Healthcare Middleware Market Size 2024-2028

The healthcare middleware market size is forecast to increase by USD 1.57 billion at a CAGR of 8.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing volume of healthcare data and the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) for data analysis. Real-time data exchange and cloud integration are becoming essential for healthcare providers to improve patient care and operational efficiency. The FHIR (Fast Healthcare Interoperability Resources) standard is gaining popularity for seamless data integration between different healthcare systems. However, data privacy and security concerns related to cloud hosting remain a challenge for market growth. To address these issues, middleware solutions are being developed with advanced security features and compliance with regulatory frameworks.

What will be the Size of the Healthcare Middleware Market During the Forecast Period?

- The healthcare industry is undergoing a significant digital transformation, with a focus on improving patient care, enhancing operational efficiency, and reducing costs. One of the key technologies driving this transformation is healthcare middleware. Middleware plays a crucial role in enabling seamless communication and data integration between various healthcare systems and smart devices. Healthcare middleware refers to software that facilitates the exchange of data between different applications, systems, and devices In the healthcare sector. This software helps ensure data interoperability, which is essential for improving patient outcomes and streamlining workflows.

- Communication middleware, platform middleware, and integration middleware are the three main types of healthcare middleware. Communication middleware enables real-time data exchange between different systems and devices, ensuring that critical patient information is available in real-time. Platform middleware provides a unified platform for managing and integrating various healthcare applications, while integration middleware facilitates the seamless transfer of data between different systems and applications. The market In the US is expected to grow significantly due to the increasing utilization of connected medical devices, telehealth, and the Internet of Medical Things (IoMT). The adoption of cloud-based middleware solutions, including machine learning (ML) and artificial intelligence (AI), is also driving market growth.

How is this Healthcare Middleware Industry segmented and which is the largest segment?

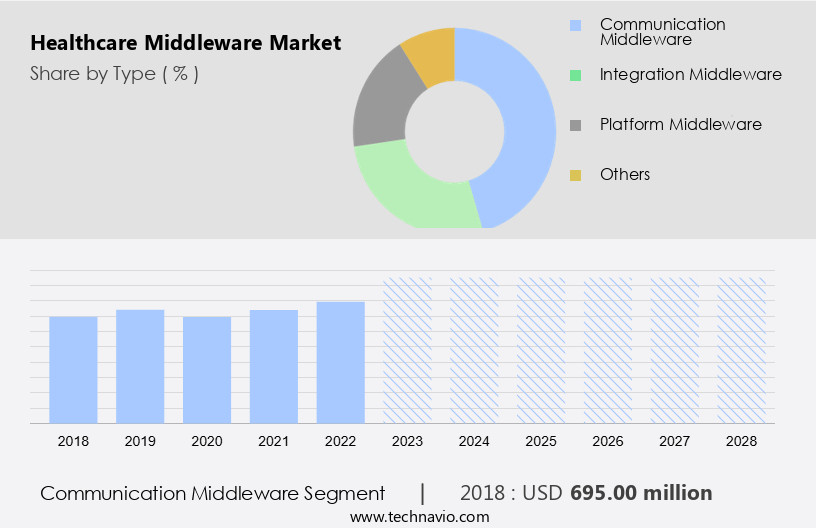

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Communication middleware

- Integration middleware

- Platform middleware

- Others

- Deployment

- On-premises

- Cloud-based

- Hybrid

- End-user

- Healthcare providers

- Life science organizations

- Healthcare payers

- Clinical laboratories

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

- The communication middleware segment is estimated to witness significant growth during the forecast period.

In the healthcare sector, middleware technology serves as a crucial communication bridge between various applications, software components, and processes. This software facilitates data exchange between previously independent systems, enabling seamless information flow within and between hospitals and clinics. Middleware plays a pivotal role in enhancing patient management by consolidating data from multiple sources into a unified database. The integration of middleware technology in healthcare also bolsters data security. By implementing secure communication channels, sensitive patient information is safeguarded from unauthorized access. Furthermore, the use of middleware solutions in hospitals and clinics enhances interoperability between disparate systems, allowing for seamless integration of pharmaceutical, insurance, and other essential healthcare services.

The advent of the Internet of Things (IoT) in healthcare has led to the emergence of the Internet of Healthcare Things (IoHT). Middleware technology plays a significant role in managing the vast amount of data generated by the proliferation of wireless and embedded devices in healthcare settings. With the implementation of middleware solutions, healthcare organizations can effectively manage and secure the data generated by these devices, ensuring optimal patient care and improved operational efficiency.

Get a glance at the Healthcare Middleware Industry report of share of various segments Request Free Sample

The Communication middleware segment was valued at USD 695.00 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the global healthcare landscape, North America holds the largest share of the market in 2023. This trend is anticipated to persist throughout the forecast period. The significant growth of this market in North America can be attributed to escalating healthcare expenditures and advanced technological developments In the healthcare sector. Major contributors to this market in North America include the United States, Canada, and Mexico.

Healthcare middleware solutions have gained increasing popularity in North America due to their ability to enhance interoperability between various medical devices and patient information systems. Furthermore, the integration of telehealth and IoMT (Internet of Medical Things) technologies into healthcare delivery systems has accelerated the adoption of healthcare middleware solutions. Artificial Intelligence (AI) is also being integrated into healthcare middleware to improve patient care and streamline operations. These advancements are expected to fuel the growth of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Healthcare Middleware Industry?

A rising amount of healthcare data is the key driver of the market.

- The healthcare industry, which contributes significantly to the economies of developed nations, generating over 10% of the GDP, is experiencing a data revolution. With technological advancements, healthcare data generation has accelerated at an unprecedented rate. To effectively manage this data influx, healthcare organizations are increasingly adopting advanced technologies such as AI and machine learning (ML) for data integration and real-time data exchange.

- FHIR (Fast Healthcare Interoperability Resources) is a standard for exchanging electronic health information, enabling seamless data transfer between systems. Cloud integration is another popular solution for managing large volumes of healthcare data. By leveraging these technologies, healthcare organizations can gain valuable insights from their data, improving patient care and operational efficiency.

What are the market trends shaping the Healthcare Middleware Industry?

Increasing adoption of advanced technologies in healthcare is the upcoming market trend.

- Healthcare organizations are enhancing their IT infrastructure to optimize operations and deliver personalized patient care. The shift towards value-based healthcare and the integration of technologies like telemedicine, remote patient monitoring, and population health management are driving this investment. Cloud computing is a key enabler, allowing for the secure storage and analysis of large datasets. Artificial Intelligence (AI) is gaining traction in healthcare, particularly In the areas of patient outcomes and personalized medicine. By leveraging AI, healthcare professionals can analyze vast amounts of data to identify patterns and trends, leading to more accurate diagnoses and effective treatments.

- Moreover, the adoption of AI is streamlining administrative tasks, freeing up time for healthcare providers to focus on patient care. Telemedicine and remote patient monitoring are also on the rise, enabling healthcare providers to deliver care outside of traditional clinic settings. Investments in IT infrastructure and the integration of new technologies are essential for healthcare organizations to remain competitive and provide high-quality care.

What challenges does the Healthcare Middleware Industry face during its growth?

Data privacy and security issues about cloud hosting is a key challenge affecting industry growth.

- The integration of healthcare IT infrastructure, such as connected medical devices and middleware solutions, has led to an influx of valuable data In the healthcare industry. However, this data is vulnerable to cyberattacks, posing significant risks to patient privacy and organizational information.

- The market, including cloud-based middleware and machine learning (ML) solutions, plays a crucial role in managing and securing this data. With the increasing use of technology in healthcare, data exchange has become essential for efficient care delivery and research.

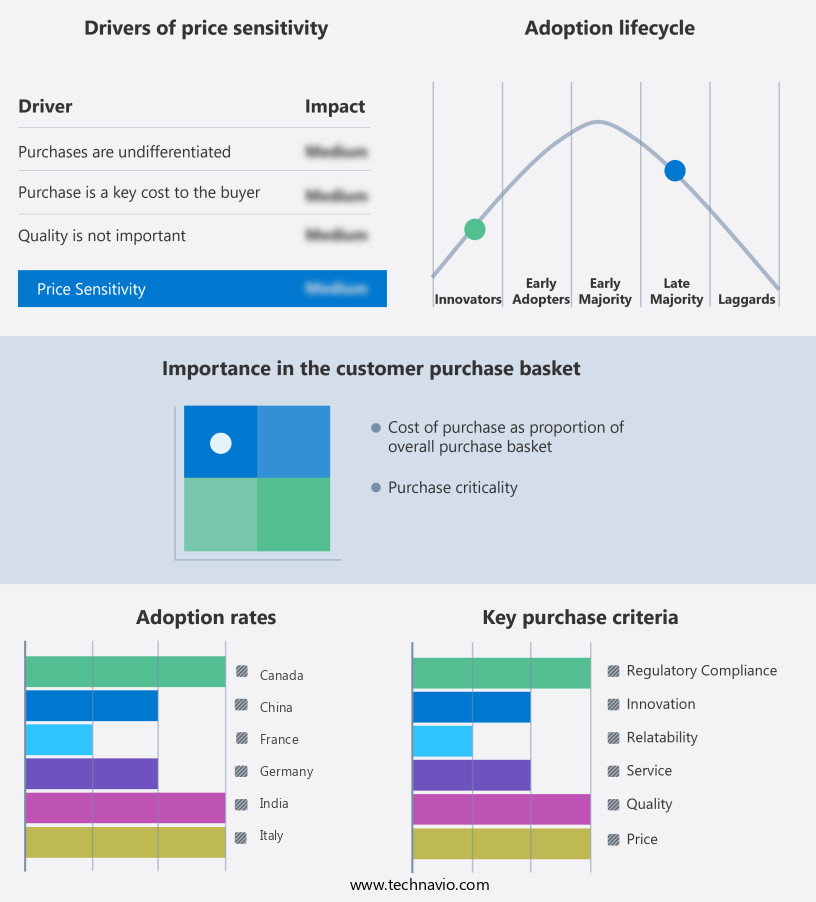

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the healthcare middleware market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, healthcare middleware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ascom Holding AG

- Axiom Software Solutions Ltd.

- BYG Informatique SAS

- Epic Systems Corp.

- Fujitsu Ltd.

- Informatica Inc.

- International Business Machines Corp.

- InterSystems Corp.

- Lyniate

- Microsoft Corp.

- Oracle Corp.

- Orion Health

- Software AG

- TIBCO Software Inc.

- Vayu Inc.

- Zoeticx Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing utilization of smart devices in healthcare and the need for seamless data interoperability. Communication middleware, platform middleware, and integration middleware are the key types of middleware solutions that facilitate data exchange between various healthcare systems and devices. Healthcare interoperability is a major challenge In the industry, and middleware plays a crucial role in enabling data integration, especially in clinical laboratories. Digital transformation in healthcare is driving the adoption of healthcare middleware, as it enables real-time data exchange, telehealth, IoMT, and AI/ML-based applications. Deployment models for healthcare middleware include on-premise, cloud-based, and hybrid models.

Furthermore, on-premise models offer physical security, while cloud-based models provide scalability and cost savings. Hybrid models offer a balance between the two. Healthcare IT infrastructure, including hospitals and clinics, pharmaceuticals, insurance, and healthcare providers, are the major end-users of healthcare middleware. Middleware solutions enable data analytics, patient management, data security, and clinical integration, leading to improved patient outcomes, personalized medicine, value-based healthcare, telemedicine, remote patient monitoring, and population health management. Cloud computing and blockchain are emerging technologies that are expected to impact the market significantly, offering deployment insights and enhanced data security.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market Growth 2024-2028 |

USD 1.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.2 |

|

Key countries |

China, US, Canada, UK, Japan, India, South Korea, Germany, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Healthcare Middleware Market Research and Growth Report?

- CAGR of the Healthcare Middleware industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the healthcare middleware market growth of industry companies

We can help! Our analysts can customize this healthcare middleware market research report to meet your requirements.