Flexible Lid Stock Packaging Market Size 2024-2028

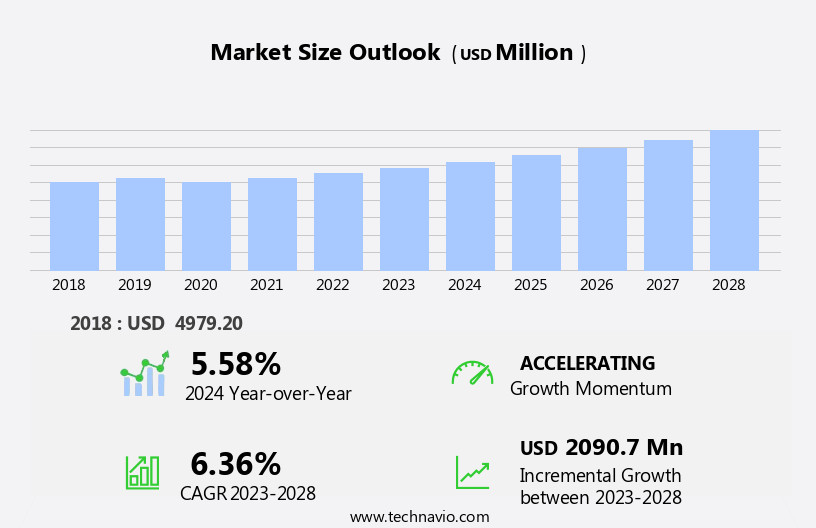

The flexible lid stock packaging market size is forecast to increase by USD 2.09 billion at a CAGR of 6.36% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for modified atmosphere packaging (MAP) in various applications, particularly In the food and beverage industry. Thermoformed packaging, which utilizes flexible lids, is gaining popularity due to its ability to preserve the freshness of perishable items such as frozen food, coffee, tea, cheese, pet care products, and fruits and vegetables. Moreover, the use of extrusion coatings and bioplastics In the production of these lids is contributing to the market's growth. However, stringent government regulations on reduction of packaging waste are posing a challenge to the market. This has led to an increased focus on sustainable packaging solutions, such as reusable and recyclable packaging.

- Key applications of flexible lid stock packaging include commercial foodservice, quick service restaurants, personal care, and industrial packaging. The market is also witnessing a trend towards the use of aluminum lidding films and plastic lidding films In the packaging of protein-rich foods and dried food products. In conclusion, the market is expected to continue its growth trajectory, driven by the increasing demand for convenient and sustainable packaging solutions.

What will be the Size of the Flexible Lid Stock Packaging Market During the Forecast Period?

- The market encompasses a range of solutions designed for various industries, including dairy, health care, and specialties. These packages, which include easy-peel and lock-tight lidding films, aluminum foils, metalized polymer films, extruded films, and extrusion coatings, offer advantages such as protection against dust, UV rays, and environmental contamination.

- The market's growth is driven by consumer preferences for recyclable and reusable packaging, as well as the need for effective plastic waste management. Recycled plastic materials and laminations are increasingly popular choices, with applications ranging from paperboard pints and plastic containers to trays. The market's size is significant, with continued expansion expected due to the lightweight and moisture-resistant properties of flexible packaging films.

- Overall, the market is poised for continued growth as businesses seek sustainable and effective solutions for product life extension.

How is this Flexible Lid Stock Packaging Industry segmented and which is the largest segment?

The flexible lid stock packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Food

- Pharmaceutical

- Personal care

- Beverage

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By End-user Insights

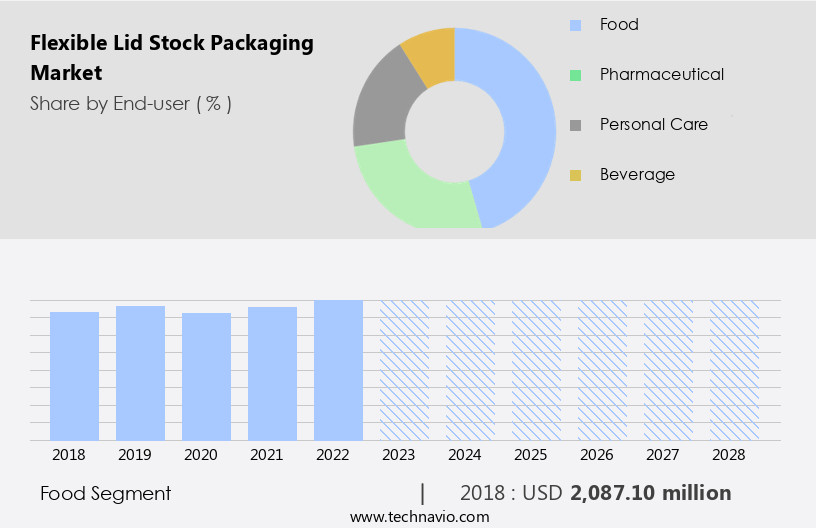

The food segment is estimated to witness significant growth during the forecast period. The market experiences significant growth due to its widespread adoption In the food industry. This market caters to the packaging needs of various edible and perishable products, including meat, dairy, frozen foods, fruits, vegetables, coffee, tea, processed food, cereals, and dried food. Factors fueling market growth include increasing disposable incomes, shrinking household sizes, expanding middle-class population, and rising demand for convenient, tasty, and health-conscious food options. Flexible packaging solutions offer advantages such as high microbial barriers, peelable features, and extended product shelf-life. Additionally, the market is driven by the use of sustainable materials like recycled PE, PET, and bioplastics, contributing to environmental conservation efforts and the achievement of sustainable development goals.

Applications extend to restaurants, hotels, and the ready-to-consume food sector, as well as personal care, healthcare, and various industries using aluminum foils, paper, or polymer films. The market encompasses various manufacturing technologies, including laminations, fluid coating, extrusion coating, and lidding films, catering to diverse storage capacities, high temperatures, and product requirements. Flexible packaging offers benefits in various sectors, including dairy, healthcare, specialties, and pharmaceuticals, among others.

Get a glance at the share of various segments. Request Free Sample

The food segment was valued at USD 2.09 billion in 2018 and showed a gradual increase during the forecast period.

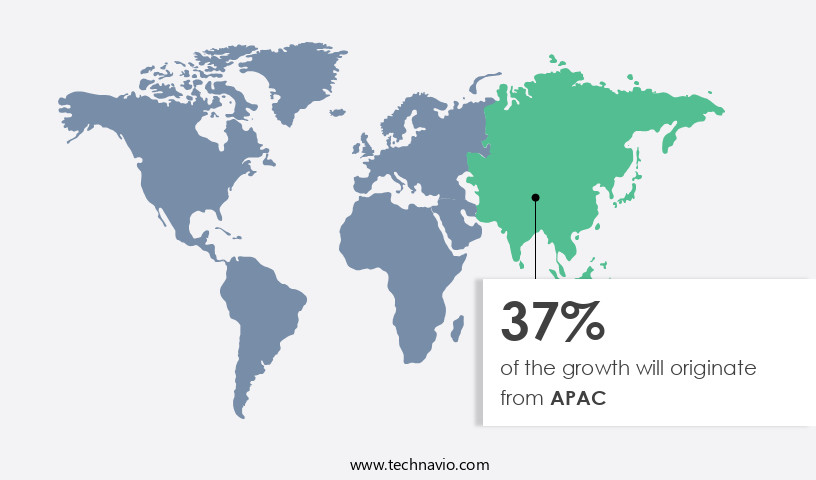

Regional Analysis

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth, particularly In the Asia Pacific (APAC) region. By 2030, APAC is projected to account for approximately two-thirds of the global middle-class population, driving demand for food and beverage products and healthcare facilities. This demographic shift offers a substantial customer base for end-user industries, leading to market expansion. Flexible lid stock packaging, including pouches, bags, and lidding films made of non-rigid materials like aluminum foils, paper, and polymer films, caters to various sectors such as dairy, healthcare, personal care, and ready-to-consume food. Sustainability is a crucial factor In the market, with an emphasis on recyclable and reusable packaging to minimize environmental contamination and promote environmental conservation.

High-barrier properties, anti-microbial activity, and printability are essential features for these packaging solutions. Key sectors include food, medical & pharmaceutical, pet care, and home care. The market is expected to grow at a substantial rate due to the convenience these packaging solutions offer and the increasing focus on environmental sustainability and the United Nations Sustainable Development Goals.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Flexible Lid Stock Packaging Industry?

- Growing demand for MAP in flexible packaging is the key driver of the market.Flexible lid stock packaging, which includes materials like aluminum foils, paper, polymer films, and non-woven, plays a significant role in preserving the quality and extending the product life of various industries, including food, personal care, healthcare, and more. These packaging solutions offer advantages such as high barriers against dust, UV rays, and environmental contamination, contributing to environmental conservation and sustainable development goals. Recyclable and reusable packaging made from recycled plastic materials, PE, PET, and bioplastic materials, are gaining popularity due to their environmental sustainability. In the food sector, flexible lid stock packaging is essential for ready-to-consume food, dairy, and nutrient-dense items like cheese, calcium, and phosphorous.

The packaging ensures sterile properties, storage capacities, and seals to maintaIn the product's freshness and prevent atmospheric gases from causing oxidation. Moreover, these packaging solutions cater to the fast-paced lifestyle by offering convenience through case-ready meals and easy-peel, lock-tight lids. Flexible packaging films, such as laminations, fluid coating, extrusion coating, and extruded films, offer high barrier properties, anti-microbial activity, and printability. They are suitable for various applications, including ovenable lidding films, chillable lidding films, and anti-fog lidding films. The pharmaceutical, medical, pet care, and home care segments also benefit from these packaging solutions, ensuring the protection and preservation of sensitive products.

In conclusion, flexible lid stock packaging is a crucial component in various industries, providing essential benefits like extended product life, environmental sustainability, and convenience. The market dynamics continue to evolve, with advancements in manufacturing technology and the increasing demand for sustainable materials.

What are the market trends shaping the Flexible Lid Stock Packaging market?

- Growing demand for thermoformed packaging is the upcoming market trend.Flexible lid stock packaging, which includes materials like aluminum foils, paper, polymer films, and non-woven, is a significant market segment In the packaging industry. Thermoforming, a manufacturing process for creating disposable cups, lids, containers, trays, and other packaging solutions using pliable raw materials, is gaining popularity due to its advantages. These benefits include lower tooling costs, compatibility with just-in-time (JIT) production strategies, shorter lead times, and diverse design, finishing, and texture options. The cost of production through thermoforming is approximately 10-20% lower than other manufacturing processes. Moreover, the use of recyclable and reusable materials in flexible lid stock packaging contributes to environmental conservation and sustainable development goals.

These materials include recycled plastic, PET, bioplastic, and sustainable materials like aluminum and paper. The food, medical & pharmaceutical, pet care, and home care segments are major consumers of flexible lid stock packaging, with applications ranging from ready-to-consume food and personal care to dairy products, pharmaceuticals, and fresh fruits and vegetables. The packaging industry faces challenges such as environmental contamination from dust, UV rays, and atmospheric gases, which can affect product life and nutrient preservation. To address these challenges, innovative packaging solutions like high barrier properties, anti-microbial activity, printability, and easy-peel and lock-tight seals are being developed. Additionally, the convenience and sterile properties of lid stock packaging are crucial in various industries, including restaurants, hotels, and healthcare.

What challenges does the Flexible Lid Stock Packaging Industry face during its growth?

- Stringent government regulations on reduction of packaging wastes is a key challenge affecting the industry growth.The market is experiencing significant growth due to the increasing demand for convenient, recyclable, and reusable packaging solutions for various industries, including food, personal care, healthcare, and restaurants. However, the environmental impact of traditional packaging materials, such as plastic, is a major concern. These materials contribute to environmental contamination through dust, UV rays, and atmospheric gases, leading to oxidation and reduced product life. In response, there is a growing emphasis on environmental conservation and sustainable development goals. Manufacturers are turning to sustainable materials, such as recycled plastic materials, bioplastic materials, and non-woven materials, to address these concerns. For instance, recycled PE and PET are becoming increasingly popular for their environmental sustainability.

In the food segment, flexible packaging films, such as easy-peel and lock-tight lidding films, offer high barrier properties, anti-microbial activity, and printability, making them suitable for preserving nutrient-dense food items like cheese, calcium, phosphorous, and protein-rich dairy products. Similarly, In the medical & pharmaceutical segment, aluminum foils and metalized polymer films offer sterile properties and storage capacities suitable for pharmaceuticals. In the personal care segment, pouches and bags made from non-rigid materials offer convenience and customizability. In the home care segment, reusable and recyclable packaging solutions are gaining popularity for their environmental sustainability. Governments and regulatory bodies are also taking steps to address packaging waste management, with regulations such as EC Directive 94/62/EC promoting recycling and reusability of packaging materials.

Exclusive Customer Landscape

The flexible lid stock packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the flexible lid stock packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, flexible lid stock packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Berry Global Inc.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- DuPont de Nemours Inc.

- Fres-co System USA Inc.

- Glenroy Inc.

- Huhtamaki Oyj

- KP Holding GmbH and Co. KG

- Mondi Plc

- Sealed Air Corp.

- Sonoco Products Co.

- Toray Industries Inc.

- UFlex Ltd.

- WestRock Co.

- Wipak Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Flexible lid stock packaging has gained significant traction in various industries due to its numerous benefits over traditional rigid packaging. This type of packaging is primarily made from non-rigid materials, including aluminum foils, paper, and polymer films. Its flexibility offers several advantages, such as convenience, customizability, and protection against environmental factors. Product life is a crucial factor In the packaging industry, and flexible lid stock packaging plays a vital role in maintaining the quality and freshness of various products. For instance, In the food sector, this packaging protects ready-to-consume food from dust, UV rays, and environmental contamination. In the healthcare sector, it ensures sterile properties and storage capacities for sensitive pharmaceuticals.

Flexible lid stock packaging is an essential component In the environmental conservation and sustainability movement. The use of recycled plastic materials and sustainable development goals, such as reducing plastic waste management, is a growing trend. This packaging is recyclable and reusable, making it an eco-friendly alternative to traditional rigid packaging. The hospitality industry, including restaurants and hotels, also benefits from flexible lid stock packaging. Its lightweight nature makes it easy to transport and store, while its high barriers properties protect food from atmospheric gases, oxidation, and fast-paced lifestyle demands. In the personal care sector, flexible lid stock packaging is used for various products, including chemicals and health care items.

Its seals ensure product integrity, while its anti-microbial activity maintains product purity. The manufacturing technology behind flexible lid stock packaging continues to evolve, with advancements in laminations, extrusion coating, fluid coating, and lidding films. These innovations provide additional benefits, such as easy-peel and lock-tight seals, high temperatures resistance, and printability. Flexible lid stock packaging is used in various industries, including dairy, healthcare, specialties, and home care. Its applications range from pouches and bags for food products to containers and trays for pharmaceuticals and personal care items. In conclusion, flexible lid stock packaging is a versatile and essential component in various industries. Its benefits include product protection, environmental sustainability, and convenience. The ongoing advancements in manufacturing technology continue to expand its applications and improve its performance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.36% |

|

Market growth 2024-2028 |

USD 2.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

China, US, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Flexible Lid Stock Packaging Market Research and Growth Report?

- CAGR of the Flexible Lid Stock Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the flexible lid stock packaging market growth of industry companies

We can help! Our analysts can customize this flexible lid stock packaging market research report to meet your requirements.