Metal Food Cans Market Size 2024-2028

The metal food cans market size is forecast to increase by USD 3.85 billion, at a CAGR of 3.1% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing disposable income of consumers worldwide. This trend is leading to an uptick in demand for convenience foods, which are often sold in metal cans. Furthermore, innovative product launches by market companies continue to attract consumers with their unique features and improved functionality. However, the market faces challenges related to the rising concerns over toxins in food due to canned goods packaging. This issue, which has gained increasing attention from health-conscious consumers, necessitates the adoption of safer production methods and alternative packaging solutions to mitigate potential health risks.

- Companies seeking to capitalize on market opportunities must focus on developing eco-friendly and health-conscious product offerings while addressing the challenges posed by the increasing consumer awareness of food safety concerns.

What will be the Size of the Metal Food Cans Market during the forecast period?

The metal food and beverage can market continues to evolve, with dynamic market trends shaping its landscape. The integration of advanced technologies in can manufacturing, such as seamless body production and automated filling lines, ensures optimal product protection and longer shelf life. Product innovation, driven by consumer preferences, is a significant market driver. Lightweight cans and sustainable packaging solutions are gaining traction, reflecting the industry's commitment to environmental stewardship. Can quality control and food safety remain top priorities, with tamper-evident seals, easy-open lids, and can inspection systems ensuring consumer confidence. Can labeling and decoration, from simple branding to intricate graphics, play a crucial role in product differentiation.

In the food service sector, can transportation and logistics are essential, with can stacking and can distribution systems streamlining the supply chain. Steel and tin cans, with their robustness and durability, continue to dominate the market, while aluminum cans offer lighter weight and recyclability. Can filling, product protection, and lacquer coating technologies are continually advancing, ensuring optimal preservation of food and beverage contents. The can body, a critical component, undergoes constant innovation, with can closures and can labeling equipment adapting to meet changing market demands. Brand loyalty and consumer preferences shape the market, with product innovation and sustainable packaging solutions being key differentiators. The ongoing unfolding of market activities and evolving patterns underscore the continuous dynamism of the metal food and beverage can market.

How is this Metal Food Cans Industry segmented?

The metal food cans industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Aluminum

- Steel

- Type

- Two-pieces

- Three-pieces

- Application

- Fruits & Vegetables

- Meat & Seafood

- Beverages

- Pet Food

- End-User

- Food Manufacturers

- Retail

- Geography

- North America

- US

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Material Insights

The aluminum segment is estimated to witness significant growth during the forecast period.

Aluminum's lightweight, corrosion-resistant, and recyclable properties make it a preferred choice in the market. Its superior performance, especially in the food and beverage sectors, is driving its adoption due to the increasing global demand for sustainable packaging solutions. The aluminum cans market is experiencing growth, as evidenced by Ball Corporation's expansion plans in South America. In 2023, they announced the construction of a new manufacturing plant in Chilca, Peru, with an annual capacity of over 1 billion beverage cans. Can quality control, handling, and decoration are essential aspects of can manufacturing, ensuring food safety and brand loyalty.

Sustainable packaging, including high-barrier cans, is a key trend, as is product innovation and food preservation through advanced can sealing, lacquer coating, and can lining. Can automation, logistics, and filling lines are also critical components, enhancing product protection and shelf life. Consumer preferences continue to influence market dynamics, with easy-open lids and can stacking essential for convenience. Can closures, labeling equipment, and graphics further contribute to the market's evolution. Steel and tin cans also remain significant players, offering cost-effective alternatives while maintaining product protection and shelf life. Overall, the market is an evolving landscape, with a focus on innovation, sustainability, and consumer preferences.

The Aluminum segment was valued at USD 14.13 billion in 2018 and showed a gradual increase during the forecast period.

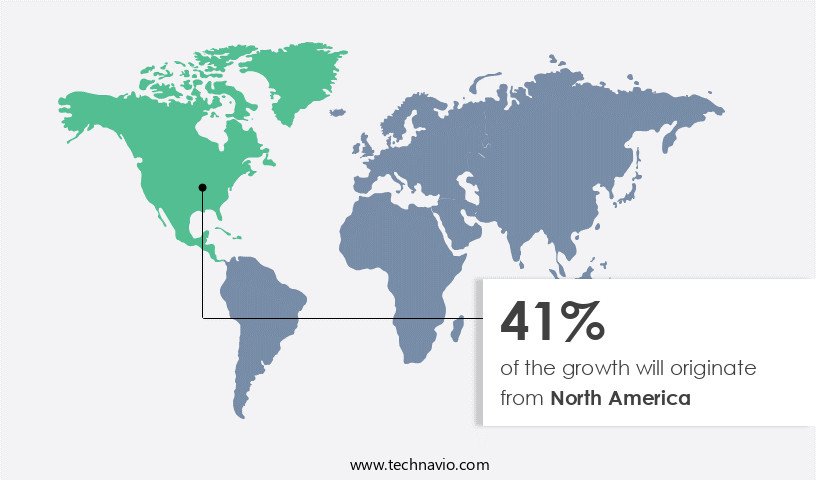

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, driven by shifting consumer preferences towards plant-based and sustainable food options. Approximately 5-8% of the US population, equating to over 10.7 million people, identify as vegetarian or vegan. In Canada, this number stands at around 2 million vegans as of 2022. This trend is fueling the demand for canned vegetables and plant-based meat alternatives, as they align with these dietary choices. Canned foods offer extended shelf life, product protection, and convenience, making them an ideal solution for both consumers and food manufacturers. The metal containers industry encompasses various entities, including beverage cans, aluminum cans, steel cans, tin cans, and metal food cans.

These containers undergo rigorous quality control processes, ensuring food safety and product preservation. Can manufacturing involves various stages, including can filling, can sealing, can inspection systems, and can automation. Sustainability is a crucial factor in the market, with the adoption of lightweight cans, sustainable packaging, and high-barrier cans. Can labeling, can decoration, and can labeling equipment are essential aspects of the industry, contributing to brand loyalty and product innovation. Can transportation and distribution networks ensure efficient logistics, while can handling and can stacking optimize storage and ease of use. Food processing plays a significant role in the industry, with can filling lines and can sealing machines streamlining production.

Easy-open lids, tamper-evident seals, and can inspection systems ensure food safety and product integrity. Can closures and can linings provide additional protection and enhance the overall consumer experience. In conclusion, the market in North America is witnessing growth due to changing consumer preferences, the rise of plant-based foods, and the ongoing focus on sustainability. The industry caters to various entities, from can manufacturing and transportation to labeling and product innovation, ensuring the delivery of high-quality, safe, and convenient food solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Metal Food Cans Market advances with metal cans for food packaging and aluminum cans for beverages. Metal cans market trends 2024 emphasize recyclable metal cans and sustainable food packaging. Cans for processed foods and cans for pet food fuel demand, per metal cans market forecast. BPA-free metal cans leverage cans for ready meals, while cans for dairy products ensure durability. Cans for retail shelves and cans for e-commerce enhance accessibility. Cans for environmental compliance, advanced can manufacturing, and metal cans supply chain drive efficiency. Cans for global markets, cans for regulatory standards, cans for food safety, cans for shelf life, and metal cans for B2B sectors propel growth through 2028.

What are the key market drivers leading to the rise in the adoption of Metal Food Cans Industry?

- The increase in disposable income serves as the primary catalyst for market growth. The market experiences growth due to increasing disposable income levels in various regions. In 2023, the average monthly income in Brazil reached approximately USD548, marking a 7.2% increase from the previous year. This income growth leads to increased consumer spending on packaged food products, including metal food cans. Similarly, in China, disposable personal income rose to around USD7,390, up from USD7,028 in 2022. This long-term trend in income growth is expected to fuel demand for convenient food packaging, such as metal cans, particularly for ready-to-eat and processed food products during the forecast period. Food safety is a critical factor in the market.

- Can manufacturing processes ensure food preservation through proper sealing and airtight containers. Easy-open lids and can labeling equipment facilitate consumer convenience. Product innovation, including the development of new can designs and materials, further enhances market growth. Can transportation logistics and closures are also essential considerations to maintain the integrity of the food products during distribution. Brand loyalty plays a significant role in market dynamics, with consumers relying on trusted brands for food safety and product quality. As consumer preferences shift towards healthier and more sustainable food options, the market will need to adapt to meet these demands. Overall, the market is poised for growth, driven by income growth, convenience, and food preservation.

What are the market trends shaping the Metal Food Cans Industry?

- Market trends indicate an increasing number of innovative product launches by companies. This professional development is shaping the market landscape.

- The market is witnessing significant innovation in packaging solutions, with a focus on enhancing product safety and sustainability. Notably, AkzoNobel Packaging Coatings introduced the Securshield 500 Series, a PVC-free and bisphenol-free internal coating for easy-open food cans. This development comes amidst increasing regulatory scrutiny on bisphenols due to health concerns. The new coating technology seamlessly integrates into existing manufacturing processes, making it adaptable for various metal food packaging applications.

- AkzoNobel asserts that this innovation improves chemical resistance, enabling it to accommodate a wide range of food products, including those with challenging characteristics like saltiness or acidity. This advancement underscores the industry's commitment to providing advanced, consumer-friendly, and health-conscious packaging solutions.

What challenges does the Metal Food Cans Industry face during its growth?

- The increase in toxins in canned food due to packaging is a significant challenge that negatively impacts the growth of the organic food industry. This issue, which arises from the preservation process, raises concerns about consumer safety and industry reputation. To mitigate this challenge, companies are investing in research and development of alternative packaging solutions and stricter quality control measures.

- The market is currently confronting substantial challenges due to growing health concerns regarding toxins in canned packaging. According to recent research, over 3,600 chemicals approved for food contact materials were detected in humans in September 2024, raising concerns about potential health risks. Among these compounds are metals and per- and polyfluoroalkyl substances (PFAS), which are linked to severe health issues such as cancer and hormone disruption. The migration of hazardous chemicals from food packaging into food poses a significant concern, as it presents an exposure pathway. Studies indicate that many toxic substances can leach into food, particularly under conditions of high temperature, fat content, and acidity.

- This issue highlights the need for advanced can technologies to mitigate the risks associated with canned food. To address these challenges, the market is witnessing innovation in various areas, including can graphics, can lining, can automation, can sealing machines, can filling lines, and can inspection systems. High-barrier cans, which offer improved protection against chemical migration, are gaining popularity. These cans employ multiple layers of protective coatings to prevent the entry of contaminants and maintain the food's freshness and quality. In conclusion, the market is undergoing significant changes to meet evolving consumer preferences and address health concerns. The focus is on developing advanced can technologies that ensure food safety and maintain product quality while minimizing the risk of chemical migration.

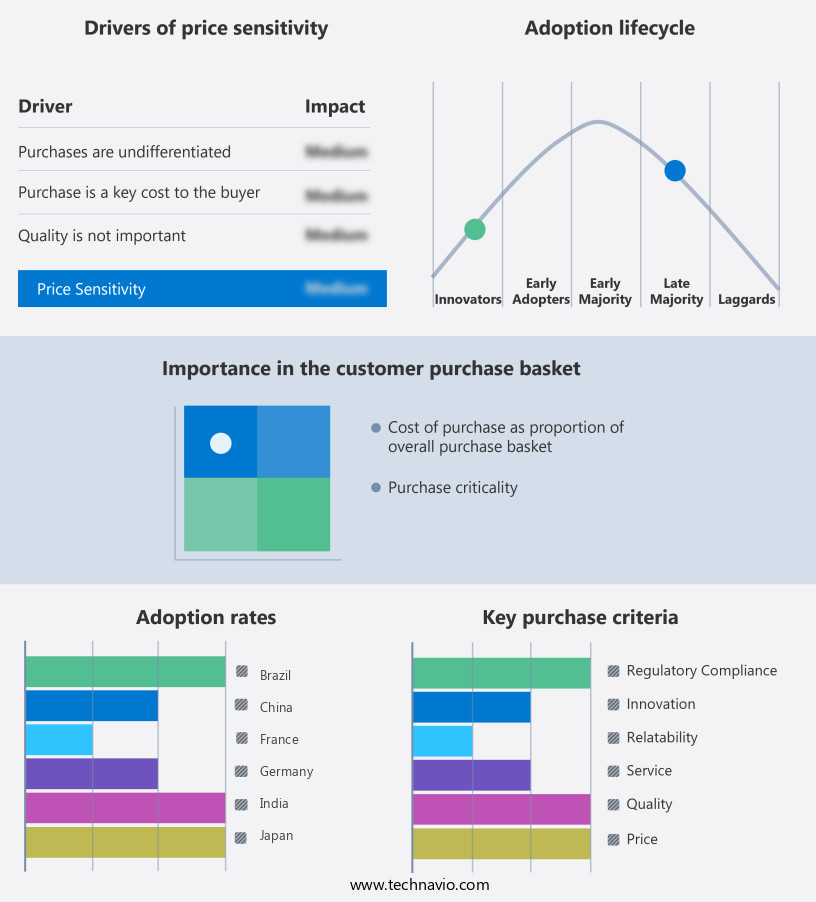

Exclusive Customer Landscape

The metal food cans market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal food cans market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal food cans market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Crown Holdings - The company specializes in a diverse range of metal food containers, including decorative tins, seamless tins, and hermetic cans. These offerings cater to various industries and applications, ensuring product integrity and aesthetic appeal. Decorative tins enhance food presentation, while seamless tins provide superior protection against contaminants. Hermetic cans, with their vacuum-sealed design, preserve food freshness for extended periods. The company's commitment to innovation and quality elevates its metal food container solutions, enhancing customer satisfaction and brand loyalty.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Crown Holdings

- Ball Corporation

- Ardagh Group

- Silgan Holdings

- Can-Pack S.A.

- Toyo Seikan

- Sonoco Products

- Trivium Packaging

- CCL Container

- Colep Packaging

- Visy Industries

- Envases Universales

- Huber Packaging

- Coster Group

- Mauser Packaging

- Nampak

- Orora Packaging

- Tata Steel

- Cansolv Technologies

- Metal Box International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metal Food Cans Market

- In March 2023, Ball Corporation announced the launch of its innovative Eco-Friendly aluminum beverage can, named the Ball Aluminum Cup, which is fully recyclable and designed to reduce plastic waste in the beverage industry (Ball Corporation Press Release, 2023).

- In July 2024, Crown Holdings Inc. And Nestlé entered into a strategic partnership to develop and commercialize a new line of sustainable metal packaging for food products. This collaboration is expected to significantly reduce the use of plastic packaging in the food industry (Crown Holdings Inc. Press Release, 2024).

- In November 2024, Ardagh Metal Packaging completed the acquisition of the metal packaging business of Silgan Containers Corporation. This acquisition strengthened Ardagh's position as a leading global supplier of metal packaging, expanding its product portfolio and geographic reach (Ardagh Metal Packaging Press Release, 2024).

- In February 2025, the European Union passed a new regulation mandating the use of recyclable or reusable packaging for food products by 2026. This regulatory initiative is expected to significantly boost the demand for metal food cans in Europe due to their high recyclability rates (European Commission Press Release, 2025).

Research Analyst Overview

- The metal food can market encompasses various product categories, including vegetable, fish, soup, tea, fruit, juice, coffee, beer, energy drink, wine, pet food, and meat cans. Can volumes continue to grow, driven by consumer preferences for convenience and longer shelf life. Labeling techniques, such as offset printing and digital printing, play a crucial role in enhancing product appeal. Can handling systems, including can depalletizing and palletizing, streamline production processes and optimize warehouse space. Can shapes and sizes vary, with BPA-free and lighter weight options gaining popularity. Coatings and materials, including those for aerosol cans, ensure product protection and safety.

- Can recycling rates remain a focus, with distribution networks and collection programs essential for effective recovery. Can reuse and sustainability initiatives are increasingly important, as are innovations in can printing technologies, such as flexographic printing and can coating applications. Can weights and warehousing solutions are critical for efficient transportation and storage, while can recovery and recycling efforts contribute to the circular economy. Market trends include the increasing use of digital printing for personalized labeling and the adoption of energy-efficient can manufacturing processes. Can handling systems, like depalletizing and palletizing, streamline production processes and optimize warehouse space. Can shapes and sizes vary, with BPA-free and lighter weight options gaining popularity.

- Coatings and materials, including those for aerosol cans, ensure product protection and safety. Can recycling rates remain a focus, with distribution networks and collection programs essential for effective recovery. Can reuse and sustainability initiatives are increasingly important, as are innovations in can printing technologies, such as flexographic printing and can coating applications. Can weights and warehousing solutions are critical for efficient transportation and storage, while can recovery and recycling efforts contribute to the circular economy. Market trends include the increasing use of digital printing for personalized labeling and the adoption of energy-efficient can manufacturing processes. Can handling systems, like depalletizing and palletizing, streamline production processes and optimize warehouse space.

- Can manufacturers adopt offset and digital printing techniques for labeling, with flexographic printing and can coating applications gaining traction. Can recycling rates remain a priority, with distribution networks and collection programs essential for effective recovery. Can reuse and sustainability initiatives are increasingly important, as are innovations in can manufacturing processes, such as energy-efficient production methods. Can weights and warehousing solutions are critical for efficient transportation and storage, while can recovery and recycling efforts contribute to the circular economy. Market trends include the growing use of digital printing for personalized labeling and the adoption of sustainable can manufacturing practices.

- Can handling systems, like depalletizing and palletizing, streamline production processes and optimize warehouse space. Can manufacturers employ offset and digital printing techniques for labeling, with flexographic printing and can coating applications gaining popularity. Can recycling rates remain a focus, with distribution networks and collection programs essential for effective recovery. Can reuse and sustainability initiatives are increasingly important, as are innovations in can manufacturing processes, such as energy-efficient production methods and the use of recycled materials. Can weights and warehousing solutions are critical for efficient transportation and storage, while can recovery and recycling efforts contribute to the circular economy.

- Market trends include the growing adoption of digital printing for personalized labeling and the increasing use of sustainable can manufacturing practices, such as energy-efficient production and the incorporation of recycled materials.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metal Food Cans Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.1% |

|

Market growth 2024-2028 |

USD 3849.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.7 |

|

Key countries |

US, China, Japan, Germany, UK, France, South Korea, Spain, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metal Food Cans Market Research and Growth Report?

- CAGR of the Metal Food Cans industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal food cans market growth of industry companies

We can help! Our analysts can customize this metal food cans market research report to meet your requirements.