medicare and Medicaid.

In the US, the Centers for Medicare and Medicaid Services (CMS) provide extensive insurance coverage, making it the major revenue contributor to the North American market. The aging population and rising incidence of heart failure, ventricular tachycardia, and other cardiovascular diseases further fuel market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Cardiac Restoration Systems market drivers leading to the rise in the adoption of Industry?

- The escalating healthcare expenditures serve as the primary market catalyst. Cardiac restoration systems, encompassing technologies such as catheter ablation, stem cell therapy, and CRT-D devices, are gaining traction in the healthcare industry due to escalating healthcare expenditure. With growing investments in medical research and technology, advanced procedures like radiofrequency ablation, gene therapy, and remote monitoring are becoming more accessible. These innovations not only enhance device efficacy but also enable improved patient care. Healthcare facilities, including cardiology departments, are increasingly allocating budgets towards procuring biocompatible and sophisticated cardiac restoration systems. This trend is driven by the need to offer superior patient care and keep up with the latest technological advancements.

- The availability of these advanced systems translates to better access to cardiac care for patients, ensuring timely treatment and improved health outcomes. Moreover, the integration of device programming and monitoring technologies in cardiac restoration systems enables healthcare providers to optimize treatment plans and closely monitor patient progress. As healthcare costs continue to rise, investments in these advanced systems can lead to long-term cost savings by reducing the need for frequent hospitalizations and improving overall patient care.

What are the Cardiac Restoration Systems market trends shaping the Industry?

- Tissue engineering approaches are increasingly being utilized in the development of mitral valve restoration systems, representing a significant market trend in the field of cardiovascular technology. This innovative approach involves the use of living cells to grow functional heart valves, offering potential benefits such as reduced risk of rejection and improved durability compared to traditional mechanical or animal tissue valves. Mitral valve restoration systems have traditionally relied on mechanical and prosthetic materials, which come with limitations such as the risk of hemorrhages, valve degeneration, calcification, and the requirement for lifelong anticoagulation medications. These systems do not adapt to functional demand changes, leading to reduced durability compared to a functional mitral valve.

- Pediatric patients are particularly vulnerable to valve-related morbidity issues due to these limitations. To address these challenges, tissue engineering technology is being explored for mitral valve restoration systems. In-vitro and in-situ approaches are being used to develop regenerative, self-repairing systems that offer life-long durability advantages. These advances in technology hold promise for improving the quality of life for patients with heart failure, particularly those at risk for ventricular tachycardia and cardiac electrophysiology disorders. Furthermore, the integration of artificial intelligence and personalized medicine approaches in cardiac resynchronization therapy and implantable cardioverter defibrillators is expected to enhance the effectiveness and efficiency of these treatments.

How does Cardiac Restoration Systems market faces challenges face during its growth?

- The expansion of the cardiac restoration industry is significantly influenced by the limited availability of effective alternatives to existing systems. The market faces competition from various alternatives, including heart repair and replacement devices, percutaneous balloon mitral valvuloplasty, commissurotomy, and vitamin D medications. Heart repair and replacement devices offer solutions for valvular heart diseases, such as valve stenosis and regurgitation, while vitamin D3 medications, like cholecalciferol, aid in the restoration of damaged cardiovascular epithelial cells. Blood thinners, such as aspirin, also contribute to the market challenge by preventing blood clots. Percutaneous balloon mitral valvuloplasty, a non-surgical procedure involving the insertion of a catheter with a balloon to widen the valve and enhance blood flow rate, serves as a substitute for cardiac restoration systems.

- These alternatives, along with clinical trials and reimbursement models, significantly impact the market dynamics. Patient compliance, device safety, and data analytics play crucial roles in the effective implementation and management of cardiac restoration systems. Predictive analytics and miniaturized devices are also essential aspects of the market, with regenerative medicine emerging as a promising area for future advancements. Patient education and understanding of conditions such as atrial fibrillation are vital for successful treatment outcomes.

Exclusive Customer Landscape

The cardiac restoration systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cardiac restoration systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cardiac restoration systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in advanced cardiac restoration systems, including the Transcatheter Mitral Valve Repair (TMVR) using Mitraclip technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AFFLUENT MEDICAL SA

- Ancora Heart Inc.

- Artivion Inc.

- Baxter Regional Medical Center

- BioVentrix Inc.

- Boston Scientific Corp.

- Edwards Lifesciences Corp.

- GE Healthcare Technologies Inc.

- Halma Plc

- Lepu Medical Technology Beijing Co. Ltd.

- LivaNova PLC

- Medtronic Plc

- NeoChord Inc.

- OMRON Corp.

- Syntach AB

- TECHNOGYM S.p.A

- Xeltis AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cardiac Restoration Systems Market

- In February 2024, Medtronic, a leading medical technology company, announced the launch of the Evolut PRO+ Transcatheter Aortic Valve Replacement (TAVR) system. This new device builds upon the success of the Evolut TAVR platform, offering enhanced delivery and implantation capabilities (Medtronic Press Release, 2024).

- In May 2025, Abbott Laboratories and Edwards Lifesciences, two major players in the market, entered into a definitive agreement to collaborate on the development and commercialization of transcatheter mitral valve repair and replacement therapies. This strategic partnership aims to expand both companies' product portfolios and address the growing demand for minimally invasive cardiac procedures (Abbott Laboratories Press Release, 2025).

- In September 2024, Siemens Healthineers, a leading medical technology company, received FDA approval for its new MAGNETOM Free.Max 1.5T MRI system. This advanced imaging technology enables real-time, high-resolution visualization of the heart, facilitating more accurate diagnosis and treatment planning for cardiac conditions (Siemens Healthineers Press Release, 2024).

- In January 2025, Boston Scientific Corporation completed the acquisition of BTG plc, a global specialist pharmaceuticals company. The acquisition significantly expanded Boston Scientific's interventional cardiology portfolio, providing the company with a range of innovative therapies for the treatment of structural heart diseases (Boston Scientific Corporation Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and the growing demand for effective solutions to address various cardiac conditions. These systems encompass a range of applications, from implantable devices and drug delivery systems to minimally invasive procedures and regenerative medicine. Device safety and data analytics are paramount in ensuring optimal patient outcomes. Integration of artificial intelligence and machine learning algorithms enables predictive analytics, facilitating early intervention and improved device management. Patient compliance is another critical factor, with home monitoring and remote patient education playing essential roles. Miniaturized devices, such as leadless pacemakers and bioresorbable leads, offer enhanced patient comfort and reduced complications. The global market for cardiac restoration systems faces competition from various alternatives, including heart repair and replacement devices, percutaneous balloon mitral valvuloplasty, and vitamin D medications.

Clinical trials for novel therapies, including gene therapy and stem cell therapy, hold promise for transforming cardiac care. Cardiac surgeons and electrophysiologists collaborate closely with primary care physicians to optimize device programming and implement ablation procedures for conditions like atrial fibrillation and ventricular tachycardia. Reimbursement models continue to evolve, with a focus on value-based care and patient quality of life. Biocompatible materials and wireless technology contribute to device longevity and ease of use. CRT-D devices and implantable cardioverter defibrillators remain cornerstones of cardiac restoration systems, with ongoing research aimed at enhancing their efficacy and reducing healthcare costs. Heart repair and replacement devices offer solutions for valvular heart diseases, such as valve stenosis and valve regurgitation, by repairing or replacing defective heart valves. Vitamin D3 medications, like cholecalciferol, aid in the restoration of damaged cardiovascular epithelial cells, while blood thinners, such as aspirin, help prevent blood clots. The market's continuous dynamism reflects the industry's commitment to addressing the complexities of cardiac conditions and improving patient care.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cardiac Restoration Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 206.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cardiac Restoration Systems Market Research and Growth Report?

- CAGR of the Cardiac Restoration Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cardiac restoration systems market growth of industry companies

We can help! Our analysts can customize this cardiac restoration systems market research report to meet your requirements.