Seafood Processing Equipment Market Size 2024-2028

The seafood processing equipment market size is forecast to increase by USD 554.8 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the expanding end-user industries, particularly in the food service and retail sectors. The increasing global population and rising consumer preference for seafood as a source of protein are key factors fueling this growth. However, the prevalence of traditional seafood processing methods poses a challenge to market expansion. Traditional methods often rely on labor-intensive processes and lack the efficiency and consistency demanded by modern businesses. New product launches featuring advanced automation and technology integration are addressing this challenge. These innovations enable increased productivity, improved product quality, and reduced operational costs.

- Additionally, the adoption of sustainable and eco-friendly processing techniques is gaining traction, as consumers and regulatory bodies demand more environmentally responsible practices. Companies seeking to capitalize on these opportunities should focus on developing technologically advanced, cost-effective, and sustainable seafood processing equipment solutions. By doing so, they will be well-positioned to meet the evolving needs of the market and stay competitive in this dynamic industry.

What will be the Size of the Seafood Processing Equipment Market during the forecast period?

- The market encompasses a range of specialized machinery used to process and preserve various fish species for human consumption. This market is driven by the growing demand for seafood, particularly in export markets, due to its nutritional benefits, such as omega-3 fatty acids. To meet this demand, processors invest in advanced equipment for filleting, slaughtering, and freezing, with a focus on food safety, automation, and enhanced hygiene features. Overfishing and seafood sourcing challenges pose risks to the industry, necessitating the development of innovative, efficient, and sustainable processing solutions. The market is segmented into several categories, including fully automatic filleting lines, specialized equipment for larger solids, and slaughtering equipment.

- Stainless steel, known for its durability and ease of cleaning, is a common material used in seafood processing equipment due to its service life and simple operation. Food safety regulations and transportation costs are key factors influencing the market, as processors strive for high reliability and minimal waste volume. Treatment processes, such as pasteurization and irradiation, are also gaining popularity to ensure the highest quality and longest shelf life for frozen seafood. Overall, the market is expected to continue growing, driven by consumer preferences, technological advancements, and the evolving needs of the global seafood supply chain.

How is the Seafood Processing Equipment Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Slaughtering equipment

- Scaling equipment

- Filleting equipment

- Gutting equipment

- Others

- Geography

- APAC

- China

- Indonesia

- Europe

- Spain

- North America

- US

- Canada

- South America

- Middle East and Africa

- APAC

By Product Insights

The slaughtering equipment segment is estimated to witness significant growth during the forecast period. Seafood processing equipment plays a crucial role in maintaining the quality and efficiency of seafood production. Slaughtering equipment, a key component, ensures humane treatment and improved flesh quality by reducing stress during the slaughtering process. This equipment facilitates percussive stunning and bleeding, which is essential for various fish species, particularly salmon, to prevent quality loss. The benefits of using slaughtering equipment include higher flesh quality, longer shelf life, and increased processing efficiency through methods like scaling and gutting. Furthermore, food safety regulations mandate the use of specialized processing equipment to ensure hygiene and maintain the desired food quality.

The seafood industry faces challenges such as overfishing, changing consumer lifestyles, and increasing population and urbanization, necessitating the need for advanced seafood processing technologies. Innovative equipment, including automated filleting and deboning machines, enhances processing capabilities and reduces labor costs. Additionally, the growing demand for omega-3 fatty acids, protein, and unsaturated fatty acids in seafood products, driven by health consciousness and pet humanization, increases the need for efficient and reliable seafood processing equipment. The seafood supply chain, from seafood sourcing to direct sales to retail and supermarkets, relies on these processing facilities to ensure larger solids, longer shelf life, and reduced transportation costs. The future of seafood processing lies in rapid advancements in technologies and packaging solutions, ensuring the natural preservation of seafood products while adhering to food safety regulations.

Get a glance at the market report of share of various segments Request Free Sample

The Slaughtering equipment segment was valued at USD 520.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

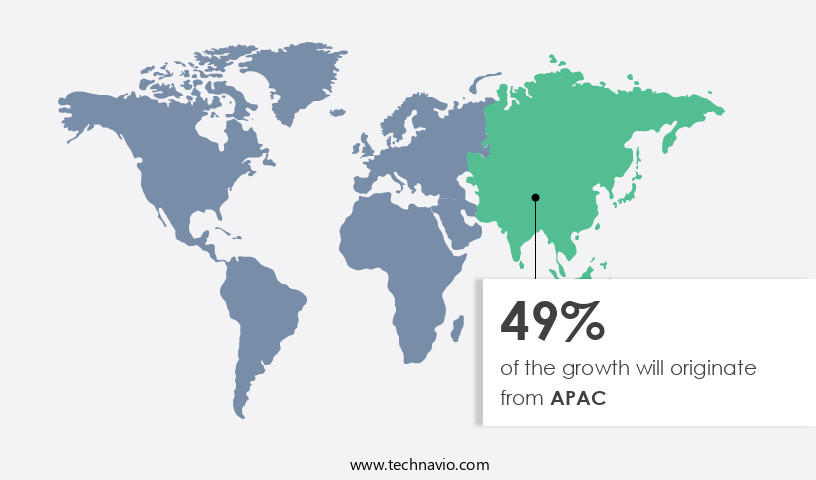

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is significant in countries including China, Vietnam, Thailand, India, Japan, Indonesia, South Korea, Bangladesh, Pakistan, and New Zealand. China is the global leader in seafood production, processing, and exports, with a focus on supplying to European markets. India is an emerging market for processed seafood products, particularly frozen and canned items, with popular choices being pickles, fillets, and canned tuna. Thailand is another major player, known for its shrimp exports. Seafood processing involves specialized equipment for tasks such as gutting, skinning, filleting, deboning, and slaughtering. Automated filleting and deboning equipment are increasingly popular for improved food safety and enhanced hygiene features.

Processing byproducts is also valuable, with applications in various industries. Seafood processing facilities must adhere to stringent food safety regulations and sustainability practices, including reducing overfishing and seafood sourcing from responsible suppliers. Innovative equipment, such as fully automatic segmented systems, is being developed to increase efficiency and shelf life while minimizing waste volume and treatment processes. Key trends include increasing consumption rate due to health consciousness, changing consumer lifestyles, and the growth of the aquaculture industry. Packaging solutions and automated equipment are essential for complex manufacturing operations to ensure desired food quality and longer shelf life.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Seafood Processing Equipment Industry?

- Expansion of end-user is the key driver of the market. The market experiences growth due to the expanding capacity of seafood processing plants. Consumers' increasing preference for convenient and high-quality processed seafood products fuels this expansion. In response, processing plants invest in advanced equipment, including filleting machines, deboning equipment, and packaging systems, to boost efficiency, enhance product quality, and adhere to regulatory standards. Companies supplying these essential tools capitalize on these investments, generating increased sales opportunities.

- Furthermore, technological advancements in automation and sustainability encourage processors to upgrade their existing equipment, propelling market growth. Moreover, the focus on environmental regulations and sustainability in the seafood industry is leading processors to invest in equipment that reduces wastewater and minimizes biological oxygen demand (BOD) and odor control. For instance, modern processing plants use recirculating aquaculture systems and closed-loop processing technologies to minimize water usage and waste generation. These advancements not only help processors meet regulatory requirements but also contribute to a more eco-friendly and sustainable seafood industry.

What are the market trends shaping the Seafood Processing Equipment Industry?

- New product launches is the upcoming market trend. Seafood processing is essential for maintaining the fresh-like characteristics and extended shelf life of seafood products while preserving their nutritional value. The process involves various steps to enhance quality, stability, and minimize changes to seafood's inherent characteristics. To cater to the increasing demand for seafood processing equipment, companies are innovating new models. These advanced tools enable uniform and precise cutting, ensuring high-quality fillets.

- Operators can manage all settings and operations using a touch screen panel connected to the equipment, enhancing efficiency and convenience. Seafood processing plants prioritize food safety, adhering to stringent regulations. With overfishing concerns and the increasing importance of seafood export markets, optimizing seafood sourcing and supply chains is crucial. Automated filleting technology offers solutions to these challenges, ensuring consistent quality and efficiency.

What challenges does the Seafood Processing Equipment Industry face during its growth?

- The prevalence of traditional seafood processing methods is a key challenge affecting the industry's growth. Seafood processing involves the use of various advanced technologies and traditional methods to preserve and process seafood for consumption. While technologies such as freezing, canning, and vacuum packaging are commonly used, some countries like India, Bangladesh, Brazil, and Nigeria continue to employ traditional methods like smoking, salting, dehydration, and sun-drying.

- Among these, sun-drying is a popular method where seafood is exposed to sunlight for a specific duration to remove water content and inhibit microbial growth. For instance, sardines may require up to seven days to dry completely under sunlight. This process helps extend the shelf life of seafood and maintain its nutritional value. Despite the adoption of advanced technologies, traditional methods continue to play a significant role in seafood processing.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baader Global SE

- CTB Inc.

- Franz Haniel and Cie. GmbH

- GEA Group AG

- Henan Lima Machinery Manufactory Co. Ltd.

- Inducore AB

- Kroma AS

- Marel Group

- Maruha Nichiro Corp.

- Mowi ASA

- MTC Food Equipment, Inc.

- Optimar AS

- Pearce Processing Systems Inc.

- Pisces Fish Machinery Inc.

- Polar Systems Ltd.

- SEAC

- Seafood Technology Ltd.

- Skaginn 3X

- Uni Food Technic AS

- Zhengda Food Machinery Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is driven by various factors, with the increasing demand for seafood products being a primary driver. Seafood is a rich source of essential nutrients such as protein, lipids, unsaturated fatty acids, and omega-3 fatty acids, making it a popular choice for consumers worldwide. The growing health consciousness among populations, particularly in urban areas, has led to an increase in seafood consumption. Seafood processing equipment plays a crucial role in ensuring the production of safe and high-quality seafood products. With the increasing focus on food safety and hygiene, specialized processing equipment is becoming increasingly important. This includes automated filleting and deboning machines, gutting and skinning equipment, and slaughtering machinery.

Moreover, the seafood industry is also subject to various regulations aimed at ensuring food safety and sustainability. Overfishing and seafood sourcing are significant concerns, leading to the need for efficient and innovative seafood processing technologies. The aquaculture industry has emerged as a viable alternative to wild-caught seafood, leading to the development of advanced processing facilities. The frozen seafood segment is a significant contributor to the market. The long shelf life of frozen seafood makes it an attractive option for retailers and consumers alike. However, transportation costs and waste volume are key challenges for the industry. Treatment processes for wastewater, including odor control and biological oxygen demand reduction, are essential for minimizing environmental impact.

Furthermore, innovative equipment designs, such as those made from stainless steel, offer extended service life and simple operation, making them a popular choice for seafood processing plants. The fully automatic segment of the market is experiencing rapid advancements, with automated packaging solutions and complex manufacturing operations becoming increasingly common. The changing consumer lifestyle and population growth are also driving demand for seafood processing equipment. The pet food industry is a growing market for seafood processing byproducts, with the trend towards nutritious pet food and pet humanization increasing expenditure capacity. The seafood processing industry is undergoing significant changes, with new technologies and processing methods continually emerging.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 554.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Spain, Indonesia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Seafood Processing Equipment Market Research and Growth Report?

- CAGR of the Seafood Processing Equipment industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the seafood processing equipment market growth of industry companies

We can help! Our analysts can customize this seafood processing equipment market research report to meet your requirements.