N-Butanol market Size 2024-2028

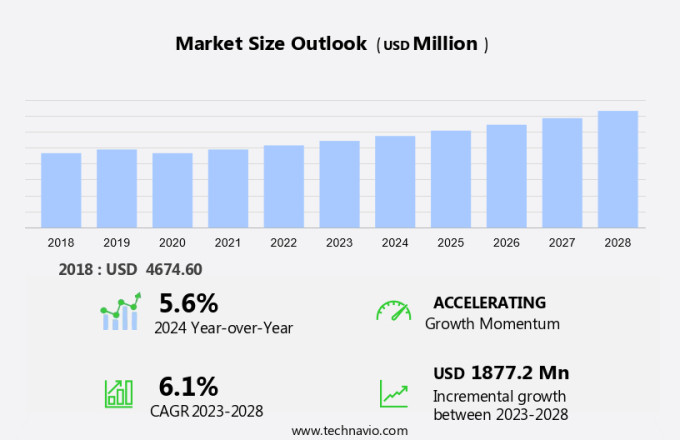

The N-Butanol market size is forecast to increase by USD 1.88 billion, at a CAGR of 6.1% between 2023 and 2028.

- The market is experiencing significant growth due to increasing demand for this primary alcohol in various industries. In the plastics sector, N-Butanolis utilized as a monomer for producing coating resins, butyl acrylate, and butyl acetates. In the construction industry, it serves as a solvent and a raw material for producing glycol ethers. Moreover, the preference for renewable N-Butanolas a biofuel is on the rise due to the growing focus on sustainable energy sources. The volatile crude oil prices have also driven the market growth, as N-Butanolprovides an economically viable alternative to petroleum-derived solvents. This trend is expected to continue, making N-Butanola valuable commodity in the global market.

What will be the Size of the Market During the Forecast Period?

- N-Butanol, a primary alcohol with the molecular formula C4H9OH, is an essential chemical intermediate with a wide range of applications in various industries. In the US market, N-Butanolis primarily used as a solvent in solvent-based systems, a chemical intermediate in the production of renewable chemicals and biofuels, and as a cleaner fuel. N-Butanolis widely used as a solvent in various applications due to its excellent solvency power and low toxicity. In the US, it is extensively used in coatings, adhesives, and plastics production. Coating resins, such as butyl acrylate and butyl acetates, use N-Butanolas a solvent to improve their flow and leveling properties. Adhesives manufacturers also utilize N-Butanolto enhance the bonding strength and flexibility of their products. In the plastics industry, N-Butanolis used as a solvent in the production of PVC and other polymers. N-Butanolis a versatile chemical intermediate used in the production of various renewable chemicals and biofuels. It is used as a raw material in the production of butyl carboxylate, which is used as an intermediate in the production of glycol ethers.

- These glycol ethers are used as solvents, swelling agents, and intermediates in various industries, including coatings, adhesives, and plastics. N-Butanolis also used as a biofuel, providing a cleaner alternative to traditional fossil fuels. It can be blended with gasoline or used as a standalone fuel in internal combustion engines. N-Butanolis a valuable chemical intermediate used in the production of various chemicals. It is used in the production of butyl acrylate, which is used as a monomer in the production of superabsorbent polymers, used in the production of disposable diapers and other absorbent hygiene products. N-Butanolis also used in the production of butyl acetates, which are used as solvents and intermediates in various industries.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Butyl acrylate

- Glycol ethers

- Butyl acetate

- Direct solvent

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Application Insights

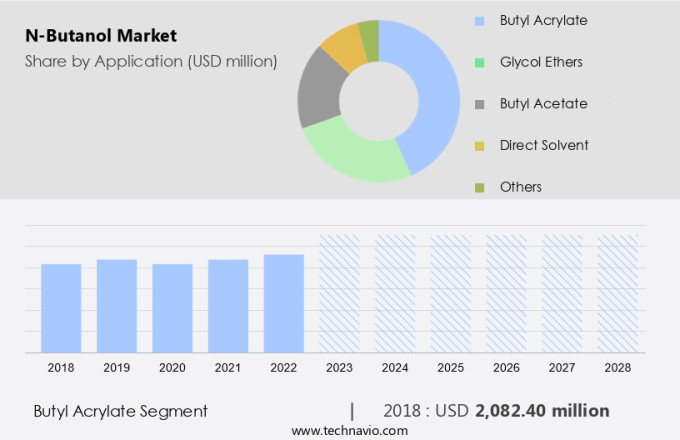

- The butyl acrylate segment is estimated to witness significant growth during the forecast period.

Butyl acrylate, a type of butanol, is a crucial component in various industries, including plastics production and construction activities. In plastics manufacturing, butyl acrylate is used as a monomer to produce acrylate polymers, which are essential in the production of butyl acetates, glycol ethers, and other chemicals. In the construction sector, butyl acetate is used as a solvent, while butyl acrylate is used in the production of coating resins. Coating resins made from butyl acrylate are widely used in various applications, including interior and exterior paints, adhesives, and other coating solutions. These resins offer several advantages, such as low viscosity, which improves the brushability of paints and varnishes, making them easier to apply uniformly on surfaces.

Moreover, butyl acrylate-based coatings emit low volatile organic compounds (VOCs), making them an eco-friendly alternative to traditional solvent-based coatings. The increasing demand for environmentally friendly products and regulations limiting VOC emissions can significantly impact the market for butyl acrylate and related products. Additionally, butyl acrylate is also used as a primary alcohol in the production of 1-butanol, which is used as a biofuel and solvent in various industries. Overall, the market for butyl acrylate and related products is expected to grow steadily during the forecast period due to their versatility and increasing demand in various industries.

Get a glance at the market report of share of various segments Request Free Sample

The butyl acrylate segment was valued at USD 2.08 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

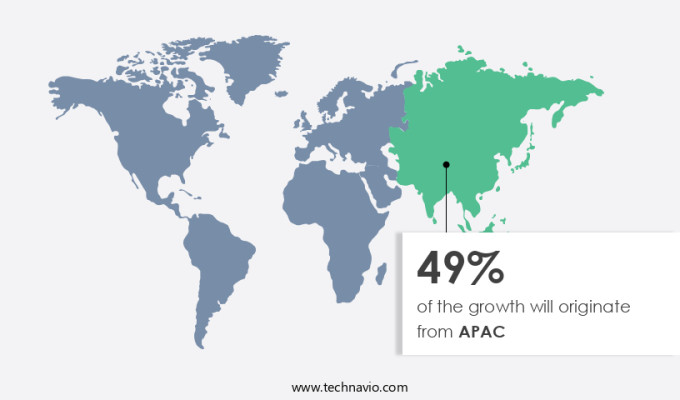

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

N-Butanolis a versatile chemical compound with various applications across multiple industries. In the automotive sector, it serves as a crucial diluent in cellulose nitrate lacquers, contributing to the production of high-quality automotive finishes for Original Equipment Manufacturers (OEM) and aftermarket applications. Furthermore, its use as a plasticizer in plastics and resins enhances their flexibility and durability. In the realm of personal care and cosmetics, N-Butanolis an essential ingredient in nail care formulations, bath soaps, detergents, eye makeup, and foundations. Its role as a solvent in perfumes and disinfectants further expands its reach in the consumer goods industry.

The thriving textile industry also utilizes N-Butanolas a solvent and intermediate in the production of textile fibers and dyes. In the pharmaceutical sector, it is used as a raw material in the synthesis of various drugs and active pharmaceutical ingredients (APIs). Moreover, the increasing use of N-Butanolas, a biofuel, particularly in China, India, Japan, and Indonesia, is expected to fuel market growth during the forecast period. The significant expansion of the automotive sector in these regions will further augment the demand for n-butanol. In summary, the increasing demand for N-Butanolin in various industries, including automotive, personal care, cosmetics, textile, and pharmaceuticals, will drive market growth during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of N-Butanol market ?

Rising demand for N-Butanolas solvent is the key driver of the market.

- N-Butanolis a versatile chemical compound with various applications in multiple industries. This colorless, flammable, and volatile organic compound is primarily used as a solvent due to its excellent solubility and compatibility with many resin formulations and aqueous systems. In the personal care sector, N-Butanolis utilized in the production of lipstick, deodorants, and aftershave lotions. In the chemical industry, it serves as a feedstock for the production of solvents, plastics, and other derivatives. One of the significant applications of N-Butanolis in the coatings industry, where it is used in coatings, lubricants, disinfectants, cleaning agents, and metalworking fluids. It is an ideal choice for coating solutions such as inks, toners, paints, and adhesives due to its high solubility.

- A considerable amount of N-Butanolproduced by leading manufacturers is converted into its derivatives, such as butyl acrylates, glycol ethers, and butyl acylates, which are extensively used in the coating industry. Butyl acrylate, a major derivative of n-Butanol, is widely used for coating resins and formulations due to its flexibility, durability, and softness. It is a crucial ingredient in the production of high-performance coatings, particularly in the automotive and architectural coatings markets. In the pharmaceutical industry, N-Butanolis used as a solvent and as an intermediate in the synthesis of various drugs.

What are the market trends shaping the N-Butanol market ?

Increasing preference for renewable N-Butanol is the upcoming trend in the market.

- N-Butanolis a colorless, transparent, neutral liquid with a faint banana-like odor, which can be produced from both petrochemical feedstocks, such as propene, and biomass through fermentation. The biomass-derived N-Butanolis renewable and eco-friendly, making it an attractive alternative to solvent-based systems that contain high Volatile Organic Compounds (VOCs). In the production of 100% bio-based n-butanol, a Clostridium microbe acts as a catalyst to ferment sugars.

- This renewable chemical is gaining popularity in various industries, including coatings, adhesives, and solvent-based systems, due to its lower toxicity and preference in end-use applications such as cosmetics, personal care products, textiles, and agrochemicals. Furthermore, it is safe for consumption and is used as a food additive in the food and beverage sector. Bio-based N-Butanolis also used in the production of Butyl Carboxylate, a key intermediate in the production of various chemicals.

What challenges does N-Butanol market face during the growth?

Volatile crude oil prices is a key challenge affecting the market growth.

- N-Butanolis a multifunctional chemical compound with applications in various industries, including drug formulations, cosmetics, plasticizers, biofuels, alternative solvents, bio-based products, sealants, architectural coatings, and automotive refinish coatings. The primary feedstock for producing N-Butanolis propene, which is derived from crude oil. However, the volatility of crude oil prices can negatively impact the market. A decrease in crude oil prices can lead to reduced profit margins, causing an increase in the final product's price and potentially decreasing demand. The decline in crude oil prices in recent years has led to cost-cutting measures in the oil and gas sector, which could potentially impact the market's growth.

- However, despite these challenges, the demand for N-Butanolin various industries remains strong due to its versatile properties. In conclusion, the market is a crucial sector that caters to various industries, including pharmaceuticals, cosmetics, plastics, biofuels, and coatings. Its production relies on propene, which is derived from crude oil. The volatility of crude oil prices can impact the market's growth by increasing the final product's price and potentially reducing demand. The recent trend of declining oil prices has forced many players in the oil and gas sector to adopt cost-cutting measures, which could impact the market's growth. However, the demand for N-Butanolremains strong due to its versatile properties.

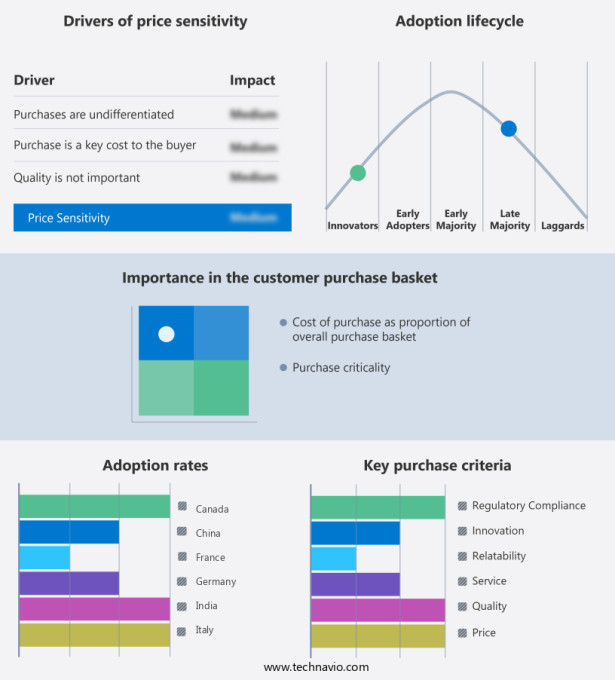

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecasts, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema

- BASF SE

- China National Petroleum Corp.

- Dow Inc.

- Eastman Chemical Co.

- Formosa Plastics Corp.

- Grupa Azoty SA

- INEOS Group Holdings S.A.

- KH Neochem Co. Ltd.

- Mitsubishi Chemical Corp.

- OQ SAOC

- Perstorp Holding AB

- Sasol Ltd.

- Saudi Arabian Oil Co.

- Texmark Chemicals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

N-butanol, a primary alcohol with the chemical formula C4H9OH, is a versatile chemical compound with various applications in different industries. It is used as a solvent in solvent-based systems, particularly in coatings, adhesives, and plastics production. In the construction sector, N-Butanolacts as a diluent in cellulose nitrate lacquers and textile processing. In the chemical industry, N-Butanolis used as a feedstock for the production of butyl carboxylate, butyl acrylate, butyl acetates, glycol ethers, and various esters. These chemicals find extensive applications in the manufacturing of coatings, adhesives, plastics, and personal care products. Moreover, N-Butanolis gaining popularity as a renewable chemical derived from bio-based sources. It is used as a cleaner fuel and a biofuel, providing an alternative to traditional fossil fuels.

Further, the demand for N-Butanolis increasing in various sectors, including automotive OEM, pharmaceutical, personal care, and cosmetics, due to its superior properties and environmental benefits. N-Butanolis also used as a solvent in various applications such as coatings, adhesives, and inks. It acts as a diluent in coatings, improving their flow and leveling properties. In adhesives, it enhances the bonding strength and flexibility. In the pharmaceutical industry, N-Butanolis used as a solvent for drug formulations and cosmetic products. It is also used as a plasticizer in the production of PVC and other polymers. Furthermore, N-Butanolis used as a feedstock for the production of bio-based products such as sealants, architectural coatings, and automotive refinish coatings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market Growth 2024-2028 |

USD 1.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, UK, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.