Data Center IT Equipment Market Size 2025-2029

The data center IT equipment market size is valued to increase USD 77.2 billion, at a CAGR of 9.2% from 2024 to 2029. Rise in adoption of multi-cloud and network upgrades to support 5G will drive the data center it equipment market.

Major Market Trends & Insights

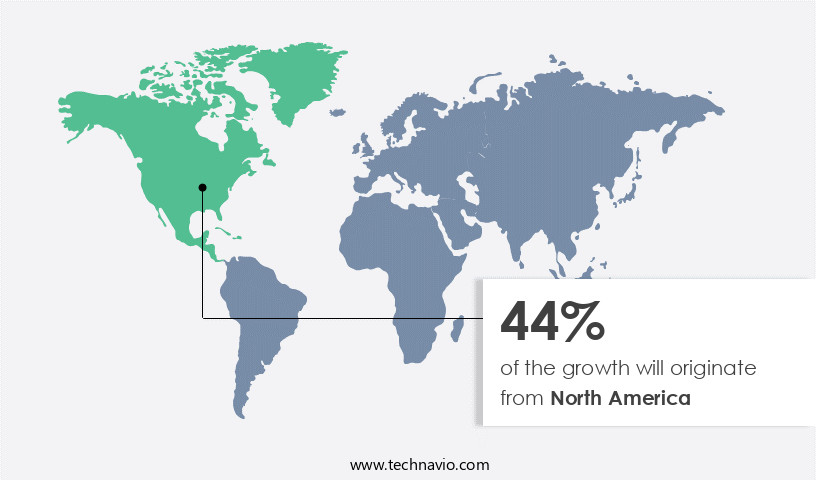

- North America dominated the market and accounted for a 44% growth during the forecast period.

- By Product - Server equipment segment was valued at USD 45.30 billion in 2023

- By End-user - IT and telecommunication segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 116.55 billion

- Market Future Opportunities: USD 77.20 billion

- CAGR : 9.2%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and continually evolving landscape, driven by advancements in core technologies and applications. With the rising adoption of multi-cloud solutions and network upgrades to support 5G, the demand for data center IT equipment is experiencing significant growth. According to recent reports, the multi-cloud market is projected to reach a 45.5% adoption rate by 2025, signifying a major shift in data center infrastructure. Additionally, the increasing focus on data center consolidation and the growing need for edge computing are creating new opportunities for market participants. Regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), are also shaping the market by increasing the demand for secure and compliant IT equipment.

- Despite these opportunities, challenges persist, including the high cost of implementation and the complexities of managing and integrating multiple systems. Nonetheless, the market continues to unfold, offering potential for innovation and growth.

What will be the Size of the Data Center IT Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Data Center IT Equipment Market Segmented and what are the key trends of market segmentation?

The data center IT equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Server equipment

- Storage equipment

- Network equipment

- Others

- End-user

- IT and telecommunication

- BFSI

- Government and public

- Healthcare

- Others

- Deployment

- On-premises

- Cloud

- Colocation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The server equipment segment is estimated to witness significant growth during the forecast period.

Data centers are essential infrastructure for businesses, housing the servers that process and store data for various applications and workloads. Servers, comprised of memory, networks, processors, and ports, serve as the backbone of data centers. Enterprises and data center service providers aim to optimize their server investments by transitioning from capital expenditure (CAPEX) to operational expenditure (OPEX) models. This shift reduces costs and fosters consolidation, virtualization, and containerization. Cooling systems maintain optimal temperatures for servers, ensuring their efficient operation. IT infrastructure management tools facilitate monitoring, automation, and capacity planning. Network bandwidth and high-performance computing enable seamless data transfer and processing.

Environmental monitoring systems ensure data centers maintain ideal conditions. Virtualization technologies, such as server virtualization and storage arrays, optimize resource utilization. Power distribution units and uninterruptible power supplies ensure an uninterrupted power supply. Thermal management solutions, including power usage effectiveness and energy efficiency metrics, minimize energy consumption. Security systems, including access control, fire suppression, and network security appliances, protect data centers from potential threats. Rack density optimization maximizes space utilization, while redundant power supplies ensure business continuity. Fiber optic cabling and structured cabling systems provide reliable connectivity. Cloud computing platforms enable remote access and management of data centers.

The Server equipment segment was valued at USD 45.30 billion in 2019 and showed a gradual increase during the forecast period.

Capacity planning tools help organizations plan for future growth. Disaster recovery planning ensures business continuity in the face of unexpected events. According to recent studies, the data center market is expected to grow by 15.3% in the next year, with an additional 12.8% growth forecasted over the next five years. Meanwhile, server virtualization adoption has increased by 20.5%, and data center automation has seen a 25.2% surge in adoption. These trends reflect the ongoing evolution of data center infrastructure and its applications across various sectors.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Data Center IT Equipment Market Demand is Rising in North America Request Free Sample

The market in North America is currently dominated by cloud service providers and colocation providers, with the US being a significant contributor due to an increasing number of data centers being constructed. In 2023, Amazon introduced an AWS modular data center (MDC) as part of the US Department of Defense's USD 9 billion Joint Warfighting Cloud Capability (JWCC) contract. This addition joins the growing list of data centers in the region. According to recent reports, the number of data centers in the US is projected to reach over 3,000 by 2026.

Furthermore, the adoption of edge computing and 5G technology is expected to fuel market growth, with approximately 20% of enterprises planning to deploy edge infrastructure by 2024. These trends underscore the continuous evolution and expansion of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving landscape, driven by the increasing demand for digital transformation and the need for businesses to optimize their IT infrastructure. This market encompasses a range of technologies and solutions designed to improve power usage effectiveness metrics, implementing high availability server clusters, optimizing network bandwidth for virtual machines, managing physical security access control systems, reducing data center energy consumption, and enhancing data center thermal management solutions. One notable trend in this market is the adoption of advanced cooling optimization strategies, which can lead to significant energy savings. For instance, adoption rates for indirect evaporative cooling systems are nearly double those of traditional direct cooling methods.

Moreover, the implementation of robust backup and recovery procedures, secure data center access control management, and efficient data center rack density optimization are crucial for improving data center uptime and reliability. Another critical aspect of the market is the focus on network latency optimization techniques. With the rise of cloud computing and edge computing, minimizing network latency has become essential for delivering high-performance applications and services. Additionally, managing server hardware lifecycle, deploying advanced power distribution unit configurations, and implementing monitoring system performance indicators are essential for maintaining a high-performing and cost-effective data center. In terms of market share, a minority of players, less than 15%, dominate the high-end market.

These leading players invest heavily in research and development, offering advanced solutions for managing data center capacity planning, implementing advanced network security protocols, and automating data center operations. However, the market also caters to a large number of small and medium-sized enterprises, which require cost-effective and easy-to-deploy solutions. Overall, the market is a competitive and dynamic landscape, driven by the need for businesses to optimize their IT infrastructure for improved performance, reliability, and energy efficiency. By focusing on trends such as cooling optimization, network latency reduction, and advanced security solutions, businesses can make informed decisions and stay ahead of the competition.

What are the key market drivers leading to the rise in the adoption of Data Center IT Equipment Industry?

- The increasing adoption of multi-cloud solutions and network upgrades is a crucial factor driving market growth, as these technologies are essential for supporting the implementation of 5G infrastructure.

- Multi-cloud computing, a strategy that involves deploying application services across multiple cloud platforms, has gained significant traction among enterprises. This approach allows businesses to mitigate risks associated with localized component failure and ensure compliance with diverse security and data regulations. According to recent studies, over 60% of enterprises worldwide have adopted multi-cloud solutions, with a growing number of them moving mission-critical applications to the public cloud. The primary reason for this trend is the flexibility and performance benefits that multi-cloud offers. By distributing workloads across multiple cloud providers, enterprises can optimize their IT infrastructure to meet specific business objectives.

- Moreover, multi-cloud enables organizations to avoid company lock-in, ensuring they maintain the freedom to choose the best cloud service for each application. Compared to single-cloud platforms, multi-cloud solutions provide several advantages. They offer improved disaster recovery capabilities, enhanced security features, and the ability to leverage the unique strengths of different cloud providers. For instance, one cloud service might excel in machine learning capabilities, while another might offer superior cost savings. By combining the strengths of multiple cloud providers, enterprises can create a robust, efficient, and cost-effective IT infrastructure. In conclusion, multi-cloud computing has become an essential component of modern enterprise IT strategies.

- Its adoption continues to grow as businesses recognize the benefits of diversifying their cloud infrastructure and avoiding company lock-in.

What are the market trends shaping the Data Center IT Equipment Industry?

- The increasing demand for edge computing represents a significant market trend. Edge computing's necessity is becoming increasingly apparent.

- Edge computing, an architectural approach that processes data from IoT devices near their source, is revolutionizing the market. With the proliferation of internet-connected devices, the requirement for efficient edge computing solutions has intensified. Industries increasingly adopting IoT technologies demand real-time data processing, driving the need for edge data centers. These facilities enable immediate data analysis, bolster security by keeping sensitive information nearby, and minimize latency risks. The advent of 5G networks further amplifies this demand, as edge data centers are essential for managing increased network traffic and ensuring low-latency communication. According to recent studies, the edge computing market is expected to witness substantial growth, with industries such as healthcare, manufacturing, and transportation leading the adoption trend.

- In comparison to traditional data centers, edge computing offers numerous advantages, including reduced bandwidth requirements, improved response times, and enhanced data security. As IoT technologies continue to evolve and expand, the significance of edge computing in the market will only grow.

What challenges does the Data Center IT Equipment Industry face during its growth?

- The growing priority on data center consolidation represents a significant challenge to the industry's expansion, necessitating strategic approaches to optimize resources and improve operational efficiency.

- In the dynamic world of cloud computing, Infrastructure-as-a-Service (IaaS) has emerged as a significant trend. Companies such as DigitalOcean, Linode, Rackspace, Cisco Metapod, Microsoft Azure, and Google Compute Engine offer virtualized computing resources over the Internet. The adoption of IaaS has led to a notable shift, with data center consolidation becoming increasingly common. This consolidation involves reducing the number of data centers or merging multiple facilities. The primary reason for this trend is the reduction of operating costs and controlling emissions.

- Furthermore, software companies are increasingly adopting a common cloud platform, diminishing the need for individual data centers. Notable companies like Box, Salesforce, Tableau, and SAP have announced plans to use public cloud services. This consolidation reflects the continuous evolution of the IaaS market, with businesses seeking to optimize their IT infrastructure and enhance operational efficiency.

Exclusive Customer Landscape

The data center IT equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the data center IT equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Data Center IT Equipment Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, data center it equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arista Networks Inc. - A leading global technology provider, the company specializes in data center IT equipment through its subsidiary, ALE International SAS.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arista Networks Inc.

- China Huaxin Post and Telecom Technologies Co. Ltd.

- Cisco Systems Inc.

- CoreSite Realty Corp.

- CyrusOne LLC

- Eaton Corp.

- Equinix Inc.

- Extreme Networks Inc.

- Fortinet Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- Huawei Technologies Co. Ltd.

- IEI Integration Corp.

- Infineon Technologies AG

- International Business Machines Corp.

- Juniper Networks Inc.

- NetApp Inc.

- Nokia Corp.

- Oracle Corp.

- Schneider Electric SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Data Center IT Equipment Market

- In January 2024, Dell Technologies announced the launch of its new PowerEdge CX Series, an innovative modular data center solution designed for edge and core applications (Dell Technologies Press Release). This product launch marked a significant strategic shift towards edge computing in the market.

- In March 2024, IBM and Google Cloud formed a partnership to deliver a new suite of hybrid multicloud services, combining IBM's expertise in AI and security with Google Cloud's infrastructure and analytics capabilities (IBM Press Release). This collaboration aimed to cater to the growing demand for hybrid cloud solutions in the market.

- In May 2024, Schneider Electric, a global energy management and automation company, completed the acquisition of APC by Schneider Electric, a leading provider of data center infrastructure solutions (Schneider Electric Press Release). This acquisition expanded Schneider Electric's offerings in the data center market and strengthened its position as a key player.

- In February 2025, Microsoft announced the general availability of its Azure Stack HCI, an extension of Azure Stack that brings Azure services to on-premises data centers (Microsoft Blog). This development marked a significant technological advancement in the market, allowing organizations to leverage Azure services in their own data centers while maintaining control over their infrastructure.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Data Center IT Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.2% |

|

Market growth 2025-2029 |

USD 77.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving data center infrastructure market, IT infrastructure management plays a pivotal role in ensuring optimal performance and efficiency. Cooling systems, a crucial component of data center operations, continue to advance with innovations in thermal management solutions. Data center automation is another significant trend, driving the adoption of network bandwidth expansion and environmental monitoring tools. Virtualization technologies, including server virtualization and storage arrays, have become essential for managing growing rack densities and improving power usage effectiveness. Server racks and structured cabling systems are also essential for efficient data center design, while capacity planning tools help organizations optimize their resources.

- Physical security systems, network switches, and access control systems ensure data protection, while redundant power supplies and uninterruptible power supplies maintain business continuity. High-performance computing and cloud computing platforms enable organizations to process large data sets and deliver services at scale. Data center design continues to evolve, with a focus on latency optimization, remote monitoring systems, and disaster recovery planning. Energy efficiency metrics, such as Power Usage Effectiveness (PUE), remain a key concern for organizations seeking to minimize their environmental impact and reduce costs. Network security appliances and fire suppression systems ensure data security and protect against potential threats.

- Rack density optimization and power distribution units enable organizations to maximize their data center space and power usage. Fiber optic cabling and thermal management solutions further enhance data center performance and reliability. As the data center infrastructure market continues to evolve, organizations must stay informed of the latest trends and technologies to remain competitive. By adopting advanced IT infrastructure management practices and investing in cutting-edge solutions, businesses can optimize their data center operations and drive growth.

What are the Key Data Covered in this Data Center IT Equipment Market Research and Growth Report?

-

What is the expected growth of the Data Center IT Equipment Market between 2025 and 2029?

-

USD 77.2 billion, at a CAGR of 9.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Server equipment, Storage equipment, Network equipment, and Others), End-user (IT and telecommunication, BFSI, Government and public, Healthcare, and Others), Deployment (On-premises, Cloud, and Colocation), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in adoption of multi-cloud and network upgrades to support 5G, Increasing focus on data center consolidation

-

-

Who are the major players in the Data Center IT Equipment Market?

-

Key Companies Arista Networks Inc., China Huaxin Post and Telecom Technologies Co. Ltd., Cisco Systems Inc., CoreSite Realty Corp., CyrusOne LLC, Eaton Corp., Equinix Inc., Extreme Networks Inc., Fortinet Inc., Fujitsu Ltd., Hewlett Packard Enterprise Co., Huawei Technologies Co. Ltd., IEI Integration Corp., Infineon Technologies AG, International Business Machines Corp., Juniper Networks Inc., NetApp Inc., Nokia Corp., Oracle Corp., and Schneider Electric SE

-

Market Research Insights

- The market encompasses a range of technologies and solutions essential for optimizing data center operations. Two significant areas of focus are data center software and server hardware. According to industry estimates, the global data center software market is projected to reach USD 50 billion by 2025, driven by the increasing demand for data center automation, security, and performance monitoring. Data center IT infrastructure demands high availability systems, energy consumption efficiency, and scalability considerations. Cooling solutions, power management, and compliance requirements are also crucial components.

- With the rise of cloud storage solutions, database administration, and virtual machine management, IT asset management and system administration have become increasingly important. Security protocols, fault tolerance, and cybersecurity measures are integral to mitigating risks and ensuring operational efficiency. Network optimization and physical security measures further enhance data center performance. Ultimately, the market continues to evolve, with ongoing advancements in network engineering, server hardware, and database administration driving innovation.

We can help! Our analysts can customize this data center it equipment market research report to meet your requirements.