Frozen Snack Food Market Size 2025-2029

The frozen snack food market size is forecast to increase by USD 16.22 billion at a CAGR of 6.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing launch of innovative frozen food products catering to diverse consumer preferences. This trend is further fueled by the rise of e-commerce platforms, enabling convenient access to a wide range of frozen snacks for consumers worldwide. However, the market is not without challenges. Frequent product recalls due to contamination issues pose a significant threat to market players, requiring stringent quality control measures and regulatory compliance. Companies seeking to capitalize on market opportunities must prioritize product innovation, ensure food safety, and effectively leverage e-commerce channels to reach a broader consumer base.

- Strategic partnerships and collaborations can also provide valuable insights and resources for navigating market challenges and staying competitive. Overall, the market presents a dynamic and lucrative landscape for businesses, with opportunities for growth and innovation in a rapidly evolving market. Additionally, the rise of e-commerce has made it easier for consumers to purchase a wide range of frozen snacks, including pretzels, croissants, squid rings, frozen momos, and various types of frozen burgers, sausages, and cutlets.

What will be the Size of the Frozen Snack Food Market during the forecast period?

- The frozen food market in the United States is experiencing significant growth and innovation, with various categories gaining traction. Frozen breakfast burritos, rice bowls, and energy bars cater to the increasing demand for convenient and nutritious options. Meatless, organic, and plant-based alternatives, such as frozen vegan options and sustainable seafood, are resonating with consumers' changing dietary preferences. Frozen fruit pops, sorbet, and yogurt bars address the growing trend towards healthier desserts. Frozen meal kits, pasta, and ready-to-eat meals offer solutions for busy consumers. E-commerce platforms are making it easier to purchase and receive frozen food items, including frozen finger foods, quesadillas, and onion rings. Furthermore, consumers are increasingly conscious of their health and are looking for convenient options that provide essential vitamins, minerals, and other nutrients.

- Frozen ingredient packs and meal solutions provide flexibility for home cooks, while frozen soup and chili offer comforting and convenient meal options. Frozen snacks, such as mozzarella sticks, potato skins, and trail mix, cater to consumers' cravings for indulgent and satisfying treats. The frozen food industry continues to evolve, with a focus on innovation, sustainability, and catering to diverse dietary needs. Frozen cauliflower bites, gluten-free foods, and non-GMO options are among the latest trends. The market is expected to remain dynamic, driven by changing consumer preferences and advancements in food technology.

How is this Frozen Snack Food Industry segmented?

The frozen snack food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- BP/MS/A

- Meat/poultry/seafood

- Vegetables and fruits

- Distribution Channel

- Offline

- Online

- End-user

- Households

- Foodservice Industry

- Institutional Buyers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The BP/MS/A segment is estimated to witness significant growth during the forecast period. In the realm of frozen food manufacturing, various sectors are experiencing significant developments. Among these, plant-based products have emerged as a prominent trend. This segment encompasses vegan pizzas, sandwiches, meat substitutes, frozen cheese snacks, and other appetizers. The preference for plant-based options stems from health and food safety concerns. Consumers increasingly seek food products that do not compromise their wellbeing. Plant-based diets, such as veganism, have gained traction worldwide due to their health benefits. These diets are linked to a reduced risk of cardiovascular diseases and metabolic disorders. Food manufacturers have responded to this trend by introducing innovative plant-based alternatives.

Get a glance at the market report of share of various segments Request Free Sample

The BP/MS/A segment was valued at USD 15.35 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

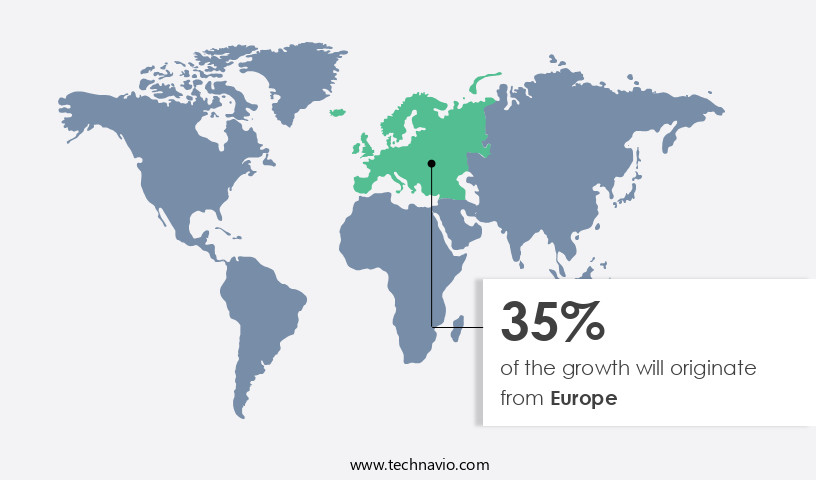

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market is experiencing growth due to urbanization and the resulting demand for space-efficient, long-lasting food options. This market caters to diverse consumer preferences, offering a range of products from traditional frozen pizzas, croissants, and savory pastries to globally-inspired snacks and healthier alternatives. As European consumers become increasingly health-conscious, there is a growing demand for frozen snacks with reduced salt, saturated fats, and artificial additives. Food manufacturers are responding by innovating with new product launches, such as frozen fruit, vegetables, and appetizers, to meet this demand. Ingredient suppliers are also playing a crucial role in this trend by providing healthier alternatives to traditional ingredients. The market encompasses a range of products, including chicken fingers and dippers, ready-to-eat meals, frozen sandwiches, and cheese snacks.

Packaging suppliers are focusing on packaging innovations to ensure the freshness and quality of these products. Grocery stores and convenience stores are key retailers in this market, while food service distributors and restaurant chains also contribute significantly to its growth. Product development and quality control are essential for maintaining brand loyalty and differentiating products in a competitive market. The European market is expected to continue evolving in response to changing consumer preferences and trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Frozen Snack Food Industry?

- Rise in launch of frozen products is the key driver of the market. The market is characterized by a diverse company landscape, with both international and domestic players contributing to its growth. Companies are introducing various types of frozen snacks to capture consumer attention and boost their market presence. The market is anticipated to experience significant expansion due to the continuous launch of innovative products. For instance, Del Monte Foods Inc., a subsidiary of Del Monte Pacific Ltd., has been focusing on expanding its branded product portfolio. Notable additions to its offerings include Gut Love and Boost Me Fruit Cup Snacks, which have been recognized as snack products of the year. This strategic move is expected to fuel market growth during the forecast period.

- This shift is evident in the growing demand for vegan pizzas, especially in developed economies. Food retailers, including grocery stores and mass market retailers, are expanding their offerings to cater to this consumer preference. Ingredient suppliers are also investing in plant-based ingredient innovations to meet the increasing demand. The convenience food sector, including frozen meals, sides, and entrees, is embracing this trend as well. Private label brands and national brands are launching new plant-based products to capture market share. Food service distributors and restaurant chains are also adopting plant-based options to cater to health-conscious consumers. Packaging suppliers are focusing on time-saving solutions and packaging innovations to meet the demands of this sector. The frozen food industry is witnessing a transformation, with plant-based options becoming increasingly popular.

What are the market trends shaping the Frozen Snack Food Industry?

- Rise of e-commerce is the upcoming market trend. The frozen snack market has experienced significant growth due to the convenience and accessibility offered by e-commerce platforms. Consumers can now order a diverse range of frozen snack products online, transcending geographic limitations and broadening the market reach for both established and emerging producers. E-commerce platforms provide an extensive selection of frozen snacks from various brands, including niche and specialty offerings that may not be readily available in physical retail stores. This variety enables consumers to discover new frozen snack options. Additionally, online shopping allows consumers to read reviews and recommendations from other buyers, facilitating informed purchasing decisions. Overall, e-commerce has revolutionized the frozen snack industry by making it more accessible and convenient for consumers worldwide.

- Restaurant chains have expanded their frozen food offerings, allowing consumers to enjoy their favorite dishes at home. Frozen pizza, entrees, and sides have become increasingly popular choices for families and individuals. National brands have capitalized on this trend by launching new product lines and advertising campaigns to boost sales. Frozen desserts, including ice cream, popsicles, and smoothies, have been another significant contributor to the market's growth. Consumer preferences for indulgent treats and healthier alternatives have driven innovation in this category. Frozen wings and meatballs have also seen increased demand, catering to consumers' cravings for savory, convenient options.

What challenges does the Frozen Snack Food Industry face during its growth?

- Frequent product recalls is a key challenge affecting the industry growth. The market faces challenges due to product recalls, which can hinder market expansion. Recalls occur when products contain unsafe materials, such as metal fragments, wood, or plastic, or undeclared ingredients. In the United States, the Food Safety and Inspection Service (FSIS), a division of the USDA, is responsible for ensuring the safety of meat, poultry, some fish, and processed egg products. The FSIS initiates recalls based on the severity and potential health risks posed by the recalled items. This regulatory oversight is crucial in maintaining consumer trust and safety in the frozen snack food industry.

-

Food safety and quality control remain top priorities for food manufacturers and retailers. Ingredient innovations have played a crucial role in addressing these concerns, with natural and organic ingredients gaining popularity. Mass market retailers and grocery stores have expanded their private label brands, offering consumers affordable alternatives while maintaining high-quality standards. Frozen food processing technologies have advanced, enabling longer shelf life and improved texture and taste. Product development continues to focus on time-saving solutions, catering to consumers' busy lifestyles. Frozen meals and sides have become essential components of many households' diets, offering convenience and variety. Brand loyalty remains strong in the frozen food market, with consumers relying on trusted brands for consistent quality and taste.

Exclusive Customer Landscape

The frozen snack food market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the frozen snack food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, frozen snack food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - The company introduces a diverse range of frozen snack food options under the brands JoseOle, LingLing, and Posada.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Al Kabeer Group ME

- BRF SA

- Conagra Brands Inc.

- Del Monte Pacific Ltd.

- ELEVATION BRANDS LLC.

- General Mills Inc.

- Home Market Foods Inc.

- JBS SA

- Kidfresh

- Maple Leaf Foods Inc.

- McCain Foods Ltd.

- Mother Dairy Fruit and Vegetable Pvt. Ltd.

- Nestle SA

- NewForrest Fingerfood B.V.

- Nomad Foods Ltd.

- Rich Products Corp.

- The Hain Celestial Group Inc.

- The Kraft Heinz Co.

- Tyson Foods Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The frozen snack food market continues to experience significant growth, with various categories contributing to its expansion. Frozen convenience foods, including breakfast items such as sandwiches and pancakes, have gained popularity due to their time-saving benefits and versatility. Consumers' preferences for on-the-go consumption and convenience have led online retailers to increase their offerings in this segment. Frozen sides, like fries and vegetables, remain staples in the market. Food manufacturers have focused on flavor trends, with innovative ingredient combinations and seasonings enhancing the taste profile of these products. Packaging suppliers have also played a crucial role in catering to consumer demands by providing convenient, single-serve portions and eco-friendly packaging solutions.

Product differentiation is essential, with companies focusing on unique flavors, ingredients, and packaging to stand out from competitors. In the realm of frozen snacks, appetizers, and sides, convenience and innovation continue to drive growth. Food service distributors play a vital role in connecting manufacturers and retailers, ensuring a steady supply of these products to various channels. Frozen fruits and vegetables have gained popularity as consumers seek healthier options. Ingredient suppliers have responded by offering organic, non-GMO, and locally sourced ingredients to cater to these demands. The frozen food market continues to evolve, with various categories and trends shaping its growth.

Consumer preferences for convenience, healthier options, and innovative flavors have driven product development and innovation in this sector. Food safety, quality control, and sustainability remain top priorities for manufacturers and retailers, ensuring consumers have access to high-quality, convenient, and affordable frozen food options. StartFragment The Frozen Snack Food Market is expanding rapidly, offering diverse options to meet consumer demands. Popular items like frozen breadsticks, frozen onion rings, and frozen mozzarella sticks remain favorites, while innovative choices such as frozen bites, frozen mini pizzas, and frozen quesadillas enhance convenience. Nutritious meals like frozen rice bowls, frozen chili, and frozen pasta cater to busy lifestyles. Creative appetizers like frozen potato skins, frozen nachos, and frozen broccoli bites add variety to menus. Desserts like frozen yogurt bars, frozen dessert cups, and frozen fruit sorbet delight the sweet tooth. Health-conscious options include frozen granola bars, frozen protein bars, and frozen energy bars. Sustainable trends such as frozen trail mix, frozen meatless options, frozen plant-based foods, frozen gluten-free foods, frozen organic foods, frozen non-GMO foods, and frozen sustainable seafood drive growth in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 16.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, China, Germany, UK, France, Japan, Canada, Brazil, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Frozen Snack Food Market Research and Growth Report?

- CAGR of the Frozen Snack Food industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the frozen snack food market growth of industry companies

We can help! Our analysts can customize this frozen snack food market research report to meet your requirements.