Flavored Powder Drinks Market Size 2025-2029

The flavored powder drinks market size is forecast to increase by USD 22.98 billion at a CAGR of 5% between 2024 and 2029.

- The market is experiencing significant growth due to rising consumer awareness regarding the health benefits associated with these beverages. The convenience and portability of flavored powder drinks and healthy snacks, which can be easily mixed with water, have made them a popular choice among health-conscious consumers seeking hydration and essential nutrients. Innovative flavors and ingredients continue to drive market growth, as companies introduce new offerings to cater to diverse consumer preferences. However, the market faces challenges due to fluctuating raw material prices for flavored powder drinks.

- These price fluctuations can impact the profitability of manufacturers and may necessitate price adjustments or cost reduction measures. Companies in the market must closely monitor raw material prices and explore alternative sourcing strategies to mitigate the impact on their business operations. To capitalize on market opportunities and navigate challenges effectively, it is essential for companies to stay informed about consumer trends and raw material market dynamics.

What will be the Size of the Flavored Powder Drinks Market during the forecast period?

- The flavored powder drink market continues to evolve, driven by consumer preferences for convenience, on-the-go nutrition, and diverse taste profiles. Powder blending enables customization and flexibility in meeting the demands of active lifestyles and busy professionals. Flavor innovation remains a key focus, with natural ingredients sourced from various regions enhancing product differentiation. Bulk packaging and single-serve packets cater to various retail channels, while brand loyalty is fostered through packaging design and social media marketing. Product innovation extends to low calorie and organic options, ensuring consumer insights are met. Shelf stability and distribution networks are crucial for maintaining product quality and accessibility.

- energy drinks and functional beverages, including protein powders and meal replacements, are popular applications. Sensory analysis and pricing strategies are essential in product development, while product branding and vitamin content further distinguish offerings in the competitive landscape. The market's dynamics continue to unfold, with ongoing product innovation and consumer trends shaping the future of the flavored powder drink industry.

How is this Flavored Powder Drinks Industry segmented?

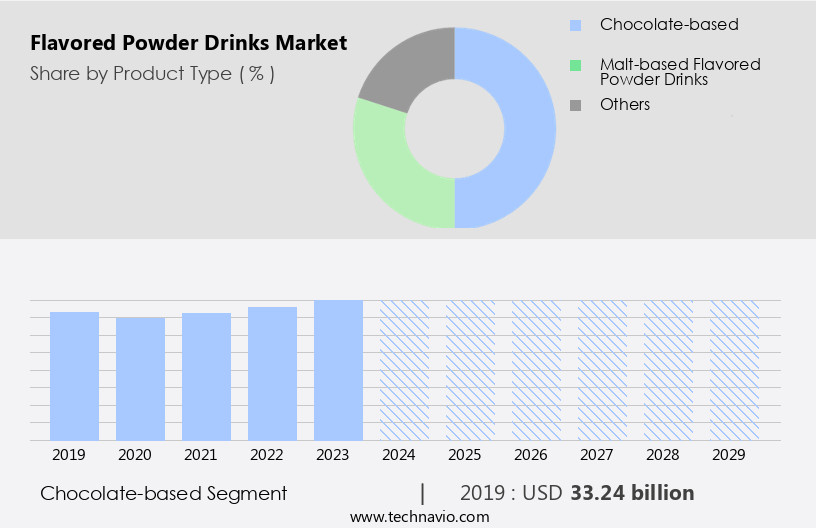

The flavored powder drinks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Chocolate-based

- Malt-based flavored powder drinks

- Others

- Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Online

- Independent retailers

- Others

- Packaging

- Sachets

- Tins

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The chocolate-based segment is estimated to witness significant growth during the forecast period.

The market experiences continuous growth due to the increasing preference for on-the-go and convenient consumption options. Active lifestyle consumers and fitness enthusiasts seek out these drinks for their nutritional benefits, such as protein powder for muscle recovery and meal replacement options for busy professionals. Flavor innovation plays a significant role in market differentiation, with natural and organic beverage ingredients becoming increasingly popular. Bulk packaging and single-serve packets cater to various consumer needs, while brand loyalty is fostered through effective social media marketing and influencer partnerships. Shelf stability and distribution networks ensure these products remain accessible to consumers, both in retail channels and foodservice industry settings.

Consumer insights drive product innovation, leading to the development of functional beverages, energy drinks, and low-calorie options. Sensory analysis and stability testing are crucial to maintaining product quality and consumer satisfaction. Pricing strategies vary, with some brands focusing on affordability while others emphasize premium positioning. Protein powder, meal replacement, and energy drinks are popular categories within the market, each catering to specific consumer needs. Chocolate-based flavors continue to dominate due to their universal appeal and indulgent taste. Meal replacement drinks offer a convenient solution for those with busy schedules, while protein powder caters to fitness enthusiasts and post-workout recovery.

Energy drinks cater to consumers seeking an energy boost, often containing caffeine and vitamin content. Market research plays a vital role in understanding consumer preferences and identifying trends, enabling companies to adapt and innovate. Product branding and packaging design are essential elements in capturing consumer attention and building brand loyalty. Overall, the market is expected to witness significant growth due to its ability to cater to various consumer needs and preferences.

The Chocolate-based segment was valued at USD 33.24 billion in 2019 and showed a gradual increase during the forecast period.

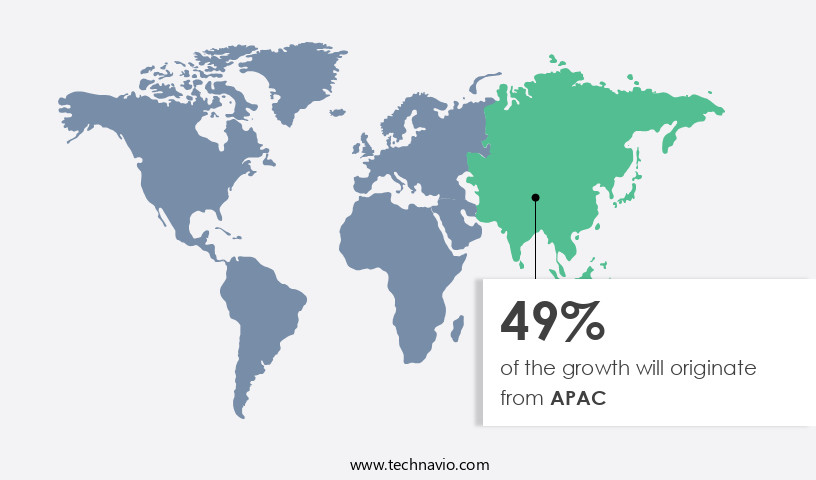

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing significant growth, fueled by the increasing preference for convenient and on-the-go nutrition solutions among active lifestyle consumers. This trend is particularly prominent in developing economies like India and China, where rising disposable income enables consumers to invest in premium products. In 2023, India's GDP grew by 8.2%, and it is projected to expand at a similar rate in 2024. China's economy grew by 5.4% in 2024. To cater to this expanding market, manufacturers are focusing on product innovation, including natural flavors and organic ingredients, to differentiate their offerings. Bulk packaging and single-serve packets are popular choices for busy professionals and on-the-go consumers.

Shelf stability and distribution networks are crucial factors for market success. Social media marketing and influencer collaborations are effective strategies for reaching consumers and building brand loyalty. Energy drinks and sports nutrition products are popular categories, with a growing emphasis on low sugar content and functional benefits. Product innovation, such as meal replacement and protein powder options, is also driving market growth. Sensory analysis and stability testing are essential to ensure product quality and consumer satisfaction. Vitamin content and dissolution rate are key considerations for consumers seeking optimal nutrition. The foodservice industry is another potential growth area, as flavored powder drinks can be easily incorporated into various dishes and beverages. Overall, the market in APAC is a dynamic and competitive landscape, with manufacturers continually seeking to meet the evolving needs and preferences of consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Flavored Powder Drinks Industry?

- The significant rise in consumer awareness regarding the potential health advantages of flavored powdered beverages serves as the primary market driver.

- Flavored powder drinks have gained popularity due to their convenience and ability to cater to various taste preferences. The market for these drinks is driven by the increasing number of on-the-go consumers with active lifestyles who seek nutritious and energy-boosting beverages. Powder blending allows for customization of flavors and the addition of essential nutrients, such as protein and meal replacement options. Flavor innovation is a key trend in the market, with companies sourcing high-quality ingredients from around the world to create unique and appealing flavors. Bulk packaging is also a popular choice for consumers to save time and money. The drinks provide a balanced mix of high-quality fats, essential protein, and carbohydrates, along with a wide range of vitamins and minerals.

- The key ingredients in major malt-based powder drinks include Malted Barley, sugar, wheat flour, milk solids, malted wheat, minerals, emulsifier, salt, acidity regulator, protein isolate, vitamins, and natural color.

What are the market trends shaping the Flavored Powder Drinks Industry?

- The current market trend favors innovative flavors and ingredients in food and beverage products.The market is experiencing significant growth due to the continuous introduction of new and innovative flavors, as well as the incorporation of trending ingredients, such as superfoods and natural sweeteners. This trend is attracting an increasing number of consumers, leading to a rise in new product launches by both regional and international players. Manufacturers are utilizing various strategies to increase market share, including innovative distribution networks and technical innovations. Social media marketing and influencer partnerships are also playing a crucial role in driving consumer interest and brand loyalty. However, the sugar content of these drinks remains a concern for health-conscious consumers.

- Shelf stability is another key factor that manufacturers must consider to ensure the longevity and quality of their products. The market is expected to grow steadily during the forecast period, driven by these market dynamics. The introduction of new flavors and ingredients, along with the adoption of innovative strategies, will continue to attract consumers and expand the market. Despite challenges, such as sugar content concerns and competition from other beverage categories, the market is poised for continued growth.

What challenges does the Flavored Powder Drinks Industry face during its growth?

- The unpredictable fluctuations in the prices of raw materials used in producing flavored powdered beverages pose a significant challenge to the industry's growth trajectory.

- The flavored powder drink market is driven by various factors, including the use of natural flavors and the increasing demand for organic ingredients. Retail channels, such as supermarkets and online platforms, dominate the market, requiring manufacturers to focus on product innovation and pricing strategies to remain competitive. Sensory analysis plays a crucial role in ensuring product quality and consumer satisfaction. Manufacturers face challenges in maintaining product stability, particularly with low calorie and high-dissolution rate formulations. The need for product branding and differentiation is also a significant consideration. Raw material costs, particularly for packaging components like aluminum, plastic, and paper, can be volatile and impact profit margins.

- Suppliers of these raw materials hold significant pricing power, necessitating manufacturers to explore cost-effective alternatives. To address these challenges, manufacturers invest in research and development to improve product formulations, packaging, and production processes. This focus on innovation and cost reduction enables them to cater to evolving consumer preferences while maintaining competitive pricing.

Exclusive Customer Landscape

The flavored powder drinks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flavored powder drinks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flavored powder drinks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company provides a range of flavored powdered drink solutions, including Ensure Nutrition Drinks. These fat-free beverages offer a refreshing fruit taste and contain essential nutrients and protein, making them an ideal choice for those seeking convenient, nutritious hydration. With a focus on clear, refreshing flavors, these drinks cater to various dietary needs and preferences, ensuring optimal nutrition intake.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AriZona Beverages USA LLC

- Cargill Inc.

- Dyla Brands

- Insta Foods

- Kent Corp.

- Kerry Group Plc

- Keurig Dr Pepper Inc.

- Lasco Foods Inc.

- Liquid I.V.

- National Beverage Corp.

- Nestle SA

- PepsiCo Inc.

- Simatek AS

- Sugam Products

- The Coca Cola Co.

- The Kraft Heinz Co.

- TreeHouse Foods Inc.

- True Citrus

- US Foods Holding Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Flavored Powder Drinks Market

- In February 2024, Nestle, a leading player in the market, introduced a new line of ready-to-drink Nesquik products, expanding its product portfolio and catering to the growing consumer preference for convenience (Nestle Press Release, 2024).

- In May 2025, PepsiCo and Starbucks announced a strategic partnership to launch Starbucks-branded ready-to-drink coffee and tea products using PepsiCo's Tazo brand. This collaboration aimed to capitalize on Starbucks' strong brand recognition in the coffee market and PepsiCo's distribution capabilities (BusinessWire, 2025).

- In October 2024, Unilever completed the acquisition of a leading functional drinks company, adding a significant market share in the flavored powder drinks segment. The acquisition was valued at approximately USD2.5 billion and was expected to strengthen Unilever's presence in the rapidly growing functional drinks market (Reuters, 2024).

- In January 2025, the European Union approved new regulations for the labeling of powdered drinks, requiring manufacturers to list added sugars as a separate item on nutrition labels. This policy change aimed to promote transparency and help consumers make informed choices about their beverage consumption (European Commission Press Release, 2025).

Research Analyst Overview

The flavored powder drink market exhibits dynamic trends, with a focus on extended shelf life and rigorous Microbial Testing to ensure product quality and safety. Brands are catering to diverse target audiences by offering product bundles, personalized recommendations, and subscription models. Sugar substitutes, including artificial sweeteners and natural alternatives like monk fruit, are popular choices for health-conscious consumers. Soy protein and plant-based proteins, such as casein and whey, are gaining traction due to their sustainability and functional benefits. Brands are also embracing sustainable sourcing and organic certification to meet consumer demands.

Consumer and online reviews play a significant role in shaping market dynamics, with preferences shifting towards soluble fiber, insoluble fiber, and functional ingredients. Particle size and water solubility are crucial factors influencing product performance and customer satisfaction. Loyalty programs and customer segmentation strategies are essential tools for brands to retain customers and stay competitive.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Flavored Powder Drinks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 22.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.5 |

|

Key countries |

US, China, UK, Canada, India, Germany, Japan, France, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flavored Powder Drinks Market Research and Growth Report?

- CAGR of the Flavored Powder Drinks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flavored powder drinks market growth of industry companies

We can help! Our analysts can customize this flavored powder drinks market research report to meet your requirements.