IGBT Market Size 2024-2028

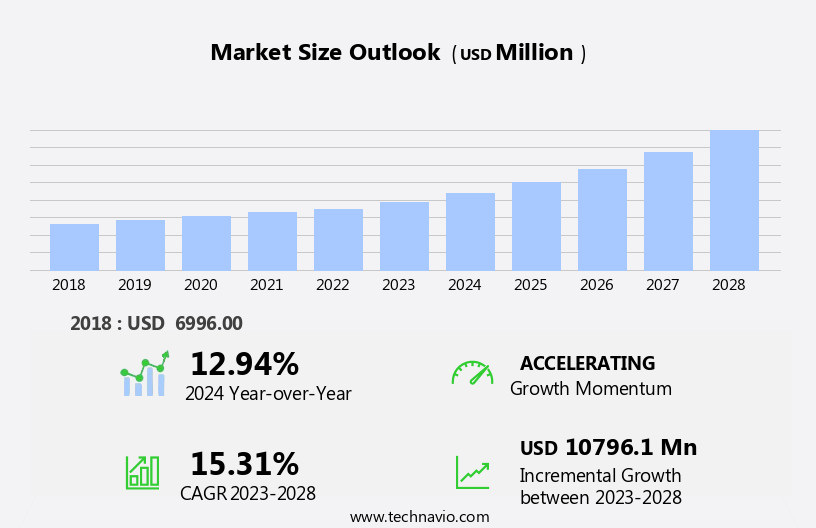

The igbt market size is forecast to increase by USD 10.8 billion at a CAGR of 15.31% between 2023 and 2028.

What will be the Size of the IGBT Market During the Forecast Period?

How is this IGBT Industry segmented and which is the largest segment?

The igbt industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- IGBT modules

- Discrete IGBTs

- Application

- EV or HEVs

- Industrial

- Motor drives

- Consumer appliance

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- North America

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

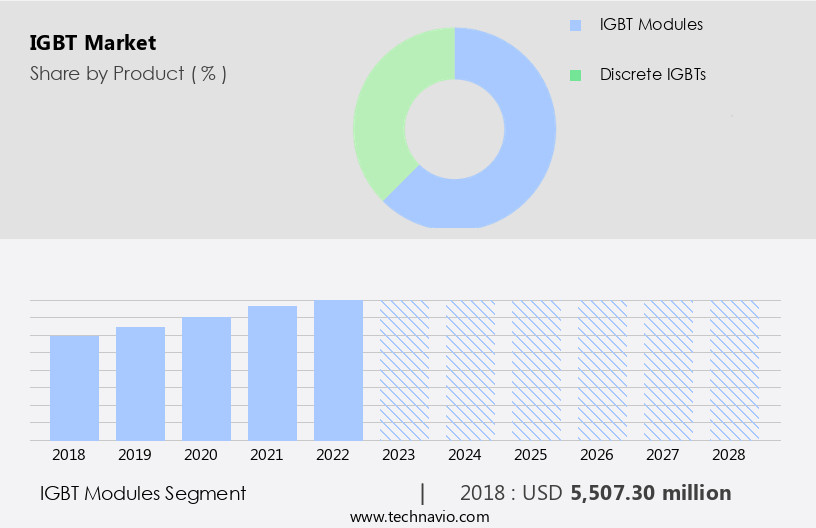

- The igbt modules segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for high-power semiconductor devices, particularly in applications such as electric vehicles (EVs), renewable projects, and industrial systems. IGBT modules, which consist of multiple integrated IGBTs, are preferred over discrete IGBTs due to their higher power handling capacity and compatibility with high-power applications. Inverter applications, including solar inverter applications, require IGBT devices to convert DC voltage to AC voltage while managing frequency and voltage. As the world transitions to electrification and renewable energy, the demand for IGBT modules is expected to rise, driven by the need for efficient power conditioning and conversion in various industries.

The high cost of electricity and carbon dioxide emissions are also factors contributing to the growth of the market. In the electronics manufacturing industry, 5G adoption and the production of electronic products, including consumer electronics, medical devices, and industrial equipment, are further boosting the demand for high-performance power transistors like IGBTs. Despite their high cost, IGBT modules offer advantages such as high efficiency, low thermal resistivity, and high turn-off time, making them a preferred choice for power transmission & distribution and smart grid applications. The market is expected to grow significantly during the forecast period due to these factors.

Get a glance at the IGBT Industry report of share of various segments Request Free Sample

The IGBT modules segment was valued at USD 5.51 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

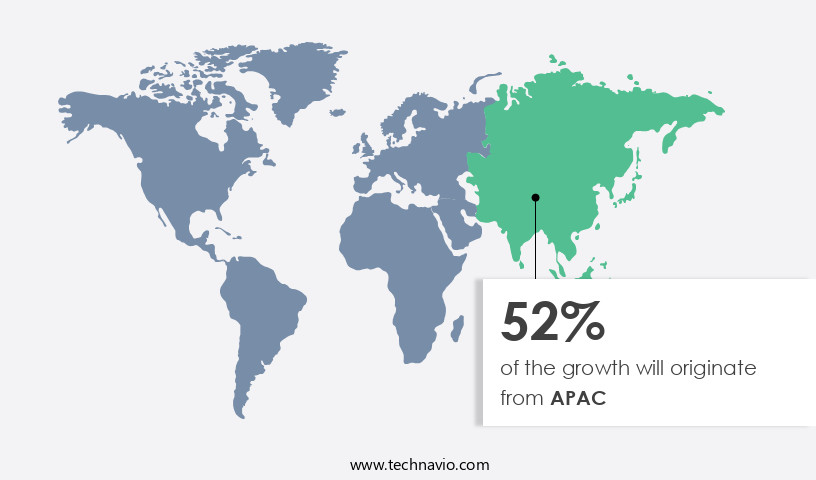

- APAC is estimated to contribute 52% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth, particularly In the APAC region, driven by industrialization, renewable energy adoption, and the rising demand for energy-efficient solutions in China, Japan, and India. The major contributors to this market are China and Japan, with companies relying heavily on their supply of IGBT products. However, Chinese companies face challenges in competing with European and Japanese companies due to their advanced R&D and fabrication capabilities. IGBTs are high-power semiconductor devices used in various applications, including inverter applications for electric vehicles (EVs), renewable projects, and industrial systems. Power transistors, such as IGBTs, offer advantages like high efficiency, low thermal resistivity, and high turn-off time.

Inverter applications require DC voltage conversion to AC voltage, which is essential for electric cars, solar inverter applications, and industrial motor drives. The increasing adoption of 5G and the electrification of industries further boosts the demand for IGBTs. Despite their high cost compared to Power MOSFETs, IGBTs offer better frequency and voltage handling capabilities and are a preferred choice for high-power applications. The market also caters to the needs of the electronics manufacturing industry, medical devices, and industrial equipment sectors. The increasing focus on reducing carbon dioxide emissions, improving fuel efficiency, and the adoption of green energy sources like solar and wind power further contribute to the market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of IGBT Industry?

Increasing government support for EV or HEVs is the key driver of the market.

What are the market trends shaping the IGBT Industry?

Functional consolidation of semiconductor devices is the upcoming market trend.

What challenges does the IGBT Industry face during its growth?

Rising competition from Wide bandgap (WBG) semiconductor materials is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The igbt market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the igbt market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, igbt market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - IGBTs, based on SPT technology, are offered In the market for manufacturing modules, press-packs, and hybrids, with voltage ranges extending from 1200 to 6500 volts. This advanced technology, established In the industry, caters to various power conversion applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Danfoss AS

- Fuji Electric Co. Ltd.

- Hitachi Ltd.

- Infineon Technologies AG

- IXYS Corp

- Jilin Hua Microelectronics Co. Ltd.

- Littelfuse Inc.

- MagnaChip Semiconductor Corp.

- Microchip Technology Inc.

- Mitsubishi Electric Corp.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Sanken Electric Co. Ltd.

- SEMIKRON Elektronik GmbH and Co. KG

- STARPOWER SEMICONDUCTOR Ltd.

- STMicroelectronics International N.V.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The IGBT (Insulated Gate Bipolar Transistor) market encompasses a range of power device technologies that are increasingly being adopted in various applications due to their unique advantages. IGBTs are high-power semiconductor devices that offer superior efficiency and thermal management capabilities, making them ideal for use in inverter applications. IGBTs find extensive usage in electronic products, including electric vehicles (EVs) and renewable energy projects. In the EV market, IGBTs are used In the inverter circuit to convert DC voltage to AC voltage, enabling the efficient operation of electric motors. In the renewable energy sector, IGBTs are employed in solar inverter applications to convert DC voltage generated from solar panels into AC voltage suitable for grid connection.

The power electronics industry's growing emphasis on reducing carbon dioxide emissions and improving fuel efficiency has led to the widespread adoption of IGBTs. The cost of electricity and the need for reliable power transmission and distribution have further boosted the demand for these devices. IGBTs are also finding increasing applications in industrial equipment, consumer electronics, medical devices, and industrial systems. The 5G adoption and the resulting increase in data center power consumption have also contributed to the growth of the market. The efficiency of IGBTs is a significant factor driving their adoption. IGBTs offer high efficiency levels, which is essential in applications where power consumption is a critical concern.

Additionally, their thermal resistivity is lower than that of traditional power transistors, enabling better heat dissipation. The market is expected to grow significantly due to the ongoing trend towards electrification and industrialization. The aging power infrastructure and the need for green energy solutions are also expected to drive the market's growth. Despite their advantages, IGBTs face challenges such as high turn-off time and the need for specialized manufacturing processes. However, ongoing research and development efforts are aimed at addressing these challenges and improving the overall performance and affordability of IGBTs. In conclusion, the market is poised for significant growth due to its applications in various industries and the increasing demand for efficient and reliable power solutions.

The market's growth is driven by factors such as the need for renewable energy, the electrification trend, and the increasing demand for high-performance electronic devices. The challenges facing the market include the need for specialized manufacturing processes and the high turn-off time of IGBTs. Despite these challenges, the future of the market looks promising, with ongoing research and development efforts aimed at improving the performance and affordability of these devices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.31% |

|

Market growth 2024-2028 |

USD 10796.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.94 |

|

Key countries |

China, Japan, South Korea, US, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this IGBT Market Research and Growth Report?

- CAGR of the IGBT industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the igbt market growth of industry companies

We can help! Our analysts can customize this igbt market research report to meet your requirements.