Polyethyleneimine Market Size 2024-2028

The polyethyleneimine market size is forecast to increase by USD 47.6 million at a CAGR of 2.12% between 2023 and 2028. The Polyethyleneimine (PEI) market is experiencing significant growth due to its increasing application in various industries. One of the primary drivers is the expanding use of PEI in adhesives and sealants, particularly in residential and commercial construction. PEI's excellent adhesion properties make it an ideal choice for concrete, mortar, and plaster applications. Additionally, PEI's use in fuel cells as a polymer electrolyte membrane is gaining traction due to the rising demand for clean energy solutions. Furthermore, PEI's role as a corrosion inhibitor in water treatment chemicals and its application in the paper industry are contributing to market growth. However, the high cost of raw materials poses a significant challenge to market expansion. Despite this, the versatility and wide range of applications of PEI continue to fuel its market growth.

PEI's unique chemical structure offers excellent adhesion properties, making it an essential component in numerous applications. In the water treatment sector, PEI is widely used as a coagulant and flocculant due to its ability to neutralize acidic water and enhance the removal of impurities. PEI also plays a crucial role in paper production, improving paper quality and enhancing its strength. Moreover, PEI finds extensive applications in biomedical research as a gene transfection agent and a component in drug delivery systems. In the detergent industry, PEI functions as an emulsifying agent and a surfactant, enhancing the cleaning power of detergents.

Further, the construction sector utilizes PEI as a binding agent in adhesives and sealants. PEI's compatibility with silanes and maleic anhydride extends its applications to coatings, including paints, inks, and water-based primers. PEI's role in the production of graphene and its derivatives is also noteworthy. Additionally, PEI is used in the manufacturing of toothpaste and other personal care products, further expanding its market reach. Overall, the versatility of PEI makes it an indispensable ingredient in various industries, addressing challenges such as water scarcity and enhancing the performance of everyday products.

Market Segmentation

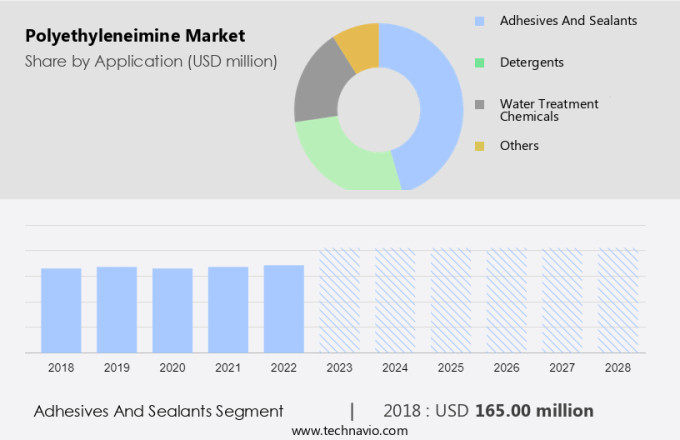

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Adhesives and sealants

- Detergents

- Water treatment chemicals

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

The adhesives and sealants segment is estimated to witness significant growth during the forecast period. Branched polyethyleneimine (PEI) is a versatile polymer widely utilized in various industries, including adhesives, paints, coatings, and nano silica composites. In the adhesive and sealant sector, PEI functions as an effective adhesion promoter for laminates. It is also employed in water-based primers for packaging films. PEI's application extends to extrusion coatings in the packaging industry, where it facilitates the bonding of polyethylene to paper and other cellulosic substrates.

Further, the packaging industry, being the largest consumer of adhesives, is expected to maintain this trend due to the growing demand for packaging applications in the food and beverage sector. Furthermore, PEI is used in electric vehicles for battery electrodes and as a detergent builder in the biomedical field. Construction applications also utilize PEI as a curing agent for mortar and concrete. Ethylene diamine is a precursor in the synthesis of PEI polymers.

Get a glance at the market share of various segments Request Free Sample

The adhesives and sealants segment accounted for USD 165.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

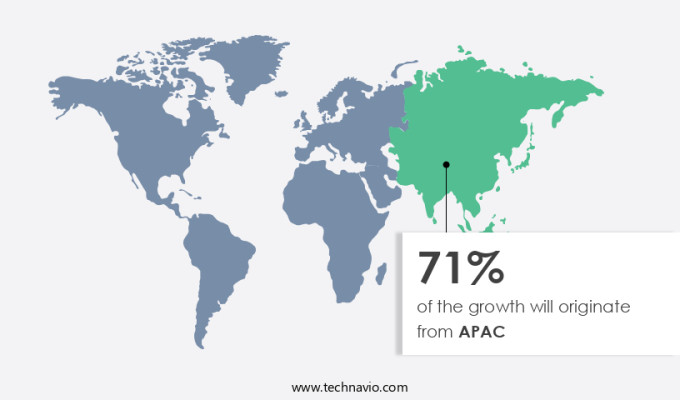

APAC is estimated to contribute 71% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The branched polyethyleneimine (PEI) market is experiencing significant growth, particularly in the Asia Pacific (APAC) region. In 2023, APAC held the largest market share and is anticipated to lead the global PEI market throughout the forecast period. The extensive utilization of PEI in various applications, such as detergents, adhesives, water treatment chemicals, cosmetics, and paper, drives the market's growth in APAC. China, India, and Japan are the primary contributors to the PEI market revenue in this region. PEI plays a crucial role as a wet-strength agent in pulp and paper production. The burgeoning paper and pulp industries in China, India, and Southeast Asia are expected to continue fueling the demand for PEI.

Moreover, PEI's applications extend to adhesives and sealants, paints and coatings, nanosilica composites, electric vehicles, and biomedical industries, further expanding its market potential. Ethylene diamine, a precursor in PEI production, is also gaining traction in the production of high-performance polymers, contributing to the market's growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growing use of adhesives in different industries is the key driver of the market. Polyethyleneimine (PEI), a type of polyaziridine, plays a significant role in various industries, including water treatment, paper production, biomedical research, detergent manufacturing, and more. In water treatment, PEI is used as a coagulant and flocculant to remove impurities and improve water quality. In paper production, PEI serves as a sizing agent to enhance the paper's wet strength and water resistance. In biomedical research, PEI is utilized as a gene delivery vector due to its ability to condense and transport DNA. In the detergent industry, PEI is added to enhance the cleaning power and foam stability. With the increasing water scarcity, the demand for water treatment applications of PEI is projected to rise.

Additionally, PEI is used in the production of silanes, maleic anhydride, titanates, and zirconates, which are essential raw materials in various industries. The packaging industry, being the largest consumer of adhesives, also utilizes PEI-based adhesives for their superior bonding properties.

Market Trends

The growing use of PEI in food packaging industry is the upcoming trend in the market. PEI, or polyethyleneimine, is a versatile polyaziridine compound with expanding applications across various industries. One significant sector driving the growth of the PEI market is water treatment. PEI's unique properties make it an effective coagulant and flocculant, enhancing water clarification and purification processes. In addition, PEI is increasingly used in paper production due to its ability to improve paper strength and brightness. Beyond industrial applications, PEI finds extensive use in biomedical research. Its high reactivity makes it an essential component in various bioconjugation techniques. Furthermore, PEI is used in the production of detergents, where it acts as a chelating agent, improving their performance. Water scarcity is a pressing issue worldwide, and the demand for water treatment solutions is on the rise. PEI's effectiveness in water treatment, coupled with the increasing water scarcity, is expected to boost the PEI market's growth during the forecast period.

Additionally, PEI is used in the production of silanes, maleic anhydride, titanates, and zirconates. These compounds are integral to various industries, including electronics, coatings, and construction, further expanding the scope of PEI's applications and driving market growth. The packaging industry, particularly the food packaging sector, is another significant contributor to the PEI market's growth. PEI-based adhesives are widely used in the packaging of frozen food products due to their high barrier properties, extended shelf life, and consumer safety. The growing demand for packaged food products, driven by changing consumer preferences and lifestyles, is expected to fuel the demand for PEI-based adhesives and, consequently, the PEI market during the forecast period.

Market Challenge

High raw material costs is a key challenge affecting the market growth. Polyethyleneimine (PEI), a polymer with the chemical structure of repeating units of -[CH2-CH2-NH2], is primarily manufactured through the ring-opening polymerization of aziridine. Aziridine, a saturated organic heteromonocyclic compound, serves as a crucial precursor in PEI production. The degree of branching in PEI can be controlled by adjusting the reaction conditions, resulting in both branched and linear forms. PEIs have gained significant attention due to their versatile applications in various industries. In water treatment, they serve as effective coagulants and flocculants. In paper production, they act as sizing agents, enhancing the paper's strength and water resistance. In biomedical research, PEIs are utilized as gene delivery vectors due to their ability to condense and protect DNA.

Furthermore, they find applications in detergent formulations, contributing to improved cleaning efficiency. Despite their widespread use, the high cost of aziridine, a key raw material in PEI production, poses a significant challenge. To mitigate this, alternative methods for PEI synthesis, such as the use of silanes, maleic anhydride, titanates, and zirconates, are being explored. These substitutes could potentially reduce production costs and expand the market for PEIs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BASF SE - The company offers polyethyleneimine products such as Palatinol N.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema SA

- Avient Corp.

- Borealis AG

- Dow Inc.

- Exxon Mobil Corp.

- FUJIFILM Corp.

- LEAP CHEM Co. Ltd.

- NIPPON SHOKUBAI CO. LTD

- Polysciences Inc.

- RTP Co.

- Saudi Basic Industries Corp.

- Sankhla Plolymers Pvt. Ltd.

- SERVA Electrophoresis GmbH

- Solvay SA

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co. Ltd.

- Wuhan Qianglong Chemical New Materials Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyethyleneimine (PEI), a type of polyaziridine, is a versatile water-soluble cationic polymer with amine groups. PEI finds extensive applications in various industries due to its unique properties. In water treatment, PEI functions as a flocculant and a drainage aid, improving the efficiency of wastewater treatment processes. PEI is also used in paper production as a retention aid and a charge density modifier, enhancing paper quality and reducing filler usage. Moreover, PEI is extensively used in biomedical research for drug delivery systems and as a binding agent in adhesives and sealants. The polymer is also employed in the production of detergents, where it acts as an emulsifying agent and a surfactant. PEI's shale inhibition properties make it a valuable component in water-based drilling fluids. PEI is also used in the production of nano silica composites, coatings, paints, and adhesives for construction materials. The polymer's ability to act as a crosslinking agent makes it an essential ingredient in the production of premium apparel, textiles, and water-based primers.

Further, PEI is also used in electric vehicles as a corrosion inhibitor and in the production of graphene, fuel cells, and polymer electrolyte membranes. Furthermore, PEI is used in various industries, including cosmetics, inks and dyes, personal care items, household products, and specialty chemicals. The polymer's unique properties make it an essential ingredient in various applications, contributing to the growth of the PEI market. PEI's role in water conservation and its ability to reduce the usage of silanes, maleic anhydride, titanates, zirconates, and ethylene diamine in various applications make it an eco-friendly alternative.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.12% |

|

Market Growth 2024-2028 |

USD 47.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.07 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 71% |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arkema SA, Avient Corp., BASF SE, Borealis AG, Dow Inc., Exxon Mobil Corp., FUJIFILM Corp., LEAP CHEM Co. Ltd., NIPPON SHOKUBAI CO. LTD, Polysciences Inc., RTP Co., Saudi Basic Industries Corp., Sankhla Plolymers Pvt. Ltd., SERVA Electrophoresis GmbH, Solvay SA, Thermo Fisher Scientific Inc., Tokyo Chemical Industry Co. Ltd., and Wuhan Qianglong Chemical New Materials Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch