Industrial Food Blender And Mixer Market Size 2025-2029

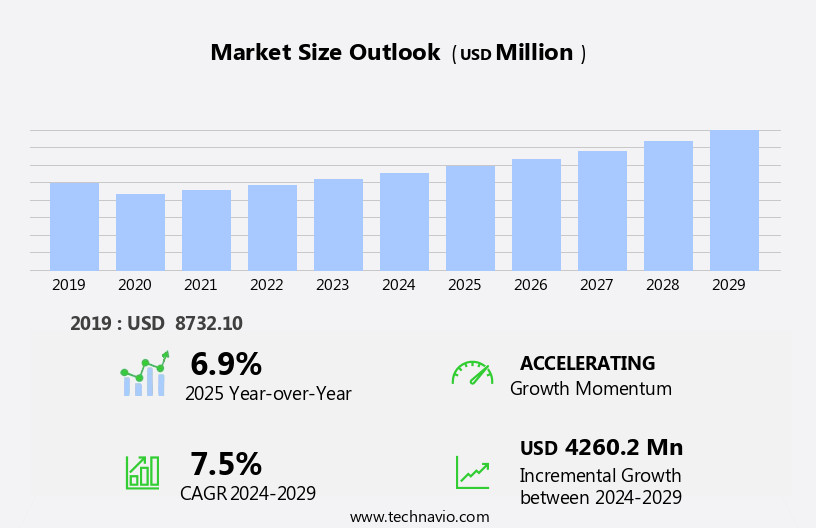

The industrial food blender and mixer market size is forecast to increase by USD 4.26 billion at a CAGR of 7.5% between 2024 and 2029.

- The market is poised for steady growth, driven by the expanding food processing industry. This sector's increasing focus on automation, efficiency, and product consistency is fueling the demand for advanced blending and mixing solutions. Technological innovations, such as energy-efficient motors and smart control systems, are further enhancing the market's appeal. However, the high energy consumption associated with these industrial-scale equipment poses a significant challenge. To mitigate this, manufacturers are exploring energy recovery systems and alternative power sources, creating opportunities for technological advancements and partnerships.

- Companies seeking to capitalize on this market's potential must stay informed about the latest trends and address the energy consumption issue effectively. By investing in research and development and collaborating with energy providers, they can differentiate themselves and meet the evolving demands of the food processing industry. Food processing companies in the region predominantly use ribbon mixers to blend powdered chocolate and cocoa with other ingredients, such as sugar, vitamins, and minerals.

What will be the size of the Industrial Food Blender And Mixer Market during the forecast period?

- The market encompasses a range of equipment used in the production of ready-to-eat goods and dairy food products. Key market drivers include the increasing demand for processed food items in developing nations and the growing health awareness trend leading to the production of more natural, minimally processed foods. High shear mixers, screw mixers, double cone blenders, ribbon blenders, planetary mixers, and batch mixing systems are among the commonly used equipment in this market. Raw materials, such as powders, liquids, and pastes, are blended and mixed using these industrial-scale machines to create a wide array of food products.

- Both continuous mixing and automatic mode operations are utilized to enhance production efficiency and ensure consistent product quality. Overall, the market is experiencing strong growth due to the expanding food processing industry and the rising demand for convenient, ready-to-eat food products.

How is this Industrial Food Blender And Mixer Industry segmented?

The industrial food blender and mixer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

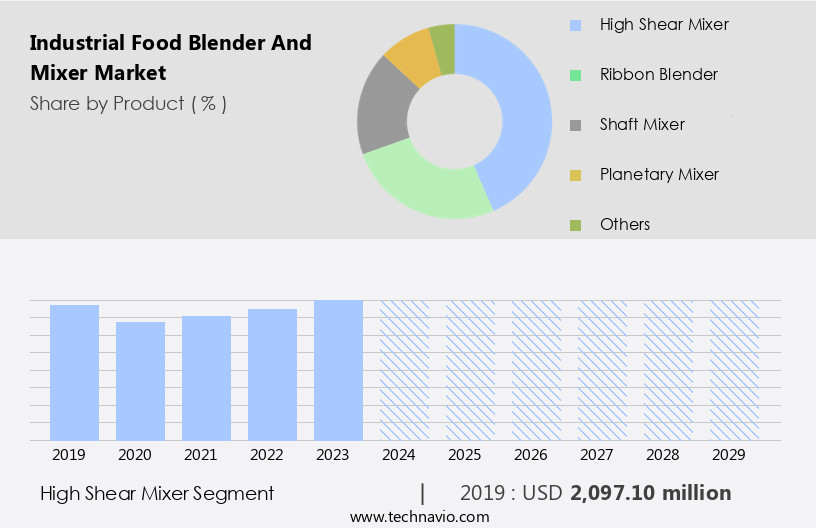

- Product

- High shear mixer

- Ribbon blender

- Shaft mixer

- Planetary mixer

- Others

- Type

- Automatic

- Semi-automatic

- End-user

- Food processing industry

- Food service industry

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- France

- Germany

- Italy

- Spain

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Europe

By Product Insights

The high shear mixer segment is estimated to witness significant growth during the forecast period. High-shear mixers are essential tools in food manufacturing, enabling the production of homogeneous mixtures for various food products. These mixers, which incorporate a high-speed rotor within a stationary stator, are primarily used for preparing sauces, salsa, sandwich spreads, syrups, oil, gravies, marinades, and gels. The shearing action of the rotating blades and the turbulence created facilitate quick homogenization of the mixture, ensuring efficient production of food items. High-shear mixers are particularly effective for preparing fluid-based products, such as soups and sauces, and are widely used in the beverage industry.

They are also suitable for processing raw materials and raw ingredients for human consumption, including nutrition bars, extruded snacks, bakery products, batter-coated products, and better-finished products. Multifunctional equipment, including power-consuming equipment, is available to handle difficult-to-mix gel structures and shear-thinning materials.

Get a glance at the market report of share of various segments Request Free Sample

The High shear mixer segment was valued at USD 2.1 billion in 2019 and showed a gradual increase during the forecast period.

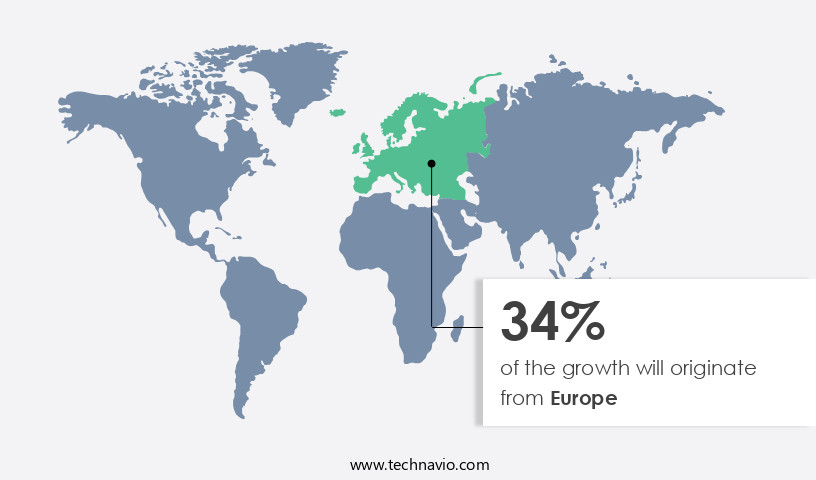

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market witnessed significant growth in 2024, driven by the expansion of the packaged confectionery sector and the adoption of energy-efficient mixing technologies. Key contributing countries include Germany, the UK, and France, where high consumption of confectionary products, particularly chocolate, fuels demand for high-quality food mixers. The market is further driven by the increasing production of ready-to-eat goods, dairy food products, and other human consumption items in developing nations.

Industrial food blenders and mixers are essential for the production of nutrition bars, extruded snacks, bakery products, batter-coated products, soups & sauces, and better-finished products. Advanced equipment, such as high-shear mixers, offer advantages like agglomerate-free dispersion, homogeneous mixing, and deaeration processes. The beverage industry also benefits from high-shear mixers for fluid-based product mixing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Industrial Food Blender And Mixer Industry?

- Steady growth of the food processing industry is the key driver of the market. The global market for industrial food blenders and mixers has witnessed significant growth in recent years due to the increasing importance of food processing in the food industry. The trend towards convenience foods with minimal preparation time has led food companies to expand their offerings of processed food products, thereby driving demand for industrial food blenders and mixers. Furthermore, government initiatives in emerging economies, such as India, are supporting the food processing sector, which is expected to increase the adoption of these machines for food processing applications.

- For instance, during the Union Budget 2023-2024, the Indian government announced substantial investments in the food processing sector. This investment is expected to create opportunities for market growth in the forecast period.

What are the market trends shaping the Industrial Food Blender And Mixer Industry?

- Advancements in food processing technology are the upcoming market trend. The market has witnessed significant progress in food processing technology, fueled by the rising demand for efficient and superior quality food production. A notable technological innovation is the emergence of high shear mixers, which are extensively utilized for emulsification and particle size reduction. These mixers play a pivotal role in generating smooth and uniform food products, making them indispensable in contemporary food processing facilities.

- Furthermore, the advent of smart and multifunctional blenders has transformed the market landscape. Equipped with features such as preset programs, Bluetooth connectivity, and energy-efficient motors, these blenders cater to the demands of tech-savvy consumers and commercial kitchens alike.

What challenges does the Industrial Food Blender And Mixer Industry face during its growth?

- High energy consumption by industrial food blenders and mixers is a key challenge affecting the industry's growth. Blending and mixing are essential processes in various industries, particularly in food and beverages. These processes can be energy-intensive due to the varying viscosity of raw materials. Intensive blending and mixing consume more power compared to non-intensive processes.

- For instance, in the food industry, some ingredients with lower viscosity can be efficiently mixed using shaft mixers or shear mixers. However, those with higher viscosity may necessitate additional equipment like multi-agitators and blades for effective mixing, leading to increased power consumption. These dynamics is crucial for companies to optimize energy usage and improve operational efficiency.

Exclusive Customer Landscape

The industrial food blender and mixer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial food blender and mixer market report also include key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial food blender and mixer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Admix Inc. - The company offers industrial food blenders and mixers such as Dynashear inline mixers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Admix Inc.

- Alfa Laval AB

- amixon GmbH

- Charles Ross and Son Co.

- EKATO HOLDING GmbH

- Frain Industries

- GEA Group AG

- JWB Systems Inc.

- Kady International

- Lindor Products BV

- Paul O. Abbe

- Satake MultiMix Corp.

- Silverson Machines Inc.

- SPX FLOW Inc.

- Statiflo Group

- Sulzer Ltd.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of equipment used in the production of various foodstuffs for human consumption. These machines play a crucial role in the processing of ready-to-eat goods, such as dairy food products, nutrition bars, extruded snacks, bakery products, batter-coated products, soups & sauces, and better-finished products. Manufacturers in this sector focus on creating multifunctional equipment that can handle a wide array of raw materials and raw ingredients. The challenge lies in ensuring agglomerate-free dispersion and homogeneous mixing, particularly with difficult-to-mix substances like gel structures and shear-thinning materials. In the food industry, high-shear mixers have gained significant popularity due to their ability to create a fine dispersion of minor ingredients in fluid-based product mixing.

The beverage industry, in particular, heavily relies on high-shear mixers for the production of various beverages, including frozen drinks. Power-consuming equipment, such as double cone blenders, ribbon blenders, planetary mixers, and screw mixers, are essential in the food processing sector. These machines cater to different mixing requirements, including batch mixing, continuous mixing, automatic mode, and semi-automatic mode. Tumble blending and vacuum mixing are other techniques used to ensure thorough mixing and deaeration processes in a closed system. The increasing health awareness among consumers has led to a growing demand for better-finished products with improved nutrition and taste. This trend has driven the development of custom-designed mixers that cater to specific food processing needs, ensuring homogeneous mixing and maintaining the desired texture and consistency of the final product.

The use of electrical kitchen appliances, such as high-shear mixers, ribbon blenders, shaft mixers, and vacuum technology, has revolutionized food processing, enabling manufacturers to produce high-quality products efficiently and cost-effectively. Ultra-high shear mixers have emerged as a popular choice for manufacturers due to their ability to create fine dispersions and homogeneous mixtures in a short time. These mixers are widely used in various industries, including food and beverage, pharmaceuticals, and cosmetics, to name a few. The market is a dynamic and evolving sector that plays a vital role in the production of various foodstuffs for human consumption.

Manufacturers continue to innovate and develop new technologies to meet the growing demand for better-finished products with improved nutrition and taste while ensuring efficient and cost-effective production processes. Guar gum, commonly used in various industries for its thickening and stabilizing properties, can sometimes be difficult to mix due to its gel structure and shear-thinning behavior. When mixing guar gum with other ingredients, traditional methods may struggle to effectively blend the components, leading to uneven textures. High-shear mixers are often employed to overcome this challenge, providing the necessary force to break down clumps and achieve a smooth consistency. Alternatively, a screw mixer, which operates by rotating a screw to move ingredients, can also be effective in uniformly mixing guar gum in certain formulations. Additionally, spinning blades can further enhance mixing, while the deaeration process can help remove air pockets, ensuring a more consistent and stable final product.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market Growth 2025-2029 |

USD 4.26 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, Germany, UK, Canada, China, France, Japan, India, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Food Blender And Mixer Market Research and Growth Report?

- CAGR of the Industrial Food Blender And Mixer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial food blender and mixer market growth and forecasting

We can help! Our analysts can customize this industrial food blender and mixer market research report to meet your requirements.