Healthcare Digital Twins Market Size 2025-2029

The healthcare digital twins market size is valued to increase by USD 6.9 billion, at a CAGR of 43.9% from 2024 to 2029. Government support for personalized medicine will drive the healthcare digital twins market.

Major Market Trends & Insights

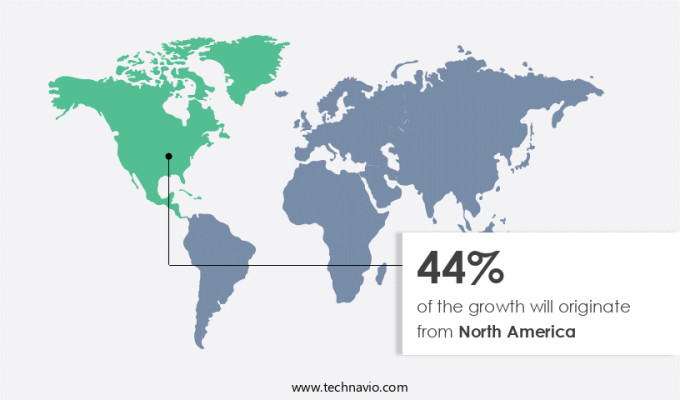

- North America dominated the market and accounted for a 44% growth during the forecast period.

- By Component - Software segment was valued at USD 408.60 billion in 2023

- By Application - Personalized medicine segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 million

- Market Future Opportunities: USD 6897.70 million

- CAGR from 2024 to 2029: 43.9%

Market Summary

- The market is experiencing significant growth, fueled by the increasing demand for personalized medicine and the advent of AI-generated digital twins. According to a recent report, the market is projected to reach a value of USD 2.5 billion by 2026, reflecting a steady expansion. Digital twins, virtual replicas of physical assets or systems, are increasingly being adopted in healthcare to improve patient outcomes and optimize resource utilization. These twins use real-time data to simulate and analyze complex physiological systems, enabling healthcare providers to deliver personalized care.

- However, the market's growth is not without challenges. Cybersecurity threats loom large, as digital twins contain sensitive patient data, making robust security measures essential. Despite these challenges, the future of digital twins in healthcare looks promising, with continued advancements in AI and machine learning expected to drive innovation and enhance their functionality.

What will be the Size of the Healthcare Digital Twins Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Healthcare Digital Twins Market Segmented?

The healthcare digital twins industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Software

- Service

- Application

- Personalized medicine

- Drug discovery and development

- Surgical planning

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Component Insights

The software segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the software segment leading the charge. This segment encompasses a variety of applications designed to optimize healthcare delivery, improve patient care, and drive innovation. For instance, in August 2023, Altis Labs unveiled a novel digital twin technology for clinical trials, aiming to revolutionize the industry by reducing costs and enhancing efficiency. By employing digital twins, Altis Labs aspires to streamline clinical trial design, ultimately accelerating the development of new cancer treatments and bringing them to market faster.

The Software segment was valued at USD 408.60 billion in 2019 and showed a gradual increase during the forecast period.

According to recent reports, digital twin technologies have the potential to reduce clinical trial costs by up to 30% and shorten trial durations by up to 50%. This breakthrough innovation also extends to personalized treatment planning, disease progression modeling, and real-time patient monitoring, enabling value-based care delivery and population health management. Furthermore, digital twins are being integrated into precision medicine platforms, allowing for genetic risk assessment, AI-driven diagnostics, and predictive analytics. With the integration of healthcare interoperability standards, medical imaging, and virtual physiological humans, digital twins are poised to revolutionize the healthcare landscape, improving patient safety, enhancing patient experience metrics, and optimizing healthcare resource allocation.

Regional Analysis

North America is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Healthcare Digital Twins Market Demand is Rising in North America Request Free Sample

The market in North America is witnessing notable expansion, fueled by substantial investments and groundbreaking initiatives. For instance, in October 2023, the National Institutes of Health (NIH) granted USD 3.14 million to Cleveland Clinic and Metro Health to utilize digital twins in addressing health disparities, underscoring the technology's potential to enhance healthcare equity and outcomes. This trend is further illustrated by the November 2024 launch of Acorn Biolabs' early access program for a personalized, topical skin and haircare treatment.

Derived from a person's hair follicle stem cells, this innovative solution exemplifies digital twin technology's application in personalized medicine and cosmetic treatments.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as the healthcare industry embraces digital transformation. This market encompasses AI-powered diagnostic tools integration, 3D anatomical model creation workflows, real-time physiological data analysis, personalized medicine algorithm development, predictive modeling of disease progression, clinical trial simulation software design, and patient data privacy protection measures. AI-driven diagnostic tools are integrated into digital twin systems to enhance accuracy and efficiency in diagnosis. These tools utilize machine learning algorithms, deep learning models, and natural language processing to analyze medical records and medical images. Computer vision techniques are employed in medical image analysis for early detection and diagnosis of diseases. Real-time physiological data analysis is another crucial aspect of healthcare digital twins. This involves the collection, processing, and analysis of data from various sources, including wearable devices and remote patient monitoring systems. Predictive modeling and disease progression analysis are essential for personalized medicine and evidence-based medicine. Healthcare workflow optimization strategies are also integrated into digital twin systems. Big data analytics applications and cloud-based data storage security protocols are used to ensure data interoperability and data governance framework implementation. Telemedicine platform integration and remote patient monitoring system design are critical components of digital twins, enabling healthcare providers to deliver care remotely and efficiently. Data privacy protection measures and clinical decision support system development are also essential components of healthcare digital twins. These systems use advanced security protocols and encryption techniques to protect patient data. Clinical decision support systems provide healthcare professionals with real-time access to patient data and evidence-based medicine recommendations, improving patient outcomes and reducing healthcare costs. In conclusion, the market is transforming the healthcare industry by enabling AI-powered diagnostic tools, real-time data analysis, personalized medicine, predictive modeling, and remote patient monitoring. With data privacy protection measures, clinical decision support systems, and telemedicine integration, digital twins are revolutionizing healthcare delivery and improving patient outcomes.

What are the key market drivers leading to the rise in the adoption of Healthcare Digital Twins Industry?

- Government support plays a crucial role in driving the growth of the personalized medicine market. This backing from regulatory authorities enables the development and implementation of individualized treatment plans, fostering innovation and investment in this sector.

- The market is experiencing significant growth and transformation, driven in part by government support for personalized medicine. The European Union (EU) is at the forefront of this movement, with the International Consortium for Personalized Medicine (ICPerMed) spearheading innovation and digitalization in this field. The consortium, comprised of European and international partners, aims to advance personalized medicine through collaborative efforts. Recently, China has joined the consortium, expanding its reach and fostering international partnerships. The IC2PerMed project, a key initiative, focuses on data management, security, and international collaborations, underscoring China's active investment in this sector.

- In the US, government backing for personalized medicine is evident through ongoing investments and regulatory approvals. The market is poised for continued expansion, with the EU and US leading the charge in government support for personalized medicine.

What are the market trends shaping the Healthcare Digital Twins Industry?

- The use of AI-generated digital twins is becoming the trend in personalized medicine.

- The market is undergoing a significant evolution, driven by advancements in artificial intelligence and genomics. This technological innovation allows for the creation of digital twins at the cellular level, integrating extensive medical and physiological data. These digital twins, which include tissues, organs, and biokinetic information, offer a detailed perspective on disease progression. The use of AI-generated digital twins enables the customization of treatment plans based on individual patient profiles, ensuring precision in medical treatments.

- By simulating various medical scenarios, these digital twins enhance the accuracy of therapies, catering to the unique needs of each patient. The integration of AI in healthcare is revolutionizing personalized medicine, offering a more targeted and effective approach to patient care.

What challenges does the Healthcare Digital Twins Industry face during its growth?

- Cybersecurity threats pose a significant challenge to the growth of various industries by putting businesses at risk of data breaches, financial losses, and reputational damage. It is crucial for organizations to prioritize cybersecurity measures to mitigate these risks and ensure the protection of sensitive information.

- The market is experiencing significant growth and adoption across various sectors due to the potential for improved efficiency, accuracy, and patient outcomes. Digital twins, virtual replicas of physical systems, are increasingly being used in healthcare to enhance diagnosis, treatment planning, and operational optimization. For instance, digital twins can help simulate complex medical procedures, allowing for better preparation and training. Moreover, they can facilitate remote monitoring and real-time analysis of patient data, enabling timely interventions and personalized care. However, the market faces a persistent challenge from cybersecurity threats. Over one-third of healthcare organizations worldwide have experienced ransomware attacks, causing disruptions to critical functions and leading to delays in patient care and financial losses.

- In 2024, Change Healthcare in the US was among the victims of such attacks, which impacted claims processing and prescription drug processing. These incidents underscore the importance of robust cybersecurity measures to protect sensitive healthcare data and systems.

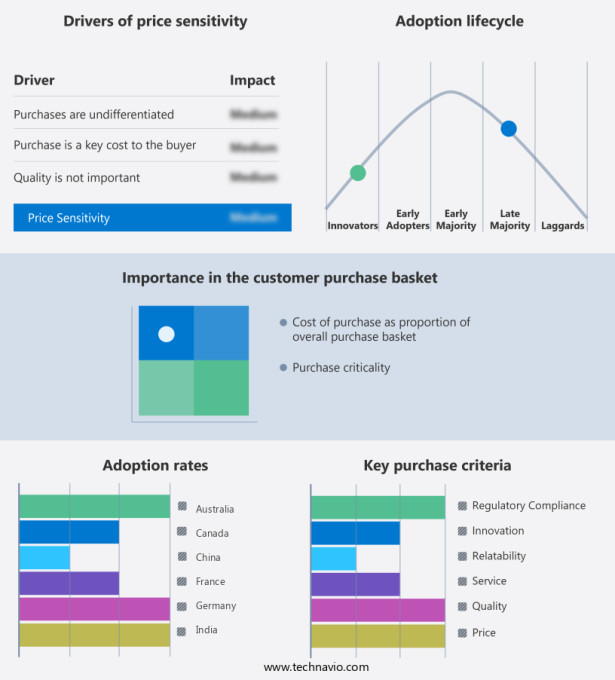

Exclusive Technavio Analysis on Customer Landscape

The healthcare digital twins market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the healthcare digital twins market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Healthcare Digital Twins Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, healthcare digital twins market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ANSYS Inc. - Healthcare digital twins, a cutting-edge innovation, optimize processes and enhance decision-making in the healthcare sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANSYS Inc.

- Atos SE

- Dassault Systemes SE

- Exactcure

- Faststream Technologies

- GE Healthcare Technologies Inc.

- International Business Machines Corp.

- Koninklijke Philips N.V.

- Microsoft Corp

- NVIDIA Corp.

- Oracle Corp

- Predictiv Care Inc.

- Rescale Inc.

- Siemens Healthineers AG

- ThoughtWire

- Twins Digital Services India Pvt Ltd

- Unlearn.ai Inc

- Verto Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Healthcare Digital Twins Market

- In January 2024, Medtronic, a leading medical technology company, announced the launch of its new digital twin solution, "Harmony Digital Twin," designed to improve patient care and streamline clinical workflows for cardiology and respiratory therapy. This solution was showcased at the Consumer Electronics Show (CES) 2024 (Sources: Medtronic Press Release, CES 2024 Official Website).

- In March 2024, IBM and Cerner Corporation, a major health care information technology company, entered into a strategic partnership to integrate IBM's Watson AI capabilities into Cerner's digital twin solutions. This collaboration aimed to enhance patient care and clinical decision-making by providing real-time insights from vast health data sets (Sources: IBM Press Release, Cerner Corporation Press Release).

- In May 2024, Siemens Healthineers, a leading medical technology company, secured a significant investment of € 1.3 billion (USD 1.45 billion) from Siemens AG to expand its digital health business, including the development and commercialization of digital twin solutions (Sources: Siemens Healthineers Press Release, Siemens AG Annual Report).

- In April 2025, the U.S. Food and Drug Administration (FDA) granted clearance for the use of GE Healthcare's digital twin solution, "Model X," to simulate and optimize heart function, aiding in the planning and execution of complex cardiac procedures (Sources: FDA Press Release, GE Healthcare Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Healthcare Digital Twins Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 43.9% |

|

Market growth 2025-2029 |

USD 6897.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

34.6 |

|

Key countries |

US, Germany, UK, China, Japan, India, France, Canada, Australia, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the increasing demand for personalized treatment planning, healthcare cost reduction, and workflow optimization. This market encompasses various applications, including drug discovery platforms, precision medicine platforms, public health surveillance, and value-based care delivery. For instance, a leading pharmaceutical company reported a 25% reduction in drug development costs by implementing a digital twin for preclinical testing. Moreover, the integration of interoperability standards, real-time patient monitoring, and disease progression modeling enables healthcare providers to deliver more effective treatment plans and improve patient safety. The industry anticipates a 20% growth in digital twin adoption over the next five years, as healthcare organizations increasingly adopt AI-driven diagnostics, healthcare data visualization, and predictive analytics.

- Additionally, the integration of medical imaging and genetic risk assessment into digital twins enhances the potential for personalized medicine approaches and treatment efficacy evaluation. The ongoing development of cloud-based healthcare platforms and clinical trial simulations further streamlines the research and development process, enabling more efficient healthcare resource allocation. The application of digital twins extends beyond the clinical setting, with surgical planning software and 3D organ modeling revolutionizing the field of precision medicine. Virtual physiological humans, patient data simulation, and population health management offer valuable insights into disease progression and patient experience metrics, ultimately contributing to the ongoing improvement of patient care.

What are the Key Data Covered in this Healthcare Digital Twins Market Research and Growth Report?

-

What is the expected growth of the Healthcare Digital Twins Market between 2025 and 2029?

-

USD 6.9 billion, at a CAGR of 43.9%

-

-

What segmentation does the market report cover?

-

The report is segmented by Component (Software and Service), Application (Personalized medicine, Drug discovery and development, Surgical planning, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Government support for personalized medicine, Cybersecurity threats

-

-

Who are the major players in the Healthcare Digital Twins Market?

-

ANSYS Inc., Atos SE, Dassault Systemes SE, Exactcure, Faststream Technologies, GE Healthcare Technologies Inc., International Business Machines Corp., Koninklijke Philips N.V., Microsoft Corp, NVIDIA Corp., Oracle Corp, Predictiv Care Inc., Rescale Inc., Siemens Healthineers AG, ThoughtWire, Twins Digital Services India Pvt Ltd, Unlearn.ai Inc, and Verto Inc.

-

Market Research Insights

- The market encompasses various applications, including pharmacodynamic and pharmacokinetic modeling, remote monitoring platforms, and disease modeling techniques. This market continues to evolve, integrating advanced technologies such as natural language processing, machine learning, and deep learning. According to recent reports, the market is expected to grow by over 20% annually. For instance, remote monitoring platforms have shown significant outcomes in improving patient care. A study revealed a 30% reduction in hospital readmissions by implementing a remote monitoring system. Furthermore, the integration of telemedicine and wearable sensor data has facilitated more effective treatment plans and better patient outcomes.

- Despite the market's promising growth, healthcare data governance and data privacy regulations remain crucial considerations. The integration of federated learning healthcare and data interoperability solutions aims to address these concerns while ensuring data security and anonymization. These advancements are paving the way for a more connected and efficient healthcare ecosystem.

We can help! Our analysts can customize this healthcare digital twins market research report to meet your requirements.