Fluoropolymer Films Market Size 2024-2028

The fluoropolymer films market size is forecast to increase by USD 545.5 million at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand in various industries, particularly in solar photovoltaic modules and the semiconductor industry. The consumption of plastic tape in the manufacturing of solar panels and the use of FE coatings in semiconductor manufacturing is driving the market's expansion. However, the market faces challenges such as unstable prices of raw materials like perfluorooctanoic acid and perfluoroalkoxyalkane, which impact the production costs of PTFE films. Additionally, the demand for biocompatible materials in blister packaging and the military sector is increasing due to the need for UV stability and moisture barrier properties. Industrial infrastructure development and the requirement for high-performance materials in various end-use industries further boost the market's growth.

What will be the Size of the Market During the Forecast Period?

The fluoropolymer films market is expanding due to the growing demand for high-performance materials in electric and hybrid vehicles, sustainable packaging, and wire insulation. These films, made from specialized polymer films and synthetic materials, offer excellent thermal conductivity and durability. High-performance fluoropolymer films are increasingly used in applications requiring resistance to environmental and health hazards, such as plastic tape consumption reduction. With a focus on sustainability, fluoropolymer films are ideal for eco-friendly packaging solutions, minimizing waste and environmental impact. Their superior properties make them essential for industries looking for advanced materials that can withstand extreme conditions, while also contributing to energy efficiency and long-term performance in various applications, including automotive and electronics.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- PTFE

- PVDF

- FEP

- PFA

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Product Insights

The PTFE segment is estimated to witness significant growth during the forecast period. Fluoropolymer films, specifically those made from polytetrafluoroethylene (PTFE), are in high demand across various industries due to their exceptional properties. PTFE films are known for their low-friction characteristics, which make them an ideal choice for coatings in industries such as pharmaceuticals, automotive, aerospace, medical devices, and telecommunications. In the solar photovoltaic modules sector, these films are utilized for their UV stability and moisture barrier properties. FE coatings, which include PTFE, are essential in the semiconductor industry for protecting sensitive components from environmental factors. Perfluorooctanoic acid (PFOA) and perfluoroalkoxyalkane (PFA) are common types of fluoropolymers used in the production of these coatings.

Blister packaging, a common application for these films, benefits from their biocompatibility and ability to provide a moisture barrier. The military sector is another significant consumer of fluoropolymer films due to their durability and resistance to harsh conditions. These films offer excellent chemical resistance, dielectric characteristics, and high thermal stability and flame resistance, making them suitable for various military applications. In industrial infrastructure, PTFE films are used for insulation and gaskets due to their excellent insulating properties and resistance to high temperatures and chemicals. The use of these films in various industries is expected to drive the growth of the market.

Get a glance at the market share of various segments Request Free Sample

The PTFE segment was valued at USD 1.11 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

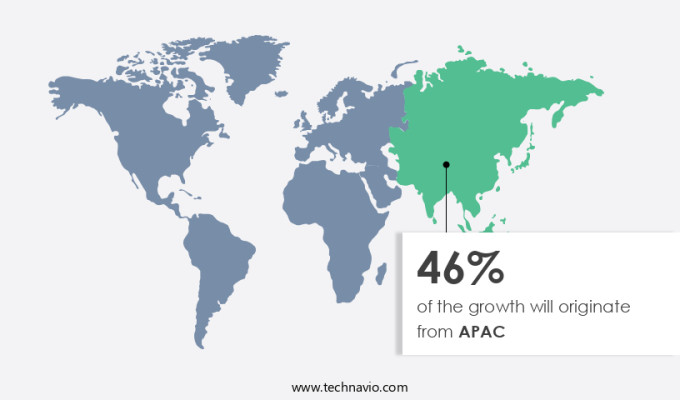

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Fluoropolymer films have gained significant traction in various industries, particularly in the electronic applications sector, due to their exceptional durability and reliability. In 2023, APAC emerged as the largest consumer of fluoropolymer films, driven by the burgeoning textile and automotive industries. China and India are the leading consumers in the textile industry, where fluoropolymer films are utilized in the form of PTFE for manufacturing fiber, filament, yarn, and fabric. The escalating consumption of textiles in these countries will fuel the demand for fluoropolymer films in APAC. Moreover, the increasing number of construction projects in the region, such as Samsung's new smartphone display plant in India, will further boost the market growth.

Fluoropolymer films offer several advantages, including moisture barrier properties, extended shelf-life benefits, thermal resistance, low surface energy, and dielectric properties. In the electronics sector, these films are extensively used for insulation and flexible printed circuits. The sustainability trend in packaging is another factor driving the market growth, as fluoropolymer films provide excellent barrier properties, ensuring the preservation of food and other perishable items. The market is expected to continue its growth trajectory during the forecast period, offering lucrative opportunities for key players.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Developments in construction sector are the key drivers of the market. The global construction sector is experiencing growth in various regions, leading to an increased demand for fluoropolymer films in residential and commercial buildings, warehouses, factories, malls, and complexes. These films are essential in manufacturing automotive components, electronic insulators, electrical systems, and machinery parts. Countries such as China, Malaysia, India, the Philippines, Indonesia, Thailand, Vietnam, UAE, and Saudi Arabia are witnessing significant infrastructure development due to industrialization and rising disposable income.

For instance, Abu Dhabi's Planning and Programming Department announced the construction of four projects in January 2020, aimed at enhancing infrastructure within the island. Fluoropolymer films play a crucial role in ensuring protection, performance, and efficiency in various applications, making them indispensable in manufacturing techniques and material science, including nanotechnology. The market is expected to grow further due to increasing investments in construction and industrial projects worldwide.

Market Trends

The development of innovative products is the upcoming trend in the market. Fluoropolymer films, derived from the combination of fluorine and carbon, have gained significant traction in various industries due to their unique properties. These films offer exceptional moisture resistance and non-stick properties, making them ideal for use in electrical and electronics applications. In addition, their optical transparency makes them suitable for use in construction, aerospace, and healthcare industries.

Also, fluoropolymer tapes, another application of fluoropolymers, provide electrical insulation and protection against harsh environments. The demand for fluoropolymer films and tapes is expected to grow as industries continue to innovate and develop new technologies. Advanced applications include the use of fluoropolymers in advanced coatings, optics, and lubricants.

Market Challenge

Unstable fluorspar prices affect PTFE film manufacturing is a key challenge affecting the market growth. Fluoropolymer films, which include Polyvinylidene fluoride (PVdF), Fluorinated ethylene-propylene (FEP), Polyethylene tetrafluoroethylene (PETFE), Polychlorotrifluoroethylene (PCTFE), and Polyvinyl fluoride (PVF), held a considerable market share in 2020. Among these, PTFE, produced via the free radical vinyl polymerization of monomer tetrafluoroethylene (TFE), accounted for a significant portion. TFE is derived from fluorspar, hydrofluoric acid, and chloroform.

However, fluorspar, a crucial raw material, has experienced a notable increase in demand and subsequent price rise due to its limited availability. In June 2021, Chinese imports of fluorspar increased by over 675% compared to the previous year. This swell in demand for fluorspar has led to frequent price hikes, affecting major TFE manufacturers who heavily rely on fluorspar suppliers and producers. These films are used in various industries, including barrier films, decorative films, microporous films, safety and security films, and the automotive and packaging sectors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers a wide range of fluoropolymer films such as skived film, extruded film, extruded sheets, calendered film and sheets, and molded membranes.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- American Durafilm Co. Inc.

- Arkema SA

- Compagnie de Saint Gobain

- Daikin Industries Ltd.

- Dow Inc.

- Dunmore Corp.

- Electron Microscopy Sciences

- Fluoro-Plastics, Inc.

- Fluortek AB

- Guarniflon S.p.A.

- Honeywell International Inc.

- Nitto Denko Corp.

- Nowofol Kunststoffprodukte GmbH and Co. KG

- Polyflon Technology Ltd.

- Rogers Corp.

- Solvay SA

- Textiles Coated International

- The Chemours Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fluoropolymer films are a type of synthetic material known for their exceptional chemical resistance, thermal stability, and moisture barrier properties. These films are made from fluorine and carbon, resulting in unique characteristics such as moisture resistance, non-stick properties, optical transparency, and electrical insulation properties. Fluoropolymer films find extensive applications in various industries, including electronics, construction, aerospace, healthcare, solar photovoltaic modules, and the semiconductor industry. The demand for fluoropolymer films is driven by their high-performance attributes, including chemical resistance, durability, reliability, and thermal resistance. They offer a competitive edge in various sectors, such as electronics, where they are used for insulation, flexible printed circuits, and protection. In the automotive sector, fluoropolymer films are used for vehicle safety and performance, while in the packaging sector, they provide shelf-life benefits and moisture barrier properties. Fluoropolymer films are also used in the production of specialized polymer films, such as fluorinated ethylene-propylene, polytetrafluoroethylene, polyvinylidene fluoride, polyethylene tetrafluoroethylene, polychlorotrifluoroethylene, and polyvinyl fluoride.

Consequently, these films are used in various applications, including barrier films, decorative films, microporous films, and safety and security films. Fluoropolymer films offer UV stability, chemical inertness, non-yellowing chemistry, and low surface energy, making them ideal for use in industries that require high-performance materials. They are also used in the manufacturing of coatings, such as FEVE coatings and PVDF coatings, which offer excellent weatherability and resistance to chemicals. In summary, the market is driven by the increasing demand for high-performance materials in various industries, including electronics, automotive, construction, aerospace, healthcare, and packaging. These films offer unique properties, such as chemical resistance, thermal stability, and moisture barrier properties, making them an essential component in various applications. The ongoing research and development in material science and manufacturing techniques, including nanotechnology, continue to expand the potential applications of fluoropolymer films.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 545.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 46% |

|

Key countries |

China, US, Germany, India, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., AGC Inc., American Durafilm Co. Inc., Arkema SA, Compagnie de Saint Gobain, Daikin Industries Ltd., Dow Inc., Dunmore Corp., Electron Microscopy Sciences, Fluoro-Plastics, Inc., Fluortek AB, Guarniflon S.p.A., Honeywell International Inc., Nitto Denko Corp., Nowofol Kunststoffprodukte GmbH and Co. KG, Polyflon Technology Ltd., Rogers Corp., Solvay SA, Textiles Coated International, and The Chemours Co. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch