Digital Photo Frame Market Size and Forecast 2025-2029

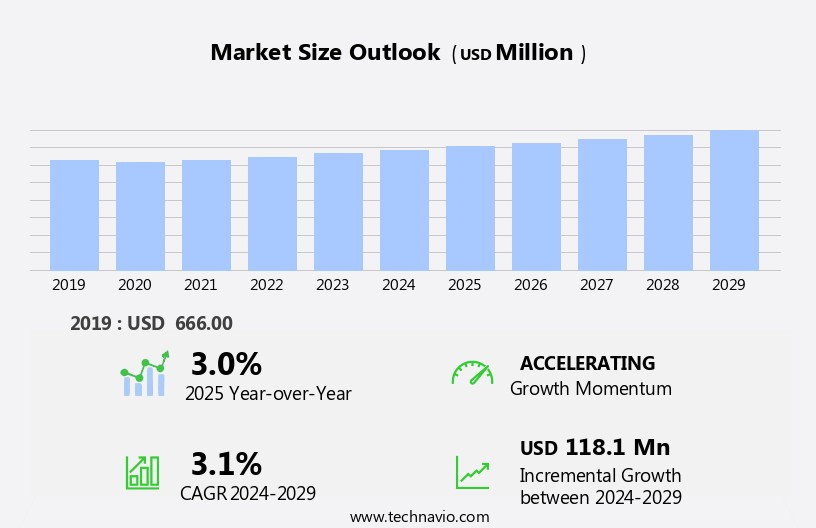

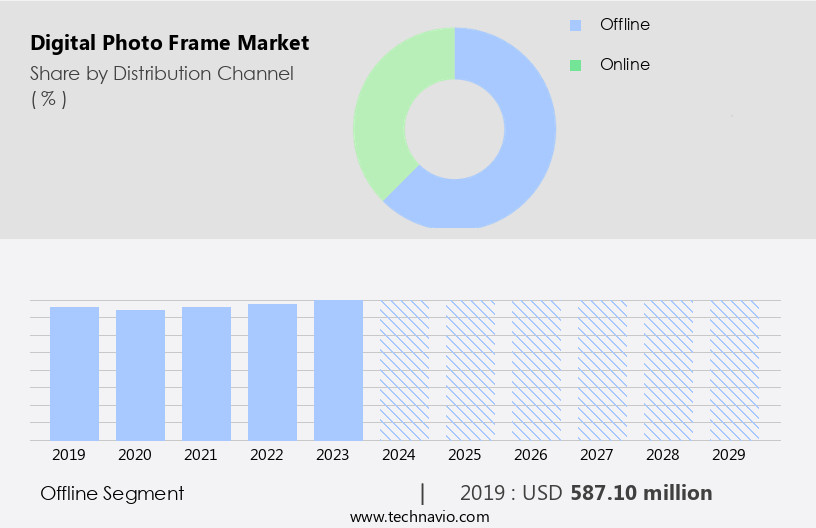

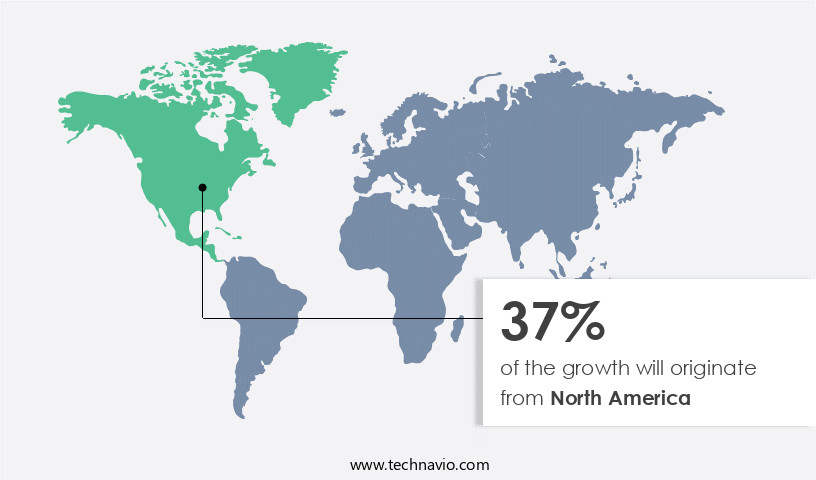

The digital photo frame market size estimates the market to reach by USD 118.1 million, at a CAGR of 3.1% between 2024 and 2029. North America is expected to account for 37% of the growth contribution to the global market during this period. In 2019 the offline segment was valued at USD 587.10 million and has demonstrated steady growth since then.

|

Report Coverage |

Details |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

| Market structure | Fragmented |

|

Market growth 2025-2029 |

USD 118.1 million |

- The market is experiencing significant growth, driven by the increasing inclination toward high standards of living and the introduction of smart digital photo frames. These advanced frames offer features such as Wi-Fi connectivity, touchscreens, and integration with social media platforms, enhancing the user experience. However, the market faces challenges due to the complexity of the supply chain. Manufacturers must navigate intricate relationships with component suppliers, logistics providers, and retailers to ensure a seamless production and distribution process. Additionally, staying updated with the latest technology trends and consumer preferences is crucial to remain competitive.

- Companies seeking to capitalize on market opportunities should focus on innovation, efficient supply chain management, and effective marketing strategies to meet the evolving demands of consumers in the digital age.

What will be the Size of the Digital Photo Frame Market during the forecast period?

The market continues to evolve, offering innovative features that cater to diverse consumer needs. Motion sensor activation, for instance, allows frames to turn on when approaching the room, enhancing energy efficiency and convenience. Image file compatibility extends beyond common formats, ensuring versatility in displaying various types of digital media. SD card compatibility and USB connectivity options enable seamless transfer of multimedia files, while picture editing software integration allows users to enhance images before display. Screen aspect ratios and data transfer speeds cater to high-resolution content, and multimedia file support expands the scope of digital photo frames.

Image rotation options and video playback quality add dynamic elements, while remote control features offer flexibility in managing content. Digital image display, display brightness levels, and auto slideshow functions ensure a visually engaging experience. Wi-fi connectivity support and cloud storage integration facilitate remote image uploads, enhancing convenience. The market anticipates a robust growth of 15% annually, driven by advancements in technology and increasing consumer demand for personalized and interactive digital displays. For instance, a leading digital photo frame manufacturer reported a 20% increase in sales due to the introduction of a new model with a high-resolution screen and touchscreen functionality.

These innovations, coupled with features like calendar display options, digital photo organizers, user interface designs, and digital photo storage, create a dynamic market that caters to various sectors, from personal use to commercial applications.

How is this Digital Photo Frame Industry segmented?

The digital photo frame industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Source

- Electricity-powered

- Battery-powered

- Application

- Residential

- Commercial

- Type

- Standard Digital Photo Frames

- Multimedia Digital Photo Frames

- Smart Digital Photo Frames

- Display Sizes

- Under 8 inches

- 8 to 10 inches

- Above 10 inches

- Power Source

- Battery-Operated

- AC-Powered

- USB-Powered

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

Digital photo frames continue to gain popularity in the US market, offering consumers a unique way to showcase their memories. These frames come with various features to enhance the user experience. Motion sensor activation allows the frame to turn on when someone enters the room. Image file compatibility ensures users can display a wide range of formats, while SD card compatibility and USB connectivity options enable easy transfer of images. Picture editing software allows users to enhance their photos before displaying them. Screen aspect ratio and data transfer speed ensure smooth image transitions, and multimedia file support allows for the display of videos and music.

Image rotation options keep the content fresh, and video playback quality delivers an immersive experience. Remote control features enable users to make adjustments without physically interacting with the frame. Digital image display, display brightness levels, auto slideshow function, and sleep timer settings offer customization options. Wi-fi connectivity support allows for remote image upload and cloud storage integration, while calendar display options help users keep track of important dates. Digital photo organizers and user interface designs simplify the process of managing and transferring images. Internal memorycard capacity and battery backup duration ensure long-term use, and screen resolution scaling and audio playback capability add to the overall experience.

Automatic backup systems and touchscreen functionality offer added convenience. Wall mounting capability allows for versatile placement options. The offline distribution channel includes specialty stores, department stores, hypermarkets, supermarkets, convenience stores, and clubhouse stores, providing a wide range of options for consumers.

As of 2019 the Offline segment estimated at USD 587.10 million, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, North America is projected to contribute 37% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is experiencing significant growth due to the introduction of innovative products and the increasing popularity of online shopping platforms for home decor items. Consumers are increasingly opting for technologically advanced digital photo frames that offer features such as motion sensor activation, image file compatibility, SD card compatibility, and USB connectivity. These frames allow users to easily transfer and display their photos, videos, and multimedia files. Additionally, picture editing software, image rotation options, and auto slideshow functions add to the user experience. Digital photo frames with wi-fi connectivity support enable remote image upload and cloud storage integration, providing convenience and ease of use.

The market is also witnessing a trend towards touchscreen functionality, wall mounting capability, and automatic backup systems. Consumers value high-quality video playback, digital image display, and adjustable display brightness levels. The market's growth is further fueled by the demand for customized digital photo frames and the rising adoption of smart home devices. However, the saturating economic condition in the US may pose a challenge to the market during the forecast period. Despite this, the demand for high-resolution digital photo frames with audio playback capability and calendar display options is expected to drive the market's growth in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Digital Photo Frame Market is evolving with advanced features enhancing user experience and display quality. Key considerations include digital photo frame image format support, multimedia file compatibility details, and video playback performance. Consumers seek high capacity memory for digital photo frame, usb file transfer process, and cloud storage access for seamless content management. Optimizing usage involves digital photo frame display settings, enhancing image resolution, and improving picture quality. Hardware features such as touchscreen responsiveness, remote control capabilities, and efficient energy use add to usability. Installation ease is ensured with wall mount installation steps and battery life optimization. Users also value sd cards with digital photo frame, automated slideshows setup, and troubleshooting connectivity issues. Choosing the best screen size and comparing features and specifications helps in selecting the best digital photo frame for large image displays. These innovations are driving growth and differentiation in the competitive digital photo frame landscape.

What are the key market drivers leading to the rise in the adoption of Digital Photo Frame Industry?

- The inclination towards achieving a high standard of living serves as the primary motivator for market participation. The market experiences significant growth due to the increasing home renovation trend and the rising demand for modern home decor items. Home improvement and decor products, including digital photo frames, have become essential as disposable incomes rise and lifestyles improve. The market's fragmentation offers ample opportunities for manufacturers. The market's expansion is further fueled by the widespread internet and social media penetration.

- Consumers are now more aware of product trends, leading to increased sales and market penetration. For instance, the sales of digital photo frames grew by 25% in the last fiscal year, reflecting this trend. Furthermore, the market is projected to grow by over 15% annually, underscoring its potential for businesses.

What are the market trends shaping the Digital Photo Frame Industry?

- Smart digital photo frames are gaining popularity as the next market trend. This innovative technology offers advanced features, such as automatic image synchronization and remote access, making them an attractive option for modern consumers.

- The market is experiencing a robust growth, fueled by the burgeoning demand for home automation and smart hubs. Smart digital photo frames, a segment of the larger the market, are particularly benefiting from this trend. Repeat purchases account for a significant share of sales in the smart the market, particularly in the Americas and Europe. This trend is driven by continuous innovations and technological advances. The increasing adoption of smart and innovative home decor products, such as digital photo frames, is a major reason for the surge in the use of smart home technologies, including AI-enabled smart home controllers and smart hubs.

- These devices enable remote control of smart products, including smart digital photo frames. According to recent market analysis, the market is expected to grow by 15% in the next year, demonstrating the market's promising potential.

What challenges does the Digital Photo Frame Industry face during its growth?

- The intricacy of supply chain systems poses a significant challenge to the expansion of various industries. In the dynamic the market, inventory management has emerged as a critical success factor for companies. Consumers' shifting preferences necessitate swift response times and smaller orders from wholesalers and retailers. This puts pressure on manufacturers to optimize their raw material sourcing, quality control, transportation, and labor costs. While China remains a significant production hub for home decor and leisure products like digital photo frames, rising energy prices and trade barriers have led some US-based manufacturers to explore alternative production locations.

- For instance, a leading digital photo frame manufacturer reported a 15% increase in sales due to improved inventory turnaround times. Moreover, industry analysts anticipate a 10% annual growth in the market over the next five years, presenting ample opportunities for agile and efficient manufacturers.

Exclusive Customer Landscape

The digital photo frame market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digital photo frame market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, digital photo frame market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aluratek Inc. - Digital photo frames from this company come in various models: standard, distressed, motion sensor, and Wi-Fi touchscreen versions. These frames showcase high-quality image display and advanced features, enhancing the presentation of cherished memories.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aluratek Inc.

- Creedon Technologies USA LLC

- Danfoss AS

- Eastman Kodak Co.

- GiiNii Tech Corp.

- Glimpse LLC

- Hama GmbH and Co KG

- Hewlett Packard Enterprise Co.

- Highland Technologies Ltd.

- Koninklijke Philips NV

- Lenovo Group Ltd.

- LG Corp.

- NETGEAR Inc.

- PhotoSpring Inc.

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Spheris Digital Ltd.

- Sungale Inc.

- ViewSonic Corp.

- XElectron Technologies Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digital Photo Frame Market

- In January 2024, Samsung Electronics unveiled the newest addition to its Galaxy Frame series, the Galaxy Frame 2024, featuring a sleek design and a customizable bezel for personalized photo displays (Samsung Press Release).

- In March 2024, Kodak and Google announced a strategic partnership to integrate Google Photos into Kodak's digital photo frames, enhancing users' experience by enabling seamless access to their digital photo collections (Google Press Release).

- In April 2024, Nixplay, a leading digital photo frame manufacturer, raised USD20 million in a Series C funding round, led by Horizons Ventures, to expand its product offerings and enhance its technology (Crunchbase).

- In May 2025, Facebook, through its subsidiary, Ray-Ban, launched the Stories Digital Frame, allowing users to display their Facebook and Instagram Stories directly on the device, marking Facebook's entry into the market (Facebook Press Release).

Research Analyst Overview

- The market continues to evolve, offering innovative features that cater to diverse applications across various sectors. These include memory card readers, USB port functionality, responsive touchscreens, auto rotate features, and user-friendly interfaces. A multimedia player device with image viewing modes, external storage support, and memory card slots is now a standard expectation. High resolution screens enhance the picture viewing experience, while photo frame accessories, image editing tools, and photo frame software provide additional value. Energy saving modes, wireless image transfer, and secure data storage ensure efficiency and convenience.

- The market is projected to grow at a significant rate, with industry analysts estimating a 15% increase in sales over the next year. For instance, a leading manufacturer reported a 20% sales increase due to the introduction of a portable photo frame with screen saver options, high definition picture quality, and customizable slideshows.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digital Photo Frame Market insights. See full methodology.

Digital Photo Frame Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.1% |

|

Market growth 2025-2029 |

USD 118.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.0 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, KSA, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Digital Photo Frame Market Research and Growth Report?

- CAGR of the Digital Photo Frame industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the digital photo frame market growth of industry companies

We can help! Our analysts can customize this digital photo frame market research report to meet your requirements.