Air Compressor In Oil And Gas Industry Market Size 2024-2028

The air compressor in oil and gas industry market size is forecast to increase by USD 2.54 billion at a CAGR of 4.36% between 2023 and 2028.

What will be the Size of the Air Compressor In Oil And Gas Industry Market During the Forecast Period?

How is this Air Compressor In Oil And Gas Industry Industry segmented and which is the largest segment?

The air compressor in oil and gas industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Positive displacement (PD)

- Centrifugal

- Type

- Stationary

- Portable

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

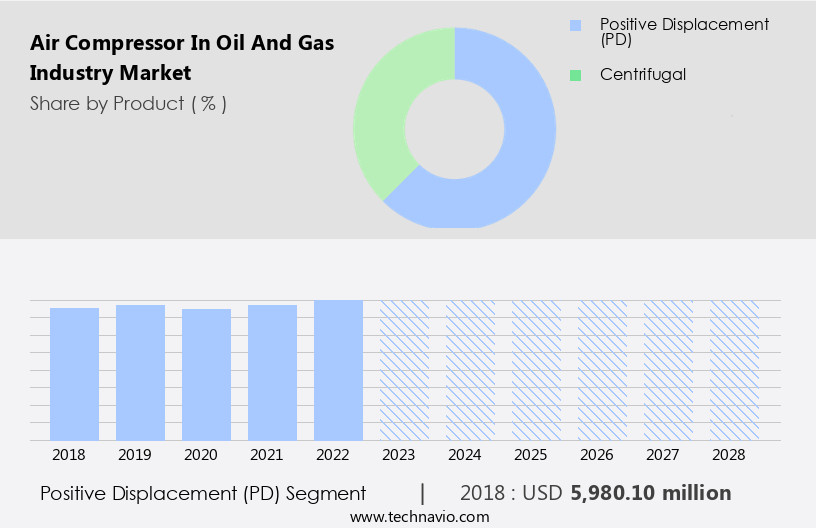

By Product Insights

- The positive displacement (pd) segment is estimated to witness significant growth during the forecast period.

The air compressor market In the oil and gas industry is primarily driven by the demand for oil-free systems In the natural gas sector. PD compressors, including reciprocating compressors, remaIn the dominant segment due to their efficiency and ability to handle high-pressure applications. Stationary air compressors, powered by electric motors, diesel engines, or gasoline engines, are extensively used in various industries, such as oil refineries, power plants, and chemical plants, for power generation projects and industrial automation. Air compressors are integral to the gas pipeline industry, enabling the transportation and processing of natural gas. They power pneumatic tools, automation equipment, conveyors, and other industrial processes.

In the context of energy savings and emission reduction, air audits help identify production losses and emission standards, ensuring air quality and energy conservation standards are met. PD compressors, including oil-free rotary compressors, centrifugal compressors, and stationary compressors, contribute significantly to the commercial manufacturing and industrial sectors, including electronics, semiconductor industries, and hydrogen production. Keywords: air compressor, oil and gas industry, positive displacement compressors, reciprocating compressors, stationary air compressors, electric motor, diesel engine, gasoline engine, natural gas sector, industrial automation, pneumatic tools, conveyors, energy savings, emission standards, air quality, energy conservation standards, PD compressors, industrial sectors, electronics, semiconductor industries, hydrogen.

Get a glance at the Air Compressor In Oil And Gas Industry Industry report of share of various segments Request Free Sample

The Positive displacement (PD) segment was valued at USD 5.98 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

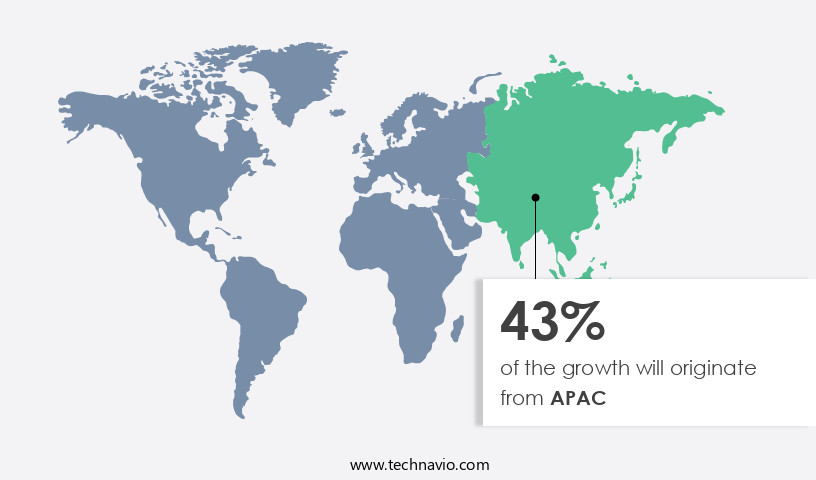

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The air compressor market In the oil and gas industry across APAC is projected to expand significantly due to the growth In the oil and gas pipeline segment, LNG, and petrochemical industries in countries like India, China, South Korea, Indonesia, and Thailand. The increasing industrial development and energy security needs in China and India, with their substantial energy demands, are driving this growth. Several cross-country oil and gas pipelines are planned for hydrocarbon transportation In these countries. China holds the world's largest shale gas reserves, with over 31 TCM of technically recoverable resources (EIA). In this context, the oil-free systems, including reciprocating compressors, oil-free rotary compressors, and centrifugal compressors, are gaining popularity due to their ability to provide clean air for various applications, such as air conditioners, automation equipment, pneumatic tools, conveyors, and industrial processes in oil refineries, power generation projects, chemical plants, and other industrial sectors.

Energy savings and emission reductions are essential considerations In the oil and gas industry, and air compressors play a crucial role in energy conservation and compliance with emission standards. Air audits and production losses due to contaminants and poor air quality are significant concerns, and advanced technologies, such as Big Data analytics and cloud technology, are being employed to optimize compressor performance and minimize energy waste. The Compressed Air Society's Code of Practice and various energy conservation standards guide the selection and operation of industrial air compressors, ensuring efficient and clean compressed air production.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Air Compressor In Oil And Gas Industry Industry?

Shift to more energy-efficient compressors is the key driver of the market.

What are the market trends shaping the Air Compressor In Oil And Gas Industry Industry?

Rising focus on economy and energy security is the upcoming market trend.

What challenges does the Air Compressor In Oil And Gas Industry Industry face during its growth?

Environmental concerns related to oil and gas exploration and production activities is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The air compressor in oil and gas industry market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air compressor in oil and gas industry market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air compressor in oil and gas industry market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ANEST IWATA Corp. - The oil and gas industry relies heavily on air compressors for various applications, including powering pneumatic tools and providing process air for operations. Air compressors used in this sector require high efficiency and reliability due to the harsh operating conditions. The company provides a range of compressor solutions for the oil and gas market, including oil-free screw compressors ZR and ZT VSD, oil-free air centrifugal compressors ZH and ZH Plus, and oil lubricated screw compressors GA VSD Plus. These compressors offer superior performance, energy efficiency, and low maintenance requirements, making them ideal for the demanding oil and gas environment. The company's compressor portfolio caters to diverse applications withIn the industry, ensuring optimal productivity and cost savings for customers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANEST IWATA Corp.

- Atlas Copco AB

- Bauer Comp Holding GmbH

- BOGE

- Chart Industries Inc.

- Doosan Portable Power Co.

- Elgi Equipments Ltd

- Fusheng Precision Co. Ltd.

- Gardner Denver

- General Electric Co.

- Hanbell Precise Machinery Co. Ltd.

- Ingersoll Rand Inc.

- KAESER KOMPRESSOREN SE

- Kaishan Compressor USA

- Kirloskar Pneumatic Co. Ltd.

- Porsche Automobil Holding SE

- Quincy Compressor

- Siemens Energy AG

- Sullair LLC

- Sulzer Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Air compressors play a crucial role in various industries, including the natural gas sector. In this context, the focus is on stationary air compressors, which are integral to the efficient operation of numerous applications In the energy and power sector. These compressors are employed in diverse settings, such as oil refineries, power generation projects, chemical plants, and industrial automation systems. Stationary air compressors are available in various types, including oil-free systems, reciprocating compressors, rotary compressors, oil flooded compressors, and centrifugal compressors. Each type caters to specific requirements based on factors like pressure, volume, and temperature. The oil and gas industry relies heavily on stationary air compressors for several applications.

For instance, in natural gas processing, these compressors are used to increase the pressure of natural gas to transport it through pipelines. In oil refineries, they help In the separation and processing of crude oil. In power generation projects, stationary air compressors are employed in combined cycle power plants to compress air for use in gas turbines. The demand for stationary air compressors In the oil and gas industry is driven by several factors. Energy savings is a significant consideration, as these compressors contribute to substantial energy consumption. The adoption of energy conservation standards and the need to reduce greenhouse gas emissions have led companies to invest in more efficient compressor technologies.

Air quality is another critical factor influencing the market dynamics. Contaminants In the compressed air can lead to production losses and equipment damage. To mitigate these issues, the use of oil-free compressors and advanced filtration systems has gained popularity. The stationary segment of the industrial air compressor market is witnessing significant growth due to the increasing automation in various industries. Automation equipment, conveyors, pneumatic tools, and other applications require clean, dry, and oil-free compressed air. The semiconductor and electronics industries, in particular, have stringent requirements for air quality due to the sensitivity of their manufacturing processes. The integration of big data analytics and cloud technology In the industrial sector is also driving the demand for stationary air compressors.

These technologies enable predictive maintenance, optimizing compressor performance, and reducing downtime. The market for stationary air compressors is expected to witness continued growth due to the increasing demand for cleaner and more efficient energy sources. The emergence of hydrogen as a potential energy source is particularly noteworthy, as it requires high-pressure compression for storage and transportation. In conclusion, the stationary air compressor market In the oil and gas industry is a dynamic and evolving landscape. Factors such as energy savings, air quality, and automation are driving the demand for more efficient and advanced compressor technologies. The integration of big data analytics and cloud technology is set to further transform the market, offering opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 2538 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Compressor In Oil And Gas Industry Market Research and Growth Report?

- CAGR of the Air Compressor In Oil And Gas Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air compressor in oil and gas industry market growth of industry companies

We can help! Our analysts can customize this air compressor in oil and gas industry market research report to meet your requirements.