PET Lidding Films Market Size 2024-2028

The pet lidding films market size is forecast to increase by USD 699.4 million at a CAGR of 6.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends and drivers. With the increasing emphasis on convenience and packaging In the food industry, there is a rising demand for PET lidding films in various applications such as meat, sauces, and snacks. The growth of food delivery services and e-commerce sales has further fueled the market's expansion. Additionally, the availability of alternative packaging materials, including aluminum foil and plastic films, is pushing manufacturers to automate their production processes using software and plastic films to improve efficiency and reduce costs. The market is also witnessing increased adoption in sectors like personal care, seafood, cosmetics, and beverage packaging. The logistics and food supply chain are also benefiting from the use of PET lidding films in ensuring freshness and preserving the quality of food products during transportation. Overall, the market is poised for robust growth In the coming years.

What will be the Size of the PET Lidding Films Market During the Forecast Period?

- The pet food packaging market, a segment of the broader food packaging industry, is experiencing significant growth due to increasing consumer demand for extended shelf-life, sustainable food packaging solutions. Innovations in pet lidding films, a key component of pet food packaging, enable brand owners to meet these demands while adhering to packaging compliance regulations. Sustainability is a major trend, with a focus on compostable, biodegradable, and recyclable packaging materials. Food preservation and food safety are critical concerns, driving the adoption of advanced packaging technologies and automation. Packaging design and branding also play essential roles in customer engagement, with a focus on microwave-safe, easy-to-use, and customer-friendly packaging.

- Packaging logistics and food labeling are crucial aspects of the supply chain, ensuring timely delivery and accurate information. Food industry trends, such as food waste reduction and foodservice packaging, further expand the market's scope. Packaging consulting, equipment, software, and design services support the industry's growth, offering solutions for food storage, packaging regulations, and packaging marketing.

How is this PET Lidding Films Industry segmented and which is the largest segment?

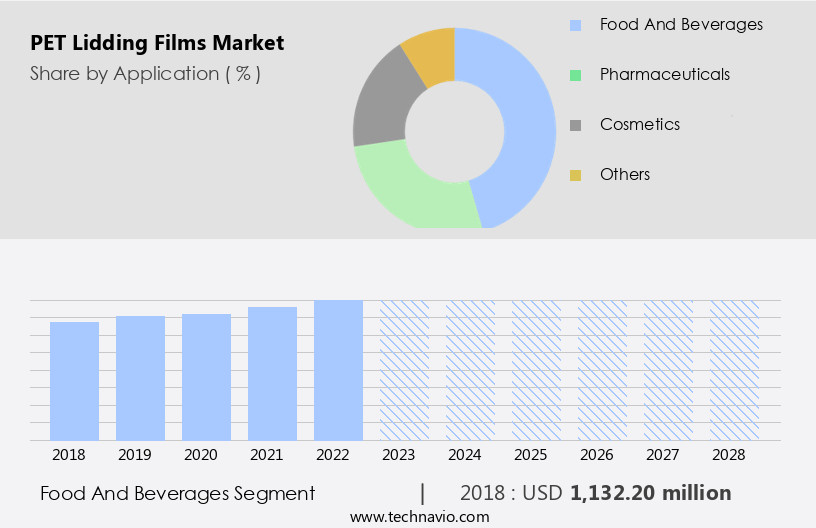

The pet lidding films industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverages

- Pharmaceuticals

- Cosmetics

- Others

- Type

- Sealable films

- Barrier films

- Microwaveable films

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

The food and beverages segment is estimated to witness significant growth during the forecast period. The market is primarily driven by its application In the food and beverages sector. Sustainability and convenience are key trends in this industry, leading to the increasing adoption of PET lidding films. For instance, Amcor's collaboration with Lorenz Snacks in 2024 focuses on creating eco-friendly packaging solutions using recyclable materials and minimizing waste. In the food industry, there is a shift towards smaller, individual portions, making PET lidding films an ideal choice due to their ability to maintain product quality and extend shelf life In these formats. Furthermore, PET lidding films are used in various food applications, including frozen food, personal care, trays, pre-packaged meals, ready-to-eat food, meat, poultry, seafood, dairy products, and canned goods.

These films offer benefits such as heat resistance, tensile strength, and resealability, making them suitable for various food packaging needs. Additionally, the rise of food delivery services and online sales further boosts the market growth.

Get a glance at the market report of various segments Request Free Sample

The Food and beverages segment was valued at USD 1132.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific market for PET lidding films is experiencing significant growth, primarily due to the expanding ready-to-eat (RTE) food sector in India. Over the next five years, the Indian RTE food industry is projected to expand by approximately 45%, driven by changing consumer lifestyles, increased urbanization, and a rising preference for convenience foods. This growth is largely attributed to the growing working population and the increasing demand for quick meal solutions. Innovations in food technology and packaging are playing a crucial role in this expansion. PET lidding films, a type of advanced packaging material, are enhancing the shelf life and quality of RTE products, making them more appealing to consumers.

Additionally, the demand for sustainable and eco-friendly packaging solutions is driving the market for PET lidding films in various end-use industries, including frozen food, personal care, trays, pre-packaged meals, ready-to-eat food, and dairy products. The market is further expected to grow due to the increasing popularity of online food delivery services and takeout services. PET lidding films offer advantages such as heat resistance, tensile strength, and high-barrier properties, making them an ideal choice for various food applications, including meat, poultry, seafood, and cans.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of PET Lidding Films Industry?

- Emphasis on convenience and packaging is the key driver of the market.The market is experiencing notable expansion due to the rising demand for convenient and innovative packaging solutions in various sectors. These films have gained popularity among manufacturers due to their superior sealing capabilities and extended product shelf life. In the food industry, the trend towards ready-meals, frozen food, and personal care products is driving market growth. In food packaging, there is a shift from traditional methods to contemporary solutions such as single-serve packages and trays for frozen food, pre-packaged meals, and ready-to-eat food. Additionally, the food sector, including dairy products, meat, poultry, seafood, and canned goods, is adopting PET lidding films for their heat resistance, tensile strength, and compatibility with online food delivery and takeout services.

- Furthermore, the increasing focus on sustainable and eco-friendly packaging is fueling the demand for PET lidding films, which offer high-barrier protection and resealability. In personal care and cosmetics, these films are used for their heat resistance and ability to maintain product freshness. Overall, the market is poised for continued growth due to the evolving consumer preferences and the need for advanced packaging solutions.

What are the market trends shaping the PET Lidding Films market?

- Growth in e-commerce sales is the upcoming market trend.The market is gaining momentum due to the increasing popularity of e-commerce sales and the demand for sustainable packaging solutions in various sectors. In 2023, e-commerce sales In the US reached an impressive USD1.119 trillion, marking a 7.6% increase from the previous year. This growth has significantly influenced the food sector, with online food delivery and takeout services becoming increasingly common. PET lidding films are a preferred choice for food packaging due to their excellent sealing properties, which help maintaIn the freshness and integrity of perishable items such as frozen food, pre-packaged meals, ready-to-eat food, meat, poultry, seafood, dairy products, and personal care & cosmetics.

- Moreover, the trend towards eco-friendly packaging and sustainable practices is driving the demand for PET lidding films, which offer high tensile strength, heat resistance, and are oven-safe. These films are also suitable for use with cans and resealable containers, making them versatile options for various applications. Overall, the market is expected to continue growing as the e-commerce sector expands and consumers seek reliable and sustainable packaging solutions.

What challenges does the PET Lidding Films Industry face during its growth?

- Availability of alternative packaging materials is a key challenge affecting the industry growth.The market is experiencing notable competition from alternative packaging materials, particularly paper-based films and aluminum foil lids. For instance, Fromagerie Milleret's introduction of AmFiber Matrix, a recyclable paper-based wrap for soft cheese in 2023, showcases this trend. This collaboration between Amcor and Milleret offers a sustainable solution that addresses challenges In the soft cheese industry, such as product ripening and recyclability. Paper-based lidding solutions provide comparable protective qualities to plastic films, ensuring product freshness and safety, which are essential for preserving the quality of sensitive items like dairy products, frozen food, personal care, and ready-to-eat food. Additionally, eco-friendly packaging solutions are gaining popularity In the food sector, including seafood, meat, poultry, and canned goods.

- High-barrier lidding films and resealable films are also preferred for food delivery and takeout services due to their heat resistance and tensile strength. Overall, the market dynamics are shifting towards sustainable packaging options that cater to the evolving needs of various industries, including food and personal care & cosmetics.

Exclusive Customer Landscape

The pet lidding films market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pet lidding films market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pet lidding films market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - PET lidding films, provided by the company, are utilized across diverse product categories such as ready meals, dairy items, and sauces. These films deliver superior sealing capabilities, effectively preserving product freshness and enhancing shelf life. By creating an airtight seal, PET lidding films prevent contamination and maintaIn the integrity of the packaged goods. The films' robustness and versatility cater to various industry requirements, ensuring product protection and customer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Berry Global Inc.

- Constantia Flexibles Group GmbH

- Cosmo First Ltd.

- Coveris Management GmbH

- FFP Packaging Ltd.

- FLAIR Flexible Packaging Corp.

- FLEXOPACK SA

- Golden Eagle Extrusions, Inc

- Impak Films Pty. Ltd

- KP Holding GmbH and Co. KG

- Multi Plastics Inc.

- Plastopil Hazorea Co. Ltd.

- Sealed Air Corp.

- TCL Packaging Ltd.

- Tilak Polypack Pvt. Ltd.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The pet food market has witnessed significant growth in recent years, driven by the increasing trend of pet ownership and the demand for convenient and high-quality feeding options. One essential component of the pet food industry is the packaging, specifically lidding films. These films play a crucial role in preserving the freshness and safety of the food while ensuring an attractive and functional presentation. Lidding films for pet food applications come in various types, including those for frozen food, pre-packaged meals, and ready-to-eat food. The demand for sustainable and eco-friendly packaging solutions has led to the emergence of biodegradable and recyclable lidding films.

Specialty lidding films, such as those with high heat resistance and tensile strength, are increasingly used for applications like canned pet food and oven-safe dishes. The food sector's shift towards online delivery and takeout services has also influenced the lidding films market. The need for films that can withstand the rigors of transportation and storage while maintaining the product's freshness is crucial. In response, manufacturers have developed films with improved barrier properties to extend the shelf life of the pet food. Another trend In the lidding films market is the use of resealable films for pet food packaging.

These films enable consumers to maintaIn the freshness of the food between feedings, reducing waste and ensuring the pet's health and well-being. Additionally, the use of eco-friendly and sustainable materials in resealable films aligns with the growing consumer preference for environmentally responsible packaging solutions. The lidding films market for the food sector is not limited to pet food but also includes applications in personal care and cosmetics. The demand for lidding films with heat resistance and high tensile strength is essential for these applications, ensuring the safety and integrity of the products during manufacturing, storage, and transportation. In conclusion, the lidding films market plays a vital role In the food industry, particularly In the pet food sector.

The demand for sustainable, functional, and attractive packaging solutions continues to drive innovation and growth in this market. The use of biodegradable and recyclable materials, high-barrier films, and resealable films are some of the trends shaping the future of the lidding films market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 699.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.0 |

|

Key countries |

US, China, India, Germany, Japan, South Korea, France, Canada, UK, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this PET Lidding Films Market Research and Growth Report?

- CAGR of the PET Lidding Films industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pet lidding films market growth of industry companies

We can help! Our analysts can customize this pet lidding films market research report to meet your requirements.