Artificial Intelligence Market (AI) In Asset Management Size 2025-2029

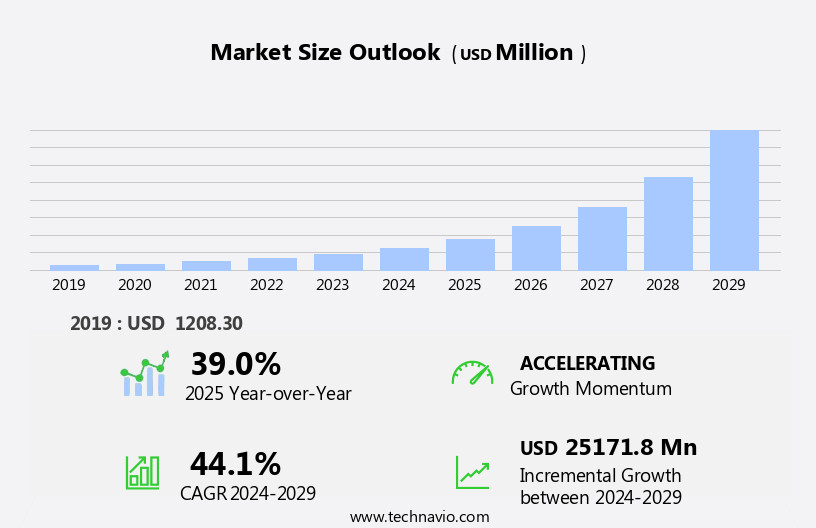

The AI in asset management size is forecast to increase by USD 25.17 billion at a CAGR of 44.1% between 2024 and 2029.

- The Artificial Intelligence (AI) market in asset management is experiencing significant growth, driven by the rapid adoption of AI technologies to enhance asset performance tracking and management capabilities. This trend is further fueled by the increasing popularity of cloud-based AI services, which offer greater flexibility and scalability for asset managers. However, the market also faces challenges related to data privacy and cybersecurity concerns, which require careful attention from industry players. Asset managers must ensure the secure handling of sensitive financial data and maintain compliance with regulatory requirements to mitigate risks and protect client information.

- Navigating these challenges while capitalizing on the opportunities presented by AI in asset management requires a strategic approach and a deep understanding of the market landscape. Companies seeking to succeed in this market must prioritize data security, invest in advanced AI technologies, and build robust compliance frameworks to meet the evolving needs of clients and regulators.

What will be the Size of the Artificial Intelligence Market (AI) In Asset Management during the forecast period?

- The artificial intelligence (AI) market in asset management continues to evolve, with various sectors integrating advanced technologies to enhance operations and improve investment strategies. Regulatory reporting and due diligence processes are streamlined through API integration and decision support systems. Virtual advisors and family offices cater to retail investors, while institutional investors, pension funds, and alternative investment managers leverage machine learning for asset allocation and risk management. AI-driven trading and predictive analytics enable quantitative investment management and high-frequency trading. Additionally, computer vision and natural language processing facilitate financial modeling and investment research.

- The ongoing integration of AI in asset management ensures continuous optimization and adaptation to market dynamics. Cloud computing enables scalable implementation and deployment of these advanced technologies. Overall, the AI market in asset management remains a dynamic and evolving landscape, with ongoing innovation and application across various sectors.

How is this Artificial Intelligence (AI) In Asset Management Industry segmented?

The artificial intelligence (ai) in asset management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- Application

- BFSI

- Retail and e-commerce

- Healthcare

- Energy and utilities

- Others

- Technology

- Machine learning

- Natural language processing

- Others

- Solution Type

- Portfolio Optimization

- Risk Management

- Predictive Analytics

- Robo-Advisors

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

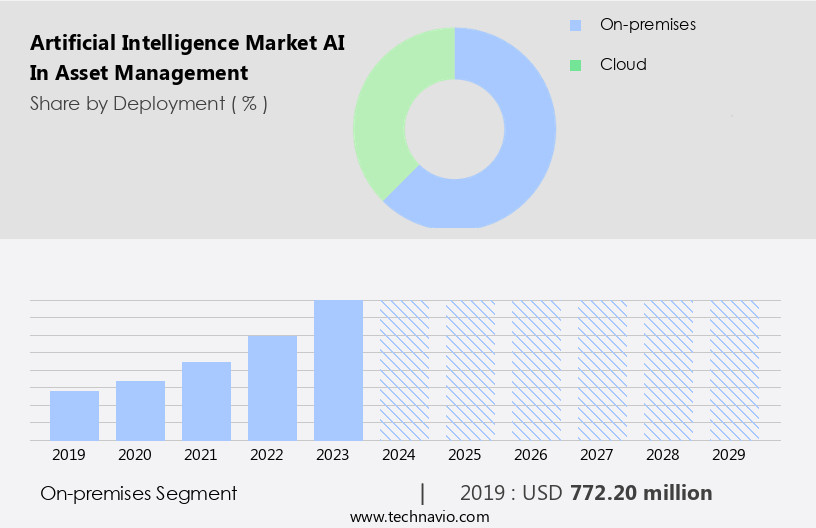

The on-premises segment is estimated to witness significant growth during the forecast period.

The on-premises segment of the artificial intelligence (AI) market in asset management is experiencing notable growth. On-premises AI solutions offer organizations greater control and flexibility over their data, as they are installed locally and customized to meet specific business requirements. Deep learning and machine learning algorithms are integrated into these solutions for advanced data analysis, enabling hedge funds, institutional investors, and family offices to make informed investment decisions. AI-driven risk management and fraud detection systems enhance financial technology, ensuring data security and regulatory compliance. Big data and predictive analytics are harnessed for quantitative investment management and portfolio optimization. Furthermore, AI-powered portfolio management and customer relationship management streamline operations, while natural language processing facilitates efficient investment research.

AI assistants and virtual advisors cater to retail investors, offering personalized investment strategies and recommendations. Cloud computing enables seamless API integration and real-time data processing, while algorithmic trading and high-frequency trading leverage AI for enhanced market insights. AI-driven research and sentiment analysis provide valuable alternative investment opportunities, and computer vision and data mining uncover hidden trends in real estate, private equity, and other asset classes. Overall, AI's role in asset management is transformative, offering a harmonious blend of technology and finance as fintech.

The On-premises segment was valued at USD 772.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The artificial intelligence (AI) market in North America's asset management sector is experiencing significant growth due to the region's rapid adoption of advanced technologies. AI, deep learning, and data science are transforming asset management by enabling fraud detection, risk management, portfolio optimization, and customer relationship management. Hedge funds and institutional investors are increasingly utilizing AI-powered portfolio management and quantitative analysis to gain a competitive edge. Financial technology firms are at the forefront of this trend, offering AI-driven trading, decision support systems, and predictive analytics. Cloud computing and API integration are facilitating the implementation of these solutions. In the realm of alternative investments, AI is being used for sentiment analysis, real estate, private equity, and predictive analytics.

Moreover, AI is enhancing financial modeling, algorithmic trading, and high-frequency trading. Natural language processing is streamlining investment research, while computer vision is revolutionizing data mining. Machine learning is enabling personalized investment strategies and wealth management. Data security is a critical concern, and AI is being employed to mitigate risks and ensure regulatory compliance. Retail investors are also benefiting from AI-assisted investment strategies and virtual advisors. Family offices and pension funds are leveraging AI for asset allocation and risk management. In conclusion, the AI market in North America's asset management sector is evolving rapidly, with advanced technologies such as AI, deep learning, and data science driving innovation and growth.The trend is expected to continue, as asset management firms seek to improve their operations, provide better services to their clients, and stay competitive in an increasingly digital industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Artificial Intelligence (AI) in Asset Management industry is rapidly transforming how investment strategies are designed, executed, and personalized. AI investment platforms for wealth management are streamlining operations and enhancing decision-making through data-driven insights. Predictive trading tools for asset managers and sentiment analysis for trading strategies enable firms to anticipate market trends with greater accuracy. Automated robo-advisors for retail investors are making personalized investing more accessible and efficient. Hedge funds are adopting AI-driven ESG analysis to align portfolios with sustainability goals. Blockchain compliance for asset management ensures transparency and trust across digital transactions. Firms are leveraging real-time portfolio management with AI and cloud-based AI for investment banks to boost scalability. Meanwhile, personalized investment tools for clients and ethical AI models for financial advisors are reinforcing client trust and regulatory alignment.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence (AI) In Asset Management Industry?

- The rapid adoption of artificial intelligence in asset management and the growing importance of asset tracking are primary drivers propelling market growth in this sector.

- Artificial Intelligence (AI) is revolutionizing the asset management industry by enabling faster, data-driven investment decisions. Utilizing advanced algorithms, AI processes vast amounts of data in real-time, allowing asset managers to optimize asset allocation and reduce risk. Deep learning and data science are key components of AI, facilitating the identification of trends and patterns that may elude human analysis. These insights can lead to more effective financial modeling and quantitative analysis. Furthermore, AI-powered portfolio management and AI-driven risk management are essential for hedge funds and other financial institutions.

- Computer vision is another application of AI, offering potential in areas such as fraud detection. The integration of AI in asset management is transforming financial technology, enabling more immersive and harmonious interactions between humans and machines. In conclusion, recent research indicates that AI is becoming increasingly essential for asset managers seeking to remain competitive in today's data-driven market.

What are the market trends shaping the Artificial Intelligence (AI) In Asset Management Industry?

- The increasing prevalence of cloud-based artificial intelligence (AI) services in asset management represents a significant market trend. This shift towards cloud-based AI solutions is mandated by the growing demand for advanced analytical capabilities and improved operational efficiency in the asset management industry.

- Artificial Intelligence (AI) is revolutionizing the asset management industry by enabling more data-driven investment strategies. Cloud-based AI services are particularly attractive to asset managers due to their cost-effectiveness and scalability. These services facilitate the processing of vast amounts of data, enabling the identification of patterns and trends that inform investment decisions. AI algorithms can analyze economic data, market trends, and other investment variables in real-time, providing asset managers with valuable insights for optimizing portfolios. Data mining and natural language processing are key AI technologies that enhance investment research, while algorithmic trading and high-frequency trading leverage AI for faster, more accurate execution of trades.

- Moreover, AI assistants can streamline customer relationship management, improving communication and personalizing the investment experience for retail investors. Data security is a critical concern in the financial sector, and AI can help mitigate risks by identifying potential threats and vulnerabilities. In conclusion, AI is transforming asset management by enhancing investment research, optimizing portfolios, streamlining customer interactions, and improving data security. Cloud computing is the enabler for these advancements, making AI services accessible and cost-effective for asset managers of all sizes.

What challenges does the Artificial Intelligence (AI) In Asset Management Industry face during its growth?

- The increasing concern over data privacy and cybersecurity issues poses a significant challenge to the industry's growth trajectory. Companies must prioritize these concerns to maintain consumer trust and mitigate potential risks, ensuring continued progress and innovation within the industry.

- The artificial intelligence (AI) market in asset management has experienced significant growth in recent years, offering asset management firms various benefits. AI technology enables more efficient regulatory reporting, enhanced due diligence, and improved decision-making processes through machine learning and virtual advisors. Institutional investors, family offices, pension funds, and other asset management entities increasingly rely on AI-driven trading and decision support systems. However, the adoption of AI in asset management comes with challenges, primarily data privacy and cybersecurity concerns. Asset management companies handle vast amounts of personal and sensitive data, which must be protected. Advanced AI algorithms require access to detailed information about individuals and their financial history, making data privacy a critical issue.

- Ensuring the security and privacy of this data while allowing AI algorithms to function effectively remains a significant challenge for the industry. In conclusion, the integration of AI in asset management offers numerous benefits, including improved operational efficiency, enhanced due diligence, and better decision-making capabilities. However, it also poses challenges related to data privacy and cybersecurity, which must be addressed to fully realize the potential of AI in asset management. API integration and advanced security measures can help mitigate these concerns, ensuring that asset management firms can reap the benefits of AI technology while maintaining data privacy and security.

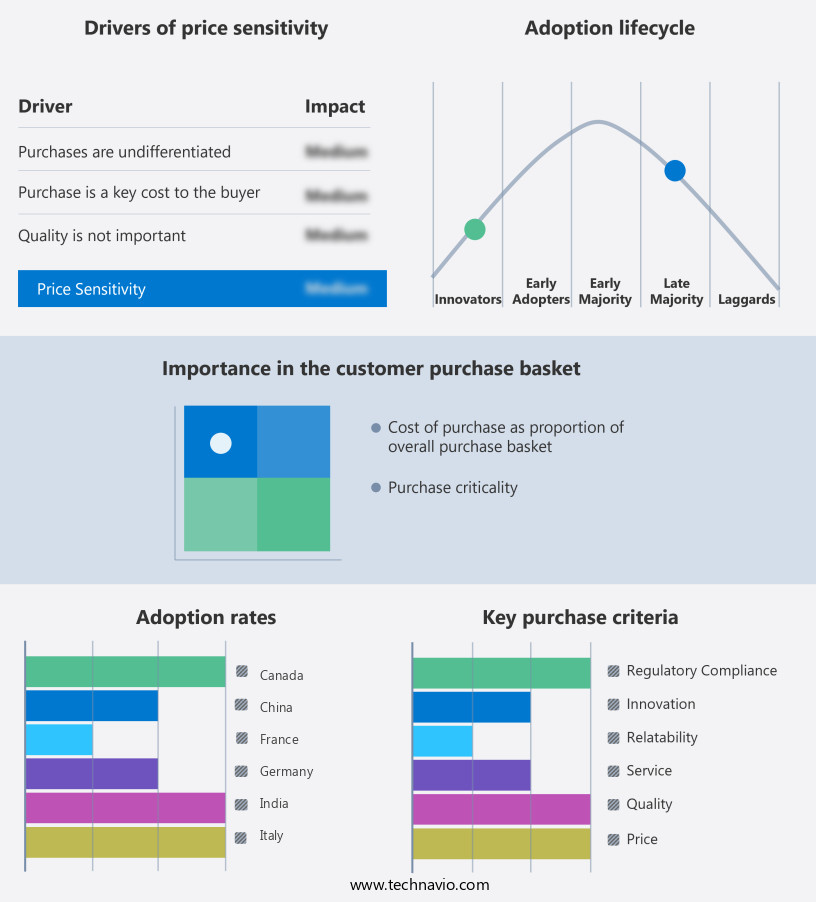

Exclusive Customer Landscape

The artificial intelligence market (ai) in asset management forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence market (ai) in asset management report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence market (ai) in asset management forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - Artificial intelligence enhances asset management services through Amazon Web Services. By leveraging advanced machine learning algorithms, this company delivers data-driven insights and optimized investment strategies. The technology analyzes market trends, identifies patterns, and makes informed decisions, thereby improving overall portfolio performance. Clients benefit from increased efficiency, accuracy, and transparency in their investment operations. This innovative approach to asset management empowers investors to make informed decisions and adapt to market fluctuations effectively.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- AXOVISION GmbH

- BlackRock Inc.

- Deloitte Touche Tohmatsu Ltd.

- Genpact Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Lexalytics Inc.

- Microsoft Corp.

- New Narrative Ltd.

- Salesforce Inc.

- The Charles Schwab Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence Market (AI) In Asset Management

- In February 2024, BlackRock, the world's largest asset manager, announced the launch of its Aladdin AI-powered portfolio management system, which uses machine learning algorithms to optimize investment portfolios based on market data and client preferences (BlackRock Press Release, 2024). This development signified a major stride in the adoption of AI in asset management, allowing for more efficient and personalized investment strategies.

- In October 2025, Goldman Sachs Asset Management entered into a strategic partnership with Microsoft to integrate Microsoft's Azure AI capabilities into its investment management platforms. This collaboration aimed to enhance Goldman Sachs' ability to process large amounts of data and make informed investment decisions more quickly (Goldman Sachs Press Release, 2025). The partnership underscored the growing importance of AI in the competitive asset management landscape.

- In December 2024, JPMorgan Chase's asset management division, J.P. Morgan Asset Management, secured a significant investment of USD150 million from SoftBank's Vision Fund 2 to expand its AI capabilities. This funding round highlighted the increasing investor confidence in the potential of AI to transform asset management and generate superior returns (J.P. Morgan Chase Press Release, 2024).

- In January 2025, the European Securities and Markets Authority (ESMA) published guidelines on the use of AI and machine learning in financial services, including asset management. The guidelines aimed to ensure a level playing field in the use of AI and promote transparency, accountability, and fairness in AI applications (ESMA, 2025). This regulatory development marked a crucial step towards establishing a robust regulatory framework for AI in asset management.

Research Analyst Overview

The Artificial Intelligence (AI) market in asset management continues to evolve, integrating advanced technologies such as blockchain technology and distributed ledger technology to enhance portfolio management. AI innovation, including reinforcement learning and automated trading systems, is revolutionizing risk appetite management by analyzing economic indicators and market volatility for optimal cost optimization. Performance attribution and tax optimization are also benefiting from AI, enabling more accurate and efficient analysis. Digital assets and smart contracts are transforming the investment landscape, requiring AI to navigate the complexities of alternative data analytics and data governance. AI ethics and bias are becoming increasingly important, with social media data and news sentiment analysis playing a crucial role in ensuring regulatory compliance and explainable AI (XAI) for investment decisions.

The financial technology ecosystem is increasingly powered by advanced digital infrastructure, enabling speed, security, and scalability. AI processing servers drive complex computations for real-time decision-making, while cloud infrastructure supports flexible and scalable deployment across global markets. Data analytics platforms extract actionable insights from large datasets, enhancing predictive accuracy. Blockchain nodes ensure secure, decentralized transaction validation, critical for transparency in digital finance. Trading terminals enable high-speed execution and monitoring of market activity. Regulatory demands are met with robust compliance software, while real-time data feeds keep firms updated on live market movements. Visualization systems help interpret data intuitively, and secure databases protect sensitive financial information. Seamless operations are achieved through API integration tools, connecting diverse systems across the financial landscape.

AI disruption in asset management is driving the adoption of AI transformation, with portfolio rebalancing and investment horizon analysis becoming more automated. Data privacy and security are essential considerations, as AI processes vast amounts of sensitive financial data. The future of AI in asset management lies in its ability to adapt to market trends and regulatory requirements while maintaining transparency and explainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence Market (AI) In Asset Management insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 44.1% |

|

Market growth 2025-2029 |

USD 25171.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

39.0 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence Market (AI) In Asset Management Research and Growth Report?

- CAGR of the Artificial Intelligence (AI) In Asset Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence market (ai) in asset management growth of industry companies

We can help! Our analysts can customize this artificial intelligence market (ai) in asset management research report to meet your requirements.