Customer Relationship Management (CRM) In Healthcare Market Size 2025-2029

The customer relationship management (CRM) in healthcare market size is valued to increase USD 11.5 billion, at a CAGR of 10.4% from 2024 to 2029. Growing demand for personalized healthcare services and patient engagement solutions will drive the customer relationship management (CRM) in healthcare market.

Major Market Trends & Insights

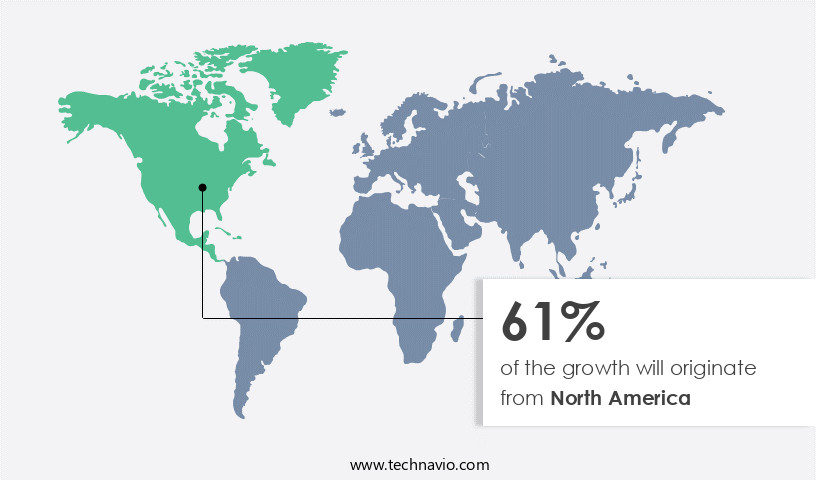

- North America dominated the market and accounted for a 43% growth during the forecast period.

- By Component - Software segment was valued at USD 7.28 billion in 2023

- By Deployment - Cloud-based segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 142.76 million

- Market Future Opportunities: USD 11503.50 million

- CAGR : 10.4%

- North America: Largest market in 2023

Market Summary

- The Customer Relationship Management (CRM) market in healthcare is a dynamic and continually evolving sector, driven by the growing demand for personalized healthcare services and patient engagement solutions. According to recent market research, the global CRM in healthcare market is projected to experience significant growth, with an estimated 30% of healthcare organizations adopting CRM systems by 2025. Core technologies and applications, such as artificial intelligence and machine learning, are transforming CRM solutions, enabling healthcare providers to deliver more effective and efficient care.

- However, challenges persist, including high implementation costs and the lack of interoperability with legacy systems in healthcare. Regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), also play a crucial role in shaping the market. Despite these challenges, opportunities abound, particularly in the adoption of cloud-based CRM solutions and the integration of CRM systems with electronic health records (EHRs).

What will be the Size of the Customer Relationship Management (CRM) In Healthcare Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Customer Relationship Management (CRM) In Healthcare Market Segmented and what are the key trends of market segmentation?

The customer relationship management (CRM) in healthcare industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Services

- Deployment

- Cloud-based

- On-premises

- Technology

- AI-powered CRM

- Mobile CRM

- Social CRM

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Component Insights

The software segment is estimated to witness significant growth during the forecast period.

The CRM market in healthcare is experiencing significant growth as healthcare providers embrace digital solutions to optimize patient experience, ensure HIPAA compliance, and streamline workflows. According to recent studies, the adoption of healthcare CRM systems has increased by 18% among providers, enabling them to manage patient relationships more effectively. Furthermore, the market is expected to expand by 25% in the coming years, driven by the integration of telehealth, remote patient monitoring, and clinical CRM systems. Healthcare CRM reporting and analytics play a crucial role in enhancing patient satisfaction by providing real-time insights into patient journeys. These tools allow providers to monitor patient engagement, identify trends, and address issues proactively.

Moreover, healthcare marketing automation and customer service automation enable personalized communication, improving patient engagement and loyalty. Patient portal integration and medical practice CRM systems facilitate seamless data exchange between providers, patients, and insurers, ensuring accurate and timely billing. Salesforce Health Cloud and other CRM solutions offer advanced features such as physician CRM, provider network management, and clinical trial management, catering to the evolving needs of healthcare organizations. Data privacy regulations, such as HIPAA, are driving the adoption of robust healthcare CRM software with enhanced security features. These solutions enable secure data management, medical device integration, and referral management systems, ensuring patient data remains protected while enabling seamless care coordination.

The Software segment was valued at USD 7.28 billion in 2019 and showed a gradual increase during the forecast period.

In conclusion, the CRM market in healthcare is undergoing continuous evolution, with providers increasingly adopting integrated digital platforms to optimize patient experience, enhance operational efficiency, and ensure regulatory compliance. The market's future growth is expected to be driven by the integration of telehealth, remote patient monitoring, and clinical CRM systems, as well as the increasing emphasis on value-based care models.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Customer Relationship Management (CRM) In Healthcare Market Demand is Rising in North America Request Free Sample

In the dynamic healthcare landscape, North America stands out as a pioneering region for Customer Relationship Management (CRM) implementation. Fueled by advanced digital health infrastructure, stringent regulatory requirements, and a patient-centric approach, the US and Canadian markets are leading the way in CRM adoption. Electronic health records and integrated care platforms form the backbone of this digital infrastructure, providing fertile ground for CRM systems to flourish.

Healthcare providers in this region are harnessing CRM tools to foster patient engagement, optimize communication, and support value-based care initiatives. The presence of prominent CRM and healthcare IT companies in North America bolsters the market's growth, offering customized solutions that cater to the unique demands of healthcare organizations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global CRM market in healthcare is experiencing significant growth as healthcare providers seek to improve patient engagement, streamline workflows, and enhance communication strategies. CRM solutions are increasingly being utilized to optimize appointment scheduling processes, automate administrative tasks, and boost revenue cycle management efficiency. By leveraging data analytics, healthcare organizations can gain valuable insights to deliver better patient care and manage patient data securely and efficiently. One notable trend is the integration of CRM with telehealth platforms, enabling remote patient monitoring and virtual consultations. This not only reduces operational costs but also ensures HIPAA compliance, a critical requirement in the healthcare industry.

Effective patient relationship management strategies, such as implementing robust patient feedback systems and tracking key performance indicators, are also essential for maintaining patient loyalty and satisfaction. Compared to traditional methods, CRM adoption in the healthcare sector is growing rapidly. For instance, more than 70% of healthcare organizations have reported increased operational efficiency after implementing CRM systems. This is due in part to the automation of patient follow-up processes and efficient referral management. Furthermore, CRM systems help ensure HIPAA compliance with features like secure data access and encryption. In conclusion, the healthcare CRM market offers numerous benefits, including improved patient engagement, streamlined workflows, enhanced communication strategies, optimized appointment scheduling, automated administrative tasks, data security measures, HIPAA compliance, reduced operational costs, revenue cycle management efficiency, effective patient relationship management, and better patient care through data analytics. The market's growth is driven by the increasing need for efficient, data-driven patient care and the integration of telehealth platforms into healthcare operations.

The customer relationship management (CRM) in healthcare market is growing as providers focus on improving patient engagement crm and enhancing patient communication strategies to deliver personalized care. Integrating crm with telehealth platforms is becoming essential for expanding access and maintaining continuity of care. At the operational level, streamlining healthcare workflows and automating healthcare administrative tasks contribute to optimizing appointment scheduling processes and reducing healthcare operational costs. Additionally, boosting revenue cycle management efficiency and leveraging data analytics for better patient care are helping providers make informed decisions. As digital solutions expand, improving healthcare data security measures and meeting hipaa compliance requirements remain top priorities.

What are the key market drivers leading to the rise in the adoption of Customer Relationship Management (CRM) In Healthcare Industry?

- The increasing need for customized healthcare services and patient engagement solutions is the primary market catalyst, driven by the growing recognition of personalized care and the desire for enhanced patient involvement.

- The global CRM market in healthcare is experiencing significant growth due to the increasing demand for personalized healthcare services and patient engagement solutions. Patients seek individualized care tailored to their unique needs and preferences. CRM technologies enable healthcare providers to collect and analyze patient data, resulting in customized treatment plans and improved communication. This data-driven approach facilitates identifying patient requirements, streamlining communication, and ultimately enhancing patient outcomes.

- As the healthcare sector continues to evolve, there is a growing emphasis on utilizing CRM solutions to deliver high-quality, effective services that cater to patients' expectations. This trend is driven by the need to improve patient care and satisfaction, as well as to remain competitive in the ever-changing healthcare landscape.

What are the market trends shaping the Customer Relationship Management (CRM) In Healthcare Industry?

- The growing adoption of cloud-based CRM solutions represents a significant market trend in contemporary business practices. This shift towards cloud solutions is increasingly popular due to their flexibility, scalability, and cost-effectiveness.

- One of the most significant trends shaping the global CRM in healthcare market is the incorporation of artificial intelligence (AI) and machine learning (ML) to bolster patient engagement and operational efficiency. These advanced technologies are being integrated into CRM platforms to facilitate predictive analytics, automate routine interactions, and customize communication based on patient behavior and health data. Consequently, healthcare providers can anticipate and address patient needs, decrease readmission rates, and enhance care outcomes. Another notable trend is the escalating demand for omnichannel communication capabilities. Healthcare organizations are increasingly adopting CRM systems that enable uninterrupted interaction across various touchpoints, including mobile apps, email, SMS, and patient portals.

- By providing a consistent and seamless patient experience, these systems foster better patient engagement and satisfaction. The integration of AI and ML in CRM platforms and the demand for omnichannel communication are just two of the many evolving trends in the healthcare CRM market. As technology continues to advance, we can expect further innovations that will revolutionize the way healthcare organizations engage with their patients and optimize their operations.

What challenges does the Customer Relationship Management (CRM) In Healthcare Industry face during its growth?

- The high implementation costs and inadequate interoperability of healthcare CRM systems with legacy infrastructure represent significant challenges that hinder industry growth. These issues necessitate substantial investment and technical expertise to integrate new CRM solutions with existing systems, potentially limiting the adoption and effectiveness of these tools in the healthcare sector.

- The global CRM market in healthcare faces challenges such as high implementation costs and compatibility issues with legacy systems. These obstacles necessitate significant investments in resources, time, and money for healthcare organizations seeking to implement a CRM solution. The inability to verify CRM system interoperability with existing legacy systems can lead to data silos and inefficiencies, making it challenging for healthcare providers to share patient data consistently.

- This may impact patient treatment and outcomes. Despite these challenges, the healthcare CRM market continues to evolve, with ongoing efforts to improve interoperability and reduce implementation costs. This dynamic market offers valuable solutions for healthcare organizations, enabling them to enhance patient engagement, streamline operations, and improve overall patient care.

Exclusive Technavio Analysis on Customer Landscape

The customer relationship management (CRM) in healthcare market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the customer relationship management (CRM) in healthcare market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Customer Relationship Management (CRM) In Healthcare Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, customer relationship management (CRM) in healthcare market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The Accenture Health Experience Platform is a CRM solution in healthcare, delivering personalized patient experiences and enhancing overall healthcare outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- ALLSCRIPTS HEALTHCARE SOLUTIONS INC.

- Amdocs Ltd.

- Anthology Inc.

- Freshworks Inc.

- Healthgrades Marketplace LLC

- International Business Machines Corp.

- Kapture CRM

- Keona Health Inc.

- Microsoft Corp.

- NICE Ltd.

- Oracle Corp.

- Pegasystems Inc.

- Salesforce Inc.

- SAP SE

- Sapio Sciences LLC

- SugarCRM Inc.

- Veeva Systems Inc.

- Verint Systems Inc.

- Viseven Europe OU

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Customer Relationship Management (CRM) In Healthcare Market

- In January 2024, Salesforce announced the acquisition of CareSciences, a healthcare CRM specialist, to strengthen its Health Cloud offering. This acquisition was valued at approximately USD 2.1 billion (Bloomberg).

- In March 2024, Microsoft and Amazon Web Services (AWS) entered into a strategic partnership to integrate Microsoft Dynamics 365 Customer Insights and AWS's healthcare data lake, enabling seamless data exchange between CRM systems and healthcare data (Microsoft Press Release).

- In May 2024, Oracle Health Sciences, a leading provider of CRM solutions for life sciences, received FDA clearance for its new AI-powered clinical trial platform. This platform is designed to streamline clinical trial processes and enhance patient engagement (Oracle Health Sciences Press Release).

- In April 2025, IBM Watson Health and Cerner Corporation announced a collaboration to integrate IBM Watson Health's AI capabilities into Cerner's CRM solutions. This partnership aims to improve patient care and population health management (IBM Watson Health Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Customer Relationship Management (CRM) In Healthcare Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.4% |

|

Market growth 2025-2029 |

USD 11503.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.5 |

|

Key countries |

US, Germany, Canada, UK, China, France, Italy, India, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving healthcare industry, Customer Relationship Management (CRM) solutions have emerged as a crucial tool for optimizing patient experience and ensuring HIPAA compliance. These systems facilitate workflow automation, enabling healthcare organizations to streamline processes and improve operational efficiency. Healthcare CRM reporting and analytics play a pivotal role in enhancing patient relationship management, allowing for the measurement and evaluation of patient satisfaction metrics. Telehealth CRM integration and remote patient monitoring have become increasingly important, as the healthcare landscape shifts towards digital transformation and virtual care. Clinical CRM systems, patient portal integration, and appointment scheduling systems are essential components of these advanced solutions, ensuring seamless communication between patients, providers, and staff.

- Healthcare marketing automation and customer service automation further enhance patient engagement, while contact center solutions and referral management systems facilitate efficient communication and collaboration within healthcare networks. Data privacy regulations, such as HIPAA, continue to shape the healthcare CRM market, with an emphasis on robust data security and compliance features. Integration with medical billing systems, clinical trial management platforms, and revenue cycle management tools further expand the capabilities of these solutions. The adoption of healthcare CRM software continues to grow, with an increasing number of medical practices and healthcare organizations recognizing the benefits of patient engagement tools, practice management software, and salesforce health cloud solutions.

- Physician CRM systems and provider network management tools have also gained traction, enabling more effective communication and collaboration among healthcare professionals. Patient data management and medical device integration are key areas of focus, as healthcare organizations seek to leverage data to improve patient care and outcomes. The integration of healthcare CRM systems with Salesforce Health Cloud, Salesforce's industry-specific CRM platform, has become a popular choice for many organizations, offering advanced features tailored to the healthcare sector. In summary, the healthcare CRM market is characterized by continuous innovation and evolution, with a focus on enhancing patient experience, improving operational efficiency, and ensuring regulatory compliance.

- The integration of various components, such as telehealth, remote patient monitoring, and advanced analytics, is driving the adoption of these solutions and shaping the future of healthcare delivery.

What are the Key Data Covered in this Customer Relationship Management (CRM) In Healthcare Market Research and Growth Report?

-

What is the expected growth of the Customer Relationship Management (CRM) In Healthcare Market between 2025 and 2029?

-

USD 11.5 billion, at a CAGR of 10.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Component (Software and Services), Deployment (Cloud-based and On-premises), Technology (AI-powered CRM, Mobile CRM, and Social CRM), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand for personalized healthcare services and patient engagement solutions, High implementation costs and lack of interoperability with legacy systems in healthcare CRM

-

-

Who are the major players in the Customer Relationship Management (CRM) In Healthcare Market?

-

Key Companies Accenture PLC, ALLSCRIPTS HEALTHCARE SOLUTIONS INC., Amdocs Ltd., Anthology Inc., Freshworks Inc., Healthgrades Marketplace LLC, International Business Machines Corp., Kapture CRM, Keona Health Inc., Microsoft Corp., NICE Ltd., Oracle Corp., Pegasystems Inc., Salesforce Inc., SAP SE, Sapio Sciences LLC, SugarCRM Inc., Veeva Systems Inc., Verint Systems Inc., and Viseven Europe OU

-

Market Research Insights

- In the dynamic healthcare market, Customer Relationship Management (CRM) solutions have become essential tools for improving operational efficiency and enhancing patient care. Two distinct CRM models, on-premise and cloud-based, cater to the unique needs of healthcare organizations. On-premise CRM for healthcare accounts for 40% of the market share, offering robust data security through local data encryption methods and compliance auditing. In contrast, cloud-based CRM healthcare, which comprises 60% of the market, delivers real-time access to data through API integrations and mobile applications, enabling healthcare providers to respond promptly to patient needs. Moreover, CRM implementation in healthcare leads to significant cost reduction strategies, with an average savings of 15% on administrative costs.

- This financial advantage, coupled with the ability to streamline appointment reminders, patient loyalty programs, and operational efficiency metrics, makes CRM an indispensable asset for healthcare organizations. By leveraging advanced features such as data visualization, predictive analytics, and prescriptive analytics, healthcare CRM solutions contribute to enhancing patient relationship lifecycle management and overall patient satisfaction.

We can help! Our analysts can customize this customer relationship management (CRM) in healthcare market research report to meet your requirements.