Automotive Parts Packaging Market Size 2024-2028

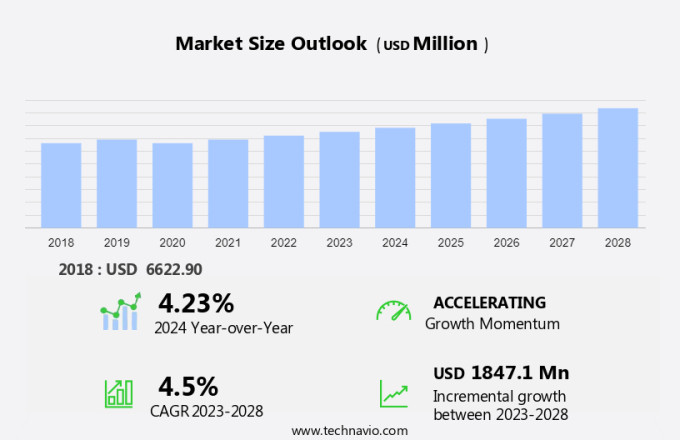

The automotive parts packaging market size is forecast to increase by USD 1.85 billion, at a CAGR of 4.5% between 2023 and 2028. Market growth in the protective packaging sector depends on several key factors. Increasing demand for protective packaging is driven by the need to safeguard products during transit and storage, ensuring they reach consumers in optimal condition. The increased usage of technological advancements in automotive parts contributes to this trend, as manufacturers require advanced packaging solutions to protect complex components.

Additionally, high demand from the after-sales market further fuels growth, as businesses seek durable and efficient packaging to enhance customer satisfaction and support returns or repairs. Together, these factors drive innovation in protective packaging solutions, highlighting the need for effective and reliable packaging to meet evolving industry requirements and consumer expectations.

What will be the Automotive Parts Packaging Market Size During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Segmentation

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Folding carton

- Corrugated box

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

By Product

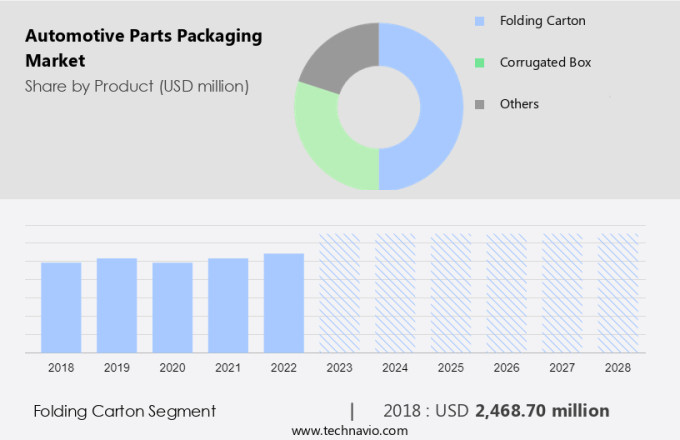

The folding carton segment is estimated to witness significant growth during the forecast period. In the automotive sector, packaging developments have gained significant importance due to the increasing production of automobiles and the growing demand for after sales components. Folding cartons are the most commonly used packaging type in the automotive parts packaging market. These cartons are cost-effective, available in various sizes, and offer flexibility. Manufactured from paperboards that are cut, folded, laminated, and printed, they are delivered as flat paperboards with folding lines for ease of use.

Get a glance at the market share of various regions Download the PDF Sample

The folding carton segment was valued at USD 2.47 billion in 2018. Folding cartons are primarily produced using recycled paper stock, virgin wood pulp, and other fibers. The automotive industry's expansion and the increasing demand from the after sales market are expected to boost the demand for folding cartons during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

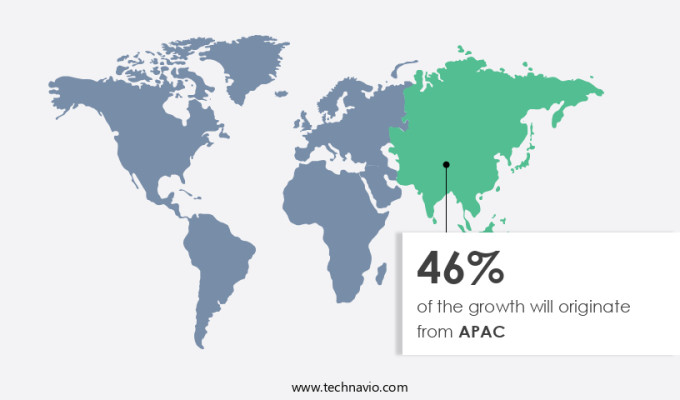

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Automotive Parts Packaging Market is witnessing significant developments in response to the evolving needs of the automotive sector. With the increasing production of automobiles, after sales components, mechanical systems, and electronic assemblies require efficient and protective packaging solutions. Space utilization and waste minimization are key considerations in production technology, leading to the adoption of reusable packaging for heavy components such as underbody and engine parts. Material science innovations, including biodegradable plastics, are gaining traction in the market for sustainable packaging solutions. Protective packaging, such as corrugated packaging products, bags, and pouches, ensures the safe transportation of automotive components. Lightweight and durable packaging solutions are essential for enhancing vehicle performance and reducing fuel consumption.

Advancements in automation, electrification, autonomous driving, connectivity, and electric vehicles necessitate packaging technology that accommodates wire bond technology, flip chip technology, and semiconductor assembly. Custom packaging solutions are increasingly important for automotive modules and components, with Tier 1 suppliers focusing on innovative designs to meet the demands of automotive applications. In-cabin options, such as passenger comfort features, require protective packaging to ensure their safety during transportation. The use of flexible packaging materials offers cost-effective and lightweight alternatives while maintaining the necessary protection for automotive components. Overall, the automotive parts packaging market is a dynamic and evolving industry, driven by technological advancements and the demands of the automotive sector.

Market Dynamic and Customer Landscape

- Automotive Parts Packaging Market Analysis,the market is a significant sector that caters to the transportation, storage, and damage prevention needs of automotive components. This market serves both the automotive manufacturers and aftermarket service providers, encompassing mechanical systems, electronic assemblies, and spare parts. Packaging developments in this industry focus on optimizing space utilization, enhancing handling, and ensuring logistics efficiency. Corrugated boxes, pallets, crates, trays, containers, and various other packaging solutions are extensively used in the automotive sector. Materials like plastic, metal, and paperboard are commonly employed due to their durability, cost-effectiveness, and protective properties. Automotive parts packaging plays a crucial role in the automotive supply chain, enabling seamless transportation and efficient after-sales service. E-commerce has significantly influenced the automotive parts packaging market, driving the demand for customized packaging solutions that cater to the unique requirements of various automotive components. The market is expected to grow steadily due to the increasing demand for automobiles and the need for effective packaging solutions to ensure the safe transportation and storage of automotive parts.

Automotive Parts Packaging Market Driver

- The growing need for protective packaging is a major factor propelling market growth, especially in the automotive industry. Protective packaging, including solutions like paper cushioning and honeycomb packaging, is widely used in the automotive sector to safeguard engine components, cooling systems, and other heavy components during storage and shipping. As automotive packaging demand rises, so does the reliance on protective packaging solutions such as molded pulp, which offers customization to product dimensions and is made from recyclable materials like paperboard and newsprints. This not only ensures eco-friendly disposal but also enhances packaging efficiency.

- For automotive parts, including both OEM and aftermarket components, durable packaging options such as corrugated packaging, plastic packaging, pallets, crates, trays, and containers are critical for preventing damage during handling and transit. These solutions are crucial for vibration protection and maintaining the integrity of sensitive components in the automotive supply chain.

- E-commerce platforms and online purchases have further fueled the demand for packaging solutions tailored to the unique needs of automotive manufacturers and aftermarket service providers. The market is also influenced by external factors like natural disasters and geopolitical conflicts, which can disrupt packaging material availability and drive up costs. In response, businesses are increasingly turning to customized packaging to ensure continuity.

- In conclusion, the Automotive Parts Packaging market growth is expected due to the rising demand for cost-effective, eco-friendly, and tailored packaging solutions, particularly in the context of protective packaging for the transportation, storage, and branding of automotive parts.

Automotive Parts Packaging Market Trends

- Increasing focus on customization and personalization in automotive parts packaging is the key trend in the market. The automotive parts packaging market encompasses various packaging materials and methods used to transport and store automotive components during the supply chain. Vendors in this industry are continually innovating to meet the unique requirements of automotive parts, leading to the development of both disposable and returnable packaging solutions. Disposable packaging, such as corrugated boxes, pallets, crates, trays, and containers made of plastic, metal, or paperboard, offer cost-effective damage prevention for automotive parts during transportation. On the other hand, returnable packaging, like reusable plastic crates and pallets, provide a more sustainable solution for the logistics of the automotive supply chain. Online purchasing and e-commerce platforms have significantly influenced the automotive parts packaging market.

- Further, aftermarket service providers and automotive manufacturers increasingly rely on customized packaging solutions to ensure branding and protection during transportation and storage. Innovations in packaging materials, such as multi-material packaging and the use of induction heat sealants, enhance the functionality and durability of automotive parts packaging. However, natural disasters and geopolitical conflicts can disrupt the supply chain and impact the demand for automotive parts packaging. Despite these challenges, the market for automotive parts packaging is expected to grow due to the increasing demand for aftermarket car parts and the need for effective damage prevention and handling solutions. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

- Rise in raw material costs is the major challenge that affects the growth of the market. The market relies heavily on disposable packaging solutions, primarily made from wood pulp. This raw material's price volatility, influenced by the availability of wood or recycled paper, poses a significant challenge for manufacturers. Any shortage in wood pulp availability results in increased prices, causing financial losses for manufacturers due to fixed box selling prices. Additionally, the cost of wood has risen in recent years, further exacerbating the issue. In response to these challenges, there is a growing trend towards returnable packaging solutions, such as pallets, crates, trays, and containers, made from multi-materials like rigid plastic, metal, and paperboard. These packaging methods offer advantages in terms of damage prevention, handling, logistics, and cost savings over time.

- Furthermore, customized packaging solutions, including branding, are increasingly popular in the automotive supply chain, catering to the needs of both OEM and aftermarket service providers. E-commerce platforms and online purchasing have also influenced the automotive parts packaging market, necessitating the need for efficient and cost-effective packaging solutions. Natural disasters and geopolitical conflicts can also impact the availability and pricing of packaging materials, making it crucial for manufacturers to maintain flexibility and adaptability in their packaging strategies. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Cascades Inc. - The company offers Cascades container board packaging for automotive parts packaging.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Deufol SE

- DS Smith Plc

- EZ Custom Boxes

- GWP Group Ltd.

- IPS Packaging and Automation

- JIT Packaging Inc.

- Mondi Plc

- Nefab AB

- Pacific Packaging Products Inc.

- Packaging Corp. of America

- Packman industries

- Pratt Industries Inc.

- Sealed Air Corp.

- Signode India Ltd.

- Smurfit Kappa Group

- Sonoco Products Co.

- Sunbelt Paper and Packaging

- THIMM Group GmbH plus Co. KG

- Victory Packaging LP

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Development and News

- In November 2024, Twinplast expanded into the automotive sector, launching custom packaging solutions made from dense polypropylene to protect vehicle components during transport. These environmentally friendly options are reusable, helping reduce carbon footprints.

- In October 2024, One World Products introduced hemp-based molded containers for Flex-N-Gate, offering a renewable material alternative for automotive packaging. This solution aims to minimize carbon emissions in the sector.

- In October 2023, DS Smith opened a new packaging research and development center in Birmingham, UK, focused on packaging waste reduction and sustainable productivity. The facility accelerates the development of innovative automotive packaging solutions.

- In November 2024, Michelin and Schaeffler announced plans to close factories and reduce nearly 6,000 jobs across Europe due to ongoing challenges in the automotive sector, including the transition to electric vehicles and increasing competition.

Market Analyst Overview

The market is a significant segment of the packaging industry, catering to the unique requirements of the automotive sector. Automobiles, whether new or after sales, necessitate various components, including mechanical systems, electronic assemblies, and spare parts. Packaging plays a crucial role in ensuring the safe and efficient transportation of these components. Space utilization and waste minimization are key considerations in automotive parts packaging. Production technology advances, such as automation, have led to the development of reusable packaging solutions for heavy components like engine parts and underbody components. Material science innovations, such as biodegradable plastics, have also gained popularity due to their environmental benefits. Protective packaging, such as corrugated packaging products, bags and pouches, and lightweight packaging, ensure the safe transportation of delicate electronic assemblies and automotive modules.

In addition, durable packaging solutions, including flexible packaging, are essential for long-term storage and transportation of automotive components. The packaging technology landscape is evolving with advancements in wire bond technology and flip chip technology, which facilitate the assembly of semiconductor components in automotive applications. The electrification trend in the automotive industry is driving the demand for packaging solutions for electric vehicle batteries and other components. Tier 1 suppliers are increasingly investing in custom packaging solutions to meet the specific needs of automotive OEMs and enhance vehicle performance. In cabin options, such as connectivity and passenger comfort, are also driving the demand for innovative packaging solutions. Overall, the automotive parts packaging market is expected to grow significantly in the coming years, driven by the increasing demand for automation, electrification, and connectivity in the automotive sector.

| Automotive Parts Packaging Market Scope | |

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 1.85 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 46% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Cascades Inc., Deufol SE, DS Smith Plc, EZ Custom Boxes, GWP Group Ltd., IPS Packaging and Automation, JIT Packaging Inc., Mondi Plc, Nefab AB, Pacific Packaging Products Inc., Packaging Corp. of America, Packman industries, Pratt Industries Inc., Sealed Air Corp., Signode India Ltd., Smurfit Kappa Group, Sonoco Products Co., Sunbelt Paper and Packaging, THIMM Group GmbH plus Co. KG, and Victory Packaging LP |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies