Canada Traffic Control Services Market Size 2025-2029

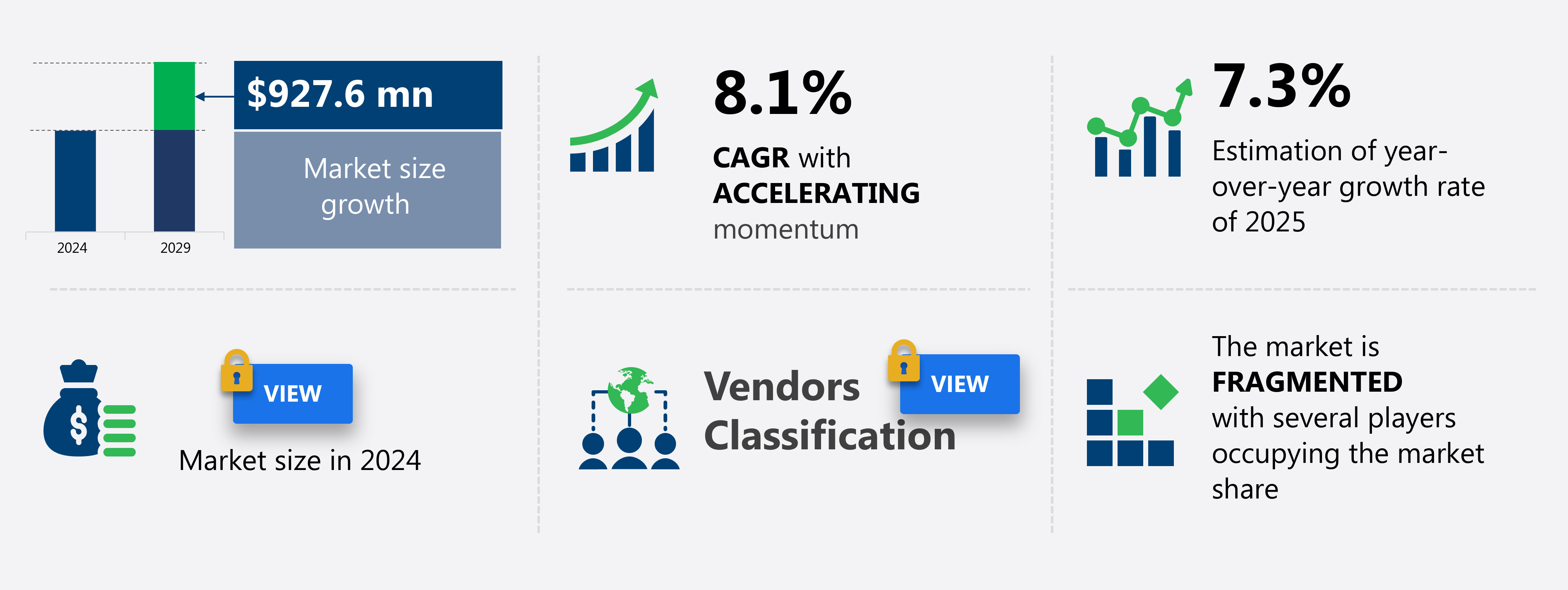

The Canada traffic control services market size is forecast to increase by USD 927.6 million at a CAGR of 8.1% between 2024 and 2029.

- The traffic control services market is experiencing significant growth due to the increasing demand for efficient management of traffic movement. With the rising number of commercial vehicles on the roads, there is a pressing need to ensure a smooth and safe flow of traffic. However, a lack of awareness about road safety remains a major challenge.

- Technological advancements, such as the use of smart traffic management systems, intelligent transport systems, and automation, are being adopted to address these issues. Additionally, the implementation of stringent regulations and government initiatives to improve traffic management are driving market growth. Overall, the traffic control services market is expected to witness steady expansion in the coming years, as the importance of safe and efficient traffic management continues to gain recognition.

What will be the Size of the Market During the Forecast Period?

- Traffic management is a critical aspect of modern urban infrastructure, encompassing various services aimed at optimizing traffic flows and ensuring safety for all road users. One such service is digital parking, which utilizes IoT solutions to manage parking facilities more efficiently. This includes real-time data analysis, automated tariffs, and optimized mobility systems. Management service providers play a pivotal role in delivering quality services, leveraging advanced technologies such as sensor technologies, radar systems, and real-time navigation. These solutions help mitigate blind spots and ensure a seamless parking experience for drivers. The labor market for traffic management services is experiencing a talent crunch, with the need for skilled professionals in IoT, data analysis, and safety measures increasingly in demand.

- This shortage, coupled with the rising demand for parking facilities, has led to project costs escalating. Connected cars are set to revolutionize the parking industry, enabling real-time data exchange between vehicles and parking facilities. This will lead to cost-effective solutions for drivers and optimized traffic flows, reducing traffic delays and enhancing safety for all road users, including bicyclists. Price increases and safety measures are key considerations for parking facilities, with corporate culture and accident rates playing a significant role in their success. Advanced vehicles, such as autonomous cars and compact transport, are expected to further transform the parking landscape, necessitating technology standards and regulatory frameworks to keep pace.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Highway

- Street

- Others

- Type

- Event safety

- Traffic pacing

- Advanced warning sign installation

- Traffic control drawings

- Others

- Area

- Urban

- Rural

- Others

- Geography

- Canada

By Application Insights

The highway segment is estimated to witness significant growth during the forecast period. Traffic control services play a crucial role in managing highway construction projects and mitigating traffic congestion in Canada. With the prevalence of extensive highway maintenance and construction projects, these services are essential for diverting traffic, managing lane closures and detours, and ensuring the safe flow of vehicles. The increasing congestion on Canadian highways, resulting in longer travel times, increased fuel consumption, and emissions, necessitates the use of traffic control services to manage traffic flow effectively. Moreover, the rising number of vehicles on the road and the increasing frequency of road accidents, particularly on highways due to excessive speeding, have heightened the demand for these services. Traffic control services enable construction crews to work efficiently while minimizing disruptions to traffic and enhancing safety.

Get a glance at the share of various segments. Request Free Sample

Market Dynamics

Our Canada Traffic Control Services Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Canada Traffic Control Services Market?

Growing demand for organizing traffic movement is the key driver of the market.

- In response to the growing urban population and increased vehicular density, traffic management has become a critical priority in Canada. With roads serving as the primary mode of transportation, efficient traffic flow is vital for economic development, ensuring the smooth movement of goods and providing access to education, employment, and healthcare. Traffic control services are being explored as a solution to mitigate congestion and enhance safety for both pedestrians and vehicle owners. Connected vehicle technology plays a significant role in traffic management, enabling real-time traffic monitoring, congestion mitigation, and incident management. This technology also facilitates parking optimization, with parking availability, pricing, and reservation systems enabling seamless parking accessibility.

- Parking infrastructure development, including smart parking and car sharing, further contributes to reducing traffic congestion and promoting sustainable transportation. Traffic modeling and simulation are essential components of traffic management, providing data insights for transportation planning and logistics optimization. Autonomous vehicles, driverless cars, and ride-hailing platforms are also transforming the transportation landscape, necessitating adaptive traffic control systems and intelligent traffic management strategies. Safety training, talent acquisition, and retention are crucial aspects of traffic control services, ensuring the effective implementation of traffic management solutions and maintaining the highest safety standards. Traffic hardware and software, including smart lights, traffic sensors, and real-time analysis systems, are essential components of traffic infrastructure development.

What are the market trends shaping the Canada Traffic Control Services Market?

Increasing number of vehicles on road is the upcoming trend in the market.

- The market has experienced significant growth due to the increasing demand for advanced vehicle technology and transportation planning to ensure safety and efficiency on the roads. Connected vehicles and real-time traffic data have become essential components of traffic management, enabling congestion mitigation, parking optimization, and accident prediction. The integration of parking guidance systems, reservation systems, and smart parking technology has improved parking accessibility, availability, and pricing. Moreover, the implementation of traffic modeling and simulation software has facilitated urban planning and logistics optimization, reducing traffic flow disruptions and improving overall traffic efficiency. The adoption of autonomous vehicles and ride-hailing platforms has further revolutionized the transportation industry, necessitating advanced traffic management systems and safety measures.

- Safety training and talent retention have become critical factors in the traffic control services market, ensuring the effective deployment of intelligent systems and traffic hardware. Parking payments, security, and analytics have also gained importance, providing valuable data insights for revenue management and sustainable transportation solutions. The market continues to evolve, with a focus on urban mobility, commercial vehicle management, and noise reduction. Smart mobility solutions, such as adaptive control systems and intelligent traffic signals, are becoming increasingly popular, offering real-time analysis and traffic prediction capabilities. In conclusion, the market is experiencing significant growth due to the increasing demand for advanced vehicle technology, transportation planning, and safety measures. The integration of smart parking, traffic modeling, and real-time traffic data is transforming the transportation industry, offering valuable data insights and sustainable transportation solutions. Such factors will increase the market growth during the forecast period.

What challenges does Canada Traffic Control Services Market face during the growth?

Lack of awareness about road safety is a key challenge affecting the market growth.

- Traffic control services play a crucial role in ensuring public safety and transportation efficiency. The integration of vehicle technology, such as connected cars and autonomous vehicles, has brought about a need for advanced traffic management systems. Traffic modeling, parking optimization, and real-time traffic analysis are essential components of effective traffic control services. These services help mitigate congestion, improve parking accessibility and availability, and enhance safety measures through safety training and parking security. The parking industry is undergoing significant changes with the emergence of smart parking, reservation systems, and parking analytics. Big data and data insights are transforming revenue management and urban planning, enabling real-time parking payments and space management.

- Sustainable transportation solutions, such as car sharing and ride-hailing platforms, are also reshaping the parking landscape. However, insufficient awareness of traffic management needs can lead to accidents, congestion, and inefficiencies in transportation systems. Proper traffic planning, including transportation integration and expressway construction, is necessary to address these challenges. Traffic monitoring, enforcement, and incident management are essential to maintaining traffic flow and ensuring public safety. Moreover, talent acquisition and retention are critical for the success of traffic control services. Providers must invest in safety training, adaptive control systems, and intelligent traffic management solutions to attract and retain top talent.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offer comprehensive traffic control services, including the installation and use of 3M MCS traffic signs, digital traffic sign printing, and application of road markings.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ATS Traffic

- Barricade Traffic Services Inc.

- Cellint Traffic Solutions Ltd.

- Cisco Systems Inc.

- GardaWorld Security Corp.

- International Business Machines Corp.

- JSK Traffic Control Services

- Kapsch TrafficCom AG

- LG Corp.

- Miovision Technologies Incorp.

- Optimum Security

- Q Free ASA

- Ramudden Global AB

- Siemens AG

- SWARCO AG

- The Universal Group

- Traffic Control Services

- Triumph Traffic

- United Traffic Control Services

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The traffic control services market is a critical component of the Intelligent Transportation Systems (ITS) industry, focusing on optimizing traffic flow, enhancing safety, and improving overall transportation efficiency. This market encompasses a range of services, including parking management, real-time traffic monitoring, congestion mitigation, and safety training. Parking management is a significant segment within the Traffic Control Services market. This service aims to address the challenges of parking availability, accessibility, and pricing through various solutions such as parking optimization, reservation systems, and smart parking. The integration of technology into parking management has led to the development of real-time data analytics, enabling more efficient parking space utilization and improved user experience. Connected vehicles and vehicle technology have a profound impact on the Traffic Control Services market. Real-time traffic data from connected vehicles enables traffic modeling and prediction, allowing for proactive traffic management and congestion mitigation strategies. Furthermore, the integration of artificial intelligence (AI) and big data into traffic management systems enhances the ability to analyze patterns and optimize traffic flow in real-time. Safety is a primary concern in the Traffic Control Services market.

Moreover, training programs for traffic safety and talent retention are essential to ensure a skilled workforce capable of operating and maintaining complex traffic control systems. Moreover, the integration of vehicle safety technology, such as adaptive control and collision avoidance systems, contributes to reducing accident rates and enhancing overall road safety. Urban planning plays a crucial role in the Traffic Control Services market. The development of smart cities and urban mobility solutions necessitates the implementation of advanced traffic management systems. These systems include traffic modeling, simulation, and optimization, as well as the integration of smart parking, real-time traffic data, and autonomous vehicles. The Traffic Control Services market is also influenced by the growing trend towards sustainable transportation. The adoption of electric and autonomous vehicles, as well as the optimization of logistics and goods movement, necessitates the development of traffic management systems that can accommodate these new mobility solutions. The integration of AI and data analytics into traffic management systems offers significant opportunities for revenue management and data insights. These technologies enable traffic control services providers to optimize pricing, improve operational efficiency, and enhance the overall user experience. The Traffic Control Services market is continually evolving, with new trends and technologies shaping its future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.1% |

|

Market growth 2025-2029 |

USD 927.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.3 |

|

Key countries |

Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Canada

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch