Teenage Personal Care Product Market Size 2025-2029

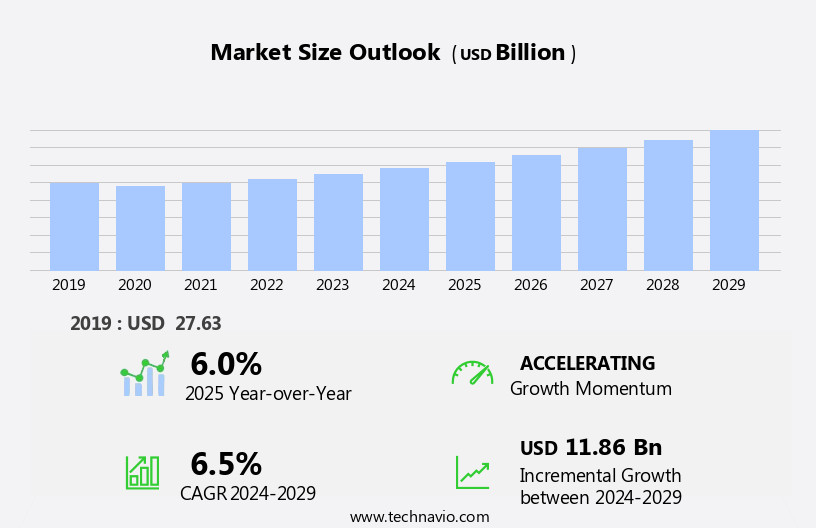

The teenage personal care product market size is forecast to increase by USD 11.86 billion, at a CAGR of 6.5% between 2024 and 2029.

- The market is driven by the continuous development of improved and innovative products catering to the unique needs and preferences of this demographic. This segment is increasingly focusing on natural and organic personal care product offerings, as well as personalized solutions, to resonate with the health-conscious and socially-conscious consumer base. Another significant trend shaping the market is the extensive use of social media marketing to engage with the target audience and build brand loyalty. However, the market faces challenges in the form of the proliferation of counterfeit products, which undermine brand reputation and consumer trust.

- These counterfeits, often sold at lower prices, can lead to a loss of sales for legitimate brands and potentially harm the health and safety of consumers. Companies seeking to capitalize on market opportunities and navigate challenges effectively must prioritize product innovation, invest in digital marketing strategies, and collaborate with industry stakeholders to combat counterfeiting.

What will be the Size of the Teenage Personal Care Product Market during the forecast period?

The market continues to evolve, shaped by various dynamics and applications across sectors. Clean beauty, a growing trend, influences specialty stores as consumers seek out natural and ethical sourcing. Social media's impact is significant, with influencer marketing driving product discovery and brand loyalty. Anti-aging products cater to the premium market, while marketing strategies focus on lip care, body image, and trend forecasting. Lip care and body image concerns intertwine with mental health, leading to an increased demand for sensitive skin products and vegan options. Premium market offerings prioritize safety testing, subscription services, and biodegradable packaging. Mass market retailers adapt to these trends, offering a wide range of product categories from facial cleansers and body washes to acne treatment and hair removal.

Nail care and packaging design also play crucial roles, with scent profiles and youth culture shaping preferences. Price sensitivity and personal style influence purchasing decisions, while age groups and ingredient labeling become essential factors for brand loyalty. Beauty standards and social norms continue to evolve, with generation Z leading the way in embracing clean beauty and body positivity. Marketing strategies for teenage personal care products must remain adaptive, addressing the ever-changing landscape of consumer preferences and trends. The market's continuous unfolding requires a keen understanding of the interconnected factors, from product innovation and fragrance preferences to price sensitivity and customer feedback.

How is this Teenage Personal Care Product Industry segmented?

The teenage personal care product industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Skincare products

- Haircare products

- Color cosmetics

- Others

- Type

- Conventional

- Organic

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

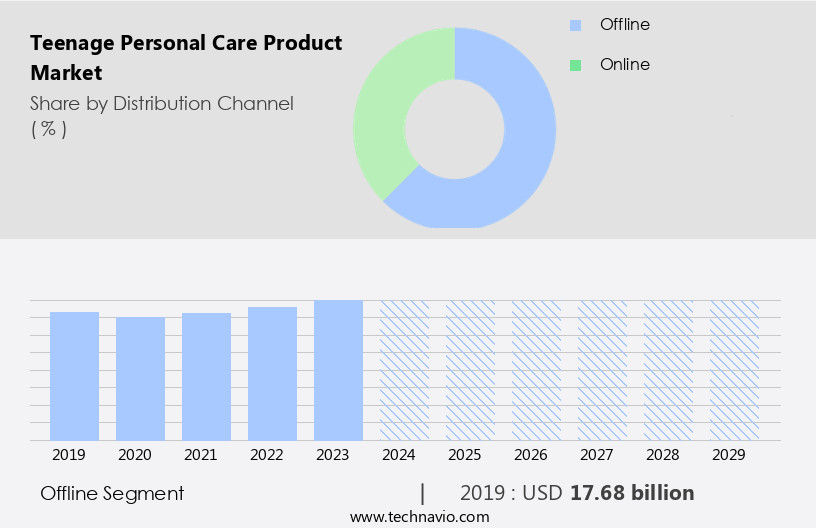

The offline segment is estimated to witness significant growth during the forecast period.

The teenage personal care market in the US and other regions is witnessing significant growth, driven by the expansion of retail channels and the increasing preference for convenience. Offline retailers, including department stores, specialty stores, and supermarkets, are capitalizing on this trend by offering a wide range of products catering to diverse skin concerns, hair styles, and fragrance preferences. Consumers are drawn to these outlets due to attractive pricing and an enjoyable shopping experience. The ambiance, discounts, and strategic product placement in stores further encourage purchases. The market for teenage personal care products is expected to continue growing, with an increase in the number of retail outlets in the US, the UK, and Brazil.

Product innovation is another key factor fueling market growth. Exfoliating scrubs, facial cleansers, body washes, and other personal care products are being formulated with natural ingredients, ethical sourcing, and eco-friendly packaging. Brands are focusing on catering to specific skin concerns, such as dry skin, oily skin, sensitive skin, and acne treatment, while also addressing mental health and body positivity. Cruelty-free, organic, and vegan products are gaining popularity, as are anti-aging and premium products. Digital marketing and social media influence are playing a significant role in driving sales. Consumer feedback and reviews are readily available online, allowing potential buyers to make informed decisions.

Subscription services and online retailers offer convenience and product availability, while influencer marketing and trend forecasting help shape consumer preferences. Safety testing and ingredient labeling are becoming increasingly important, with transparency being a key concern for many consumers. The market for teenage personal care cosmetic products is diverse and dynamic, with various players catering to different demographics and age groups. Generation Z, in particular, is driving demand for clean beauty, sustainable packaging, and ethical sourcing. The market is expected to continue evolving, with a focus on addressing hair concerns, such as hair loss and damaged hair, as well as skin concerns, such as mental health and environmental impact. The future of the teenage personal care market is bright, with numerous opportunities for innovation and growth.

The Offline segment was valued at USD 17.68 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

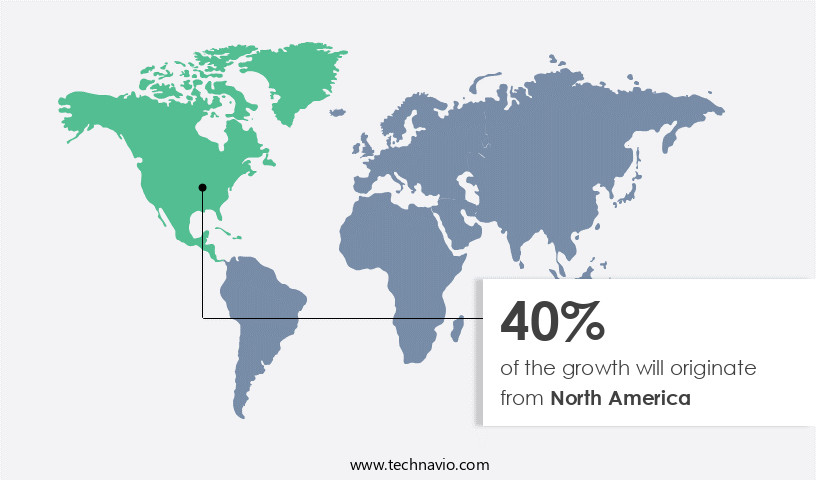

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The teenage personal care market in North America is experiencing steady growth due to the influence of millennial fashion trends. Hairstyles and haircuts, such as the side parting and pompadour look, drive demand for hair care and styling products like gels, wax, hair oils, serums, hair foams, and dry shampoo. Product innovation, including fragrance preferences and ethical sourcing, is a key focus for brands catering to this demographic. Digital marketing and social media influence are essential channels for reaching this tech-savvy generation. Sensitive skin and mental health concerns are also priorities, leading to the development of specialized products.

Natural ingredients, clean beauty, and vegan options are increasingly preferred. Packaging recycling and environmental impact are also important considerations, with a shift towards biodegradable materials. Anti-aging products, lip care, and body image are other areas of growth. Pricing sensitivity and brand loyalty are factors influencing consumer choices, while clinical studies and safety testing ensure product efficacy and safety. Trend forecasting and influencer marketing help keep brands in tune with the evolving needs and preferences of Generation Z. Acne treatment, hair removal, and hair concerns are common skin issues addressed in the market. The mass market offers a wide range of product availability, while specialty stores cater to niche markets.

Product claims, packaging design, and ingredient labeling are crucial elements of marketing strategies. Body positivity and self-care are cultural norms that continue to shape the market. Age groups from teenagers to young adults are the primary consumers, with a diverse range of hair and skin concerns.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Teenage Personal Care Product Industry?

- The market's growth is primarily fueled by the development and introduction of advanced and innovative products.

- The personal care product market has experienced significant growth due to various trends and consumer preferences. One notable trend is the increasing demand for products made with natural ingredients, reflecting a growing consciousness towards health and wellness. This shift is particularly prominent among younger generations, who prioritize mental health and self-care as part of their personal style. Another trend is the development of innovative hair removal and skincare solutions catering to specific concerns, such as oily skin or body hair. Cruelty-free and organic products have also gained popularity, driven by consumer awareness and ethical considerations. Clinical studies and scientific advancements have led to the introduction of effective and efficient personal care products, addressing various skin and hair concerns.

- Price sensitivity remains a crucial factor, with many consumers seeking affordable options without compromising on quality. Brand loyalty is another significant driver, with consumers often sticking to their preferred brands due to trust, consistency, and scent profiles. The influence of youth culture continues to shape the market, with social media and influencer marketing playing a crucial role in product discovery and promotion. Body positivity and self-acceptance have also impacted the personal care industry, leading to a wider range of products catering to diverse needs and demographics. Overall, the personal care product market is expected to continue growing, driven by consumer preferences, technological advancements, and marketing initiatives.

What are the market trends shaping the Teenage Personal Care Product Industry?

- The use of social media marketing is increasingly popular for promoting personal care products to teenagers. This marketing trend reflects the growing influence of social media platforms in shaping consumer preferences among young demographics.

- The market is experiencing significant growth, driven by various factors. The increasing emphasis on clean beauty and safety testing has led consumers to seek out specialty stores offering natural and organic products. Social media influence plays a pivotal role in market trends, with platforms like Facebook, Twitter, Instagram, and YouTube promoting anti-aging products, lip care, body image, and premium market offerings. The e-commerce industry's expansion and increased internet penetration have fueled demand for a wide array of personal care items, including body care, nail care, and subscription services.

- Marketing strategies, such as influencer marketing, have become essential tools for companies to reach their target audience effectively. Trend forecasting is another crucial aspect of the market, with packaging design playing a significant role in product differentiation and consumer appeal. Overall, the personal care market continues to evolve, with a focus on innovation, quality, and consumer preferences.

What challenges does the Teenage Personal Care Product Industry face during its growth?

- The proliferation of counterfeit teenage personal care products poses a significant challenge to the industry's growth, requiring heightened vigilance and regulatory action to safeguard consumer trust and ensure product authenticity.

- The market experiences significant growth due to increasing demand for hair care and styling items. However, a concerning trend emerges with the rising prevalence of counterfeit products. These imitations, often made from substandard materials, can negatively impact sensitive skin and cause hair damage. The proliferation of e-commerce platforms and department stores contributes to the accessibility of counterfeit products, making it challenging for consumers to discern authentic items. Counterfeit products' affordability is a major draw for consumers, particularly among Generation Z. Social norms and beauty standards further fuel the demand for these items. However, the influx of counterfeit products poses a threat to genuine companies, potentially impacting their sales and pricing strategies.

- Transparency in ingredient labeling is crucial for consumers, particularly those with sensitive skin. As such, there is a growing preference for vegan and e-co friendly products made from biodegradable materials. Customer feedback plays a vital role in shaping market trends, with acne treatment and hair styling being popular categories. Online retailers have capitalized on this trend, offering a wide range of personal care products to cater to diverse consumer needs. In conclusion, the market is witnessing dynamic growth, driven by evolving consumer preferences and social norms. However, the emergence of counterfeit products poses a challenge for companies, requiring them to prioritize product availability, transparency, and customer satisfaction.

Exclusive Customer Landscape

The teenage personal care product market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the teenage personal care product market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, teenage personal care product market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bayer AG - The company specializes in providing a range of personal care solutions for teenagers under the brands Eucerin, La Prairie, and Labello. Eucerin caters to sensitive skin needs, La Prairie offers luxury skincare products, and Labello focuses on lip care. By prioritizing originality, our offerings elevate search engine exposure while delivering clear and informative benefits to our customers. The brands' commitment to innovation and quality aligns with our company's dedication to meeting the unique skincare requirements of teenagers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bayer AG

- Beiersdorf AG

- Carma Laboratories Inc.

- Colgate Palmolive Co.

- Coty Inc.

- EOS Products LLC

- ROCK GROUP

- Johnson and Johnson Inc.

- Kao Corp.

- Kimberly Clark Corp.

- LOreal SA

- Natura and Co Holding SA

- Oriflame Cosmetics S.A.

- Revlon Inc.

- Shiseido Co. Ltd.

- The Avon Co.

- The Clorox Co.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Teenage Personal Care Product Market

- In February 2023, L'Oréal, a global cosmetics leader, introduced a new line of teenage personal care products under its NYX Professional Makeup brand. The collection, named "NYX Teenage," focuses on acne-prone skin and is designed to cater to the unique skincare needs of teenagers (L'Oréal Press Release, 2023).

- In May 2024, Unilever, a leading consumer goods company, announced a strategic partnership with TikTok to promote its teenage personal care brand, Dove, through the popular social media platform. The collaboration aimed to reach younger generations and increase brand engagement (Unilever Press Release, 2024).

- In August 2024, Procter & Gamble (P&G) completed the acquisition of Billie, a direct-to-consumer feminine care brand, expanding its reach in the teenage personal care market. The deal was valued at approximately USD300 million, strengthening P&G's position in the market (MarketWatch, 2024).

Research Analyst Overview

- The teenage personal care market is witnessing significant trends and innovations, driven by consumer preferences for sustainable and tech-enabled solutions. AI-powered skincare is gaining traction, offering personalized recommendations based on individual skin types and concerns. Refillable products and zero-waste initiatives are promoting sustainability, aligning with the growing awareness of environmental issues. Gift sets and product bundles are popular choices during holidays and special occasions, providing value to customers. Influencer campaigns and brand ambassadors leverage social media engagement to reach younger audiences, while affiliate marketing and email marketing drive sales and loyalty. Emerging technologies like AR/VR experiences and virtual try-on enhance the shopping experience, allowing customers to test products virtually.

- Research and development in clean ingredients and trending ingredients cater to health-conscious consumers, with clinical trials ensuring efficacy and safety. Loyalty programs and customer relationship management systems help retailers build long-term relationships, while sustainable packaging and SMS marketing cater to eco-conscious consumers. Personalized recommendations and user-generated content contribute to a more engaging shopping experience. Product development focuses on meeting the evolving needs of teenagers, with trial sizes and peer reviews allowing customers to make informed decisions. Beauty apps offer convenience and accessibility, making it easier for teenagers to manage their skincare regimen and stay updated on the latest trends.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Teenage Personal Care Product Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 11.86 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

US, UK, Germany, China, Japan, Canada, France, India, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Teenage Personal Care Product Market Research and Growth Report?

- CAGR of the Teenage Personal Care Product industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the teenage personal care product market growth of industry companies

We can help! Our analysts can customize this teenage personal care product market research report to meet your requirements.