Isophthalic Acid Market Size 2024-2028

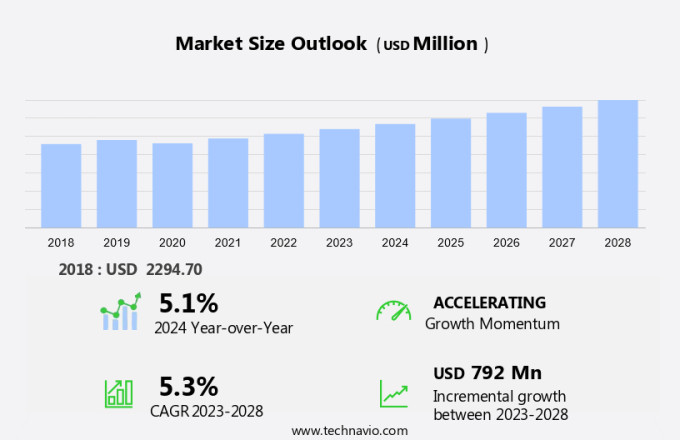

The isophthalic acid market size is forecast to increase by USD 792 billion at a CAGR of 5.3% between 2023 and 2028.

- Isophthalic acid is a crucial chemical intermediate used in the production of polyester resins, finding extensive applications in various industries. The market for isophthalic acid is driven by the increasing demand for polyester resins in sectors such as textiles, aerospace interiors, railway components, and specialty resins.

- Furthermore, the surge in automotive component production and the adoption of isophthalic acid in 3D printing and electrical vehicles are additional growth factors. However, the market faces challenges including inflation and the use of fossil fuel-based and biofuels feedstocks, which contribute significantly to carbon emissions. The shift towards bio-based isophthalic acid is expected to mitigate these challenges and offer sustainable solutions.The market analysis report provides a comprehensive study of these trends and challenges, enabling stakeholders to make informed decisions and capitalize on opportunities in the market.

What will be the Size of the Market During the Forecast Period?

- Isophthalic acid, an aromatic dicarboxylic acid, plays a significant role in various industries due to its unique chemical properties. This organic compound is a raw ingredient for the production of unsaturated polyester resins, which are widely used in the manufacturing of resins, composites, coatings, and other applications. The demand for isophthalic acid is driven by its applications in diverse sectors such as construction, renewable energy, textiles, aerospace, and specialty resins. In construction, isophthalic acid is used to enhance the corrosion resistance of coatings, ensuring the durability and longevity of infrastructure.

- In the renewable energy sector, it is a vital feedstock for the production of unsaturated polyester resins used in wind turbine blades and solar panels, contributing to the growth of the renewable energy industry. Isophthalic acid also finds extensive applications in the textile industry, where it is used as a raw material for producing high-performance textiles. In the aerospace industry, it is used in the production of aerospace interiors and railway components, owing to its excellent strength and durability properties. Furthermore, it is used in the production of specialty resins, 3D printing, electrical vehicles, food packaging, and plastic bottles.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- PET copolymer

- Unsaturated polyester resins

- Surface coating

- Others

- End-user

- Textile industry

- Automotive industry

- Construction

- Marine

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Application Insights

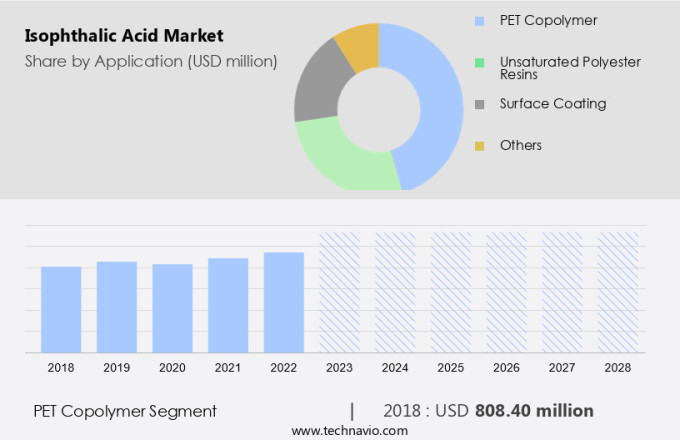

- The pet copolymer segment is estimated to witness significant growth during the forecast period.

Isophthalic acid (IPA) plays a crucial role in the manufacture of polyester resins, specifically in the production of copolymers with polyethylene terephthalate (PET). IPA functions as a comonomer, enhancing the characteristics of PET for various applications. By incorporating IPA into PET, the resulting copolymers exhibit enhanced thermal stability, mechanical strength, and processability. This is achieved by replacing a small percentage of terephthalic acid units with IPA. The superior clarity, slower crystallization rate, and improved barrier properties of PET copolymers make them desirable for premium and specialized packaging applications. The demand for these advanced packaging solutions continues to increase, driving the growth of the market.

IPA's molecular recycling properties also contribute to the production of composite materials and fiber production, further expanding its market potential. The chemical resistance of IPA makes it a valuable raw ingredient in various industries, including food packaging and plastic bottles.

Get a glance at the market report of share of various segments Request Free Sample

The PET copolymer segment was valued at USD 808.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Isophthalic acid (IPA), a significant chemical compound, plays a pivotal role in the manufacturing of resins, including unsaturated polyester resins (UPRs), which are in high demand in the Asia-Pacific (APAC) region. The region's rapid industrialization and urbanization have fueled the need for materials used in infrastructure development, automotive manufacturing, and textiles. In the automotive sector, the APAC market is a major player globally, with a growing preference for lightweight composite materials. IPA is an essential ingredient in producing UPRs, which are utilized in the production of fiber reinforced polymers (FRP). These materials offer automotive components, such as bumpers, body panels, and interior parts, the required strength, durability, and low weight.

Moreover, IPA's applications extend beyond the automotive industry. It is also used in the production of coatings and corrosion-resistant materials, making it a valuable component in the renewable energy sector, particularly in wind turbine blades. The construction industry also benefits from IPA as it is used in the production of insulation materials and concrete admixtures. In summary, the demand for IPA is on the rise in the APAC region due to its extensive use in various industries, including automotive manufacturing, construction, and renewable energy. Its versatility and unique properties make it an indispensable component in the production of high-performance materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market for isophthalic acid is influenced by several factors, including inflation, carbon emissions, and the shift towards bio-based isophthalic acid. The increasing inflation rates lead to higher production costs, which can impact the pricing of isophthalic acid and its downstream products. Additionally, the growing focus on reducing carbon emissions has led to an increased demand for bio-based isophthalic acid, which is produced using renewable feedstocks, thereby reducing the carbon footprint. Isophthalic acid is also used as a raw material in the production of polymers, including polyethylene terephthalate (PET) resins and coatings. The increasing demand for fuel efficiency and sustainability in various industries, such as automotive and packaging, is driving the growth of the PET resins market, which, in turn, is boosting the demand for isophthalic acid.

The glass transition temperature of isophthalic acid makes it an ideal raw material for producing high-performance coatings and resins, which are used in various applications, including lubricants and adhesives. The versatility and wide range of applications of isophthalic acid make it a crucial component in the chemical industry. In conclusion, isophthalic acid is a vital chemical compound with a wide range of applications in various industries, including construction, renewable energy, textiles, aerospace, and specialty resins. Its unique properties, such as high strength, durability, and versatility, make it an essential raw material for the production of various products, including unsaturated polyester resins, coatings, and polymers. The market for isophthalic acid is influenced by several factors, including inflation, carbon emissions, and the shift towards bio-based isophthalic acid, making it an interesting and dynamic market to watch.

What are the key market drivers leading to the rise in adoption of Isophthalic Acid Market ?

Growing demand for polyester resins is the key driver of the market.

- Isophthalic acid (IPA) plays a significant role in the production of polyester resins, which are widely used in various industries due to their superior properties. The demand for these resins is increasing as they are utilized in manufacturing lightweight and durable components for the automotive industry, contributing to enhanced fuel efficiency and reduced emissions. In the construction sector, IPA is essential for producing robust and weather-resistant building materials. Moreover, in the textile industry, IPA is used in the production of polyethylene resin and unsaturated polyester resin (UPR), which are integral to creating high-performance engineering plastics and thermosetting fibers.

- Additionally, IPA is used in the production of thermo-resistant coatings and copolyesters, further expanding its applications. The recycling of PET bottles and other plastic waste is another area where IPA is gaining importance as a raw material. Overall, the versatility and utility of IPA make it an indispensable component in numerous industries, driving the growth of the IPA market.

What are the market trends shaping the Isophthalic Acid Market?

Surge in automotive component production is the upcoming trend in the market.

- The market is witnessing a notable development due to the increasing demand for feedstock in the production of automotive components. This trend is notably observed in Kazakhstan, where there is a growing emphasis on localizing automotive manufacturing. In February 2024, a conference in Astana showcased strategic initiatives to strengthen local manufacturing capabilities. Investments worth over USD900 million from both local and foreign investors are being poured into the establishment of auto component manufacturing facilities in the region. This investment aims to make vehicles more cost-effective for consumers by reducing dependence on imported parts and fostering a strong local supply chain.

- The localization of automotive component production in Kazakhstan is poised to bring about a substantial impact on the regional the market. The shift towards local production is expected to reduce carbon emissions, making it an eco-friendly alternative. Furthermore, the use of Isophthalic Acid in textiles, aerospace interiors, railway components, specialty resins, 3D printing, and electrical vehicles is expanding, adding to the market's growth.

What challenges does Isophthalic Acid Market face during the growth?

Variable crude oil prices is a key challenge affecting the market growth.

- Isophthalic acid (IPA) is a crucial chemical intermediate used in the production of various polymers and coatings. The primary applications of IPA include the manufacturing of Polyethylene terephthalate (PET), Polybutylene terephthalate (PBT), and other polyesters. In addition, IPA is used as a lubricant in the production of plastics and as a component in coating applications, such as waterproof gel coatings, self-extinguishing composite materials, wood paints, and fiberglass. The market is influenced by several factors, with crude oil prices being a significant determinant. IPA is derived from petroleum-based feedstocks, such as xylene, making its production costs highly sensitive to changes in oil prices.

- For instance, the average Brent crude oil price in 2023 was USD83 per barrel, a decrease from USD101 per barrel in 2022. This USD19 per barrel drop can lead to uncertain production costs, negatively impacting both manufacturers and end-users, particularly during periods of oil price instability. Despite these challenges, the demand for isophthalic acid remains strong due to its wide range of applications in various industries. According to industry reports, the market for isophthalic acid is expected to grow at a steady pace in the coming years, driven by increasing demand for PET and PBT in the packaging and automotive industries, respectively.

- Furthermore, the use of IPA in coating applications, such as waterproof gel coatings and self-extinguishing composite materials, is also expected to drive market growth. In conclusion, the market is a vital sector that plays a crucial role in the production of various polymers and coatings. While the market faces challenges due to the volatility of crude oil prices, the demand for isophthalic acid remains strong, driven by its applications in various industries.

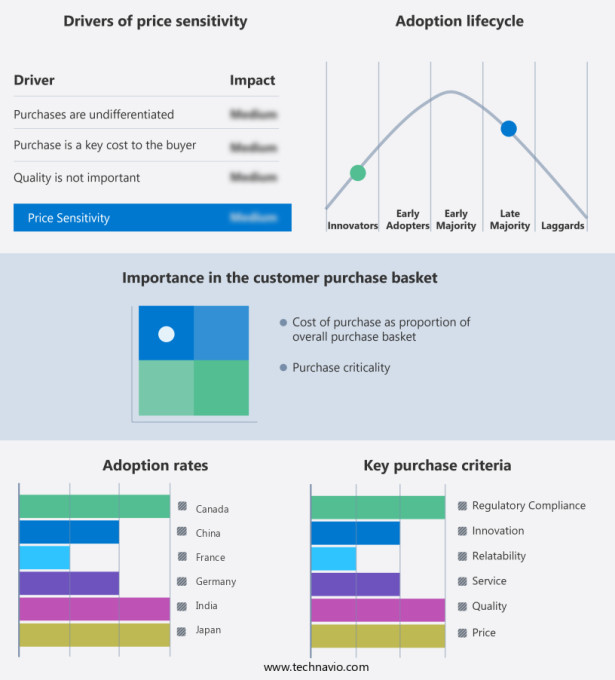

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

DHALOP CHEMICALS - This company provides isophthalic acid, a crucial component in the manufacture of metal coordination polymers and serving as a precursor for the production of crystalline tetragonal structures. Isophthalic acid's applications extend beyond this, making it an essential ingredient in various industries, including coatings, plastics, and textiles. With its versatility and high demand, our isophthalic acid offering caters to the growing needs of the North American market. Our commitment to quality and customer satisfaction ensures a reliable supply of this essential chemical, contributing to the success of numerous businesses in the region.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- DHALOP CHEMICALS

- Dow Inc.

- Eastman Chemical Co.

- EMCO Dyestuff Pvt. Ltd.

- Formosa Plastics Corp.

- Golden Dyechem

- Groupe Veritas Ltd.

- Hefei TNJ Chemical Industry Co. Ltd.

- Indorama Ventures Public Co. Ltd.

- INEOS Group Holdings S.A.

- Lotte Chemical Corp.

- Merck KGaA

- Mitsubishi Gas Chemical Co. Inc.

- Perstorp Holding AB

- Sisco Research Laboratories Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Isophthalic acid, an aromatic dicarboxylic acid, plays a significant role in the production of various industrial products. This chemical compound is a key feedstock for the manufacture of unsaturated polyester resins (UPR), which are widely used in the production of composites, coatings, and resins. In the composites industry, isophthalic acid is used to produce thermo-resistant coatings and self-extinguishing composite materials. These materials find extensive applications in construction, renewable energy, and transportation sectors. In the renewable energy sector, isophthalic acid is used in the production of wind turbine blades and solar panels, contributing to fuel efficiency and reducing carbon emissions.

Isophthalic acid is also used in the production of high-performance engineering plastics, such as copolyesters and polyesters. These polymers exhibit excellent chemical resistance, making them suitable for use in various industries, including aerospace, textiles, and automotive. Moreover, isophthalic acid is used as a raw ingredient in the production of pet resins, which are used in the manufacture of PET bottles and fibers. It is also used in the production of specialty resins, including those used in 3D printing, electrical vehicles, and hot melt adhesives. Isophthalic acid is also used in the production of various coatings, including waterproof gel coatings, thermosetting fiber, and coil coating.

These coatings offer excellent electrical and thermal resistance, making them suitable for use in various applications, including aircraft, special fibers, and printing inks. In summary, isophthalic acid is a versatile chemical compound with wide applications in various industries, including construction, renewable energy, transportation, textiles, and electronics. Its use in the production of various polymers, coatings, and resins contributes to the development of high-performance materials with excellent properties, such as chemical resistance, thermal resistance, and electrical resistance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2024-2028 |

USD 792 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Key countries |

China, US, India, Japan, Germany, Canada, France, South Korea, Saudi Arabia, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch