Containerized And Modular Data Center Market Size 2024-2028

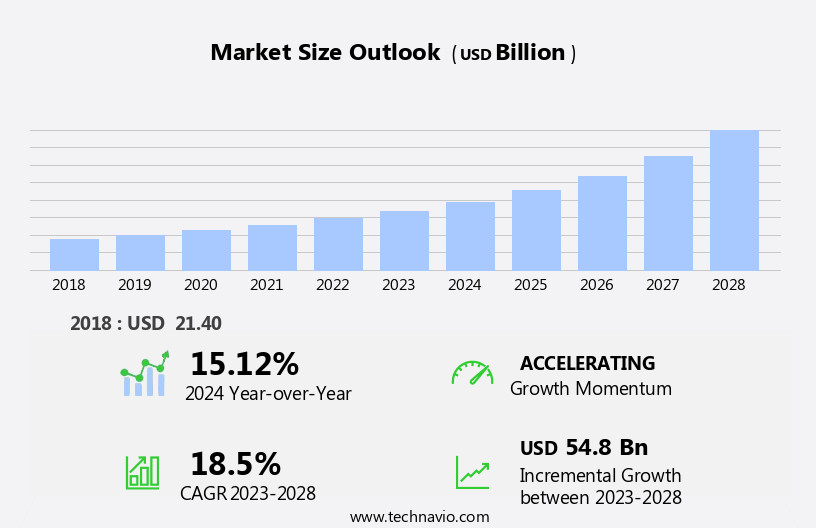

The containerized and modular data center market size is forecast to increase by USD 54.8 billion at a CAGR of 18.5% between 2023 and 2028.

- The market is witnessing significant growth, driven by the rapid deployment capability of these data centers. The use of containerized and modular designs allows for faster setup and scalability, making them an attractive option for businesses seeking to quickly expand their IT infrastructure. Another key trend in the market is the implementation of software-defined modular data centers, which offer increased flexibility and efficiency through automation and virtualization. Data center cooling systems are being optimized to reduce energy consumption and improve efficiency, while compliance and standards are increasingly important to ensure data security and regulatory adherence. Power management and optimization are also critical, with the integration of renewable energy sources and energy storage systems becoming more prevalent.However, the market also faces challenges, including the lack of awareness and expertise in operating containerized and modular data centers.

- As these systems differ significantly from traditional data center designs, organizations may require additional training and resources to effectively manage and maintain them. This could potentially hinder market growth and may require companies to provide comprehensive support and consulting services to help customers navigate the transition.

What will be the Size of the Containerized And Modular Data Center Market during the forecast period?

- The market continues to evolve, driven by the demand for agile and scalable IT solutions. Data center deployment is shifting towards containerized and modular designs, enabling faster deployment and easier expansion. Data center virtualization is a key enabler, allowing for the efficient utilization of resources and improved IT infrastructure management.

- Micro and modular data centers are gaining traction in edge computing applications, enabling decentralized IT infrastructure and reducing latency. The integration of networking infrastructure, server infrastructure, and storage infrastructure is essential for seamless data center operations. Data center design and monitoring are becoming more sophisticated, with cloud management platforms and software-defined networking enabling real-time data analysis and automation. Data center resilience is a key consideration, with virtualization software and cloud computing providing robust disaster recovery solutions. The ongoing development of 5G networks is driving the need for advanced data center infrastructure, while sustainability remains a priority with the adoption of green energy and energy-efficient technologies. The market dynamics are constantly unfolding, with new applications and technologies shaping the future of data center deployments.

How is this Containerized And Modular Data Center Industry segmented?

The containerized and modular data center industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Enterprise IT

- Cloud Providers

- Edge Computing

- Telecom

- Type

- Modular data center

- Containerized data center

- Deployment

- Temporary Setups

- Permanent Installations

- Hybrid Models

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

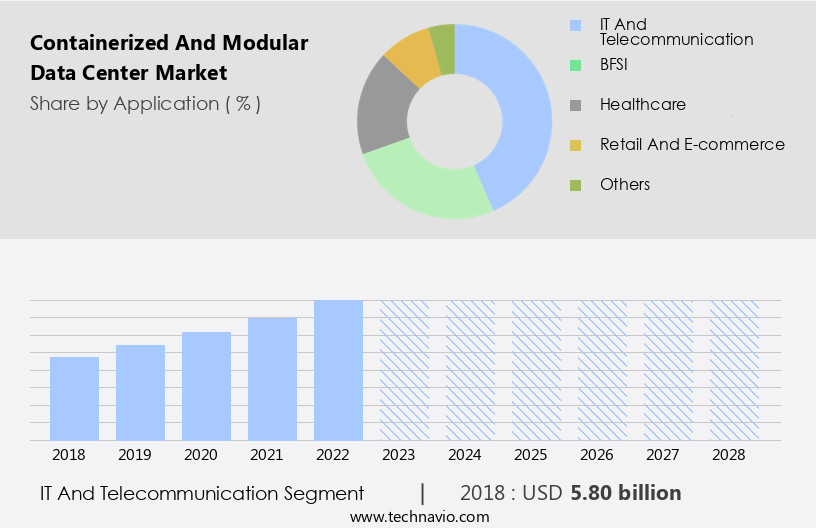

By Application Insights

The enterprise it segment is estimated to witness significant growth during the forecast period.

Data centers play a pivotal role in the IT and telecom sector, supplying essential computing power and storage for a multitude of applications and services. With the widespread adoption of cloud computing, businesses can access on-demand resources such as central processing units (CPUs), computer memory, file storage, and I/O devices, eliminating the need for costly hardware investments. The surge in data generation from businesses and individuals necessitates advanced data center solutions, including containerized and modular data centers, capable of handling vast amounts of data. Data center certifications ensure adherence to industry standards, while data center management optimizes resources and ensures compliance.

Data center consolidation streamlines operations, reducing costs and improving efficiency. The integration of 5G technology in data centers enhances connectivity and enables faster data processing. Data center security safeguards sensitive information, while analytics provide valuable insights for businesses. Server infrastructure and networking infrastructure form the backbone of data centers, supporting the deployment and virtualization of IT infrastructure. Data center cooling systems maintain optimal temperatures, and power management ensures energy efficiency. Data center optimization and sustainability are crucial, with micro and modular data centers and edge computing reducing carbon footprint. Virtualization software, cloud management platforms, and software-defined networking facilitate seamless data center design, monitoring, and networking.

Hyperscale data centers accommodate massive amounts of computing power and storage, making them ideal for handling the demands of cloud computing. Storage infrastructure and data center automation further enhance data center capabilities. Data center resilience ensures business continuity in the face of disruptions. Overall, the data center market is dynamic, with evolving trends shaping the industry landscape.

The Enterprise IT segment was valued at USD 5.80 billion in 2018 and showed a gradual increase during the forecast period.

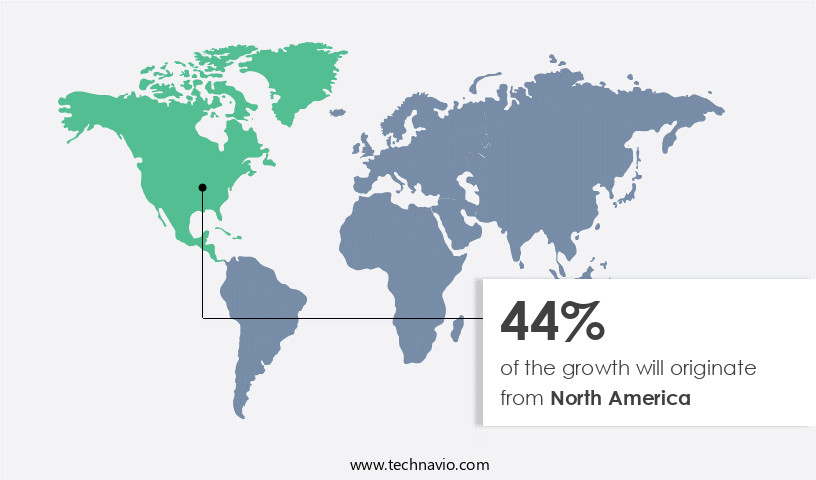

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US and Canadian markets for data center solutions are experiencing significant growth due to the increasing adoption of cloud services by enterprises. Cloud computing offers enterprises the opportunity to reduce operational and capital expenditures associated with traditional on-premises data centers. Hyperscale cloud providers, such as AWS, Microsoft, and Oracle, are popular choices for businesses seeking to meet their computing capacity requirements at minimal cost. As of March 2024, the US hosts approximately 5,381 data centers, making it the global leader in this regard. This existing infrastructure, coupled with the region's enterprise base, further fuels the market's expansion.

Data center certifications and compliance are crucial factors in ensuring the reliability and security of these facilities. Data center management, optimization, and monitoring are essential to maintaining their efficiency and performance. Data center cooling, power, and infrastructure are essential components, as is the integration of networking and server infrastructure. Data center virtualization and automation are key trends, with software-defined networking and cloud management platforms playing significant roles. Edge computing and modular data centers, including containerized solutions, are gaining traction due to their flexibility and scalability. Data center security remains a top priority, with analytics and resilience being critical components.

Data center design, sustainability, and 5G integration are also important considerations. The market for data center infrastructure, including server, storage, and networking components, is expected to grow as businesses continue to prioritize digital transformation and cloud adoption.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

ISO container data centers for cloud computing target IT and telecom, while prefabricated modular units for edge computing appeal to healthcare. 20-foot containers for disaster recovery suit BFSI, and 40-foot containers for 5G infrastructure support telecommunication networks. Customized containers for remote operations attract military and defense, while hybrid cooling solutions for energy efficiency draw energy and utilities. AI-optimized infrastructure for high-performance computing serves large enterprises. Scalable modular designs for smart city applications, energy-efficient data centers for telecommunication networks, and liquid cooling technology for IoT data processing ensure sustainability and rapid deployment for SMEs.

Scalable modular designs enable rapid deployment systems, while energy-efficient data centers use liquid cooling technology. AI-driven automation optimizes high-performance computing, and edge-optimized solutions support low-latency infrastructure. Green data center solutions incorporate sustainable materials, while modular UPS systems ensure high reliability. Liquid cooling technology enhances energy efficiency, and low-latency infrastructure powers 5G infrastructure & services. Scalable modular designs cater to smart city applications, and AI-driven automation streamlines IoT data processing. These innovations meet end-user needs for cost-effective solutions, sustainability, and flexibility and mobility, fostering growth in cloud computing and telecommunication networks.

What are the key market drivers leading to the rise in the adoption of Containerized And Modular Data Center Industry?

- The rapid deployment of data centers serves as the primary catalyst for market growth.

- In today's rapidly evolving business landscape, organizations require flexible and efficient data center solutions to meet their evolving needs. Traditional data center deployment can take up to 18-24 months, which is too long for many businesses. Modular data centers, with their preassembled standardized components such as racks and IT infrastructure, offer a faster deployment time of around six months. Containerized data centers can be operational in just four months, making them six times faster than traditional data center construction. Data center monitoring, networking, automation, and storage infrastructure are crucial components of these modern data centers.

- Cloud computing is increasingly being adopted for its scalability and cost savings. Software-defined networking (SDN) is another key trend, providing greater control and agility in managing network infrastructure. Hyperscale data centers, which cater to the needs of large cloud service providers, are also gaining popularity due to their ability to handle massive amounts of data. These data centers require advanced cooling systems, power management, and security features. In conclusion, the market for containerized and modular data centers is dynamic and evolving, driven by the need for faster deployment, increased efficiency, and advanced capabilities. These solutions offer significant benefits, including shorter deployment times, improved scalability, and cost savings.

- Organizations looking to deploy new data centers or expand their existing ones should consider these modern, flexible, and efficient solutions.

What are the market trends shaping the Containerized And Modular Data Center Industry?

- Software-defined modular data centers are becoming increasingly popular in the market. The implementation of this technology is a mandated trend in modern data center design.

- A software-defined modular data center is an advanced infrastructure solution where hardware is managed through intelligent software systems, enabling the delivery of data center services as a virtualized offering. This approach supports both legacy applications and cloud computing services, leading to improved efficiency, reduced costs, and faster application deployment. Comprised of software-defined networking (SDN), software-defined data centers (SDC), and software-defined storage (SDS), SDDC solutions offer higher availability, better security, and the ability to deliver workloads through the cloud. With the increasing adoption of cloud-based infrastructure, businesses are recognizing the benefits of SDDCs for greater control over critical operations and enhanced data center management.

- Key components of SDDCs include data center certifications, data center management, data center consolidation, data center 5G, data center security, data center analytics, data center edge, server infrastructure, and networking infrastructure. These elements work together to create a harmonious and immersive environment for businesses seeking to optimize their data center operations.

What challenges does the Containerized And Modular Data Center Industry face during its growth?

- The absence of sufficient awareness and expertise in managing data centers poses a significant challenge to the industry's growth trajectory.

- Modular and containerized data centers offer numerous advantages over traditional brick-and-mortar facilities, including faster deployment, scalability, and cost savings. However, some data center operators remain unaware of these benefits due to a lack of understanding about modular facilities. The construction of modular data centers involves lower upfront costs compared to traditional facilities, as they can be added in modules as demand grows. This flexibility makes them an attractive option for colocation and telecommunication service providers. Despite these advantages, there are challenges to implementing modular and containerized data center solutions. One of the main obstacles is the need for specialized skills to operate and configure these facilities.

- Additionally, there may be incremental capital expenditures involved in the initial setup of a modular data center. Data center infrastructure, including virtualization, cooling, power, and compliance, are essential considerations for both traditional and modular data centers. Ensuring data center infrastructure adheres to industry standards and regulations is crucial for maintaining business continuity and protecting sensitive data. Data center optimization is also a critical factor in reducing operational costs and improving efficiency. In conclusion, while modular and containerized data centers offer significant benefits, there are challenges to their adoption. Data center operators must consider the upfront costs, skills required for operation, and regulatory compliance when deciding between traditional and modular data center solutions.

- Understanding these factors is essential for making informed decisions and maximizing the value of data center infrastructure investments. Recent research indicates that modular data centers are gaining popularity worldwide, and their adoption is expected to continue growing in the coming years.

Exclusive Customer Landscape

The containerized and modular data center market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the containerized and modular data center market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, containerized and modular data center market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Dell Technologies Inc. - The company specializes in containerized and modular data center solutions, including the MDC 2000 and MDC 4000 models. These advanced data centers offer scalability, flexibility, and efficiency for businesses seeking to optimize their IT infrastructure. The containerized design ensures ease of deployment and relocation, while the modular architecture allows for customizable expansion. These data centers are engineered for high performance and reliability, enabling organizations to manage their critical data and applications with confidence. By implementing containerized and modular data center solutions, businesses can reduce their carbon footprint and save on capital and operational expenses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- IBM Corporation

- Cisco Systems Inc.

- Vertiv Group Corporation

- Schneider Electric SE

- Eaton Corporation plc

- Rittal GmbH & Co. KG

- Atos SE

- Fujitsu Limited

- NEC Corporation

- Hitachi Ltd.

- Huawei Technologies Co. Ltd.

- ZTE Corporation

- Inspur Group Co. Ltd.

- Lenovo Group Ltd.

- Computacenter plc

- Kao Data Ltd.

- NextDC Limited

- EdgeConneX Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Containerized And Modular Data Center Market

- In February 2023, Schneider Electric, a global energy management and automation company, introduced its MicroData Center in a Box, a prefabricated, containerized data center solution designed for edge computing applications (Schneider Electric Press Release, 2023). This new product launch caters to the growing demand for smaller, decentralized data centers to support the increasing adoption of IoT devices and edge computing.

- In July 2024, Microsoft and Google announced a strategic partnership to collaborate on developing modular data centers using Google's containerized data center design (Microsoft News Center, 2024). This collaboration aims to reduce the environmental impact of data centers and improve energy efficiency by sharing best practices and technologies.

- In March 2025, Vertiv, a global provider of critical infrastructure solutions, acquired Sentrics, a data center infrastructure management software company, for an undisclosed amount (Vertiv Press Release, 2025). This acquisition enhances Vertiv's portfolio of integrated solutions for containerized and modular data centers, providing customers with advanced monitoring, management, and optimization capabilities.

- In October 2025, the European Union approved the European Data Infrastructure Alliance's (EDI) plan to invest â¬4 billion in building a network of modular data centers across Europe (European Commission Press Release, 2025). This initiative aims to strengthen the EU's digital infrastructure, promote data sovereignty, and support the growth of the digital economy.

Research Analyst Overview

In the market, businesses seek agility and efficiency in their IT infrastructure. Data center DevOps and outsourcing have gained traction, enabling organizations to focus on core competencies while experts manage data center operations. On-demand data centers, utilizing pre-fabricated solutions, offer rapid deployment and scalability. Data center consulting services ensure optimal availability and reliability, while leasing and integration simplify the transition process.

Redundancy is a critical consideration, with containerized and modular designs providing cost-effective disaster recovery solutions. Data center colocation allows businesses to house their IT equipment in secure, high-performance facilities, enhancing overall data center performance and reliability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Containerized And Modular Data Center Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.5% |

|

Market growth 2024-2028 |

USD 54.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.12 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Containerized And Modular Data Center Market Research and Growth Report?

- CAGR of the Containerized And Modular Data Center industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the containerized and modular data center market growth of industry companies

We can help! Our analysts can customize this containerized and modular data center market research report to meet your requirements.