Organic Chips Market Size 2024-2028

The organic chips market size is forecast to increase by USD 3.37 billion at a CAGR of 5.87% between 2023 and 2028.

- The market is experiencing significant growth due to the rising demand for healthy snacks globally. Consumers are increasingly seeking out organic food options, including organic chips, as part of a healthier diet. Another trend driving market growth is the growing prominence of online shopping, which provides consumers with greater convenience and access to a wider range of organic chip brands and varieties. However, the market faces challenges such as a mismatch in demand and supply, as the production of organic crops is subject to various factors, including weather conditions and crop diseases, which can impact availability and pricing. Despite these challenges, the market is expected to continue growing due to the strong consumer preference for healthy and natural food options.

What will the size of the market be during the forecast period?

- The market is witnessing significant growth due to the increasing trend of eating clean-label food products as part of healthier alternatives. With rising health awareness, consumers are shifting towards chemical-free food options, leading to a rise in demand for organic chips made from vegetables, fruits, cereals, and grains. These chips offer nutritional value and cater to various dietary preferences, including vegan and vegetarian options. The market is driven by changing eating patterns, with a focus on clean eating, mindful eating, and calorie counting. Consumers are increasingly opting for plant-based snacks, making on-the-go organic chips a popular choice. The market includes a wide range of organic chips, from vegetable chips to cereals and grains, flavored with natural spices.

- Organic chips are available through various distribution channels, including store-based distribution in retail and supermarkets and online sales through e-commerce platforms. The market is expected to continue growing as consumers prioritize health and wellness in their eating habits, leading to increased demand for organic and nutritious snack options. Obesity and related health issues are driving the demand for healthy dietary patterns, further boosting the market. The market is expected to experience steady growth, with advertising and promotional activities playing a crucial role in increasing consumer awareness and demand.

How is this market segmented and which is the largest segment?

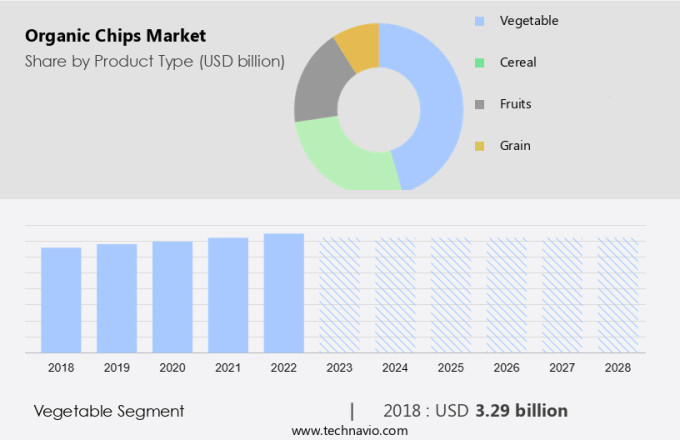

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Vegetable

- Cereal

- Fruits

- Grain

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Type Insights

- The vegetable segment is estimated to witness significant growth during the forecast period.

Organic chips, including vegetable chips made from potatoes, carrots, kale, red onion, broccoli, and spinach, have gained popularity as healthier alternatives to traditional snack options. These clean-label food products cater to increasing health awareness and eating patterns, such as clean eating, mindful eating, calorie counting, and plant-based diets. Vegetable chips offer nutritional benefits with their low fat, low sugar content, and high fiber, making them a preferred choice for health-conscious consumers. Moreover, the rising trend of obesity and obesity-related health issues has fueled the demand for organic chips. companies are responding by offering a wide range of organic chips, including those made with superfoods, onion, and cinnamon, to enhance taste and nutritional value.

The food industry growth in the market is driven by the increasing preference for chemical-free food and food safety concerns. Retail channels, including store-based distribution and online retailing, are expanding their offerings to cater to the growing demand for organic chips. These snacks are not only popular as on-the-go snacks but also as healthy alternatives to processed snacks like potato chips. Organic farming practices and food processing techniques ensure the production of high-quality organic chips that offer health benefits, such as improved digestion, increased energy levels, and reduced inflammation. In conclusion, the market is witnessing significant growth due to the increasing demand for healthier snack options, clean-label products, and the health benefits associated with organic farming and food processing.

Get a glance at the market report of share of various segments Request Free Sample

The vegetable segment was valued at USD 3.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

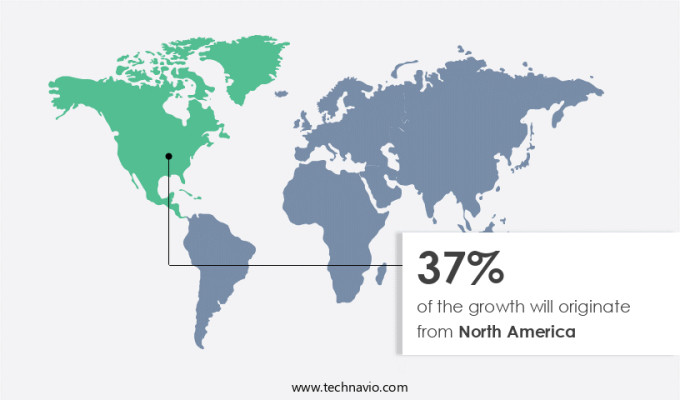

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth, with the United States being the leading consumer in the region. companies in the market are focusing on offering USDA-certified organic variants of chips to cater to the increasing demand for healthy snacking options. The popularity of Mexican cuisine and the rising trend of healthy dietary patterns among consumers, particularly millennials, are major growth drivers. The younger demographic prefers snacking due to their hectic lifestyles, leading to an increase in demand for convenient and organic snack options. Additionally, the growth of e-commerce and retail and supermarket channels is facilitating the expansion of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Organic Chips Market?

Rising demand for healthy food globally is the key driver of the market.

- The market is experiencing significant growth due to the increasing trend of clean eating and mindful snacking among consumers. With rising health awareness and concerns about the consumption of chemical-free food, people are seeking healthier alternatives to traditional snacks like potato chips. Vegetables, fruits, cereals, and grains are becoming popular choices for organic chips. Consumers are increasingly looking for snacks that offer nutritional value, are plant-based, and are free from artificial additives and preservatives. The shift towards healthier snacking is driven by various factors, including obesity trends, calorie counting, and dietary preferences such as vegan and vegetarian. The convenience of on-the-go snacking has also led to an increase in demand for organic chips, which are available in various flavors, including spices and herbs.

- Furthermore, organic farming practices ensure food safety and maintain the health benefits of the produce. The food industry growth is witnessing a rise in organic food production and distribution, with retail channels expanding to include store-based and online retailing. General Mills, along with other major players, has entered the market, catering to health-conscious consumers who prefer clean-label products. Snack culture continues to evolve, with consumers seeking snacks that offer a balance between taste and nutrition. Organic chips made from vegetables, fruits, cereals, and grains are an excellent choice for those who want to enjoy a tasty snack without compromising their health.

What are the market trends shaping the Organic Chips Market?

The growing prominence of online shopping is the upcoming trend in the market.

- The market has witnessed substantial growth in recent years, driven in part by the increasing preference for clean-label food products and healthier alternatives. As consumers become more health conscious and aware of the potential health risks associated with processed foods, the demand for chemical-free food items, such as vegetables, fruits, cereals, and grains, has risen. Organic chips, made from plant-based sources and free from artificial additives, fit perfectly into this trend. The snack culture has evolved, with mindful eating and calorie counting becoming popular eating patterns. Consumers are increasingly seeking out plant-based, vegan, and vegetarian options for on-the-go snacking. The nutritional value of organic chips, derived from organic farming practices and food safety standards, makes them an attractive choice for health-conscious individuals.

- Furthermore, the food industry's growth in the market is further fueled by the availability of these products through various retail channels. Store-based distribution, including supermarkets and convenience stores, continues to dominate the market. However, the online retailing sector has gained significant traction, enabling consumers to access a wider range of organic chip brands from around the world. Major online retailers offer organic chips through their platforms, catering to the growing demand for healthy snacks. With the increasing penetration of smartphones and the rise of e-commerce in developing countries, sales of organic chips through online channels are expected to increase significantly during the forecast period. The health benefits associated with organic farming, clean eating, and food safety are key factors driving the growth of the market.

What challenges does the Organic Chips Market face during its growth?

Mismatch in demand and supply is a key challenge affecting the market growth.

- The market has experienced a significant rise in demand due to consumers' shifting eating patterns towards clean-label food products and healthier alternatives. With growing health awareness, there is a rising preference for chemical-free food, leading to increased consumption of organic chips made from vegetables, fruits, cereals, and grains. The trend towards clean eating, mindful eating, and calorie counting has fueled the demand for organic snacks, including vegetable chips and potato chips, which offer higher nutritional value compared to traditional snack foods. The food industry's growth in the health-conscious sector, driven by the obesity trend, has further boosted the demand for organic chips.

- Retail channels, including store-based distribution and online retailing, have expanded their offerings to cater to this demand. However, the supply of organic chips remains low due to factors such as the long crop rotation period, low yield, and the fact that organic farmers often use the same land to grow both organic fresh food and non-organic fresh food. This affects the production cycle of organic food, leading to disparities between its supply and demand. Organic farming practices prioritize food safety and health benefits, making organic chips an attractive option for vegan, vegetarian, and health-conscious consumers. The snack culture's shift towards healthy alternatives has also led to the emergence of new players in the market, offering a wide range of organic chips flavored with spices and herbs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Blife Srl

- Campbell Soup Co.

- Dieffenbach's Potato Chips

- FZ Organic Food

- Gruma SAB de CV

- Intersnack Group GmbH and Co. KG

- Jacksons Food Company LLC

- Karanth Foods

- Kind LLC

- Luke's Organic

- PepsiCo Inc.

- PopChips

- R.W. Garcia

- Rhythm Superfoods LLC

- Simply 7 Snacks LLC

- The Hain Celestial Group Inc.

- The Planting Hope Company Inc.

- Utz Brands Inc.

- Wayanad Organic Research Pvt. Ltd

- Yellow Chips B.V.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to shifting eating habits towards clean-label food products and healthier alternatives. With increasing health awareness, consumers are seeking chemical-free food options, leading to a rise in demand for organic chips made from vegetables, fruits, cereals, and grains. These chips offer health benefits, including being plant-based, vegan, and vegetarian, making them popular among health-conscious individuals. Obesity trends and dietary patterns, such as clean eating, mindful eating, calorie counting, and on-the-go snacking, are driving the demand for organic chips. These snacks cater to various taste preferences by offering a wide range of flavors, including those made with spices and herbs.

Furthermore, organic chips are processed using food safety standards and organic farming practices, ensuring the highest nutritional value. The market is witnessing growth through various retail channels, including store-based distribution and online retailing. The food industry growth is further fueling the demand for organic chips, as snack culture continues to evolve and prioritize health benefits. Organic farming practices, which exclude the use of synthetic fertilizers, pesticides, and genetically modified organisms, are gaining popularity among consumers seeking safe and healthy food options. The market for organic chips is expected to continue its growth trajectory, offering a wide range of products, from potato chips to vegetable chips, catering to diverse consumer preferences.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.87% |

|

Market Growth 2024-2028 |

USD 3.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.99 |

|

Key countries |

US, Canada, China, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch