Cold Chain Logistics Market For Pharmaceuticals Industry Size 2025-2029

The cold chain logistics market for pharmaceuticals industry size is forecast to increase by USD 14.56 billion at a CAGR of 9.9% between 2024 and 2029.

What will be the Size of the Cold Chain Logistics Market For Pharmaceuticals Industry during the forecast period?

How is this Cold Chain Logistics For Pharmaceuticals Industry Industry segmented?

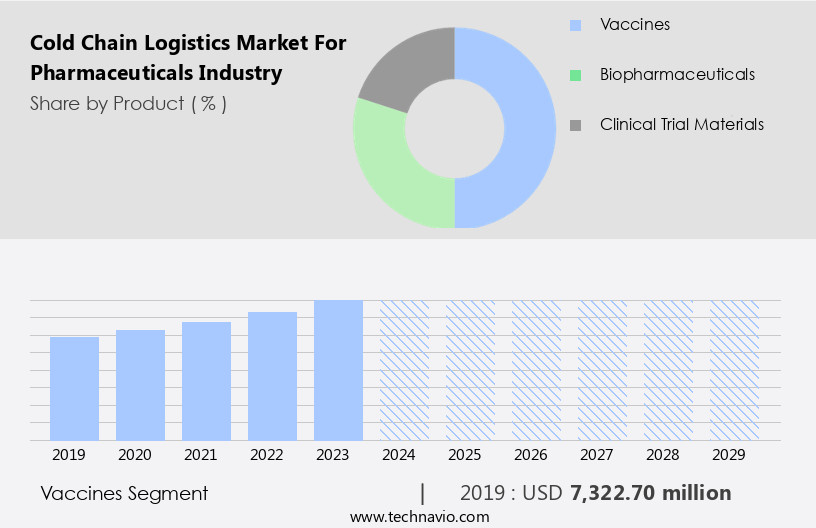

The cold chain logistics for pharmaceuticals industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Vaccines

- Biopharmaceuticals

- Clinical trial materials

- Service

- Warehousing and VAS

- Transportation

- Mode of Delivery

- Last-Mile Delivery

- Hubs-to-Distributor

- Temperature Range

- Ambient

- Refrigerated

- Frozen

- Cryogenic

- End User

- Hospitals & Clinics

- Pharmaceutical

- Biopharmaceutical

- Biotechnology Companies

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Product Insights

The vaccines segment is estimated to witness significant growth during the forecast period.The pharmaceutical industry's reliance on cold chain logistics has grown significantly due to the increasing development and export of temperature-sensitive goods, including novel drugs, vaccines, and biopharmaceuticals. Cold chain logistics ensures the proper transportation, storage, labeling, and last-mile delivery of these goods at specific temperatures - ambient, refrigerated, frozen, or cryogenic. With the rise of advanced technologies like telematics, machine learning, big data, automation instruments, and warehouse execution software, cold chain logistics has become more efficient and effective. The need for cold chain logistics is further accentuated by the increasing production and distribution of temperature-sensitive clinical trial materials. Cold chain logistics plays a crucial role in delivering these vital goods to hospitals, clinics, pharmacies, health centers, raw material suppliers, packaging suppliers, retailers, and OTC medicines providers like Walmart and Anthem.

The transportation modes include sea freight logistics, air freight logistics, and overland logistics. Cold chain logistics is a vital component of the pharmaceutical supply chain, ensuring the integrity and efficacy of these essential products.

Get a glance at the market report of share of various segments Request Free Sample

The Vaccines segment was valued at USD 7.32 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The cold chain logistics market for pharmaceuticals in Asia Pacific (APAC) is experiencing significant growth due to the expanding healthcare sector. The consumer healthcare market in APAC is projected to expand substantially between 2022 and 2024, fueled by increased investments from both public and private sectors in enhancing healthcare infrastructure. Additionally, rising foreign investment and improved healthcare insurance access in most Asian economies are anticipated to further boost the consumer healthcare market. This growth can be attributed to the enhanced healthcare facilities and increased investments by governments and NGOs in promoting public health standards. Temperature-sensitive pharmaceutical goods, including novel drugs, vaccines, biopharmaceuticals, clinical trial materials, and over-the-counter (OTC) medicines, require specialized transportation, storage, labeling, last-mile delivery, and distribution systems to maintaIn their efficacy.

Advanced technologies, such as telematics, warehouse execution software, warehouse management software, and blockchain technology, are crucial in ensuring the integrity and security of the cold chain logistics process. Sea freight logistics, air freight logistics, and overland logistics are essential modes of transportation for cold chain pharmaceutical goods. Key players In the market include hospitals, clinics, pharmacies, health centers, raw material suppliers, packaging suppliers, retailers, and OTC medicines providers like Walmart and Anthem. Cold chain logistics providers, such as FedEx, SenseAware, and advanced technology companies like Louisenthal, Veridos, and

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cold Chain Logistics For Pharmaceuticals Industry Industry?

- Increase in global demand for pharmaceuticals is the key driver of the market.

- The global pharmaceutical industry has experienced significant growth due to the increase in average life expectancy and the implementation of healthcare initiatives, such as the Affordable Care Act in certain regions. This act has enabled millions of previously uninsured individuals to gain access to healthcare services and prescription medications. Consequently, the efficient transportation, warehousing, and distribution of pharmaceuticals in large volumes have become essential for end-user companies. Cold chain logistics services, which ensure the proper preservation of temperature-sensitive pharmaceuticals, are increasingly in demand to maintain product integrity and efficacy. Thus, the global cold chain logistics market for the pharmaceuticals industry is expected to grow steadily during the forecast period, addressing the increasing demand for temperature-controlled supply chain solutions.

What are the market trends shaping the Cold Chain Logistics For Pharmaceuticals Industry Industry?

- Growing consolidation in global healthcare logistics industry is the upcoming market trend.

- The global cold chain logistics market for pharmaceuticals is characterized by a high degree of fragmentation, with numerous players. This fragmentation presents challenges for large players looking to expand into new geographies or countries, as they must either build a network from scratch or consolidate the market through acquisitions. Market consolidation is a strategic tool adopted by established logistics companies, such as UPS, Deutsche Post, and FedEx, to expand their market presence, adopt local technologies, and achieve profitability In the competitive landscape. By acquiring regional players, these companies can gain a foothold in new markets and enhance their offerings to customers.

What challenges does the Cold Chain Logistics For Pharmaceuticals Industry Industry face during its growth?

- Functional barriers in cold chain logistics increase operational costs is a key challenge affecting the industry growth.

- Cold chain logistics, a crucial aspect of pharmaceutical supply chain management, involves the procurement of land for warehouses to ensure proximity to production facilities. Real estate costs, particularly in countries like China, India, and the US, have risen due to fluctuating interbank exchange rates. For instance, land prices in China are projected to increase by over 5% during the forecast period. Moreover, the vacancy rate of industrial spaces In the US, which comprises factories, offices, warehouses, and light manufacturing buildings, declined in 2020 compared to the previous year. These trends underscore the strategic importance of making informed real estate decisions for third-party logistics providers (LSPs) In the cold chain logistics market for the pharmaceutical industry.

Exclusive Customer Landscape

The cold chain logistics market for pharmaceuticals industry forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cold chain logistics market for pharmaceuticals industry report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cold chain logistics market for pharmaceuticals industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Agility Public Warehousing Co. K.S.C.P - The company specializes in logistics solutions for less-than-container-load (LCL) reefer shipments and the transportation of pharmaceutical products to challenging destinations, including areas with power outages and for last-mile delivery. Our cold chain services ensure the preservation of temperature-sensitive goods throughout the supply chain.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agility Public Warehousing Co. K.S.C.P

- Americold

- Burris Logistics Co.

- Cold Chain Technologies

- Coldman Logistics Pvt. Ltd.

- Confederation Freezers - Brampton

- DHL Express Ltd.

- DSV AS

- Emergent Cold

- FedEx Corp.

- FreezPak Logistics

- Helapet ltd.

- Interstate Warehousing, Inc

- Kuehne Nagel Management AG

- Lineage Logistics Holdings LLC

- Nichirei Corp.

- SCG Logistics Management Co. Ltd.

- SF Express Co. Ltd.

- Snowman Logistics Limited

- Trenton Cold Storage, Inc.

- Uber Technologies Inc.

- United Parcel Service Inc.

- United States Cold Storage

- VersaCold Logistics Services

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The cold chain logistics market for the pharmaceutical industry plays a crucial role in ensuring the integrity and efficacy of temperature-sensitive goods, including novel drugs, vaccines, biopharmaceuticals, clinical trial materials, and over-the-counter (OTC) medicines. These goods require specific temperature conditions during transportation, storage, and last-mile delivery to maintaIn their quality and potency. The pharmaceutical exports sector relies heavily on cold chain logistics to meet the stringent regulatory requirements and customer expectations. Hospitals, clinics, pharmacies, health centers, and other healthcare facilities are key consumers of these temperature-sensitive goods. Raw material suppliers, packaging suppliers, and retailers also depend on efficient cold chain logistics to deliver their products in a timely and cost-effective manner.

The cold chain logistics market encompasses various transportation modes, such as sea freight, air freight, and overland logistics. Each mode offers unique advantages and challenges in terms of temperature control and transit time. Sea freight logistics, for instance, is often the most cost-effective option for large volumes of goods, but it may take longer transit times and require additional insulation and refrigeration equipment. Air freight logistics, on the other hand, offers faster transit times but is generally more expensive. Overland logistics, including road and rail transport, can be a cost-effective alternative for shorter distances and can offer more flexible temperature control options.

The cold chain logistics market is driven by several factors, including the increasing demand for temperature-sensitive goods, the growing number of clinical trials and regulatory approvals for novel drugs, and the expanding global pharmaceutical market. Advanced technologies, such as telematics, machine learning, big data, automation instruments, warehouse execution software, and warehouse management software, are also transforming the cold chain logistics market by improving temperature control, monitoring, and traceability. The market dynamics of cold chain logistics for the pharmaceutical industry are complex and multifaceted. Key players In the market include logistics providers, such as FedEx and SenseAware, and technology providers, such as warehouse management software and blockchain technology companies.

These players are constantly innovating to meet the evolving needs of the pharmaceutical industry and to stay competitive In the market. The cold chain logistics market for the pharmaceutical industry is a critical component of the larger supply chain, which also includes the production and distribution of raw materials, manufacturing, packaging, and labeling. Effective cold chain logistics can help reduce costs, improve efficiency, and ensure regulatory compliance, making it an essential aspect of the pharmaceutical industry's value chain. In conclusion, the cold chain logistics market for the pharmaceutical industry plays a vital role in ensuring the quality, safety, and efficacy of temperature-sensitive goods, including novel drugs, vaccines, biopharmaceuticals, clinical trial materials, and OTC medicines.

The market is driven by several factors, including the increasing demand for temperature-sensitive goods, regulatory requirements, and technological innovations. Effective cold chain logistics is essential for the pharmaceutical industry's value chain, from raw material suppliers to retailers, and requires a complex and multifaceted approach to temperature control, monitoring, and traceability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 14561.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.2 |

|

Key countries |

US, China, Germany, India, Canada, UK, Japan, Brazil, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cold Chain Logistics Market For Pharmaceuticals Industry Research and Growth Report?

- CAGR of the Cold Chain Logistics For Pharmaceuticals Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cold chain logistics market for pharmaceuticals industry growth of industry companies

We can help! Our analysts can customize this cold chain logistics market for pharmaceuticals industry research report to meet your requirements.