Ion Exchange Membranes Market Size 2024-2028

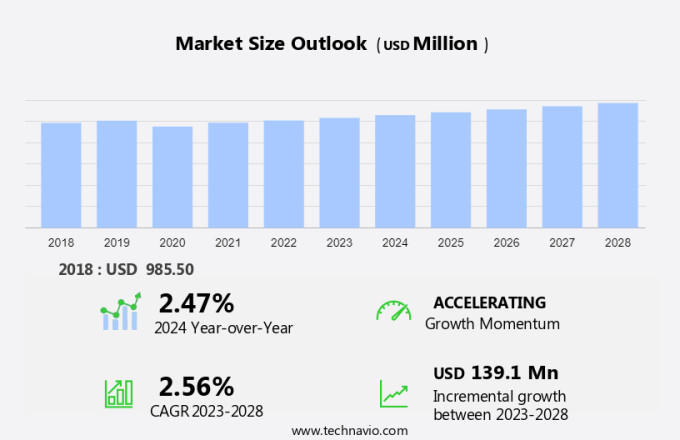

The ion exchange membranes market size is forecast to increase by USD 139.1 million at a CAGR of 2.56% between 2023 and 2028. Ion exchange membranes, specifically cation exchange membranes, have gained significant traction in various industries due to their unique properties. The polymer matrix of these membranes is engineered to enhance their performance in industrial processes like zero liquid discharge systems. However, the market faces challenges such as the presence of substitutes and the harmful effects of hard water. As consumers become more health-conscious, the demand for water treatment solutions using ion exchange membranes is expected to increase.

Market Analysis

Ion exchange membranes (IEMs) are a type of membrane technology that plays a crucial role in various industries, including water treatment and chemical processing. These membranes are essential for separating ions from water and other solutions, making them indispensable in applications such as desalination, power generation, and effluent treatment systems. IEMs function by utilizing a semipermeable membrane with a polymer matrix that contains fixed ionic groups. These groups exchange ions with ions in the feed solution, resulting in the separation of ions and the production of pure water or concentrated solutions.

Furthermore, anion exchange membranes (AEMs) and cation exchange membranes (CEMs) are two common types of IEMs, each selectively exchanging anions and cations, respectively. The water treatment industry is a significant consumer of IEMs, with applications in desalination and drinking water production. Reverse osmosis plants and electrodialysis systems utilize IEMs to remove ions and impurities from water, ensuring safe drinking water for households and industries. In the municipal sector, regulatory mandates require the implementation of zero liquid discharge (ZLD) systems, which rely on IEMs for the treatment and recovery of wastewater. IEMs also find extensive applications in the chemical processing and oil & gas sectors.

Moreover, in chemical processing, IEMs are used for the recovery of valuable chemicals and the separation of ions in various industrial processes. In the oil & gas sector, IEMs are employed in fuel cells and hydrocarbon membranes for the separation of gases and the production of hydrogen. Moreover, IEMs are used in chromatographic separation processes for the purification of pharmaceuticals, food additives, and other high-value chemicals. Heterogeneous membranes and composite membranes are advanced IEM designs that offer improved selectivity and efficiency in various applications. Inorganic membranes are another type of IEMs that exhibit superior stability and resistance to harsh environments.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Hydrocarbon Membrane

- Perfluorocarbon Membrane

- Inorganic Membrane

- Composite Membrane

- Partially Halogenated Membrane

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- France

- Middle East and Africa

- South America

- APAC

By Material Insights

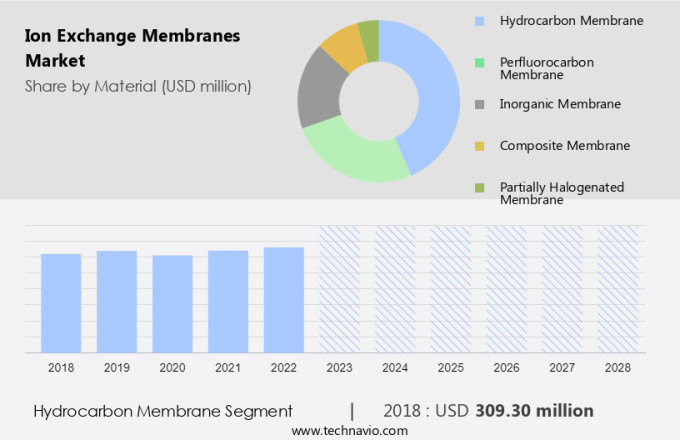

The hydrocarbon membrane segment is estimated to witness significant growth during the forecast period. Hydrocarbon membranes, comprised primarily of hydrocarbon-based polymers, have gained significant traction in the market due to their application in anion exchange membranes (AEMs) for water electrolysis. AEM water electrolysis is a process used to generate green hydrogen from water through the utilization of renewable energy. This technology is increasingly being adopted in various industries, including residential energy storage, mobility, power generation, and research, as a viable alternative to fossil fuels. Additionally, AEM water electrolysis is employed in industrial processes such as salt splitting for the recovery of acids and metals, as well as in the production of AEM fuel cells and the conversion of carbon dioxide.

Furthermore, the electrolysis segment of the market is anticipated to grow substantially due to the increasing demand for AEM water electrolysis in various industries and sectors. Moreover, the oil & gas sector is another major consumer, specifically cation exchange membranes (CEMs), in the desalination and water treatment processes. Semipermeable membranes, a type of ion exchange membrane, are used in these applications to separate ions from water, making it suitable for industrial processes and zero liquid discharge systems. The membrane filtration technology employed in these membranes is essential for the efficient separation and recovery of valuable chemicals in the oil & gas industry.

Get a glance at the market share of various segments Request Free Sample

The hydrocarbon membrane segment accounted for USD 309.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

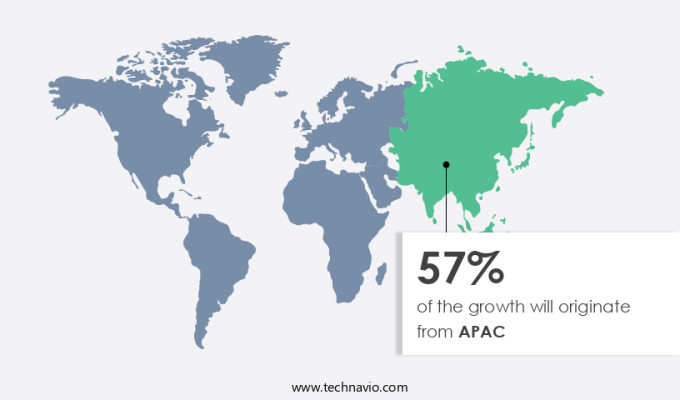

APAC is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific is poised for continuous expansion due to the region's thriving economy and the growth of various end-user industries. Notably, the food and beverage and water treatment sectors are significant contributors to market growth in this region. In addition, the demand is escalating in the pharmaceutical industry, particularly in countries like India and China, where the production of antibody-based pharmaceuticals is on the rise. Furthermore, the agriculture, biotechnology, academic institutions, and research laboratories sectors are also driving market growth in this region. The Chinese and Indian markets are anticipated to experience remarkable growth during the forecast period due to increased government investment in the healthcare and biomedical sectors.

Furthermore, ion exchange membranes are essential in various applications, including ballast water treatment in maritime industries, refineries, petrochemical plants, and bulk storage terminals. They are also used in cooling towers and boilers for water softening and desalination processes. Inorganic membranes, specifically cation exchange membranes, are widely used in these applications due to their high selectivity and efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The harmful effects of hard water is notably driving the market growth. They are essential components in various industries, including the food and beverage sector and waste water treatment, where they play a crucial role in ensuring safe drinking water and industrial processes. Two primary types of ion exchange membranes are Cation Exchange Membranes (CEM) and Anion Exchange Membranes (AEM). CEMs selectively allow the passage of cations, while AEMs allow the passage of anions. Hydrocarbon membranes and inorganic membranes are other types, each with unique applications. Composite membranes, which combine the advantages of homogenous and heterogeneous membranes, are increasingly popular. Electro Dialysis (ED) and Electrolysis are common applications of ion exchange membranes. ED is used for the separation of ions from water, while Electrolysis is used for the production of chemicals and green hydrogen processing.

In the electronic sector, ion exchange membranes find use in batteries and sensors due to their high proton conductivity. Heterogeneous membranes, which have an inert matrix, are preferred for their stability and long service life. The performance of these membranes is critical in various applications, from water treatment to industrial processes and advanced technologies. Iron chromium cells, a type of electrolysis plant, are a significant consumer of ion exchange membranes. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Growing health consciousness among consumers is the key trend in the market. Ion exchange membranes are essential components in various industries, including the food and beverage sector and waste water treatment, where they play a crucial role in ensuring safe drinking water and industrial processes. Two primary types of ion exchange membranes are Cation Exchange Membranes (CEM) and Anion Exchange Membranes (AEM), each selectively allowing the passage of specific ions. Hydrocarbon membranes and inorganic membranes are other types used in specific applications. Composite membranes, which combine the advantages of different membrane types, are gaining popularity due to their enhanced performance.

Further, electro Dialysis and Electrolysis are common applications of ion exchange membranes, with the latter used in electrolysis plants, such as those employing iron chromium cells, for green hydrogen processing. In the electronic sector, these membranes find use in batteries and sensors due to their proton conductivity. Heterogeneous membranes, featuring an inert matrix, are preferred for their stability and longevity in various industrial applications. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The presence of substitutes is the major challenge that affects the growth of the market. They are essential components in various industries, including the food and beverage sector and waste water treatment, for ensuring safe drinking water and industrial processes. Two primary types of ion exchange membranes are Cation Exchange Membranes (CEMs) and Anion Exchange Membranes (AEMs), which selectively exchange ions based on their charge. Hydrocarbon membranes and inorganic membranes are other types used in specific applications. Composite membranes, combining the advantages of different membrane types, have gained popularity.

Electro Dialysis and Electrolysis, which utilize ion exchange membranes, are crucial in water treatment and green hydrogen processing. In the electronic sector, these membranes are employed in batteries and sensors, enhancing their performance. Membrane performance is influenced by factors like proton conductivity, membrane structure, and the presence of an inert matrix. Electrolysis plants, such as those using iron chromium cells, leverage these membranes for efficient electrolysis processes. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers ion exchange membranes using hybrid purifiers that are designed for soluble and insoluble impurities reduction using anion exchange chromatography and eliminates the need for packing and cleaning validation and has 100X higher binding capacity for proteins, viruses, virus-like particles, and other large negatively charged complexes when to compared to resins, under the brand name of 3M Emphaze and 3M Polisher ST.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AGC Inc.

- Applied Water Solutions Inc.

- ASTOM Corp.

- BWT Holding GmbH

- DuPont de Nemours Inc.

- FUJIFILM Corp.

- Ion Exchange India Ltd.

- Ionomr Innovations Inc.

- Lanxess AG

- Liaoning Yichen Membrane Technology Co. Ltd.

- M.L. Ball Co. Inc.

- Merck KGaA

- ResinTech Inc.

- Saltworks Technologies Inc.

- SUEZ WTS USA Inc.

- The Chemours Co.

- Toray Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ion exchange membranes play a significant role in various industries, including desalination, chemical processing, power generation, and water treatment. These membranes are essential in reverse osmosis plants, municipal sector, and industrial processes for water treatment, effluent treatment systems, and zero liquid discharge. Regulatory mandates drive the demand for ion exchange membranes in the water technology sector, particularly in seawater distillation, oil & gas sector, and cooling towers. The electrolysis segment, including chlor-alkali electrolysis, utilizes ion exchange membranes for chemical recovery. Fuel cells, electrodialysis, and perfluorocarbon membranes are other applications of ion exchange membranes. The oil & gas sector uses these membranes in oil well injection, refineries, petrochemical plants, and bulk storage terminals.

Furthermore, inorganic membranes, such as cation exchange membranes, anion exchange membranes, hydrocarbon membranes, and composite membranes, are widely used due to their high selectivity and stability. Membrane filtration technology, including electro dialysis, electrolysis, chromatographic separation, and membrane performance, are crucial for various industries. The food & beverage sector and wastewater treatment companies employ ion exchange membranes for safe drinking water and wastewater treatment. Membranes are also used in sewage treatment, earth's water, and drinking water. Heterogeneous and homogenous membranes offer proton conductivity, making them suitable for various applications. Electrolysis plants, iron chromium cells, green hydrogen processing, batteries, sensors, and membrane performance are other areas where ion exchange membranes contribute significantly. The electronic sector benefits from these membranes in various applications, including batteries and sensors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.56% |

|

Market growth 2024-2028 |

USD 139.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.47 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 57% |

|

Key countries |

US, China, Germany, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., AGC Inc., Applied Water Solutions Inc., ASTOM Corp., BWT Holding GmbH, DuPont de Nemours Inc., FUJIFILM Corp., Ion Exchange India Ltd., Ionomr Innovations Inc., Lanxess AG, Liaoning Yichen Membrane Technology Co. Ltd., M.L. Ball Co. Inc., Merck KGaA, ResinTech Inc., Saltworks Technologies Inc., SUEZ WTS USA Inc., The Chemours Co., and Toray Industries Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch