Paper Pallet Market Size 2024-2028

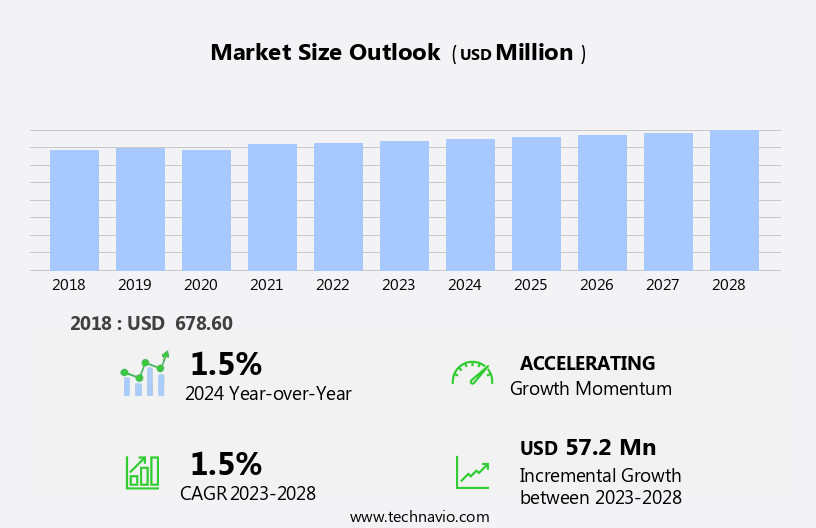

The paper pallet market size is forecast to increase by USD 57.2 million at a CAGR of 1.5% between 2023 and 2028.

What will be the Size of the Paper Pallet Market During the Forecast Period?

How is this Paper Pallet Industry segmented and which is the largest segment?

The paper pallet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Corrugated

- Honey comb

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By Product Insights

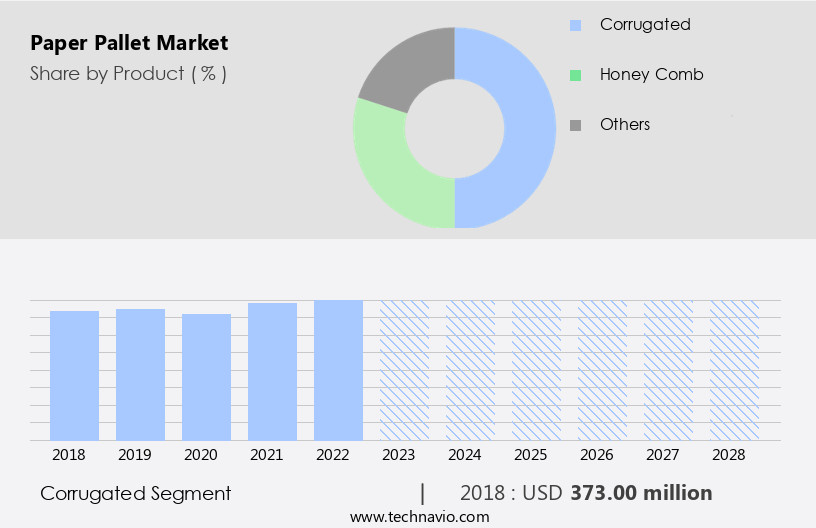

The corrugated segment is estimated to witness significant growth during the forecast period. Paper pallets are a type of pallet manufactured from paperboard or molded paper pulp, serving as an alternative to traditional wooden and plastic pallets. These pallets are utilized for shipping and displaying various goods and products, including consumer electronics, cosmetics, food and beverages, pharmaceuticals, household decor, and chemicals. Paper pallets can be categorized by structure into corrugated, honeycomb, hybrid, and others. The corrugated paper pallet, with its strong load-bearing capacity, features built-in holes for forklift access, enhancing material handling efficiency in warehouses and trucks. Paper pallets offer benefits such as cost-effectiveness, moisture resistance, and eco-friendliness due to their recyclable nature.

They are also used in industries like agriculture, logistics, and e-commerce, adhering to international shipping regulations and phytosanitary standards. Heat treatment and chemical methods like fumigation and calcium carbonate fillers are employed to mitigate pests, insects, pathogens, and bacterial contamination. The market encompasses various applications, including healthcare, retailing, and electrical and electronics industries.

Get a glance at the market report of various segments Request Free Sample

The Corrugated segment was valued at USD 373.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

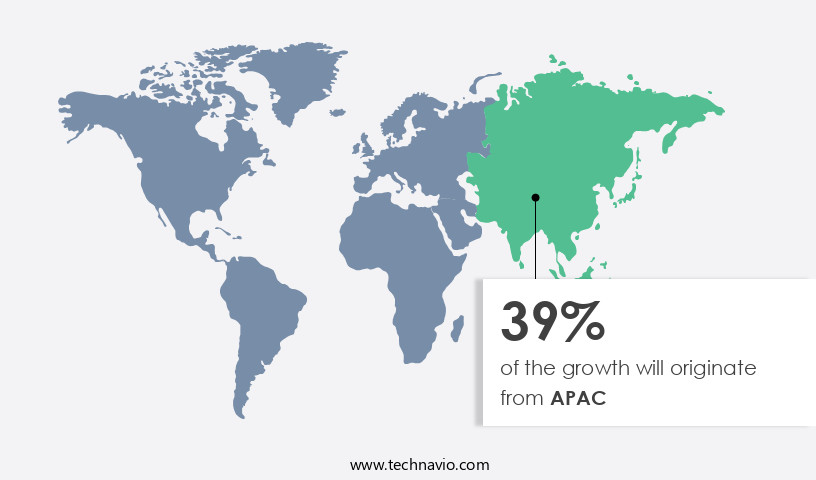

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market holds a significant share In the market, driven by the increasing preference for eco-friendly packaging solutions, the expansion of the e-commerce sector, and investments In the US to support the paper pallet industry. In 2023, the pharmaceutical sector in North America experienced growth in paper pallet demand due to the presence of major pharmaceutical companies, such as Gilead Sciences Inc., Pfizer Inc., and Abbott Laboratories. Paper pallets offer advantages like cost-effectiveness, moisture resistance, and versatility, making them suitable for various industries, including healthcare and material handling. The market also benefits from advancements in technology, such as heat treatment, fumigation, and moisture-resistant coatings, ensuring compliance with international phytosanitary standards and reducing the risk of pest contamination and bacterial growth.

Additionally, the market is witnessing the emergence of alternative packaging solutions, such as hybrid pallets and four-way paper pallets, catering to the needs of industries handling heavy load volumes and requiring efficient material handling.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Paper Pallet Industry?

- Growing demand for hygienic packaging is the key driver of the market.Paper pallets, an eco-friendly alternative to traditional wooden pallets, are gaining popularity In the logistics industry due to their numerous benefits. These pallets, made from paper pulp molding or honeycomb paperboard, offer several advantages over wooden pallets, particularly in terms of preserving the quality of packaged goods. Paper pallets are ideal for industries dealing with perishable items, such as food and pharmaceuticals, as they are pest-resistant and prevent bacterial and chemical contamination. In international shipping, paper pallets adhere to phytosanitary standards, preventing the spread of invasive species and protecting ecosystems and human health. Moreover, paper pallets are cost-effective, as they require less storage space and are lighter than wooden pallets.

They are also recyclable and can be made from recycled paper fibers, making them an eco-friendly packaging solution. The increasing demand for eco-friendly and sustainable packaging, driven by the growing trend of online shopping, has led to the development of advanced paper pallet technology. These include moisture-resistant coatings, four-way paper pallets, and hybrids made of paper and other materials. In the US, manufacturers of paper pallets must comply with the regulations set by the Grocery Manufacturers Association (GMA) to ensure their products meet the highest standards of hygiene and safety. Paper pallets are suitable for various industries, including agriculture, healthcare, material handling, and the electrical and electronics sector.

In summary, the market is driven by the need for sustainable, cost-effective, and hygienic packaging solutions. Paper pallets offer numerous advantages over traditional wooden pallets and are gaining popularity in various industries, including logistics, food, pharmaceuticals, and electronics.

What are the market trends shaping the Paper Pallet market?

- Automation of palletization and depalletization is the upcoming market trend.The market has seen a shift towards automation in recent years, with key players adopting advanced technologies such as robotics for palletization and depalletization processes. This trend is observed In the manufacturing of various paper pallet packaging types, including shelf-ready, tamper-resistant, resealable, modified humidity, and reusable paper pallets. These technologies enable efficient packaging, assembly, stacking, and transportation of goods for distribution. The benefits of paper pallets include cost-effectiveness, moisture-resistant coatings, and eco-friendly features using recycled paper fibers. Additionally, paper pallets offer alternative solutions to plastic pallets and provide advantages in terms of storage space and load volume. The market caters to various industries, including agriculture, healthcare, material handling, electrical and electronics, and e-commerce, among others.

Phytosanitary standards, such as heat treatment and fumigation, are essential for international shipping to prevent pests, insects, pathogens, invasive species, and bacterial contamination. The market also includes hybrid pallets, such as honeycomb paperboard pallets, presswood pallets, bamboo pallets, and calcium carbonate and titanium dioxide fillers.

What challenges does the Paper Pallet Industry face during its growth?

- Raw material scarcity is a key challenge affecting the industry growth.The Paper Pallets Market confronted a significant hurdle in 2023 due to the scarcity of raw materials. This predicament was a consequence of the COVID-19 pandemic's detrimental effect on the market. The manufacturing of paper pallets relies on various raw materials, including paperboard, chipboard, adhesives, paperboard tubes and cores, core stock, and more. The global crisis led to the imposition of import and export restrictions by governments, escalating raw material prices, and a labor shortage, all of which impeded the procurement and distribution of these essential components. This raw material scarcity posed a considerable challenge for paper pallet manufacturers and suppliers.

In logistics, the shortage of paper pallets affected industries such as agriculture, healthcare, e-commerce, and shipping and logistics, as they rely on these pallets for material handling and storage space. Alternatives like wooden pallets, plastic pallets, corrugated cardboard, and recycled paper fibers were explored to mitigate the impact of this shortage. Paper pallet technology, such as moisture-resistant coatings, heat treatment, fumigation, and recyclable fillers like calcium carbonate and titanium dioxide, remained essential to maintaining the integrity and durability of paper pallets. Despite the challenges, the market continued to evolve, with innovations like four-way paper pallets, hybrid pallets, and honeycomb paperboard offering cost-effective and eco-friendly packaging solutions for various industries.

Exclusive Customer Landscape

The paper pallet market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paper pallet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, paper pallet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Cortek Inc. - The company specializes in manufacturing and supplying paper pallet solutions, including Honeycom Pallets and Corrugated Pallets, catering to various industries. These eco-friendly pallet options offer durability and cost-effectiveness, making them a preferred choice for businesses seeking sustainable logistics solutions. Paper pallets provide numerous benefits, such as lightweight design, easy handling, and recyclability, ensuring efficient supply chain operations. The company's commitment to innovation and quality ensures the delivery of top-tier paper pallet products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cortek Inc.

- Dongheng Development (Hong Kong) Ltd.

- DS Smith Plc

- EcoDuro Inc.

- Eltete TPM Ltd

- Green Label Packaging

- Green Ox Pallet Technology LLC

- Hansen Packaging

- Hurst Manufacturing Co.

- International Paper Co.

- Ipcube

- KraftPal

- Lifdek Corp.

- MANDRILADORA ALPESA SL

- OX BOX

- Smurfit Kappa Group

- Sonoco Products Co.

- Tri-Wall Ltd.

- YOJ pack-kraft

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years due to various factors influencing the logistics industry. Paper pallets offer several advantages over traditional wooden pallets, making them a popular choice for businesses seeking cost-effective and eco-friendly alternatives. One of the primary drivers of the market is the increasing focus on international shipping and phytosanitary standards. With the global trade of goods continuing to expand, the need for packaging solutions that meet international regulations and prevent the spread of invasive species, pests, and pathogens has become essential. Paper pallets, which are free of wood and other organic materials, provide a solution that meets these requirements.

Another factor contributing to the growth of the market is the rise of e-commerce and online retailing. As more consumers shop online, the demand for efficient and reliable shipping and logistics solutions has increased. Paper pallets offer several advantages in this regard, including their lightweight and moisture-resistant properties, which make them ideal for handling and storing various types of goods. Moreover, the market is driven by advancements in technology. Paper pallets are now available in various forms, including four-way and hybrid pallets, which offer greater versatility and ease of use in material handling applications. Additionally, paper pallets can be manufactured using recycled paper fibers and eco-friendly materials, making them an attractive option for businesses seeking to reduce their environmental impact.

The market also caters to industries with heavy load volumes, such as healthcare and manufacturing. Paper pallets offer the strength and durability required to handle heavy loads while maintaining the benefits of being lightweight and easy to transport. Furthermore, they can be treated with chemicals to prevent bacterial contamination and pest infestation, ensuring the safety and quality of the goods being transported. In the material handling sector, paper pallets are gaining popularity due to their versatility and cost-effectiveness. They can be used in various applications, including the transportation and storage of goods in industries such as electrical and electronics, agriculture, and food processing.

Additionally, they can be coated with moisture-resistant materials and fillers like calcium carbonate and titanium dioxide to enhance their durability and protect against damage during shipping. Despite the numerous advantages of paper pallets, they face competition from other packaging solutions, such as plastic pallets and corrugated cardboard. However, the market continues to grow as businesses seek more sustainable and cost-effective alternatives to traditional wooden pallets and plastic pallets. In conclusion, the market is driven by various factors, including international shipping regulations, the rise of e-commerce, technological advancements, and the need for cost-effective and eco-friendly packaging solutions. Paper pallets offer several advantages over traditional wooden pallets and plastic pallets, making them an attractive option for businesses across various industries.

As the logistics industry continues to evolve, the market is expected to grow and adapt to meet the changing needs of businesses worldwide.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.5% |

|

Market growth 2024-2028 |

USD 57.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

1.5 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Paper Pallet Market Research and Growth Report?

- CAGR of the Paper Pallet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the paper pallet market growth of industry companies

We can help! Our analysts can customize this paper pallet market research report to meet your requirements.