Firewall As A Service Market Size 2024-2028

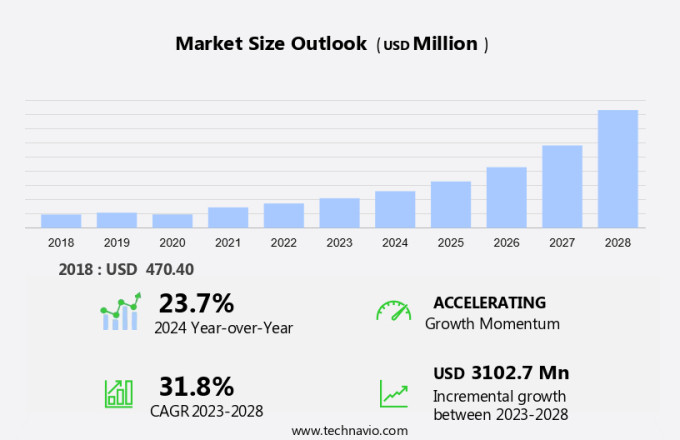

The firewall as a service market size is forecast to increase by USD 3.1 billion at a CAGR of 31.8% between 2023 and 2028.

- In the digital business landscape, Enterprises are increasingly relying on Cloud environment and remote working models, leading to a surging demand for Network protection solutions. Traditional Physical firewalls are no longer sufficient to secure networks in this dynamic environment. Instead, Scalable and flexible Firewall as a Service (FwaaS) solutions are gaining traction. The adoption of cloud-based security services is on the rise due to their ease of deployment and ability to provide real-time threat detection. Moreover, the availability of open-source and free-of-cost security firewalls is further fueling the market growth. FwaaS offers enterprises the advantage of seamless integration with existing infrastructure, easy customization, and automatic updates, making it an ideal choice for securing networks in the cloud and hybrid environments. The market is expected to witness significant growth in the coming years, driven by these trends and the need for robust Network security solutions.

What will be the Size of the Market During the Forecast Period?

- The market has emerged as a critical solution for enterprises seeking to fortify their network security in today's complex and dynamic IT landscape. With the increasing adoption of cloud environments, remote working models, and dispersed networks, traditional firewall solutions are no longer sufficient to protect against unauthorized strikes and network vulnerabilities. FwaaS offers several advantages over physical firewalls, including simplified installation, centralized policy management, and automation and orchestration capabilities. These features enable enterprises to deploy scalable solutions that adapt to their evolving network security needs.

- In the cloud environment, FwaaS plays a pivotal role in securing Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) offerings. Next-generation firewalls (NGFW) integrated with FwaaS provide advanced security features such as intrusion prevention, application control, and threat intelligence, ensuring robust protection against cyber threats. Enterprises benefit from FwaaS through various service models, including managed services and professional services. Managed services offer ongoing monitoring, management, and maintenance of the firewall infrastructure, while professional services provide consultation, design, and implementation support. FwaaS is particularly relevant for enterprises operating in a cloud computing era, where network security is a top priority.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- BFSI

- Healthcare

- Retail

- Education

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

- The BFSI segment is estimated to witness significant growth during the forecast period.

The Firewall as a Service (FaaS) market in the banking, financial services, and insurance (BFSI) sector is experiencing significant growth due to the heightened importance of safeguarding customer data confidentiality. With the surge in online transactions, the risk of data breaches, phishing attacks, and other cyber threats has escalated. In response, the BFSI sector is strengthening its internal security and embracing FaaS solutions to counteract these threats. The proliferation of mobile devices and the increasing popularity of mobile banking among end-users further amplify the need for robust cybersecurity measures. FaaS solutions offer corporate flexibility, enabling organizations to adapt to the demands of dispersed networks and remote work environments.

Cloud computing technology powers these services, allowing for customizable solutions that can be easily integrated into existing network equipment. The future of network security lies in the adoption of advanced technologies like Artificial Intelligence (AI) to enhance threat detection and response capabilities. FaaS solutions provide an effective and scalable response to the evolving cybersecurity landscape.

Get a glance at the market report of share of various segments Request Free Sample

The BFSI segment was valued at USD 118.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

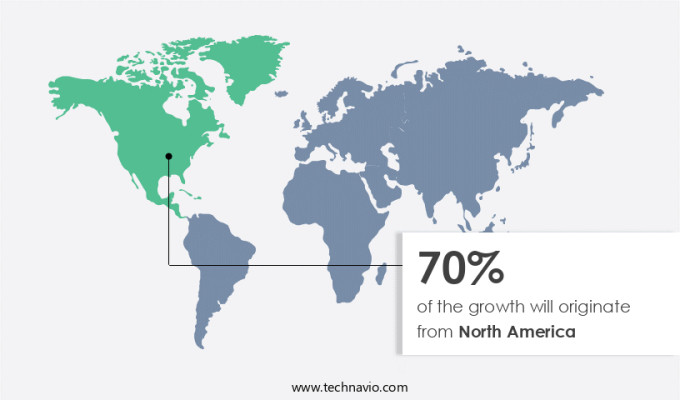

- North America is estimated to contribute 70% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the Firewall as a Service (FaaS) market is poised for continuous expansion due to the escalating need for cybersecurity solutions and the expanding use of bring-your-own-device (BYOD) policies and Internet of Things (IoT) devices. The proliferation of IoT in industries such as utilities, healthcare, and automotive is intensifying security concerns among end-users. In the US, the consumer electronics and wearables sectors, particularly in gaming, healthcare, and entertainment, are significant drivers of the FaaS market growth. Given the increasing reliance on efficient and dependable communication networks for business processes, all industries are striving for the Internet of Everything (IoE) integration.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Firewall As A Service Market?

Growing need for network security and privacy is the key driver of the market.

- In today's digital landscape, enterprises across various sectors, including finance, healthcare, retail, telecommunications, and manufacturing, are integrating technologies such as IoT and big data analytics to enhance productivity and streamline operations. The adoption of cloud solutions and the increasing use of digital sensors in production and manufacturing facilities have led to significant advancements. However, these technological innovations also introduce new security challenges. Threats like distributed denial-of-service (DDoS) attacks and malicious controllers and applications pose a significant risk to enterprise networks. To mitigate these risks, businesses are prioritizing network security and data privacy. Firewall as a Service (FaaS) is an attractive solution for enterprises seeking simplified installation, automation, and orchestration of security management.

Managed and professional services offerings from leading providers enable enterprises to choose the most suitable service models based on their unique requirements. Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) are popular deployment options for FaaS, allowing enterprises to scale their security solutions as needed. By partnering with trusted managed security service providers, enterprises can ensure their network remains secure and their data remains private, enabling them to focus on their core business objectives.

What are the market trends shaping the Firewall As A Service Market?

Adoption of cloud-based services is the upcoming trend in the market.

- In today's business landscape, enterprises are increasingly relying on cloud-based security services to safeguard their network in various deployment models. With the rise of remote working models, the need for secure network protection has become more critical than ever. Cloud environments offer scalable solutions that cater to the varying security needs of businesses, making them an attractive option for network security. As more and more establishments, such as financial institutions and healthcare providers, move their sensitive data to the cloud, securing this information from unauthorized access becomes paramount. Cloud-based security services provide a cost-effective solution for small and medium-sized enterprises (SMEs) as they do not require on-premises infrastructure for implementation.

The flexibility and adaptability of cloud-based security solutions enable them to accommodate the evolving security requirements of consumers. Moreover, the adoption of cloud-based services for business functions like customer relationship management (CRM), payroll, and enterprise communication ensures seamless remote access to data. In conclusion, the shift towards cloud-based services for network security is a trend that is here to stay. The benefits of cost-effectiveness, flexibility, and scalability make cloud-based security solutions an indispensable component of an organization's security strategy.

What challenges does Firewall As A Service Market face during the growth?

Availability of open-source and free-of-cost security firewalls is a key challenge affecting the market growth.

- Firewalls as a Service (FaaS) is a security solution offered through Software as a Service (SaaS) model, which allows businesses to protect their data and infrastructure in Public, Private, and Hybrid cloud environments. The monthly subscription cost for FaaS ranges from USD 150 to USD 300. While this expense is higher than traditional security solutions, it's essential for enterprises to secure their digital assets against cyber threats, including malware and ransomware attacks. However, smaller entities and individual customers with budget constraints prefer free or open-source firewalls. These solutions, developed and distributed by organizations or communities, pose a challenge to the expansion of the FaaS market.

To cater to diverse business requirements, FaaS providers offer customizable solutions, ensuring optimal security for various industries such as Energy and Utilities, Retail and eCommerce, Telecommunication, IT and ITES, and Remote location access.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AlgoSec Inc.

- Barracuda Networks Inc.

- Cato Networks Ltd.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- F5 Inc.

- FireMon LLC

- Forcepoint LLC

- Fortinet Inc.

- Juniper Networks Inc.

- Palo Alto Networks Inc.

- Skybox Security Inc.

- SonicWall Inc.

- Sophos Ltd.

- Spitfire Technology Group

- WatchGuard Technologies Inc.

- Zscaler Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Firewalls as a Service (FaaS) is a cloud-based network security solution that offers enterprises simplified installation, automation, and orchestration for their security management needs. In today's digital landscape, enterprises require scalable solutions for network protection in various deployment models, including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). FaaS caters to enterprises operating in diverse industry verticals such as retail and ecommerce, telecommunications, IT and ITes, energy and utilities, healthcare, and more. FaaS provides advanced threat protection against cyberattacks, ransomware, fraudulent activities, and other malicious threats in public, private, and hybrid cloud environments. It offers customizable solutions that cater to the unique needs of large enterprises, enabling them to secure their dispersed networks and remote location access. FaaS integrates seamlessly with network equipment and operating systems, providing traffic control and identity management features. Furthermore, it leverages artificial intelligence (AI) and machine learning algorithms to enhance security services and ensure corporate flexibility in remote work models.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 31.8% |

|

Market growth 2024-2028 |

USD 3.10 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

23.7 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, France, UAE, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch