Organic Energy Drinks Market Size 2024-2028

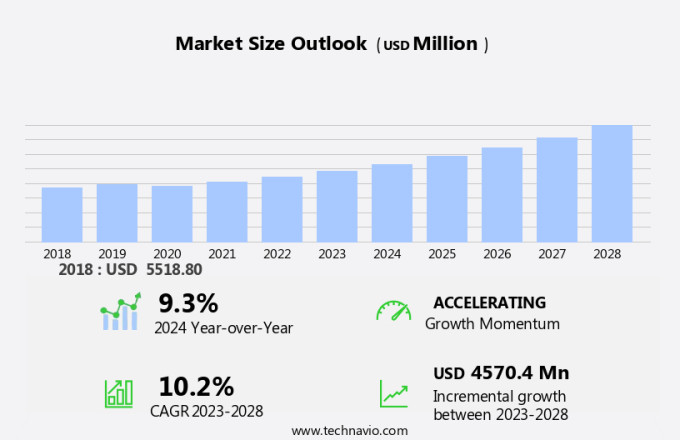

The organic energy drinks market size is forecast to increase by USD 4.57 billion, at a CAGR of 10.2% between 2023 and 2028.

- The market is experiencing significant growth, driven by the launch of new products and increasing innovation from companies. This trend is fueled by consumers' increasing preference for healthier beverage options, leading to a rise in demand for soft drinks and organic energy drinks. However, the market also faces challenges such as recalls of organic energy drinks due to contamination issues. companies must ensure stringent quality control measures to mitigate these risks and maintain consumer trust. As the market continues to evolve, companies will need to focus on product innovation, sustainability, and transparency to stay competitive. Overall, the market is expected to witness steady growth in the coming years, driven by these key factors.

What will be the size of the Organic Energy Drinks Market During the Forecast Period?

- The organic energy drink market continues to gain traction among consumers seeking quick energy boosts without compromising their health. Driven by the increasing demand for mental alertness and physical performance enhancement, energy drinks have emerged as popular alternatives to traditional soft drinks, particularly among teens and young adults. While caffeine remains a key ingredient, the market is witnessing a shift towards organic options, with natural ingredients such as vitamin B, amino acids, herbal extracts, and taurine gaining popularity. Health-conscious consumers are increasingly concerned about the health effects of sugar and artificial ingredients in energy drinks, leading to the growth of sugar-free and low-calorie options.

- The geriatric population and fitness enthusiasts, including athletes, are also embracing organic energy drinks for their energy-boosting properties. Distribution channels, including direct selling, are expanding to cater to the diverse needs of this market. However, potential health risks associated with excessive caffeine consumption and lifestyle changes continue to pose challenges for market growth. Brand building and innovation remain crucial for companies to differentiate themselves in this competitive landscape.

How is this Organic Energy Drinks Industry segmented and which is the largest segment?

The organic energy drinks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Packaging

- Can

- Bottle

- Tetra pack

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- Mexico

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- North America

By Packaging Insights

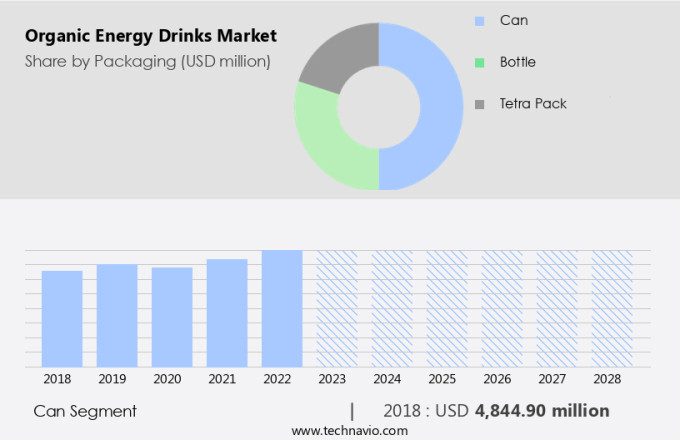

- The can segment is estimated to witness significant growth during the forecast period.

The market has experienced notable growth due to the rising consumer trend towards healthier and more natural beverage alternatives. Among the various packaging options, cans have gained prominence in this market. Cans offer several advantages, including convenience, portability, and extended product shelf life. Lightweight and easy to transport, cans are a preferred choice for consumers on-the-go. Moreover, cans are highly recyclable, aligning with the increasing consumer preference for eco-friendly packaging solutions. Key ingredients in organic energy drinks include vitamins B, amino acids, herbal extracts, and natural sugars. These beverages cater to health-conscious consumers seeking a quick energy boost without the added sugars and artificial additives found in traditional energy drinks.

Get a glance at the Organic Energy Drinks Industry report of share of various segments Request Free Sample

The can segment was valued at USD 4.84 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

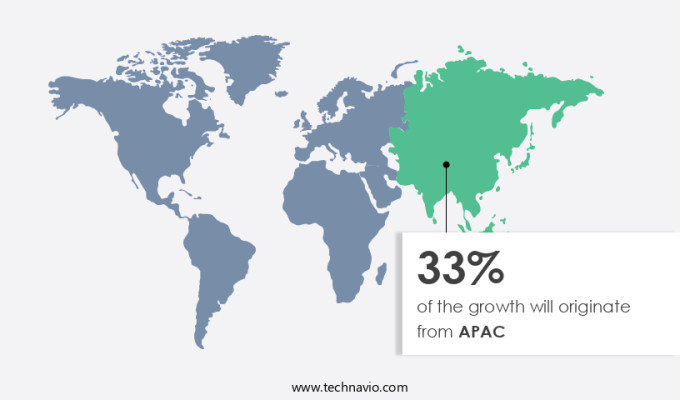

- APAC is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for organic energy drinks is witnessing significant growth due to the rising consumer trend towards healthier and more natural beverage alternatives. With a high level of health consciousness and a strong preference for organic products, the US and Canadian markets present a prime opportunity for organic energy drink brands. Fitness enthusiasts and athletes, as well as gamers and professionals seeking a quick energy boost, are key consumer segments for organic energy drinks. Taurine, a popular ingredient In these beverages, contributes to mental and physical performance. Organic energy drinks cater to the increasing demand for natural and healthier alternatives to traditional energy drinks.

Market Dynamics

Our organic energy drinks market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Organic Energy Drinks Industry?

Launch of new products is the key driver of the market.

- The market is witnessing significant growth due to the increasing demand for beverages that offer mental alertness and physical performance enhancements, without the negative health effects associated with traditional energy drinks. This trend is driven by the continuous launch of new organic energy drink products, which cater to the evolving tastes and preferences of consumers. For instance, in May 2023, Guru Organic Energy Corp. Introduced a new zero-sugar organic energy drink category, targeted at health-conscious consumers. The new product line includes a Wild Berry flavor and was launched with a comprehensive marketing campaign, which included in-store promotions, high-impact displays, digital media placements, social media content, influencer partnerships, and special events.

- The market is also witnessing an increasing demand for natural and clean-label products, as consumers shift towards healthy eating habits and a focus on nutrition. Organic energy drinks, with their natural ingredients, are well-positioned to meet this demand. Product innovations, such as sugar-free and taurine-infused organic energy drinks, are further expanding the market's reach. The market targets consumers across various demographics, including teens, young adults, and the geriatric population. Fitness enthusiasts, athletes, and gamers are also significant consumers of organic energy drinks, seeking a quick energy boost. Distributors are leveraging various channels, including direct selling, to reach these consumers.

- However, the market also faces challenges, such as health risks associated with excessive caffeine consumption and lifestyle changes that prioritize healthier alternatives. As a result, brands are focusing on brand building and product innovation to differentiate themselves and meet the evolving consumer demands. Organic energy drinks, with their natural ingredients and clean labels, are expected to gain increasing popularity in the market. The market landscape is diverse, with various beverage options, including carbonated organic energy drinks, ready-to-drink tea, beverage concentrates, fruit juices, and vegetable juices. Packaging innovations, such as eco-friendly and reusable packaging, are also gaining popularity, aligning with consumer preferences for sustainable products.

What are the market trends shaping the Organic Energy Drinks Industry?

Increasing innovation by companies is the upcoming market trend.

- The market is experiencing innovation and growth as companies respond to the increasing demand for healthier and more natural energy options. Consumers, particularly teens, young adults, and fitness enthusiasts, are seeking alternatives to traditional energy drinks, soft drinks, and carbonated beverages. These consumers prioritize mental alertness and physical performance, but also want to avoid the negative health effects associated with high caffeine content and excessive sugar. As a result, the market is witnessing the introduction of organic energy drinks with natural ingredients such as vitamins B, amino acids, herbal extracts, and Taurine. These beverages cater to various consumer segments, including gamers, athletes, and those adopting healthy eating habits.

- Product innovations include sugar-free options, ready-to-drink tea, beverage concentrates, fruit juices, and vegetable juices. Marketing strategies focus on brand building and convenience, with distribution channels expanding to include direct selling and various retail outlets. However, health risks associated with energy drinks, particularly those containing alcohol, remain a concern. As consumers become more health-conscious and aware, the market for organic energy drinks is expected to continue growing, offering a clean-label, natural alternative to traditional energy drinks.

What challenges does the Organic Energy Drinks Industry face during its growth?

Recalls of organic energy drinks is a key challenge affecting the industry growth.

- The market is driven by the growing demand for mental alertness and physical performance enhancements among teens, young adults, and fitness enthusiasts, including athletes. These consumers seek quick energy boosts from organic energy drinks, often containing natural ingredients such as caffeine, vitamins B, amino acids, herbal extracts, and taurine. However, the market faces challenges related to product recalls, which can negatively impact brand reputation and consumer trust. These recalls can stem from regulatory violations and quality control issues, emphasizing the importance of adhering to strict manufacturing standards and implementing rigorous quality control measures. For instance, in January 2024, Monster Energy recalled its Monster Green Energy Drink due to contamination from can coating delamination.

- To cater to evolving consumer preferences, product innovation, marketing strategies, and distribution channels continue to shape the market. While some consumers opt for healthier alternatives, such as sugar-free and non-carbonated options, others prefer ready-to-drink tea, beverage concentrates, fruit juices, and vegetable juices. The market also includes alcoholic energy drinks, but their popularity is relatively low compared to non-alcoholic energy drinks. Overall, the market is expected to grow, driven by increasing health awareness, convenience, and consumer preferences for clean-label products.

Exclusive Customer Landscape

The organic energy drinks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the organic energy drinks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, organic energy drinks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ardor Organic, Inc.

- Babe Brewing LLC

- Bot Organic Pvt. Ltd.

- Ethans, Inc.

- Global Flavors LLC

- Greenhouse Juice Co.

- Guru Organic Energy Corp.

- Gusto Organic Ltd.

- Healthy Beverage, LLC

- Hiball Inc.

- Machu Picchu Energy, LLC

- Non Acidic Beverages LLC

- PepsiCo Inc.

- PureHeart Energy ApS.

- Remedy Drinks Pty Ltd

- Sambazon Inc.

- Scheckter Organic Beverages Ltd.

- Tractor Beverage Co.

- Unity Wellness Co.

- Yerbae Brands Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Organic energy drinks have gained significant traction In the beverage market, appealing to consumers seeking a more natural and health-conscious alternative to traditional energy drinks. These beverages offer a pick-me-up for both mental alertness and physical performance without relying on artificial ingredients or excessive caffeine. The organic energy drink market is driven by several factors. Consumers, particularly young adults and teens, are increasingly seeking quick energy boosts to keep up with their busy lifestyles. However, they are also becoming more health-conscious and prefer to avoid sugary, carbonated drinks with artificial additives. Organic energy drinks provide an attractive solution, offering the energy benefits of caffeine and other performance-enhancing ingredients, such as vitamins B, amino acids, and herbal extracts, all derived from natural sources.

Further, the market for organic energy drinks is diverse, catering to various consumer segments. Fitness enthusiasts and athletes are drawn to these beverages for their ability to enhance physical performance and provide sustained energy. Gamers and students also turn to organic energy drinks for mental alertness and focus during long hours of gaming or studying. Product innovation plays a crucial role In the organic energy drink market. Companies are constantly exploring new ingredients and formulations to differentiate their offerings and meet evolving consumer preferences. For instance, some organic energy drinks are sugar-free or contain natural sweeteners, while others offer healthier alternatives such as ready-to-drink tea, beverage concentrates, or fruit and vegetable juices.

Moreover, marketing strategies for organic energy drinks focus on brand building and targeting specific consumer segments. Companies focus the natural and organic nature of their products, highlighting the benefits of clean-label products and the potential health risks associated with traditional energy drinks. Direct selling and distribution channels, such as e-commerce and specialty stores, are also popular marketing tactics for reaching niche consumer groups. Despite their growing popularity, organic energy drinks are not without their challenges. The market faces competition from other beverage categories, such as soft drinks and carbonated beverages. Health risks associated with excessive caffeine consumption and lifestyle changes, such as the rise of healthier eating habits, also pose challenges to the market.

|

Organic Energy Drinks Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.2% |

|

Market growth 2024-2028 |

USD 4.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.3 |

|

Key countries |

US, China, Germany, India, UK, France, Brazil, Japan, Mexico, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Organic Energy Drinks Market Research and Growth Report?

- CAGR of the Organic Energy Drinks industry during the forecast period

- Detailed information on factors that will drive the Organic Energy Drinks growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the organic energy drinks market growth of industry companies

We can help! Our analysts can customize this organic energy drinks market research report to meet your requirements.