Eubiotics Market Size 2024-2028

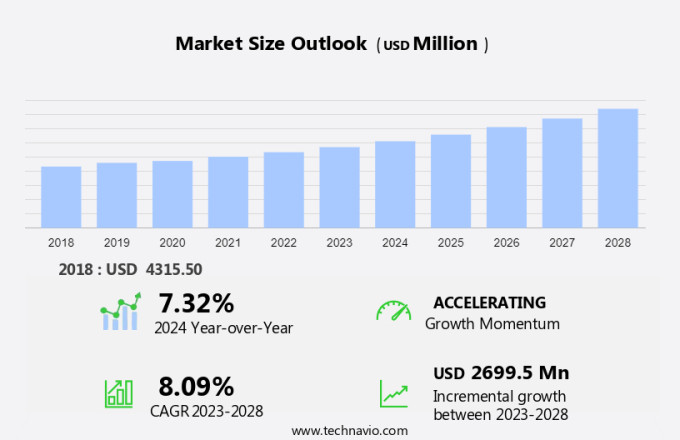

The eubiotics market size is forecast to increase by USD 2.7 billion at a CAGR of 8.09% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. With a heightened focus on animal health to prevent disease outbreaks, the demand for eubiotics as preventative measures is increasing. Additionally, rising awareness about disease prevention among farmers and livestock owners is driving market growth. The market encompasses a range of products, including organic acids, fermentation-derived feed additives, and chemically synthesized compounds, used in animal feed to enhance nutrient absorption, improve feed quality, and ensure animal health. However, the market is also facing challenges such as increasing raw material prices, which can impact the affordability of eubiotics for farmers.

- Despite these challenges, the market is expected to continue growing due to the proven benefits of eubiotics in maintaining animal health and productivity. The use of eubiotics as a cost-effective solution to prevent disease outbreaks and improve animal welfare is a major factor fueling market growth. Furthermore, the growing demand for sustainable and ethical farming practices is also expected to boost the market's growth In the coming years. Overall, the market holds immense potential for growth, with a focus on innovation and cost-effective solutions being key to capitalizing on this opportunity.

What will be the Size of the Eubiotics Market During the Forecast Period?

- Feed mills and pre-mixers serve as key distribution channels for these eubiotics, supplying livestock producers with formulations that optimize feed efficiency and safety. The market dynamics are influenced by raw material availability, agro-climatic conditions, and regulatory frameworks. Organic acids, such as formic and propionic acids, are commonly used to preserve feed and improve nutrient availability. Fermentation processes, employing probiotics like Enterococcus faecium, yield feed enzymes and antimicrobials that bolster animal health.

- The market continues to evolve, with a shift towards natural feed grades and a growing demand for antibiotic-free alternatives. The animal feed industry's focus on animal welfare and sustainability further fuels market growth.

How is this Eubiotics Industry segmented and which is the largest segment?

The eubiotics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Poultry

- Swine

- Ruminant

- Aquaculture

- Others

- Product

- Dry

- Liquid

- Geography

- Europe

- Germany

- North America

- US

- APAC

- China

- South America

- Brazil

- Middle East and Africa

- Europe

By Type Insights

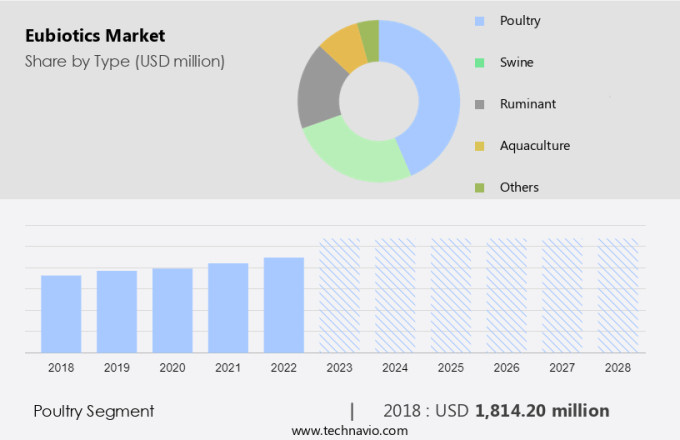

- The poultry segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for animal health and productivity In the livestock industry. Eubiotics, including organic acids, enzymes, and probiotics, are used in various forms (solid and liquid) to improve gut health, nutrient absorption, and feed safety in animals. Feed mills and pre-mixers are significant distributors of eubiotics to livestock producers. The poultry and pork segments are the largest consumers due to the growing demand for poultry meat and eggs, as well as swine feed. Factors such as changing consumer preferences, increasing population, and rising disposable income are driving the growth of the market. Contributing factors like agro-climatic conditions, raw material availability, and feed grades also impact the market.

The animal feed industry, including pharmaceutical and nutraceutical applications, is a significant contributor to the market's growth. Developing economies, particularly in Asia Pacific, are expected to provide significant opportunities due to the increasing industrialized meat production and the livestock sector's expansion. The market is expected to continue growing due to the increasing demand for natural feed grades and the need to address enteric pathogens, gastric pH, and the immune system.

Get a glance at the Eubiotics Industry report of share of various segments Request Free Sample

The poultry segment was valued at USD 1.81 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

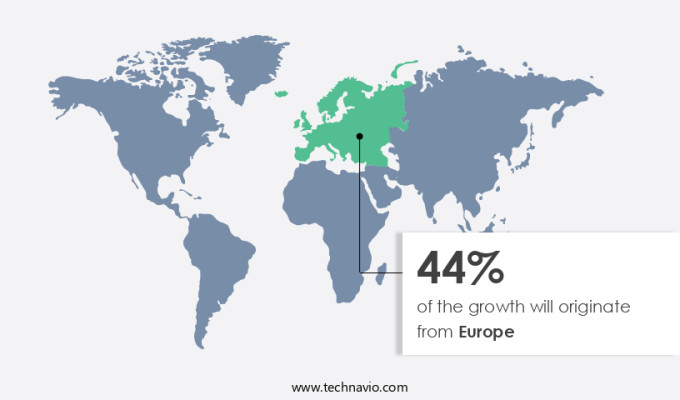

- Europe is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European market is experiencing steady growth due to the increasing demand for healthy animal feed products, particularly canola meals. This growth is driven by the rising awareness of the benefits of gut enzymes on livestock and poultry performance. Europe is a significant market for meat production, with major consumers being Spain, Germany, and France for pork. The increasing meat consumption In the region is fueling the demand for eubiotics. Eubiotics are essential additives used in animal feed to enhance nutrient absorption, improve feed quality, and ensure safety. They include organic acids, probiotics, feed enzymes, and antimicrobials. The market for these ingredients is influenced by raw material availability, agro-climatic conditions, and form (solid or liquid).

Furthermore, eubiotics play a crucial role in gut health applications, immune system enhancement, and enteric pathogens control. They are used in various animal feed industries, including poultry, pork, and cattle. The market is further fuelled by the growing nutraceuticals industry and the livestock sector's expansion in developing economies. Key ingredients include propionic acid, enterococcus faecium, and nitrogen and phosphorous-based feed additives. Eubiotics ensure optimal animal performance and contribute to industrialized meat production's safety and feed grades.

Market Dynamics

Our eubiotics market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Eubiotics Industry?

Increased focus on animal health to prevent disease outbreaks is the key driver of the market.

- Eubiotics, a crucial segment of the animal feed industry, play a significant role in enhancing gut health and improving nutrient absorption in livestock. Feed mills and pre-mixers are integral to the production and distribution of eubiotics, which include organic acids produced through fermentation and chemical synthesis. Specific distributors cater to the demand for these products in various livestock sectors, including poultry, pork, and cattle. The importance of eubiotics extends beyond animal health, as they contribute to feed quality, safety, and feed grades. Organic acids, such as propionic acid, are available in both solid and liquid forms and serve as effective antimicrobials against enteric pathogens. They help maintain a healthy gut environment by reducing gastric pH and improving the immune system. In developing economies, the nutraceuticals industry's growth has fueled the demand for eubiotics, as they offer natural alternatives to antibiotics.

- Furthermore, feed enzymes and probiotics, such as Enterococcus Faecium, are increasingly popular in poultry feed, leading to better poultry meat and egg production. Agro-climatic conditions and raw material availability are essential factors influencing the market. Livestock rearing and industrialized meat production require consistent access to high-quality feed ingredients. Ensuring the availability of these ingredients is crucial for maintaining optimal animal health and productivity. Thus, the market is a vital component of the animal feed industry, addressing the need for improved gut health, nutrient absorption, and feed safety. Organic acids, probiotics, and feed enzymes are essential ingredients that contribute to the overall health and productivity of livestock. The importance of eubiotics is further focuses on by their role in maintaining feed quality and safety, ensuring consistent production In the livestock sector.

What are the market trends shaping the Eubiotics Industry?

Rising awareness about disease prevention is the upcoming market trend.

- Eubiotics, a crucial segment of animal nutrition, encompasses organic acids, probiotics, and feed enzymes. These ingredients are integral to improving feed quality, animal health, and nutrient absorption. Feed mills and pre-mixers are significant distributors of eubiotics, ensuring the availability of these essential nutrients for livestock producers. Organic acids, produced via fermentation or chemical synthesis, are essential for maintaining gut health and reducing the risk of enteric pathogens. Propionic acid, available in both solid and liquid forms, is a widely used organic acid in animal feed. Probiotics, such as Enterococcus Faecium, enhance gut health applications and support the immune system. Feed grades and ingredients, including nitrogen and phosphorous, are essential for animal nutrition. Agro-climatic conditions significantly impact the availability and effectiveness of these nutrients.

- Furthermore, livestock producers rely on eubiotics to optimize animal feed, ensuring safety and efficient nutrient absorption. The animal feed industry, including poultry, pork, and swine feed, heavily utilizes eubiotics. Cattle feed also benefits from eubiotics, contributing to improved digestibility and animal waste management. The organic acids, probiotics, and feed enzymes in eubiotics improve overall animal health and productivity. In developing economies, the nutraceuticals industry is growing, with eubiotics playing a vital role in industrialized meat production. Eubiotics improve animal health, reduce the reliance on antibiotics, and contribute to the sustainability of livestock rearing. In summary, eubiotics are essential ingredients in animal nutrition, contributing to improved feed quality, animal health, and productivity. The use of eubiotics in animal feed is a critical component of preventive healthcare In the livestock sector, ensuring the safety and efficiency of animal husbandry practices.

What challenges does the Eubiotics Industry face during its growth?

An increase in raw material prices is a key challenge affecting the industry's growth.

- The market faces challenges from rising raw material prices and stringent regulations, particularly In the area of waste biomaterials and wastewater treatment. Eubiotics, which include organic acids produced through fermentation and chemical synthesis, are essential additives used in animal feed to enhance gut health and nutrient absorption. Feed mills and pre-mixers rely on eubiotics to produce high-quality feed for livestock producers, including those in developing economies. Key ingredients in eubiotics include propionic acid, probiotics, and feed enzymes. These additives improve animal health by combating enteric pathogens, maintaining a healthy gut pH, and boosting the immune system. The animal feed industry, which includes poultry, pork, and cattle, is under pressure to meet increasing demand for food, leading to challenges in procuring raw materials such as corn, wheat, and barley.

- Furthermore, feed additive manufacturers must constantly innovate and upgrade their facilities to comply with evolving regulations, resulting in substantial increases in operating costs. The use of eubiotics in animal feed also reduces the need for antibiotics, making natural feed grades a preferred choice for many livestock producers. In the nutraceuticals industry, eubiotics are used In the production of pharmaceutical and health supplements for humans. Agro-climatic conditions also impact the availability and cost of raw materials for eubiotics production. For instance, certain organic acids are more efficiently produced in specific climates, affecting the global supply chain. The market is expected to grow as the demand for high-quality animal feed and nutritional supplements continues to rise.

Exclusive Customer Landscape

The eubiotics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the eubiotics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, eubiotics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced BioNutrition Corp.

- Archer Daniels Midland Co.

- Associated British Foods Plc

- BASF SE

- Behn Meyer Deutschland Holding AG and Co. KG

- Calpis Co., Ltd.

- Cargill Inc.

- China National Chemical Corp. Ltd.

- Chr Hansen Holding AS

- Kemin Industries Inc.

- Koninklijke DSM NV

- Lallemand Inc.

- Lesaffre and Cie

- Novo Holdings AS

- Novus International Inc.

- RAG Stiftung

- SHV Holdings N.V.

- Sudzucker AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Eubiotics, a category of feed additives, play a crucial role in enhancing animal health and productivity In the global livestock sector. These substances, which include organic acids, probiotics, and certain strains of bacteria, contribute to improving gut health, nutrient absorption, and overall animal performance. Feed mills and pre-mixers are integral to the production and distribution of eubiotics. These facilities ensure the proper manufacturing, blending, and formulation of eubiotics with other essential nutrients and ingredients for various livestock species, such as poultry, pork, and cattle. The production of eubiotics involves several methods, including fermentation and chemical synthesis. Organic acids, like propionic acid, are often produced through fermentation processes, while some eubiotics, such as certain strains of Enterococcus faecium, may be produced through fermentation or chemical synthesis. Raw material availability and agro-climatic conditions are essential factors influencing the market. For instance, the availability of raw materials for fermentation, such as molasses and corn, can significantly impact the production costs and, consequently, the market dynamics.

Additionally, the specific climatic conditions in different regions can affect the growth of certain bacteria used In the production of probiotics. The market is not limited to animal feed applications. These substances also find extensive use In the pharmaceutical and nutraceuticals industries, where they serve as key ingredients in various health supplements and functional foods. The importance of eubiotics extends beyond animal health and productivity. They contribute to improving feed quality and safety, ensuring that the feed meets the required nutritional standards and is free from contaminants. Additionally, eubiotics help enhance the nutrient absorption in animals, leading to better growth rates and improved feed conversion ratios. The use of eubiotics in animal feed is a strategic approach to address the challenges posed by enteric pathogens and antimicrobial resistance. By improving gut health and enhancing the immune system, eubiotics help reduce the reliance on antibiotics in industrialized meat production. The market is driven by the growing demand for high-quality animal products, increasing awareness of animal welfare, and the need to ensure food safety.

Moreover, the market is witnessing significant growth in developing economies, where the livestock sector is expanding rapidly due to rising meat consumption and changing dietary preferences. In summary, eubiotics are a vital component of animal nutrition, contributing to improved animal health, productivity, and feed quality. The production and distribution of these substances involve various methods and processes, and their market dynamics are influenced by several factors, including raw material availability, agro-climatic conditions, and the growing demand for animal products in various industries.

|

Eubiotics Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 2.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Germany, China, Brazil, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Eubiotics Market Research and Growth Report?

- CAGR of the Eubiotics industry during the forecast period

- Detailed information on factors that will drive the Eubiotics growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the eubiotics market growth of industry companies

We can help! Our analysts can customize this eubiotics market research report to meet your requirements.