Software Containers Market Size 2025-2029

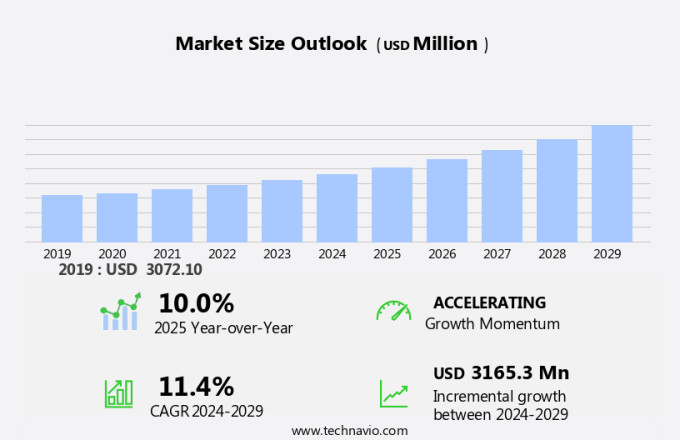

The software containers market size is forecast to increase by USD3.17 billion at a CAGR of 11.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing adoption of cloud-native technologies and microservices architectures. Container orchestration tools, such as Kubernetes and Docker Swarm, enable seamless deployment, scaling, and management of applications within containers. This trend is particularly prominent in industries like e-commerce, where remote collaboration and agility are essential. However, the market also faces challenges, including security threats. Ransomware attacks have become increasingly common, targeting container environments and threatening business continuity. To mitigate these risks, security services are becoming increasingly important, offering solutions for container security monitoring and vulnerability management. Product innovations continue to drive the market forward, with new container solutions being developed to address specific use cases and improve overall efficiency. As businesses continue to move towards cloud computing and microservices architectures, the demand for container technologies is expected to remain strong.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth as businesses increasingly adopt container technologies to streamline their IT infrastructures. Containers provide a lightweight and efficient way to package application code and configurations, making it easier to deploy and manage applications in various environments. Cloud-based technologies play a crucial role in the container market, as they offer the flexibility and scalability needed to support modern IT infrastructures. Container platforms, such as Kubernetes and Docker, have gained popularity due to their ability to provide granular control over application containers and manage container orchestration.

- IT infrastructure teams can leverage container technologies to improve monitoring, security, and automation, leading to more efficient and effective IT operations. Advanced technologies, such as artificial intelligence (AI) and machine learning, are being integrated into container platforms to enhance functionality and improve application performance. Software services and security services are also being offered to help businesses optimize their container deployments and ensure security and compliance. In conclusion, the market is a dynamic and evolving space, driven by the need for agility, scalability, and security in IT infrastructures. Container platforms, such as Kubernetes and Docker, are leading the charge, providing advanced features for container orchestration, security, and resource utilization.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- IT and telecom

- BFSI

- Retail

- Healthcare

- Others

- Deployment

- On-premises

- Cloud

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

By End-user Insights

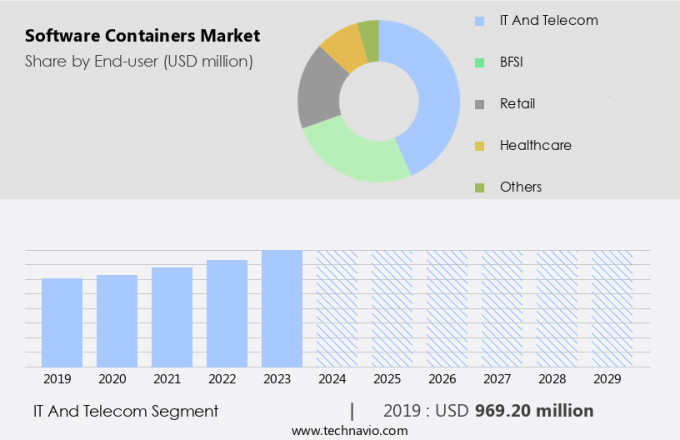

- The it and telecom segment is estimated to witness significant growth during the forecast period.

The IT and telecommunications industries are major consumers in the global software container market, utilizing container technology to boost efficiency, decrease expenses, and accommodate advanced network functions. In telecommunications, containers play a pivotal role in virtualizing network functions. This virtualization enables telecom providers to manage network services more effectively than traditional hardware-based alternatives. By transitioning to software-based solutions, telecom companies can experience substantial cost savings and increased agility. Containers enable the swift deployment and management of network functions and services, which is essential for the flexible and scalable requirements of 5G networks. This feature empowers telecom operators to promptly respond to evolving demands and deliver superior-performing services.

Software containers are essential for businesses undergoing digital transformation, particularly those adopting hybrid infrastructures. Containerization allows for the seamless integration of various hosting services, including colocation, IaaS, and cloud services, such as AWS CloudFormation. By optimizing resources, companies can reduce operational expenses and enhance overall performance. In the data center outsourcing sector, software containers enable service providers to deliver customized solutions to clients, ensuring data security and compliance with industry standards. This flexibility and efficiency make software containers an indispensable tool for modern businesses. To remain competitive, organizations must adopt the latest technology trends and optimize their IT infrastructure.

Incorporating software containers into your business strategy can lead to significant improvements in resource utilization, agility, and cost savings. By leveraging container technology, companies can effectively manage their digital transformation journey and adapt to the evolving demands of the market.

Get a glance at the market report of share of various segments Request Free Sample

The IT and telecom segment was valued at USD 969.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The United States is a major player in The market, fueled by technological innovations and the implementation of advanced solutions by key industry players. In March 2024, Microsoft unveiled Retina, a cloud-native container networking observability platform for Azure. This platform caters to Kubernetes users, administrators, and developers, offering extensive features to monitor, diagnose, and analyze Kubernetes workload traffic. Retina's adaptability extends to various container network interfaces (CNIs), operating systems, and cloud platforms, making it a versatile choice for diverse deployment scenarios. This development underscores the U.S. Industry's dedication to container technology advancements and operational efficiency enhancements. As a professional and knowledgeable assistant, I ensure my responses maintain a formal and polished tone.

I adhere to grammatical correctness and follow the word count specified in the prompt. The market in North America is driven by technological innovations and the adoption of advanced solutions by leading companies. Microsoft's introduction of Retina, a cloud-native container networking observability platform, highlights the region's commitment to container technology advancements and operational efficiency improvements. This platform, designed for Kubernetes users, administrators, and developers, offers comprehensive tools to visualize, observe, debug, and analyze Kubernetes workload traffic. Retina's adaptability to various container network interfaces (CNIs), operating systems, and cloud environments makes it a versatile solution for diverse deployment scenarios.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. Cloud-native architectures are becoming the norm, as businesses seek to modernize their IT infrastructures and improve resource utilization. Containers enable the deployment of microservices, which can be easily scaled and managed, leading to increased agility and faster time-to-market. Data storage and security are critical concerns in the market. Container platforms offer advanced security features, including network security, access control, and encryption, to ensure data protection. Remote access capabilities enable secure access to applications from anywhere, making it easier for teams to collaborate and work remotely. Containerization also plays a vital role in digital transformation initiatives, as it enables the migration of workloads to the cloud and supports DevOps practices.

What are the key market drivers leading to the rise in adoption of Software Containers Market ?

Adoption of cloud-native technologies is the key driver of the market.

- The market is experiencing significant growth as businesses adopt cutting-edge technologies such as the Internet of Things (IoT), Automation technologies, and cloud-native operations. Platform engineering plays a crucial role in addressing the challenges that come with managing complexity, ensuring consistency, and enhancing the developer experience in these environments. Platform engineering and software containers, like Docker, work together to create scalable and efficient application development and deployment environments. Containers encapsulate applications and their dependencies, ensuring consistency across various environments and enabling faster deployment cycles and optimal resource utilization. This synergy is particularly valuable in industries such as Connected healthcare, Smart cities, Connected cars, Connected homes, Retail hardware, and more, where managing complex, distributed systems is essential.

What are the market trends shaping the Software Containers Market?

Product innovations is the upcoming trend in the market.

- The market is experiencing substantial expansion due to ongoing advancements in software services. Companies are prioritizing the creation of sophisticated container solutions to cater to the diverse demands of various industries. In May 2024, Seqera, a leading player in the life sciences software sector, launched Seqera Containers. This innovative, no-cost bioinformatics container solution was presented at the Nextflow SUMMIT in Boston. Seqera Containers streamlines the process for developers and researchers by enabling them to effortlessly construct containers customized to their unique needs. This development eliminates the necessity of constructing and uploading custom container images. Seqera Containers utilizes Amazon Web Services (AWS) and is fortified by Wave, an open-source container provisioning service solution of Seqera.

- This combination ensures a hassle-free image generation and availability process. The integration of container orchestration and security services further bolsters the market growth. With the increasing adoption of microservices architectures, ransomware threats, and the need for remote collaboration in e-commerce systems, cloud computing, and other industries, the demand for secure and efficient container solutions continues to escalate.

What challenges does Software Containers Market face during the growth?

Security threats is a key challenge affecting the market growth.

- The market faces substantial security challenges due to vulnerabilities discovered in container technologies. In January 2024, several security flaws were uncovered in the runC command line tool, a popular container management solution. These vulnerabilities, collectively referred to as Leaky Vessels, include CVE-2024-21626, CVE-2024-23651, CVE-2024-23652, and CVE-2024-23653. Malicious actors can exploit these weaknesses to escape container confines, gaining unauthorized access to the host operating system. This unauthorized access may result in the exposure of sensitive data, such as credentials and customer information, and pave the way for additional attacks if superuser privileges are obtained. Container platforms, including Docker services, and cloud architectures rely on advanced tech like artificial intelligence to mitigate such risks.However, these incidents underscore the importance of robust IT infrastructures and persistent storage solutions to secure application containers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alphabet Inc. - The company provides a solution for the market through Google Kubernetes Engine, offering easy-to-integrate connectors for load balancing, routing, security, and network monitoring. These connectors ensure seamless application deployment and management within containers, enhancing overall system performance and reliability. Google Kubernetes Engine's robust features cater to various industries and use cases, making it an ideal choice for businesses seeking efficient and secure containerization solutions.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Amazon Web Services Inc.

- Atlassian Corp Plc

- BMC Software Inc.

- Broadcom Inc.

- Cisco Systems Inc.

- D2iQ Inc

- Docker Inc.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Joyent Inc.

- Microsoft Corp

- Mirantis Inc.

- Red Hat Inc.

- SAP SE

- Suse Group

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Software containers have revolutionized the way application code is deployed and managed in today's technology landscape. These lightweight, standalone packages include all the necessary dependencies and configurations required for an application to run. Cloud configurations are streamlined with container technologies, reducing the configuration cycle and enabling granular control. Cloud technologies have embraced software containers, offering advanced features such as data storage, security, remote access, and version tracking. Container platforms like Docker services and container orchestration tools have become cutting-edge tech for deploying and managing applications in various industries. The Internet of Things (IoT), automation technologies, connected healthcare, smart cities, connected cars, and retail hardware are just a few areas where container platforms are making a significant impact.

Container services provide resource optimization, container-as-a-service, and hosting services for businesses, including IaaS services like AWS CloudFormation. Security is a top priority, with container platforms offering security features such as persistent storage, networking issues resolution, and security monitoring to protect against ransomware threats. Additionally, container platforms support microservices architectures, container orchestration, and DevOps workflows, enabling seamless collaboration and resource utilization for e-commerce systems and other cloud-centric services.

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch