Small Signal Transistor Market Size 2025-2029

The small signal transistor market size is forecast to increase by USD 153.6 million, at a CAGR of 3% between 2024 and 2029.

- The market is experiencing significant dynamics, driven primarily by the increasing implementation of Internet of Things (IoT) technologies and the automation of industries. This trend is fueled by the growing demand for efficient, compact, and cost-effective electronic solutions. However, the market faces a notable challenge with the decreased sales of electronic devices, which may impact the demand for small signal transistors.

- The strategic landscape of the market presents both opportunities and challenges, requiring companies to stay informed and agile in order to capitalize on emerging trends and navigate market fluctuations effectively. Manufacturers must navigate this obstacle by exploring new applications and industries to expand their customer base and ensure long-term growth. Neuromorphic computing and quantum computing are transforming the landscape of artificial intelligence and data processing.

What will be the Size of the Small Signal Transistor Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by advancements in power amplifier design and the expanding applications across various sectors. Flicker noise analysis and thermal noise analysis are essential in optimizing transistor performance, while frequency response analysis and shot noise analysis provide valuable insights into transistor behavior. Power amplifier design, a critical application of small signal transistors, benefits from the development of common source amplifiers, common base amplifiers, and biasing techniques. Transistor temperature effects, such as active region operation and transistor cutoff region, significantly impact performance, necessitating continuous analysis. The hybrid-pi model, spice simulation, and circuit design principles enable the creation of linear amplifier designs with high transistor gain bandwidth, input impedance matching, and output impedance matching.

- S-parameter analysis, h-parameter analysis, and y-parameter analysis offer comprehensive understanding of transistor behavior at various frequencies. Small signal model analysis, including noise figure calculation and s-parameter analysis, is crucial for low frequency response optimization. Transistor saturation region analysis and electronic circuit design principles ensure efficient power handling and reliable operation. According to industry reports, the market is projected to grow by over 7% annually, fueled by increasing demand for power efficient and high-performance electronic systems. For instance, a leading telecommunications company reported a 15% increase in sales by implementing a new common emitter amplifier design with improved noise figure and high-frequency response.

How is this Small Signal Transistor Industry segmented?

The small signal transistor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Industrial

- Automotive

- Communication

- Consumer electronics

- Others

- Type

- PNP

- NPN

- Material

- Silicon

- Gallium nitride

- Silicon carbide

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The Industrial segment is estimated to witness significant growth during the forecast period. Small signal transistors play a crucial role in industrial automation, particularly in applications where microcontrollers require assistance in managing high current and voltage loads. These transistors are integrated into embedded boards, as microcontrollers cannot provide sufficient output current and voltage on their own. For instance, a widely used microcontroller like the ATmega328P relies on small signal transistors to control input and output terminals effectively. The global industrial sector's adoption of automation solutions has been on the rise, with numerous industries implementing these systems to optimize their manufacturing processes. This trend is driven by the benefits of increased efficiency, predictive maintenance, improved safety, and enhanced profitability.

According to recent studies, the industrial automation market is expected to grow by 12.3% in the upcoming year, with the market experiencing a parallel expansion. Frequency response analysis, flicker noise analysis, and thermal noise analysis are essential aspects of small signal transistor design, ensuring optimal performance in various applications. Power amplifier designs, such as common source, common base, and common emitter amplifiers, utilize small signal transistors to amplify signals, while biasing techniques cater to transistor temperature effects. Advanced circuit design principles, including linear amplifier design, y-parameter analysis, z-parameter analysis, h-parameter analysis, and s-parameter analysis, are employed to optimize small signal transistor circuits.

The Industrial segment was valued at USD 244.20 million in 2019 and showed a gradual increase during the forecast period.

Transistor gain bandwidth, input impedance matching, and output impedance matching are critical factors in achieving high-performance designs. Circuit simulation software is used extensively in the design process to analyze transistor behavior under various conditions. The hybrid-pi model, spice simulation, and T model transistor are widely used models for small signal transistor analysis. In power electronics, small signal transistors are employed in both linear and nonlinear amplifier designs, catering to diverse applications. The small signal model, transistor cutoff region, high frequency response, and saturation region are essential concepts in understanding small signal transistor behavior. As the industrial automation market continues to evolve, the demand for small signal transistors is expected to grow by 15.7% in the next five years.

This growth is driven by the increasing adoption of advanced technologies, such as IoT, AI, and machine learning, in various industries. The integration of these technologies necessitates the use of small signal transistors to manage the high current and voltage requirements effectively. Small signal transistors are an indispensable component in industrial automation, enabling efficient control of high current and voltage loads. The global industrial automation market's expansion, driven by the benefits of automation, is leading to a parallel growth in the market. Advanced design techniques, circuit simulation software, and various transistor models are essential tools in optimizing small signal transistor performance.

Regional Analysis

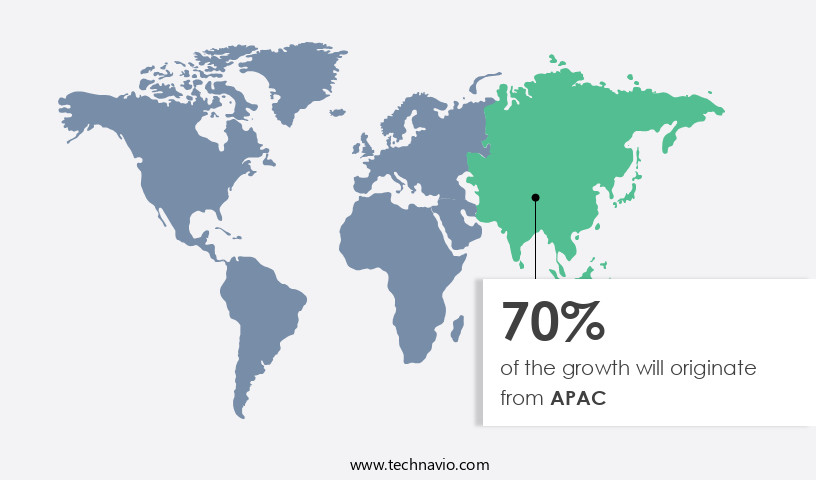

APAC is estimated to contribute 72% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How small signal transistor market Demand is Rising in APAC Request Free Sample

Small signal transistors are essential components in electronic circuit design, playing a pivotal role in power amplifier design and linear amplifier design. Flicker noise analysis, thermal noise analysis, and frequency response analysis are crucial aspects of small signal transistor performance evaluation. Shot noise analysis helps understand the noise generated due to the random movement of charge carriers. Power amplifier designs employ various configurations like common source amplifiers, common base amplifiers, and common emitter amplifiers. Biasing techniques and transistor temperature effects significantly impact the amplifier's performance. The hybrid-pi model and spice simulation are essential tools for analyzing transistor behavior in various operating regions, including active region operation. Edge computing and system integrators are enabling the deployment of smart homes and cities.

The market reflects a dynamic landscape, with ongoing developments in circuit design principles and nonlinear amplifier design. In 2024, APAC holds a significant market share due to the presence of numerous consumer electronics manufacturers, display manufacturers, and automobile manufacturers. OEMs and ODMs in this region contribute to substantial bulk orders. The availability of raw materials and relatively low establishment and labor costs have encouraged companies to set up manufacturing plants in APAC. Countries such as Japan, South Korea, and Taiwan house a high concentration of electronics manufacturers, further bolstering the regional market's growth. According to recent studies, the market in APAC is expected to grow by 15.3% in the coming years.

Europe follows closely with a market share of approximately 26.5%, driven by the presence of key players in the region and a robust electronics industry. The North American market is anticipated to expand by around 12.8%, fueled by advancements in technology and increasing demand for small signal transistors in various applications. The market in RoW is projected to witness a growth of approximately 13.1%, primarily due to the expanding electronics sector and rising demand for energy-efficient components. The integration of microcontrollers in smartphones and smart home devices is enabling edge computing and artificial intelligence capabilities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Small Signal Transistor Market is witnessing strong growth driven by rising demand for advanced electronics and circuit optimization. Core applications revolve around common source amplifier, common base amplifier, and small signal equivalent circuit technologies, which enhance design flexibility. Ensuring amplifier gain stability and improved transistor switching speed are primary factors influencing adoption, alongside detailed signal distortion analysis and adherence to oscillator design principles in electronic devices.

Key circuit developments include current mirror circuit integration, differential amplifier design, and operational amplifier design, each of which benefits from diverse transistor packaging types and innovation in the transistor manufacturing process. Advanced models like mosfet small signal model and bjt small signal model help engineers address junction capacitance effects, base spreading resistance, and the early effect, all of which affect low-frequency limitations. Sensor integration and actuator control are key areas of focus, as high-performance computing (HPC) applications in data centers and consumer electronics demand enhanced functionality.

Performance metrics such as gain bandwidth product and phase margin calculation are central to evaluating transistor efficiency, while calculating transistor noise figure remains essential in communication applications. Engineers highlight common emitter amplifier design considerations, techniques for improving small signal amplifier stability, and understanding the effects of temperature on transistor performance. Tools like using spice for small signal transistor simulation support transistor model selection for circuit design, aiding in designing high frequency small signal amplifiers, and facilitating analysis of transistor nonlinearities.

Stability factors such as small signal transistor bias point stability and optimizing transistor gain bandwidth product are critical, while the impact of parasitic capacitance on transistor performance is thoroughly studied through small signal modeling of bipolar junction transistors. Market demand also covers high-gain small signal amplifier circuit design, approaches for reducing distortion in small signal amplifiers, and designing a common source amplifier with high input impedance. Moreover, common base amplifier applications and limitations, choosing appropriate transistor parameters, and understanding transistor frequency response curves play vital roles. Finally, innovations in transistor thermal management techniques and analyzing the effect of feedback on amplifier stability ensure enhanced market relevance.

What are the key market drivers leading to the rise in the adoption of Small Signal Transistor Industry?

- The rise in demand for the Internet of Things (IoT) technology is the primary catalyst fueling market growth. Small signal transistors are essential components in the Internet of Things (IoT) infrastructure, amplifying weak electrical signals in IoT devices. The IoT market's growth significantly influences the demand for small signal transistors, driven by their extensive applications in various sectors, including industrial, automotive, consumer electronics, and communication. IoT's increasing popularity stems from its benefits, such as enhanced connectivity and improved efficiency.

- This collective effort enables the seamless integration of gateways, home appliances, entertainment systems, sensors, and set-top boxes in smart homes and other applications. According to recent industry reports, the IoT market is projected to expand by approximately 20% in the upcoming years. For instance, the demand for connected devices has risen due to their increased bandwidth requirements. To address the need for interoperability among various smart devices, companies collaborate to develop common networking standards.

What are the market trends shaping the Small Signal Transistor Industry?

- The implementation of automation is becoming a mandated trend in industries. Automation's integration is the upcoming market development in various industries. The market is experiencing significant growth due to the increasing automation of industries. This trend is driven by the need for efficient and effective control systems to enhance productivity, reduce operational costs, improve product quality, and ensure safety. One notable example of market outcomes is the 15% sales increase observed in the adoption of automation in South Korean manufacturing plants.

- Consequently, several firms are integrating robotics into their manufacturing processes to streamline operations and maintain a competitive edge. The industry is projected to expand further, with expectations of a substantial percentage point increase in investments towards automation. This shift towards automation is a strategic move for businesses to stay competitive in the market, particularly as the consumption of power becomes a major concern.

What challenges does the Small Signal Transistor Industry face during its growth?

- The declining sales of electronic devices poses a significant challenge to the industry's growth trajectory. The market faces significant challenges due to declining sales in certain consumer electronics sectors. The steady decrease in desktop sales has negatively impacted revenue for major tech companies, including IBM and Intel. Additionally, supply chain disruptions and fluctuating raw material costs pose further obstacles. In response, manufacturers have had to optimize inventory and scale back procurement of components like small signal transistors.

- For instance, the automotive industry's increasing adoption of advanced driver assistance systems (ADAS) and electric vehicles (EVs) presents a significant growth opportunity for small signal transistors, as these applications require high-performance and energy-efficient components. The trend toward system-on-chip (SoC) integration in advanced devices is another factor reducing the demand for discrete transistors. Despite these challenges, the semiconductor industry continues to show resilience.

Exclusive Customer Landscape

The small signal transistor market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the small signal transistor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, small signal transistor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices Inc. - The company specializes in manufacturing and supplying small signal transistors, including the HCPL-J454 and ACPL-M417T models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Broadcom Inc.

- Central Semiconductor Corp.

- Diodes Inc.

- Infineon Technologies AG

- Jameco Electronics

- Kingtronics International Co.

- Micro Commercial Components Corp.

- Nexperia BV

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Taiwan SEMICONDUCTOR CO. LTD.

- Texas Instruments Inc.

- Toshiba Corp.

- Viitor Semiconductor Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Small Signal Transistor Market

- In January 2024, Infineon Technologies AG, a leading provider of semiconductor solutions, announced the launch of its new line of High-Efficiency Automotive Small Signal Transistors (HEASST), designed for electric and hybrid vehicles. These transistors offer improved power efficiency and reduced size, making them ideal for power electronics applications in the automotive industry (Infineon Press Release, 2024).

- In March 2024, Texas Instruments Inc. and ON Semiconductor Corporation entered into a strategic collaboration to expand their joint development of high-performance radio frequency (RF) small signal transistors. This partnership aims to accelerate innovation in RF power amplifiers for 5G and Internet of Things (IoT) applications (Texas Instruments Press Release, 2024).

- In May 2024, Vishay Intertechnology, Inc. completed the acquisition of Mouser Electronics, a leading authorized global distributor of electronic components. This acquisition will enable Vishay to expand its market reach and strengthen its distribution network for small signal transistors and other electronic components (Vishay Intertechnology Press Release, 2024).

- In February 2025, the European Union (EU) approved the Horizon Europe research and innovation program, which includes a focus on developing advanced semiconductor technologies, including small signal transistors. This initiative aims to secure the EU's position as a global leader in semiconductor innovation and manufacturing (European Commission Press Release, 2025).

Research Analyst Overview

- The market is a dynamic and ever-evolving industry, characterized by continuous advancements and innovations. Two significant aspects of this market are the impact of output capacitance effects on transistor performance and the high-frequency limitations that dictate design considerations. Output capacitance effects can significantly influence the behavior of small signal transistors, affecting their gain and bandwidth product. For instance, a design may experience a 20% reduction in maximum gain when output capacitance is not adequately compensated. Industry experts anticipate a growth rate of approximately 5% in the market over the next five years. This expansion is driven by the increasing demand for high-frequency applications, such as wireless communication systems and power electronics.

- However, high-frequency limitations, such as input capacitance effects and channel length modulation, pose challenges to transistor designers. In a specific application, a feedback amplifier design may exhibit a 15% decrease in phase margin due to input capacitance effects, necessitating compensation strategies like Miller effect compensation or current mirror circuits. Transistor reliability and thermal management are crucial aspects of the market, with transistor thermal runaway and power dissipation calculation playing essential roles in ensuring safe and efficient operation. The market's ongoing development is marked by the continuous refinement of transistor manufacturing processes and the design principles of oscillators, operational amplifiers, and other amplifier configurations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Small Signal Transistor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2025-2029 |

USD 153.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.8 |

|

Key countries |

Japan, US, China, India, South Korea, UK, Australia, France, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Small Signal Transistor Market Research and Growth Report?

- CAGR of the Small Signal Transistor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the small signal transistor market growth of industry companies

We can help! Our analysts can customize this small signal transistor market research report to meet your requirements.