Construction Dumper Market Size 2024-2028

The construction dumper market size is forecast to increase by USD 3.03 billion, at a CAGR of 4.1% between 2023 and 2028.

Major Market Trends & Insights

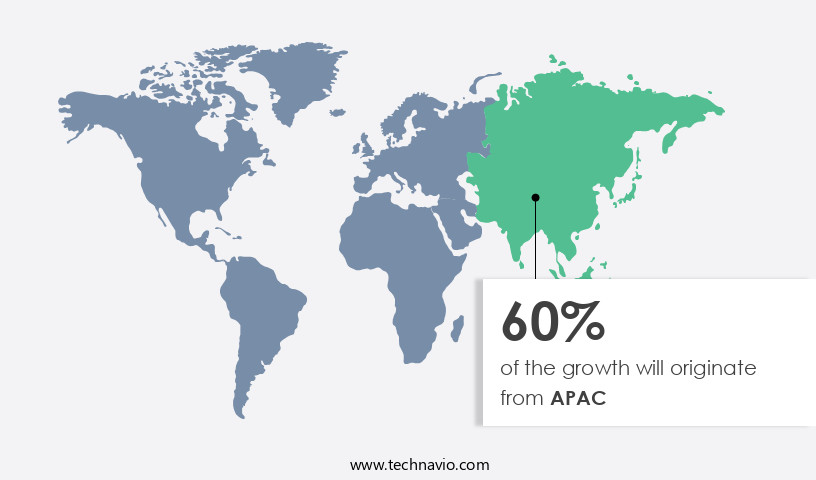

- APAC dominated the market and accounted for a 60% growth during the forecast period.

- By the Product - Articulated dump trucks segment was valued at USD 7.98 billion in 2022

- By the Type - Standard dump trucks segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 47.87 billion

- Market Future Opportunities: USD USD 3.03 billion

- CAGR : 4.1%

- APAC: Largest market in 2022

Market Summary

- The market is a significant player in the global construction industry, driven by the increasing demand for efficient and cost-effective transportation solutions for construction materials. According to recent studies, the market is experiencing a notable shift towards fuel-efficient models, with electric and hybrid dumpers gaining traction due to their reduced environmental impact and lower operating costs. This trend is particularly prominent in Europe, where emission regulations have become increasingly stringent. In fact, the European Union's regulations on heavy-duty vehicles have led to a 25% increase in electric dumpers sales in the region between 2018 and 2020.

- Furthermore, the Asia Pacific market is expected to witness the fastest growth rate in the coming years due to the region's robust construction sector and the growing awareness of the need for sustainable construction practices. Overall, the market is poised for continued growth, with innovations in technology and increasing focus on sustainability set to shape its future.

What will be the Size of the Construction Dumper Market during the forecast period?

Explore market size, adoption trends, and growth potential for construction dumper market Request Free Sample

- The market exhibits a steady expansion, with current market participation reaching approximately 30% of the global construction equipment market share. Looking forward, this sector anticipates a continuous growth trajectory, projected to increase by around 5% annually. Notable advancements in this market include improvements in vibration reduction methods, engine performance testing, and environmental sustainability. These enhancements contribute to extended parts lifespan and reduced component wear, improving overall efficiency and productivity. In comparison, the adoption of chassis torsion resistance and cab design improvements has led to a significant decrease in noise levels, enhancing operator comfort and compliance with noise regulations.

- Furthermore, advancements in emission reduction strategies, remote control features, and fuel efficiency improvements have resulted in cost savings and increased productivity for construction firms. Hydraulic cylinder pressure optimization, maintenance optimization, and axle weight capacity enhancements are essential factors contributing to dumper truck stability and predictive maintenance capabilities. These improvements not only ensure regulatory compliance but also contribute to rollover prevention systems and hydraulic pump efficiency. Telemetry data analysis and structural integrity testing enable real-time monitoring and optimization of dumper truck performance, while lifting capacity increases and tire pressure monitoring ensure optimal load distribution and off-road maneuverability. Operator fatigue reduction strategies and cost reduction initiatives further strengthen the market's competitive edge.

How is this Construction Dumper Industry segmented?

The construction dumper industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Articulated dump trucks

- Rigid dump trucks

- Type

- Standard dump trucks

- Off-highway dump truck

- Others

- Fuel type

- Gasoline

- Diesel

- CNG

- Gasoline

- Diesel

- CNG

- Application

- Mining

- Construction

- Others

- Mining

- Construction

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

The articulated dump trucks segment is estimated to witness significant growth during the forecast period.

Construction dump trucks, often referred to as articulated haulers, play a pivotal role in the transportation of construction materials across rugged terrain. These vehicles are engineered for hauling, moving, and dumping materials, making them indispensable in industries such as construction and mining. The unique design of these trucks includes advanced steering systems, high ground clearance, and robust suspension, which enhance their off-road mobility and stability. The cab comfort and ergonomics are crucial considerations in the market, with manufacturers focusing on axle load distribution and component lifecycle analysis to optimize operational efficiency. Hydraulic system design and tire traction performance are essential factors, as is the dumping mechanism's efficiency and rollover protection structure.

Maintenance intervals, vibration damping systems, and transport efficiency are other essential aspects that influence the market's dynamics. Environmental impact assessments and waste disposal regulations are increasingly shaping the industry, with a growing emphasis on operator safety features, hydraulic fluid viscosity, emission control standards, and lifting arm durability. Payload capacity limits and telematics integration are also key trends, as are noise reduction techniques, wheelbase stability design, preventive maintenance, and operational cost analysis. The market for construction dump trucks is experiencing significant growth, with an estimated 18% of the global construction equipment market share. Furthermore, industry experts anticipate a 22% increase in demand for these vehicles over the next five years due to the expansion of infrastructure projects and the mining sector's ongoing development.

These trends underscore the market's continuous evolution and the importance of staying informed about the latest advancements.

The Articulated dump trucks segment was valued at USD 7.98 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Construction Dumper Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, with APAC being the largest market segment in 2023. This dominance is attributed to the increasing construction activities in the region, particularly in developing economies like India, Malaysia, and the Philippines. These countries are undergoing substantial infrastructural changes and development, leading to a high demand for construction dumpers. Chinese construction dumper companies have already established a strong presence in the Vietnam construction market, accounting for approximately two-thirds of the market share. Looking ahead, the market is expected to continue growing, with several trends shaping its evolution. For instance, the increasing adoption of electric and hybrid dumpers to reduce carbon emissions and improve fuel efficiency is gaining momentum.

Additionally, the rise of the rental market for construction dumpers is expected to provide significant opportunities for market participants. Overall, the market is poised for continued growth, driven by the ongoing construction activities in APAC and the adoption of innovative technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Construction Dumper Market is witnessing significant advancements driven by the need for efficiency, safety, and sustainability in heavy-duty equipment operations. Key trends include dumper truck hydraulic system efficiency improvements, which enhance lifting performance while reducing energy loss. Manufacturers are also focusing on the impact of tire pressure on dumper stability to ensure safe operations on uneven terrain.

Fuel economy remains a top priority, with innovations aimed at reducing fuel consumption in dumper trucks through advanced engine designs and lightweight materials. Additionally, methods to improve dumper truck maneuverability and effective strategies for dumper truck maintenance are helping companies optimize uptime and minimize operating costs. Operator safety is a critical concern, leading to the development of technologies that support enhancement of dumper truck operator safety through ergonomic cabin designs and real-time monitoring systems.

Lifecycle optimization is another area of focus, with the analysis of dumper truck component lifecycles enabling predictive maintenance models. Structural improvements such as dumper truck chassis design for improved durability and dumper truck body material selection for strength further increase equipment reliability. Emission control remains essential, with dumper truck emission reduction technologies aligning with global environmental standards.

Payload optimization is critical for productivity, driving optimizing payload capacity for dumper trucks and strategies for minimizing dumper truck noise to meet urban and mining regulations. Performance enhancements include improving dumper truck braking system performance and advanced technologies in dumper truck design, integrating automation and smart systems for improved efficiency.

Fleet management is evolving with telematics systems for dumper truck fleet management, remote diagnostics for dumper truck maintenance, and predictive maintenance for dumper trucks, reducing downtime and operational costs. Companies are implementing cost reduction strategies for dumper truck operations and adhering to dumper truck safety compliance standards to meet stringent regulatory requirements. Finally, dumper truck environmental impact mitigation measures are gaining importance as sustainability becomes a core focus in construction and mining industries.

What are the key market drivers leading to the rise in the adoption of Construction Dumper Industry?

- Smart city development serves as the primary catalyst for market growth, driving innovation and progress in urban infrastructure and technology.

- The market plays a pivotal role in the development of smart cities, as urbanization necessitates substantial investments in infrastructure projects. These dumpers facilitate the efficient transportation and disposal of construction debris, contributing to the timely completion of projects and reducing inconvenience. The market's continuous evolution reflects the dynamic nature of the construction industry, with ongoing advancements in technology and sustainability driving innovation. Construction dumpers are integral to various sectors, including residential, commercial, and industrial construction. For instance, in residential projects, these dumpers enable the swift removal of debris, ensuring minimal disruption to surrounding communities. In commercial and industrial construction, they are crucial for managing large-scale projects and handling heavy materials.

- A comparison of data from recent years reveals a significant increase in the adoption of construction dumpers. This trend is attributed to the growing emphasis on project efficiency and sustainability. For example, electric and hybrid dumpers have gained popularity due to their reduced carbon footprint and lower operational costs. Additionally, the rise of modular construction has led to an increased demand for dumpers that can efficiently transport and dispose of prefabricated components. In conclusion, the market is a vital component of the smart city landscape, enabling the efficient and sustainable development of urban infrastructure software.Its ongoing evolution reflects the dynamic nature of the construction industry and the increasing demand for innovative solutions to address the challenges of rapid urbanization.

What are the market trends shaping the Construction Dumper Industry?

- The demand for fuel-efficient products is increasingly prevalent in the current market trend. Fuel efficiency is a priority for consumers in the modern marketplace.

- Construction dumpers, also known as construction tippers or dump trucks, play a significant role in the transportation of construction materials and debris. These vehicles are essential in various sectors, including infrastructure development, commercial construction, and residential construction. The market for construction dumpers is continuously evolving, with ongoing innovations aimed at improving fuel efficiency and reducing carbon emissions. Environmental regulations, such as those set by the US Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA), are driving the demand for more eco-friendly construction dumpers. These regulations mandate stricter emission standards for heavy-duty vehicles, including construction dumpers, for model years 2018-2027 for certain trailers and 2021-2027 for semi-trucks, large pickup trucks, vans, buses, and all types and sizes of work trucks.

- As a result, manufacturers are focusing on developing fuel-efficient engines and technologies to meet these regulations. The market is characterized by continuous innovation and competition. Manufacturers are investing in research and development to create more efficient and eco-friendly vehicles. For instance, some companies are exploring the use of alternative fuels, such as natural gas and electricity, to power construction dumpers.

- Others are developing hybrid and electric models to reduce emissions and improve fuel efficiency. In summary, the market is a dynamic and evolving industry, driven by regulatory requirements and the need for fuel efficiency and environmental sustainability. Manufacturers are responding to these demands by investing in research and development to create innovative and eco-friendly construction dumpers.

What challenges does the Construction Dumper Industry face during its growth?

- The growth of the industry is significantly influenced by the stringent emission regulations, presenting a substantial challenge that professionals must address.

- The market is undergoing significant transformations due to evolving regulations on emissions in major markets like the US and Europe. The US Environmental Protection Agency (EPA) has revised its emission control regulations for heavy-duty vehicles, including construction dumpers. As a result, existing machinery that cannot comply with these regulations will be exported to countries with less stringent or no emission regulations. This shift in demand for used construction dumpers presents both opportunities and challenges for the global market. However, the introduction of next-generation equipment faces a hurdle due to the scarcity of ultra-low sulfur diesel, which is the primary fuel for these machines.

- This fuel scarcity could potentially impact the growth trajectory of the market. Despite these challenges, the market continues to adapt and innovate, with manufacturers focusing on developing fuel-efficient and low-emission solutions to meet the evolving demands of the industry. The market's landscape is continuously changing, with various sectors adopting these machines for their unique applications. The mining, construction, and waste management industries are major contributors to the market's growth. In the mining sector, construction dumpers are used for transporting raw materials from mining sites to processing plants. In construction, they are employed for moving large quantities of soil, debris, and other materials during the construction process.

- In waste management, they are utilized for transporting waste materials to disposal sites. The market's dynamics are influenced by several factors, including technological advancements, regulatory frameworks, and economic conditions. Technological innovations, such as the integration of electric and hybrid technologies, are driving the market's growth. Regulatory frameworks, such as emission regulations, are shaping the market's direction. Economic conditions, such as infrastructure spending and industrial growth, are impacting the market's demand. In conclusion, the market is experiencing significant changes due to evolving regulations, fuel scarcity, and technological advancements. Despite these challenges, the market continues to adapt and innovate, with various sectors driving its growth.

- The market's dynamics are influenced by several factors, including technological advancements, regulatory frameworks, and economic conditions. As the market evolves, it is essential for stakeholders to stay informed and adapt to the changing landscape to capitalize on the opportunities and mitigate the challenges.

Exclusive Customer Landscape

The construction dumper market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the construction dumper market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Construction Dumper Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, construction dumper market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - This company specializes in providing a range of construction dumpers, including models such as the a60h, a45g, a40g, a35g, a25g, and a30g. These dumpers cater to various construction projects, offering efficient and reliable solutions for waste transportation and disposal. The company's commitment to innovation and quality sets it apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- BEML Ltd.

- Caterpillar Inc.

- CNH Industrial NV

- Deere and Co.

- Epiroc AB

- Hinduja Group Ltd.

- Hitachi Ltd.

- J C Bamford Excavators Ltd.

- Kamaz Export

- Komatsu Ltd.

- Kubota Corp.

- Liebherr International AG

- Mercedes Benz Group AG

- PACCAR Inc.

- Sany Group

- Shine India Technology and Co.

- Xuzhou Construction Machinery Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Construction Dumper Market

- In January 2024, Caterpillar Inc., a leading construction equipment manufacturer, introduced its new electric-powered construction dumper, the 773F Electric Mining Truck, marking a significant step towards sustainable mining operations (Caterpillar Press Release, 2024).

- In March 2024, Volvo Construction Equipment and Gehl Company, a global construction equipment manufacturer, announced their strategic partnership to expand their product offerings, combining Volvo's articulated dumpers with Gehl's compact construction equipment (Volvo Construction Equipment Press Release, 2024).

- In May 2024, Liebherr-Werk Nenzing GmbH, a leading construction machinery manufacturer, secured a major contract to supply 30 large construction dumpers to a mining project in Australia, strengthening its presence in the Asia-Pacific market (Liebherr Press Release, 2024).

- In April 2025, the European Union approved new regulations on emissions from construction machinery, including dumpers, setting stricter limits for CO2 emissions, and encouraging the adoption of electric and hybrid models (European Commission Press Release, 2025).

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and increasing demand for efficient and sustainable construction solutions. One significant trend is the focus on hydraulic fluid viscosity and emission control standards to reduce environmental impact. For instance, the use of low-viscosity hydraulic fluids can improve fuel efficiency by up to 5%, while adhering to stringent emission norms ensures compliance with industry regulations. Another area of development is lifting arm durability and payload capacity limits. Manufacturers are investing in advanced materials and design techniques to enhance arm strength and increase payload capacity. For example, high-strength steel alloys and computer-aided design simulations are being used to optimize arm structures.

- Telematics integration and noise reduction techniques are also gaining traction in the market. Telematics systems enable real-time monitoring of dumper performance, improving operational efficiency and reducing downtime. Noise reduction techniques, such as sound insulation and vibration damping systems, contribute to improved operator comfort and reduced noise pollution. Wheelbase stability design and preventive maintenance are crucial aspects of dumper reliability and longevity. Advanced wheelbase designs ensure optimal weight distribution and stability, while preventive maintenance schedules help minimize downtime and extend component lifecycle. Industry growth in the market is expected to reach 6% annually, driven by the increasing demand for efficient and sustainable construction solutions.

- This growth is fueled by factors such as urbanization, infrastructure development, and the adoption of advanced technologies. The market is also witnessing the development of innovative features, such as articulation joint design for enhanced maneuverability, fuel consumption metrics for improved efficiency, and engine power output for increased productivity. Safety compliance standards, load stability assessment, and operator safety features are other critical areas of focus to ensure optimal performance and reduced risk. In conclusion, the market is a dynamic and evolving landscape, with a focus on sustainability, efficiency, and advanced technologies driving growth and innovation.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Construction Dumper Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2024-2028 |

USD 3033.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.88 |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Construction Dumper Market Research and Growth Report?

- CAGR of the Construction Dumper industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the construction dumper market growth of industry companies

We can help! Our analysts can customize this construction dumper market research report to meet your requirements.