What is the High Performance Fibers Market Size?

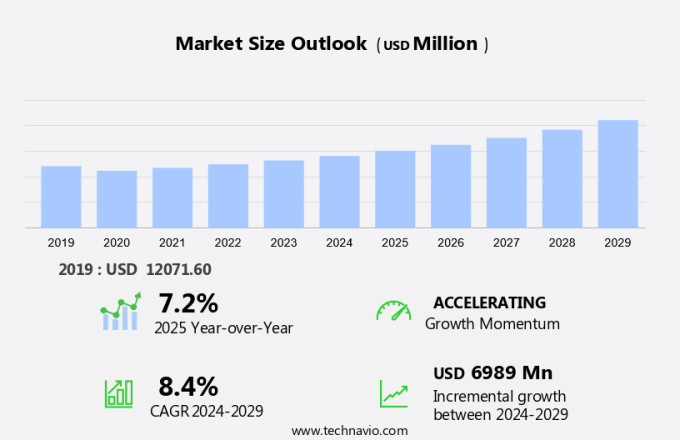

The high performance fibers market size is forecast to increase by USD 6.99 billion, at a CAGR of 8.4% between 2024 and 2029. The market is experiencing significant growth due to the increasing demand for lightweight, durable, and strong fibers in various industries. Key market trends include the expansion of companies through inorganic growth strategies, such as mergers and acquisitions, to enhance their product portfolios and gain a competitive edge. However, the high cost of production remains a challenge for market participants. In the US and North America, the market is expected to witness steady growth, driven by the increasing adoption of high-performance fibers in the automotive, aerospace, and sports industries. Additionally, the rising awareness of the benefits of high-performance fibers, such as improved durability and reduced weight, is fueling market growth. Companies are focusing on innovation and research and development to offer advanced high-performance fibers with enhanced properties, thereby catering to the evolving needs of consumers and industries.

What will be the size of the Market during the forecast period?

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Type

- Carbon fibers

- Aramid fibers

- Polyethylene fibers

- Glass fibers

- Others

- Application

- Aerospace and defense

- Automotive

- Electronics and electrical

- Construction

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

Which is the largest segment driving market growth?

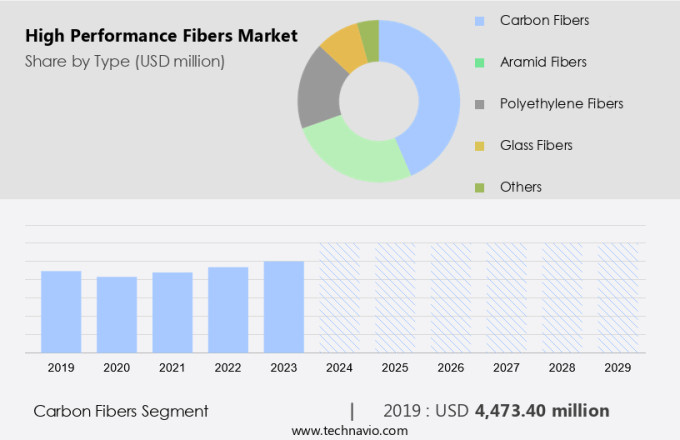

The carbon fibers segment is estimated to witness significant growth during the forecast period. The market encompasses various fiber types, with carbon fibers leading in growth and demand. Carbon fibers offer remarkable strength-to-weight ratios, making them essential for high performance applications in sectors like aerospace, automotive, and sports equipment. In July 2024, Toray Composite Materials America, Inc. announced a three-year MOU with Elevated Materials. This agreement designates Elevated Materials as the repurposing partner for Toray's Tacoma, Washington facility. Through this collaboration, Elevated Materials will process and repurpose scrap prepreg materials from Toray, including slit-edge and full-width prepreg sheets. This initiative supports sustainability efforts in the high performance fibers industry

Get a glance at the market share of various regions. Download the PDF Sample

The carbon fibers segment was valued at USD 4.47 billion in 2019. Carbon fibers exhibit superior chemical resistance and high glass transition temperatures, making them ideal for use in concrete reinforcing, aircraft components, fishing nets, and ropes. The research and development sector continues to explore new applications for these fibers, including emission reduction technologies. Organic solvents are often used in the production process, necessitating a focus on sustainable manufacturing methods and waste reduction strategies. As an asbestos substitute, high performance fibers offer a safer alternative for various industries.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

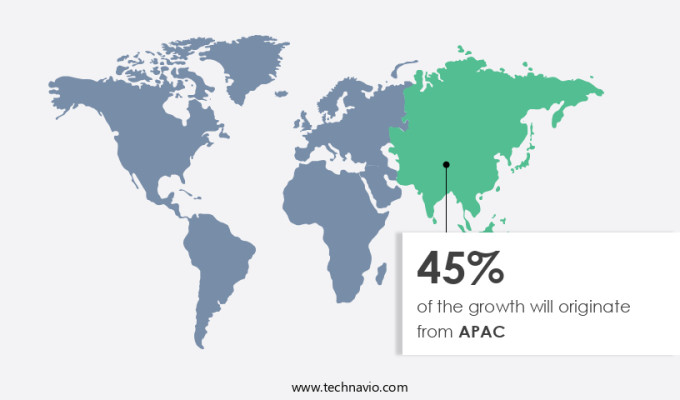

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional market trends and drivers that shape the market during the forecast period. The Asia-Pacific (APAC) region is a significant market for high performance fibers, fueled by industrial growth, technological advancements, and rising demand in various industries. Notable progress was made in December 2023, as Teijin initiated the production and sale of Tenax Carbon Fibers, manufactured using sustainable acrylonitrile (AN). This development signifies the region's dedication to sustainability and innovation in high performance fiber production. Teijin Tenax Carbon Fibers are produced from waste and residue derived from biomass-sourced products or recycled raw materials, earning them ISCC PLUS certification from the International Sustainability and Carbon Certification system. This certification guarantees that the raw materials are ethically sourced and traceable throughout intricate supply chains. High performance fibers, such as aramid fibers, are widely used in industrial fabrics, surgical sutures, and applications within the sports industries. In addition, these fibers are crucial in defense, aerospace, and other sectors due to their antimicrobial properties and enhanced fuel efficiency. The APAC market's growth is attributed to the increasing demand for these high-performance materials in various industries and applications.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers high performance fibers, which are used in aerospace, automotive, industrial furnaces, and other high-temperature environments. They help improve efficiency, reduce maintenance costs, and extend the life of equipment.

Technavio provides the ranking index for the top 19 companies along with insights on the market positioning of:

- Celanese Corp.

- Denka Co. Ltd.

- DuPont de Nemours Inc.

- Fiber-line

- Hexcel Corp.

- Honeywell International Inc.

- HS HYOSUNG ADVANCED MATERIALS

- Kolon Industries Inc.

- Kureha Corp.

- Mitsubishi Chemical Group Corp.

- Nexstar Extrusions Pvt Ltd

- PT Asia Pacific Fibers Tbk

- SGL Carbon SE

- Stein Fibers Ltd.

- Syensqo SA

- Teijin Ltd.

- Toray Industries Inc.

- United Shield International LLC

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

7.2 |

Market Dynamics

High-performance fibers have emerged as a critical component in various industries due to their exceptional properties and versatility. These fibers, which include high-modulus materials, fiber-reinforced polymers (FRPs), and advanced materials, have gained significant attention due to their ability to enhance the mechanical, thermal, and chemical properties of composite materials. The global high-performance fibers market is driven by several factors. The increasing demand for lightweight and durable materials in the automotive, aerospace, and construction industries is a significant factor. High-performance fibers offer improved mechanical properties, such as high strength, stiffness, and resistance to impact, corrosion, and fire. Moreover, the growing emphasis on sustainability and eco-materials has led to the development of bio-based plastics, recycled fibers, and biodegradable materials. These eco-friendly textiles are gaining popularity in the fashion industry, contributing to the sustainable development of textiles and apparel. Material characterization and composite testing play a crucial role in the production and application of high-performance fibers.

Composite manufacturing techniques, such as pultrusion, filament winding, and resin transfer molding, are used to produce high-performance composites with optimal mechanical, thermal, and chemical properties. The use of high-performance fibers in structural composites has led to the development of innovative solutions in various industries. For instance, in the construction industry, high-performance fibers are used to produce fire-resistant and impact-resistant materials, enhancing the safety and durability of buildings. In the automotive industry, high-performance fibers are used to produce lightweight and fuel-efficient vehicles, reducing carbon emissions and improving fuel efficiency. The market for high-performance fibers is expected to grow significantly due to the increasing demand for sustainable manufacturing practices and the development of advanced materials. The circular economy is gaining momentum, with a focus on reducing waste and increasing the use of recycled fibers and bio-based composites. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

The increasing need for lightweight high-performance fibers is notably driving the market growth. The market is experiencing significant growth due to the increasing demand for lightweight, strong, and durable materials across various industries. In the aerospace sector, high performance fibers such as carbon-reinforced fiber composites and PBI fibers are being extensively used in the production of aircraft components, including wings, fuselages, and landing gear. These fibers offer an exceptional strength-to-weight ratio, making them ideal for use in aircraft manufacturing. In the automotive industry, high performance fibers are being used to produce lightweight armor for bullet-proof jackets and body armor. These fibers offer high elongation, chemical resistance, and non-conductivity, making them suitable for use in protective gloves and heat-resistant cushions. Additionally, high performance fibers are being used as an asbestos substitute in concrete reinforcing, contributing to the reduction of emissions during construction.

Further, the research and development of new high performance fibers, such as polybenzimidazole fibers, melamine fibers, and polyphenylene sulfide fibers, is driving innovation in the market. These fibers offer superior properties, including high temperature resistance, high strength, and resistance to organic solvents. They are being used in various emerging sectors, including fiber optics, energy, marine, and industrial fabrics. The market is driven by factors such as the need for fuel efficiency, durability, and emission reduction, as well as the development of sustainable fiber alternatives. The use of high-performance fibers in additive manufacturing is also expected to drive market growth in the coming years. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

Expansion through inorganic growth strategies by companies is an emerging trend shaping market growth. The market is experiencing substantial growth, driven by strategic acquisitions and product diversification. Carbon-reinforced fiber composites and hpf-reinforced composites, such as those made from PBI fibers like Polybenzimidazole, are increasingly used in aerospace production for lightweight, heat-resistant components, including bullet-proof jackets, protective gloves, and aircraft components. These fibers offer superior chemical resistance, strength-to-weight ratio, and non-conductivity, making them ideal for use in electronics, composite materials, and industrial fabrics. High-performance fibers are also used in emerging sectors like additive manufacturing, sports, and healthcare applications.

For instance, they are used in the production of lightweight, high-strength armor for military vehicles and body armor, as well as in the development of eco-friendly alternatives for sports equipment, such as fishing nets, ropes, and fabric integrity. Moreover, high-performance fibers are used in various industries, including automotive, marine, and construction, to enhance durability, fuel efficiency, and emission reduction. Fluoropolymer fibers, polyphenylene sulfide fiber, and melamine fibers are popular choices for insulation, fiber optics, and energy applications. Research and development in sustainable fiber development, such as bio-based carbon fibers, is a growing focus area for companies in the market. Thus, such trends will shape the growth of the market during the forecast period.

What are the major market challenges?

The high cost of production is a significant challenge hindering the market growth. The market encompasses a range of advanced materials, including carbon-reinforced fiber composites and HPF-reinforced composites, used in various industries such as aerospace production, electronics, and protective gear. Carbon fibers, known for their exceptional strength-to-weight ratio and non-conductivity, are widely used in lightweight armor for bullet-proof jackets, military vehicles, and sports equipment. PBI fibers, like Polybenzimidazole, offer heat-resistant properties and are used in protective gloves and insulation. However, the high production costs, primarily due to the use of organic solvents and high-priced precursors like PAN in carbon fiber production, pose a significant challenge to market growth. Research and development efforts are underway to explore alternative precursors and production methods to lower costs while maintaining fiber performance. Sustainable fiber development, such as bio-based and recycled fibers, is also gaining traction in emerging sectors like automotive, marine, and industrial fabrics.

Moreover, additive manufacturing and nanotechnology are expected to revolutionize the production of high-performance fibers, leading to advancements in applications such as smart textiles, healthcare, and sports industries. High-performance fibers are used in a variety of applications, including protective gear, automotive, aerospace, and industrial fabrics. Carbon fibers, for instance, are used in lightweight armor for bullet-proof jackets, military vehicles, and sports equipment due to their exceptional strength-to-weight ratio and non-conductivity. PBI fibers, such as Polybenzimidazole, offer heat-resistant properties and are used in protective gloves and insulation. However, the high production costs, primarily due to the use of organic solvents and high-priced precursors like PAN in carbon fiber production, pose a significant challenge to market growth. Hence, the above factors will impede the growth of the market during the forecast period. Hence, the above factors will impede the growth of the market during the forecast period.

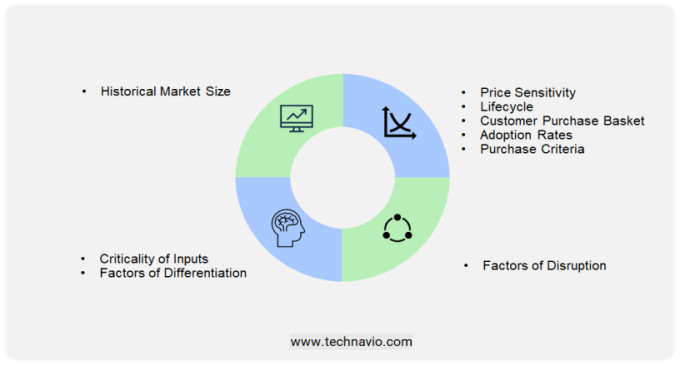

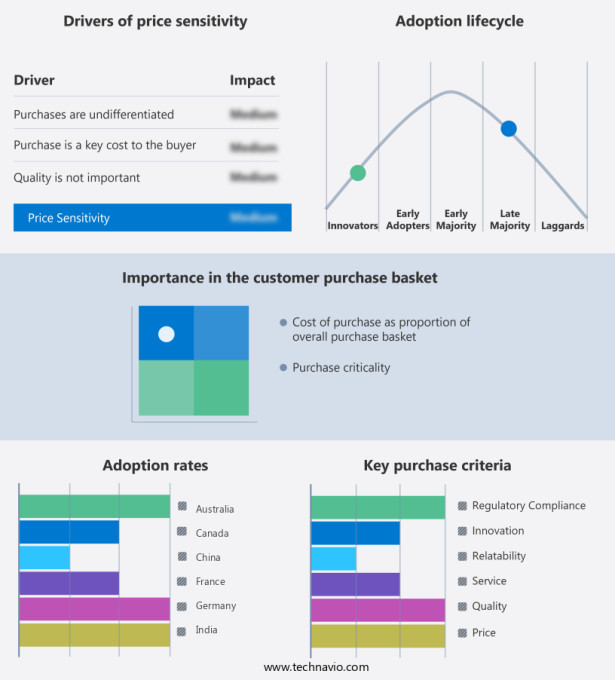

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

High-performance fibers have gained significant attention in various industries due to their exceptional properties, including high strength-to-weight ratio, chemical resistance, and non-conductivity. These fibers, such as carbon-reinforced fibers and PBI fibers, are increasingly being used in composite materials to enhance the performance of products across multiple sectors. Carbon-reinforced fiber composites are widely used in aerospace production for manufacturing lightweight and strong aircraft components, including chassis and wings. These materials offer superior fuel efficiency, making them an ideal choice for aircraft manufacturers. In addition, carbon fibers are also used in the production of bullet-proof jackets, providing exceptional protection in high-risk situations. Composite materials made from high-performance fibers are also finding applications in the electronics industry. For instance, heat-resistant cushions made from these fibers are used to protect sensitive electronic components from extreme temperatures.

Similarly, protective gloves made from high-performance fibers are used in hazardous environments to provide insulation and protection from chemicals. PBI fibers, specifically polybenzimidazole fibers, are known for their non-conductivity and chemical resistance, making them an excellent choice for use in protective clothing and armor. These fibers are used in the production of lightweight armor for military vehicles and body armor for law enforcement personnel. Research and development in the field of high-performance fibers is ongoing, with a focus on creating eco-friendly alternatives to traditional materials. For instance, bio-based fibers are being developed for use in sports industries, providing sustainable fiber development for use in sportswear and athletic performance equipment. High-performance fibers are also being used in emerging sectors such as smart textiles and healthcare applications.

In addition, the market is advancing with the rise of bio-based resins and bio-sourced materials, promoting eco-conscious design and green chemistry. These fibers, made from eco-friendly materials like natural fibers, offer a low-carbon footprint and are key in sustainable textiles. With applications in fiber optic cables, flame retardant fibers, and fiber reinforced composites, they deliver superior corrosion resistance, high tensile strength, thermal stability, and heat resistance. Fiber reinforced polymers and fiber reinforced concrete are enhancing engine performance and structural integrity, while abrasion resistance and fiber reinforced plastics continue to evolve for future innovations in fiber reinforced composites future and fiber reinforced metals. The market is advancing with the rise of bio-based resins and bio-sourced materials, promoting eco-conscious design and green chemistry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market Growth 2025-2029 |

USD 6.99 billion |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 45% |

|

Key countries |

US, China, Japan, Germany, France, Canada, South Korea, India, UK, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Celanese Corp., Denka Co. Ltd., DuPont de Nemours Inc., Fiber-line, Hexcel Corp., Honeywell International Inc., HS HYOSUNG ADVANCED MATERIALS, Kolon Industries Inc., Kureha Corp., Mitsubishi Chemical Group Corp., Nexstar Extrusions Pvt Ltd, PT Asia Pacific Fibers Tbk, SGL Carbon SE, Stein Fibers Ltd., Syensqo SA, Teijin Ltd., Toray Industries Inc., and United Shield International LLC |

|

Market Segmentation |

Type (Carbon fibers, Aramid fibers, Polyethylene fibers, Glass fibers, and Others), Application (Aerospace and defense, Automotive, Electronics and electrical, Construction, and Others), and Geography (APAC, North America, Europe, Middle East and Africa, and South America) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies