Metal Machining Scrap Equipment Market Size 2024-2028

The metal machining scrap equipment market size is forecast to increase by USD 300.6 million at a CAGR of 3.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand for metal scrap in various application industries is driving market growth. This is because metal scrap is a cost-effective alternative to primary metal sources and is widely used in industries such as automotive, construction, and manufacturing. Aluminum and copper are among the commonly recycled metals, with industrial shredders and baler press equipment being essential for their processing. Another trend influencing market growth is the automation of metal scrap equipment. This not only enhances productivity but also reduces labor costs and improves the quality of the scrap produced. Additionally, the rise in tariffs for metal imports is encouraging the use of domestically produced scrap, further boosting market demand. These factors are expected to continue shaping the market In the coming years.

What will be the Size of the Metal Machining Scrap Equipment Market During the Forecast Period?

- The market encompasses the production and deployment of machinery utilized In the processing and recycling of various types of metal scrap, including ferrous and non-ferrous metals. This market is driven by the increasing demand for recyclable metals in industries such as construction, manufacturing, and electronics. The global metal scrap recycling industry is projected to grow significantly due to the rising labor shortage in manufacturing sectors, making the automation of scrap processing an attractive solution. The market participants offer baler press equipment, recycling systems, and technology solutions to facilitate the efficient processing of non-biodegradable solid trash, such as aluminum, ferrous metal, and non-ferrous metal scrap.

- The market is further driven by advancements in recycling technology, enabling the recycling of a broader range of materials, including plastics, rubber, wood, glass, textiles, and electronics. The export of metal waste to countries with lower labor costs and advanced recycling infrastructure also contributes to the market's growth.

How is this Metal Machining Scrap Equipment Industry segmented and which is the largest segment?

The equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Machine shops

- Foundries

- Type

- Baler press

- Shredders

- Shears

- Others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

- The machine shops segment is estimated to witness significant growth during the forecast period.

Machining shop equipment, including chip conveyors, coolant filtration systems, balers, shredders, and granulators, plays a crucial role in metal machining operations by collecting, transporting, and disposing of metal chips and debris. These systems enhance shop floor cleanliness, boost machining efficiency, and decrease scrap material disposal costs. Moreover, they facilitate the recycling and reuse of scrap metal in production processes. The metal recycling industry, driven by the need to conserve raw materials and minimize greenhouse gas emissions, significantly utilizes this equipment.

The recycling system's integration into various industries, such as construction materials, automotive, and electronics, contributes to waste management initiatives and reduces the reliance on virgin materials. Demolition contractors, scrap metal collections businesses, and site relocations also benefit from these recycling technologies.

Get a glance at the Metal Machining Scrap Equipment Industry report of share of various segments Request Free Sample

The machine shops segment was valued at USD 1.04 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

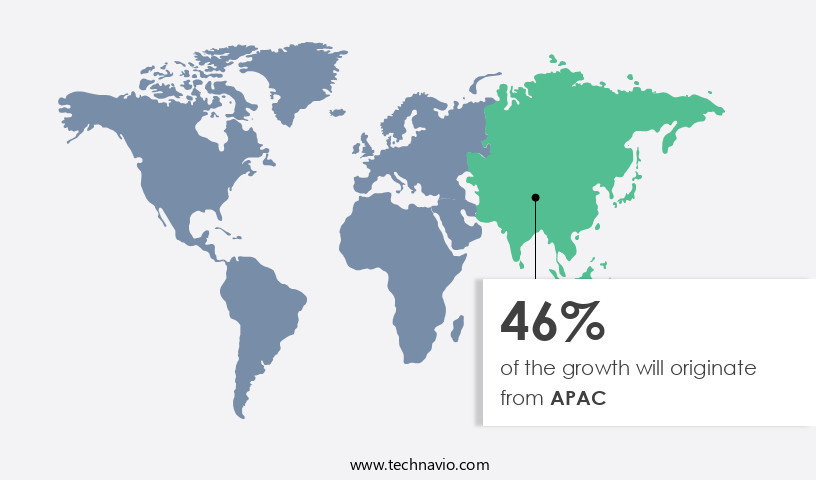

- APAC is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is expected to experience significant growth in Asia-Pacific (APAC) due to increased infrastructure investment and construction activities. This region's demand for metal scrap equipment is driven by large-scale projects, primarily in China and India, which consume substantial amounts of metals like steel, copper, and aluminum. Furthermore, Southeast Asian countries, including Indonesia and the Philippines, have announced numerous infrastructure initiatives from 2015 to 2025, such as residential and commercial building construction, airport development, and railway line expansion. The recycling of non-biodegradable trash, including solid waste and construction materials, is a crucial aspect of these projects, leading to a growing demand for recycling equipment like balers, shredders, and industrial shredders.

The aluminum and copper industries, which are significant contributors to the metal recycling system, will also benefit from this trend. The implementation of advanced metal recycling technology and waste management initiatives by demolition contractors and collections businesses further supports the market's growth. The scrap metal industry's expansion is influenced by global economic activity, with a focus on reducing greenhouse gas emissions through the use of electric arc furnaces and recycling processes. Key metals, such as iron, steel, and ferrous and non-ferrous metals, are in high demand for various industries, including automotive, electronics, and mining. The recycling of waste metal, such as steel slag, cast iron, mild steel, and ferrous metals, is an essential part of the recycling process.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Metal Machining Scrap Equipment Industry?

Increasing demand for metal scrap in various application industries is the key driver of the market.

- Metal scrap demand rises in diverse application sectors due to factors such as raw material necessity, cost savings, and environmental consciousness. In construction, scrap serves as a crucial input for steel and other metal production, fueling infrastructure development and growth in emerging economies. The automotive industry is another major consumer, utilizing scrap metal to manufacture new vehicles, thereby cutting down the reliance on new materials and lowering production costs. The recycling industry, particularly metal recycling technology, plays a pivotal role in this process. Aluminum and copper are prominent metals in high demand, with recycling systems employing balers, shredders, and industrial shredders to process these materials.

- The shift towards green initiatives and reduced greenhouse gas emissions propels the use of electric arc furnaces In the recycling process. Non-biodegradable trash, including plastic, rubber, wood, glass, textiles, electronics, appliances, car parts, and waste metal crusher, are all processed through recycling equipment. The scrap metal industry thrives on global economic activity, with demand from industries such as shipbuilding, tools, and civil construction, as well as infrastructure investment and scrap metal prices. The recycling of ferrous and non-ferrous metals, such as iron, steel, cast iron, mild steel, and ferrous metals, is a significant contributor to the reduction of carbon emissions. The recycling technology also extends to mining and collections businesses, involving site relocations and the processing of copper, crude steel, and steel slag.

What are the market trends shaping the Metal Machining Scrap Equipment Industry?

Automation of metal scrap equipment is the upcoming market trend.

- Metal machining scrap equipment automation plays a pivotal role In the market by enhancing efficiency, precision, and sustainability. Automated systems enable continuous operation without human intervention, minimizing downtime and boosting productivity. These systems optimize metal scrap processing, yielding higher recovery rates and superior product quality. Moreover, automation reduces waste by improving material utilization, leading to resource conservation and decreased environmental impact. Companies leverage automated equipment to expand their market presence and remain competitive. Aluminum and copper are prominent recyclable metals in focus, with industrial shredders and balers essential for their processing. Metal recycling technology reduces greenhouse gas emissions by utilizing electric arc furnaces instead of crude steel production.

- Automation also facilitates the recycling of non-biodegradable trash, such as plastic, rubber, wood, glass, textiles, electronics, construction materials, auto parts, and waste management initiatives. Demolition contractors and scrap metal collections businesses benefit from site relocations and investments in recycling equipment technology. Ferrous and non-ferrous metals, including iron, steel, cast iron, mild steel, and ferrous metals, are recycled using advanced recycling technology. The mining industry and industrial shredders contribute to the recycling of metal compounds, such as PCBs and e-waste, In the digital world. Steel slag and scrap iron are valuable byproducts In the steel and shipbuilding industries. Tools and civil construction projects also utilize recycled metals.

What challenges does the Metal Machining Scrap Equipment Industry face during its growth?

An increase in tariffs for metal imports is a key challenge affecting the industry growth.

- The market has been influenced by the imposition of tariffs on the import of metal scrap for use in industries like construction and automotive. For example, the US implemented 25% and 10% tariffs on steel and aluminum scrap imports in March 2018, causing uncertainty In the metals industry. These tariffs were expected to have the most significant impact on China, but countries such as Canada, Mexico, and Germany, which were excluded from the North American Free Trade Agreement (NAFTA) and the European Union, were also affected. The primary reason for these tariffs was to encourage domestic production of steel and aluminum.

- The global economic activity and waste management initiatives have driven the demand for metal recycling technology, particularly for recyclable metals such as aluminum and copper. Metal recycling systems, including balers, shredders, and industrial shredders, have gained popularity due to their ability to reduce greenhouse gas emissions by minimizing the need for new raw materials. The scrap metal industry is essential for infrastructure development, including the shipbuilding industry, civil construction, and infrastructure investment. The prices of scrap metal, including iron, steel, and aluminum, have been influenced by global economic activity and the demand for recycling technology. Electronic waste, such as PCBs and e-waste from the digital world, is a significant source of non-ferrous metals.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal machining scrap equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advance Hydrau Tech Pvt. Ltd.

- Applied Recovery Systems Inc.

- Brentwood RM Pty Ltd

- Caterpillar Inc.

- CP Manufacturing Inc.

- Fornnax Technology Pvt Ltd.

- Gensco Equipment Inc.

- Granutech Saturn Systems

- Green Machine

- Iron Ax

- Lefort

- MAYFRAN INTERNATIONAL

- Metso Outotec Corp.

- PRAB Inc.

- Rapid Granulator

- SP Industries Inc.

- Vaner Machinery Co. Ltd.

- WEIMA America Inc.

- Wendt Corp.

- Wiscon Envirotech Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market experiences dynamic fluctuations, driven by various market forces. The global economy plays a significant role in shaping the demand for scrap equipment. As economic activity increases, so does the generation of scrap metal from industries such as construction, automotive, and electronics. The construction sector contributes a substantial amount of solid trash to the scrap market. This waste, which includes ferrous and non-ferrous metals, is often generated during demolition and site relocations. The labor shortage In the industry can lead to inefficiencies in scrap collection and transportation, making the use of advanced recycling technology increasingly important. Trash generated from industries like aluminum production and recycling also contributes to the scrap equipment market.

Moreover, aluminum is a recyclable metal that is in high demand due to its lightweight and durable properties. The recycling system for aluminum involves the use of balers and shredders to compact and process the scrap. The recycling of non-biodegradable trash, such as plastic, rubber, wood, glass, textiles, and electronics, also generates demand for scrap equipment. Industrial shredders are used to process these materials into smaller sizes, making transportation and further processing more efficient. The recycling of aluminum and copper, two of the most commonly recycled metals, is a significant contributor to the reduction of greenhouse gas emissions. Electric arc furnaces are used to melt scrap metals, including aluminum and copper, to produce new metals.

Furthermore, this process emits fewer greenhouse gases than traditional methods, making it a more sustainable option. The scrap metal industry is a vital player In the circular economy, with waste management initiatives playing a crucial role in its growth. Demolition contractors and collections businesses are key players In the scrap metal supply chain, ensuring that scrap metal is collected and transported to processing facilities. The global scrap metal industry is diverse, with a range of metals and materials being recycled, including ferrous metals like iron and steel, non-ferrous metals like copper, and various industrial compounds. The mining industry is a significant source of raw materials for the production of new metals, but the recycling of scrap metal reduces the need for mining and the associated environmental impact.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market Growth 2024-2028 |

USD 300.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.07 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution to the industry in focus on the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- A thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal machining scrap equipment market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.