Gaming Graphic Processing Unit (GPU) Market Size 2025-2029

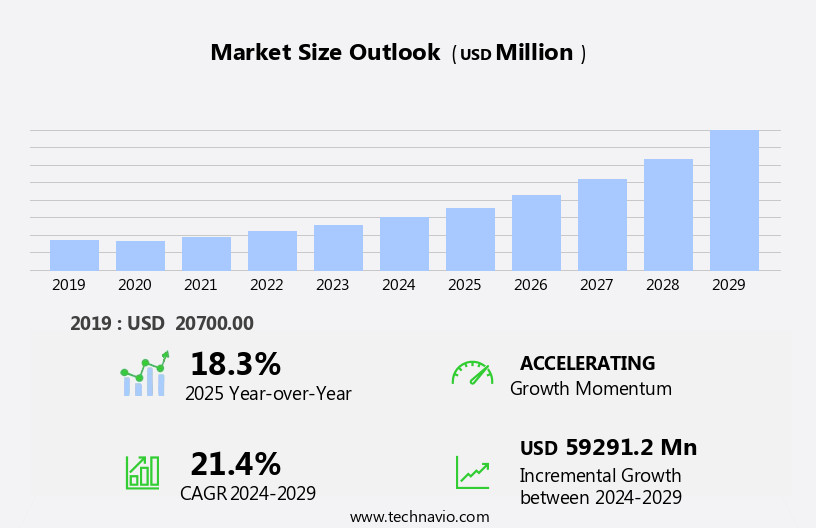

The gaming graphic processing unit (gpu) market size is forecast to increase by USD 59.29 billion, at a CAGR of 21.4% between 2024 and 2029.

- The Gaming Graphics Processing Unit (GPU) market is experiencing significant growth, driven by the increasing popularity of PC games and next-generation gaming consoles. The launch of new, high-performance GPUs is fueling this demand, as gamers seek to enhance their gaming experience with more realistic graphics and smoother gameplay. However, this market is not without challenges. Cybercrime poses a significant threat to the gaming industry, with hackers targeting vulnerable systems and exploiting user data for financial gain. As the market continues to evolve, companies must prioritize cybersecurity measures to protect their customers and maintain trust.

- Additionally, staying ahead of the competition and continuously innovating to meet the ever-evolving demands of gamers will be crucial for market success. Companies that can effectively address these challenges and capitalize on the growing demand for advanced GPUs will be well-positioned to succeed in this dynamic and exciting market.

What will be the Size of the Gaming Graphic Processing Unit (GPU) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The GPU market continues to evolve, driven by advancements in technology and expanding applications across various sectors. Graphics Processing Units (GPUs) have become essential components in cloud computing, enterprise solutions, and consumer electronics. In scientific computing, GPUs power simulations and modeling, while in machine learning, they accelerate AI workloads. The gaming industry remains a significant market for GPUs, with continuous advancements in graphics APIs, VR headsets, and AR devices. Clock speed, memory bandwidth, and performance metrics are key factors influencing the market. Cooling solutions, such as air cooling, liquid cooling, and water cooling, are crucial to managing power consumption and noise levels.

E-waste management and semiconductor fabrication are also critical aspects of the GPU market. The supply chain, from silicon wafers to retail sales, is subject to ongoing dynamics. New technologies, such as ray tracing and tensor cores, are shaping the technology roadmap. Customer support and software optimization are essential for maximizing the value of GPU investments. HPC, CAD software, and content creation benefit from high-performance GPUs. The product lifecycle management of GPUs, from game engines to distribution channels, is a continuous process. The GPU market is characterized by its dynamic nature, with new applications and technologies continually emerging. From 3D modeling to virtual reality, GPUs are at the heart of innovation.

The future of GPUs is bright, with exciting possibilities in areas such as mixed reality, deep learning, and professional visualization.

How is this Gaming Graphic Processing Unit (GPU) Industry segmented?

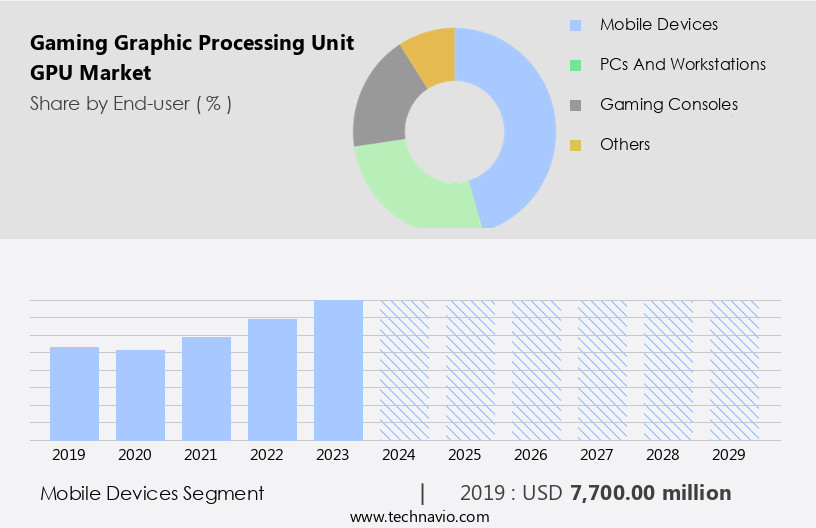

The gaming graphic processing unit (gpu) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Mobile devices

- PCs and workstations

- Gaming consoles

- Others

- Type

- Dedicated graphic card

- Integrated graphic card

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The mobile devices segment is estimated to witness significant growth during the forecast period.

The global gaming GPU market is experiencing significant growth, particularly in the cloud computing and enterprise solutions sectors. This expansion is fueled by the increasing demand for advanced graphics processing capabilities in video editing, scientific computing, machine learning, and professional visualization. GPU architectures continue to evolve, with an emphasis on boosting clock speeds, increasing shader units, and incorporating AI acceleration and ray tracing. In the consumer electronics realm, the integration of powerful GPUs into gaming consoles, VR headsets, and AR devices has revolutionized immersive experiences. Silicon wafer suppliers and semiconductor fabrication companies are working diligently to meet the rising demand for these advanced components.

Cooling solutions, such as liquid cooling and water cooling, are essential to managing the heat generated by high-performance GPUs. Moreover, the market is witnessing a shift towards online sales, with e-waste management becoming a crucial concern. Performance metrics, including frame rate, memory bandwidth, and power consumption, are key factors influencing consumer decisions. The technology roadmap includes advancements like tensor cores, CAD software optimization, and product lifecycle management to enhance the overall gaming experience. As the market evolves, companies focus on software optimization and game engine development to ensure compatibility with various GPUs. The integration of GPUs into data centers for high-performance computing applications is also gaining traction.

Despite the complexity of the supply chain, the price-performance ratio and power efficiency remain critical factors for success. In the realm of gaming, the competition is fierce, with leading players continually pushing the boundaries of innovation. From CUDA cores and RT cores to pixel fillrate and frame rate, the race for superior performance is ongoing. Companies are also focusing on customer support and product lifecycle management to maintain a strong market presence. In summary, the gaming GPU market is undergoing rapid transformation, driven by advancements in cloud computing, enterprise solutions, and consumer electronics. The integration of powerful GPUs into various applications, from video editing to virtual reality, is revolutionizing the way we experience and interact with digital content.

As the market continues to evolve, companies must focus on innovation, optimization, and sustainability to stay competitive.

The Mobile devices segment was valued at USD 7.7 billion in 2019 and showed a gradual increase during the forecast period.

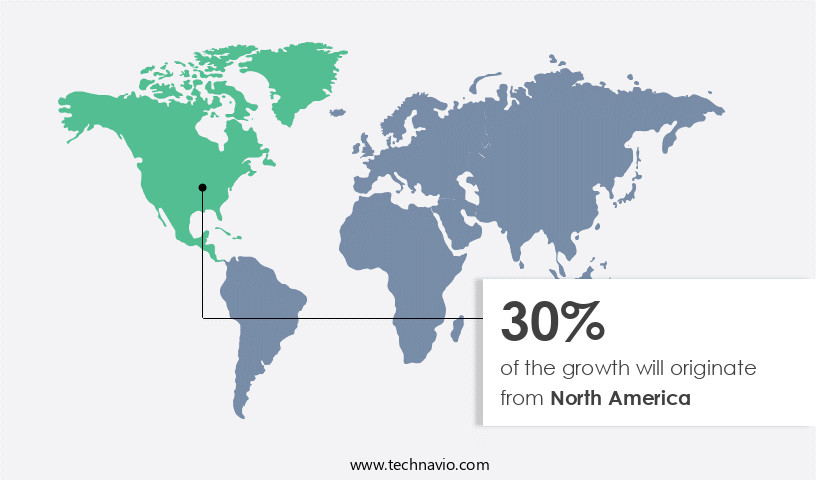

Regional Analysis

North America is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The gaming GPU market in North America is experiencing significant growth, driven by the increasing popularity of console games. Game developers and publishing enterprises are responding to this trend by releasing new titles and upgrading existing ones to meet consumer demand. While PC games continue to generate a substantial portion of market revenue, console games are experiencing a rapid revenue growth. This shift in focus towards console games is leading to an increased demand for high-performance GPUs in North America. In the realm of enterprise solutions, GPU architecture plays a crucial role in areas such as scientific computing, machine learning, and professional visualization.

The integration of AI acceleration and deep learning capabilities in GPUs has further expanded their applications, particularly in data centers. The demand for GPUs in these areas is expected to remain strong, contributing to the overall growth of the market. Augmented reality (AR) and virtual reality (VR) technologies are also driving the demand for GPUs. AR devices, such as smart glasses, require powerful GPUs to render high-quality graphics in real-time. VR headsets, on the other hand, require GPUs with high memory bandwidth and processing power to deliver immersive gaming experiences. The gaming GPU market is also witnessing advancements in cooling solutions, such as liquid cooling and water cooling, to improve performance and reduce noise levels.

Power consumption and e-waste management are becoming critical concerns for consumers and manufacturers alike, leading to the development of power-efficient GPUs and initiatives for responsible disposal of e-waste. The technology roadmap for GPUs includes advancements in ray tracing, which promises more realistic graphics, and the integration of tensor cores for AI and machine learning applications. These innovations are expected to further boost the performance of GPUs, making them increasingly indispensable in the gaming industry and beyond. The gaming GPU market is a dynamic and evolving landscape, with a diverse range of applications and stakeholders. From console games and enterprise solutions to AR/VR technologies and scientific computing, the demand for high-performance GPUs is on the rise.

As the market continues to innovate and adapt to new technologies and consumer demands, the role of GPUs in powering the future of gaming and beyond is set to become even more significant.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The gaming GPU market continues to evolve, fueled by advancements in technology and the growing demand for immersive gaming experiences. High-performance GPUs are essential for rendering complex graphics and delivering smooth gameplay. Gamers seek GPUs with superior tessellation, shading, and texture capabilities, ensuring lifelike visuals and realistic lighting effects. VR and 3D gaming further push the boundaries, requiring powerful GPUs with high VRAM capacity and efficient cooling systems. Manufacturers focus on producing GPUs with advanced features like real-time ray tracing, DLSS, and adaptive sync, enhancing the overall gaming experience. The market is driven by continuous innovation, with consumers eagerly anticipating the latest GPU releases. Gamers value energy efficiency, quiet operation, and compatibility with the latest games and software. The GPU market caters to diverse needs, offering budget-friendly options and high-end solutions for the most demanding gamers.

What are the key market drivers leading to the rise in the adoption of Gaming Graphic Processing Unit (GPU) Industry?

- The significant surge in the demand for PC games and gaming consoles serves as the primary catalyst for market growth in this sector.

- The gaming industry has experienced significant advancements, transitioning from traditional board games to technology-driven experiences. Gaming consoles like Xbox and PlayStation have spearheaded this evolution, leading to the development of modern video games. In response, PC manufacturers such as Dell Inc. Have enhanced their devices to accommodate gaming requirements. The shift towards digital distribution has become prevalent in the PC gaming sector. Platforms like Steam by Valve Corp. Offer downloadable content, eliminating the need for physical media like DVDs. This trend is gaining traction due to the convenience and accessibility it provides. Furthermore, the gaming GPU market is expanding beyond gaming applications.

- Cloud computing, enterprise solutions, video editing, AI acceleration, and AR/VR technologies are increasingly utilizing GPU architecture for compute units, shader units, ROP units, and liquid cooling. The GPU market dynamics are influenced by the demand for immersive and harmonious gaming experiences, as well as the need for advanced processing units for various industries. Silicon wafer manufacturers and GPU architecture companies are essential players in this supply chain, ensuring the production of high-performance GPUs. The market's growth is driven by the increasing demand for 3D modeling, AI, and real-time rendering, making GPU technology an indispensable component in today's technology landscape.

What are the market trends shaping the Gaming Graphic Processing Unit (GPU) Industry?

- The upcoming market trend involves the launch of new gaming graphics processing units (GPUs). As a professional and knowledgeable assistant, I can provide you with the latest information on this topic.

- The global gaming GPU market is experiencing significant growth due to the increasing demand for immersive and harmonious gaming experiences. Companies are focusing on product innovation to meet the competitive market requirements, with major players like Intel Corp., NVIDIA Corp., and Advanced Micro Devices Inc., launching new GPU products. For instance, NVIDIA Corp.'s GeForce RTX 50 Series GPUs, unveiled in January 2025, represent a significant advancement in AI-driven computer graphics, powered by the Blackwell architecture, delivering breakthroughs in neural shaders and digital human technologies. Moreover, the integration of GPU technology in scientific computing, machine learning, virtual reality (VR) headsets, augmented reality (AR) devices, and mixed reality (MR) applications is driving market growth.

- Cooling solutions are becoming increasingly important to manage noise levels and power consumption, making air cooling and liquid cooling solutions essential. Memory bandwidth and clock speed are critical performance metrics for gaming GPUs, and retail sales are expected to increase as these technologies become more accessible. E-waste management is also a significant concern, and companies are focusing on sustainable manufacturing practices to reduce the environmental impact of their products. Overall, the global gaming GPU market is poised for continued growth, driven by technological advancements and increasing demand for immersive gaming experiences.

What challenges does the Gaming Graphic Processing Unit (GPU) Industry face during its growth?

- The gaming industry faces significant challenges to its growth due to the increasing threat of cybercrime. Cyberattacks, including hacking, identity theft, and data breaches, pose a major risk to both players and developers. These incidents can result in financial losses, reputational damage, and the erosion of consumer trust. To mitigate these risks, it is essential for gaming companies to prioritize cybersecurity measures, such as encryption, multi-factor authentication, and regular software updates. Additionally, educating players about safe online practices and implementing strict privacy policies can help minimize the threat of cybercrime and protect the industry's growth.

- The market in consumer electronics is experiencing significant growth due to the increasing demand for immersive and harmonious gaming experiences. This trend is driven by advancements in technology, such as ray tracing and virtual reality (VR), which require high pixel fillrates and the ability to process complex data. GPU manufacturers are responding by increasing the number of CUDA cores and RT cores in their offerings to meet these demands. Moreover, the technology roadmap for GPUs includes deep learning capabilities, making them essential for content creation and software optimization in various industries, including cad software and data centers.

- Semiconductor fabrication processes continue to advance, enabling smaller, more efficient GPUs with greater processing power. Customer support and software optimization are critical factors in the success of GPU manufacturers. Companies must provide reliable and efficient solutions to ensure a positive user experience. Online sales have become a significant revenue source, requiring robust security measures to protect against cyber threats. In summary, the GPU market in consumer electronics is driven by the demand for immersive gaming experiences, advancements in technology, and the need for efficient processing power in various industries. Manufacturers must focus on customer support, software optimization, and security to meet the evolving needs of their customers.

Exclusive Customer Landscape

The gaming graphic processing unit (gpu) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gaming graphic processing unit (gpu) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gaming graphic processing unit (gpu) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Micro Devices Inc. - The company specializes in high-performance graphics processing units (GPUs), including the Radeon RX 6900 Series, RX 6800 Series, and RX 6700 Series, delivering cutting-edge technology for immersive gaming experiences. Our advanced GPUs optimize visual effects, ensure smooth gameplay, and enhance overall system performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Micro Devices Inc.

- Arm Ltd.

- ASUSTeK Computer Inc.

- EVGA Corp.

- Gigabyte Technology Co. Ltd.

- Imagination Technologies Ltd.

- Intel Corp.

- Micro Star International Co. Ltd.

- NVIDIA Corp.

- PC Partner Group Ltd.

- Qualcomm Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gaming Graphic Processing Unit (GPU) Market

- In January 2024, Nvidia, a leading GPU manufacturer, announced the launch of its new GeForce RTX 30 series GPUs, which offered significant performance improvements and increased affordability compared to their predecessors. These GPUs gained popularity among gamers due to their ability to support ray tracing and DLSS technology, enhancing gaming visuals and performance (Nvidia Press Release, 2024).

- In March 2024, AMD, a major competitor in the GPU market, revealed its new Radeon RX 6000 series GPUs, featuring 7 nm chip technology and high-performance capabilities, aiming to challenge Nvidia's market dominance (AMD Press Release, 2024).

- In May 2024, Intel, traditionally known for its Central Processing Units (CPUs), entered the GPU market by acquiring Altera Corporation's programmable logic business, which included its FPGA (Field-Programmable Gate Array) technology, allowing Intel to expand its product portfolio and compete in the GPU market (Intel Press Release, 2024).

- In April 2025, Samsung Electronics, a prominent player in the semiconductor industry, announced a strategic partnership with AMD to manufacture custom GPUs using Samsung's 7 nm EUV (Extreme Ultraviolet) process technology. This collaboration aimed to enhance AMD's GPU production capabilities and improve performance (Samsung Press Release, 2025).

Research Analyst Overview

- In the dynamic GPU market, cooling system maintenance and data center infrastructure are crucial for ensuring optimal performance of GPU servers and clusters. Display technologies continue to evolve, with 3D animation software and video editing tools pushing the boundaries of graphics processing capabilities. Industry standards and performance testing tools play a vital role in ensuring compatibility and interoperability with game development tools and professional visualization software. Cloud computing platforms are transforming the landscape, enabling access to GPU resources for various applications, including content creation software and machine learning libraries. Power supplies and memory modules are essential components, requiring careful consideration for maximum efficiency and reliability.

- Warranty claims and driver updates are common issues in the market, necessitating robust customer support channels. Graphics API libraries and deep learning frameworks are driving technology innovation, with AI software frameworks and benchmarking software playing a pivotal role in evaluating and optimizing GPU performance. Heat sinks and liquid coolants are essential for managing thermal issues, while gpu monitoring software and gpu servers enable real-time performance analysis and troubleshooting. GPU clusters and professional visualization software are essential for scientific research and engineering applications, while gaming peripherals and input devices cater to the consumer market.

- The market is witnessing significant investment in research and development funding, fueling the development of new technologies and applications. Overall, the GPU market is a vibrant and diverse ecosystem, underpinned by constant innovation and evolving customer demands.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gaming Graphic Processing Unit (GPU) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.4% |

|

Market growth 2025-2029 |

USD 59291.2 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

18.3 |

|

Key countries |

US, China, Germany, Canada, Brazil, UK, Japan, India, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gaming Graphic Processing Unit (GPU) Market Research and Growth Report?

- CAGR of the Gaming Graphic Processing Unit (GPU) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gaming graphic processing unit (gpu) market growth of industry companies

We can help! Our analysts can customize this gaming graphic processing unit (gpu) market research report to meet your requirements.