Optical Network Terminal Equipment Market Size 2024-2028

The optical network terminal equipment market size is forecast to increase by USD 6.67 billion, at a CAGR of 7.9% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for advanced network technologies to support high-speed broadband services and rising internet penetration. Telecom services, such as Voice over IP (VoIP) and videoconferencing, as well as video on demand, require substantial bandwidth. However, the limited infrastructure for optical fiber connectivity poses a challenge. Optical transceivers play a crucial role in optical network terminal equipment, enabling metro network and data center interconnect applications, as well as long haul applications. The communication infrastructure market, including colocation and cloud network operators, is also driving the demand for optical network terminal equipment. The ongoing 5G network projects are expected to further boost the market, as they require high-speed, reliable, and low-latency connectivity.

What will be the Size of the Market During the Forecast Period?

- The market represents a significant segment of the networking industry, playing a crucial role in enabling high-speed data connectivity for various applications. Optical network terminals (ONTs), also known as network interface devices (NIDs), serve as the interface between fiber optic links and end-user devices, facilitating the delivery of television, voice telephone, and internet access services. Demultiplexing is a key function of optical network terminal equipment, allowing the separation of multiple data streams into individual signals for further processing. This process is essential for various applications, including metro networks, data center interconnect, and long haul applications. Digitization is another critical aspect of optical network terminal equipment, as it enables the conversion of analog signals to digital format for efficient transmission and processing. With the increasing adoption of the Internet of Things (IoT) and the need for seamless data connectivity, the demand for advanced optical network terminal equipment continues to grow. Optical transceivers are an integral component of optical network terminal equipment, responsible for converting electrical signals to optical signals and vice versa.

- Compact optical modules have gained popularity due to their small form factor and high performance, making them suitable for a wide range of applications, from portable devices to large-scale networking infrastructure. Power delivery is another essential feature of optical network terminal equipment, enabling the efficient transfer of power over the same fiber optic link used for data transmission. This reduces the need for additional power cables and simplifies installation and maintenance. Optical communication networking equipment is a complex field, requiring a deep understanding of fiber optics, digital signal processing, and power delivery systems. Network complexity continues to increase, driven by the growing demand for high-speed connectivity and the integration of various services and applications. Connectivity ICS (Integrated Circuit Solutions) and other leading networking companies are focusing on developing advanced optical network terminal equipment to meet the evolving needs of the market.

How is this market segmented and which is the largest segment?

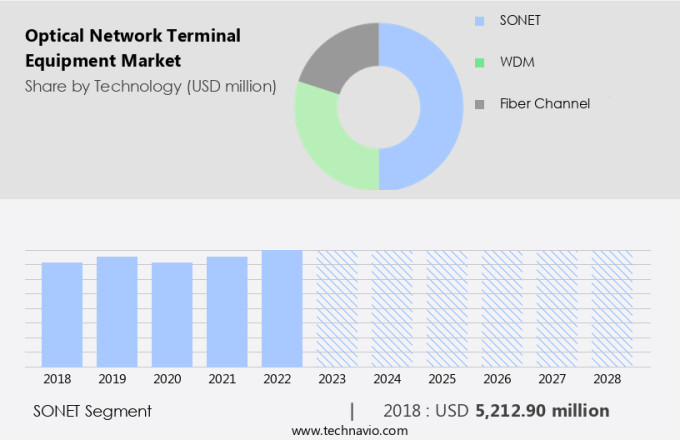

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- SONET

- WDM

- Fiber Channel

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Technology Insights

- The SONET segment is estimated to witness significant growth during the forecast period.

The market encompasses technologies that facilitate the transmission and reception of optical signals for telecom services, including Internet Penetration and VoIP. These network solutions are essential for meeting the escalating bandwidth demand in various applications, such as videoconferencing, Video on Demand, and Data Center Interconnect. SONET, a set of standards defining optical network specifications in ANSI T1.105, T1.106, and T1.117, plays a pivotal role in consolidating Ethernet, data, video, and voice traffic among locations. SONET's synchronous frame structure supports up to 9.95 Gbps of traffic, ensuring reliable Wide Area Network (WAN) connectivity for telecom services.

Get a glance at the market report of share of various segments Request Free Sample

The SONET segment was valued at USD 5.21 billion in 2018 and showed a gradual increase during the forecast period.

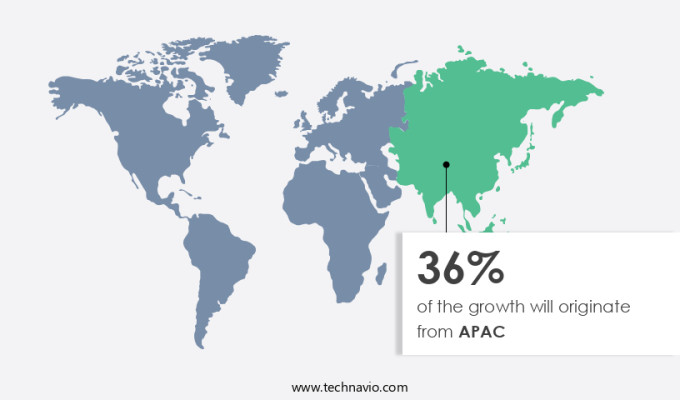

Regional Analysis

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the expanding telecom subscriber base and the widespread adoption of fiber optic technology for information transfer. ONTEs are essential components that connect fiber optic cables to other wiring, such as ethernet and phone lines, enabling seamless data transfers. The increasing deployment of fiber optics in communications is driving the demand for ONTEs in APAC, as more organizations and individuals require secure and efficient data transfer solutions. Moreover, the region's rising income levels have led to an increase in smartphone sales, resulting in a substantial increase in mobile subscribers with internet access. This trend is further fueling the demand for ONTEs, as more users require reliable and high-speed connectivity for their personal and professional needs. Furthermore, the BFSI vertical is a significant contributor to the ONTE market in APAC, as financial institutions prioritize data security in their operations. ONTEs offer advanced security features, such as encryption and authentication, making them an ideal choice for safeguarding sensitive financial data.

In addition, the adoption of Artificial Intelligence (AI), Machine Learning (ML), Cloud Computing, and Quantum Optics is also driving the growth of the ONTE market in APAC. These technologies require high-speed and secure data transfer capabilities, which ONTEs can provide. Defense spending in APAC is another factor fueling the growth of the ONTE market, as military organizations require secure and reliable communication networks for their operations. ONTEs offer advanced security features and high-speed data transfer capabilities, making them an essential component of defense communications infrastructure.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Optical Network Terminal Equipment Market?

High demand for high-speed broadband services is the key driver of the market.

- In today's digital age, the expansion of internet connectivity worldwide fuels the necessity for advanced telecommunication solutions. The ubiquitous use of portable devices, such as smartphones, to access the internet has led to a rise in demand for high-capacity links. This trend is driving the development of ultra-fast broadband services, with mobile data traffic projected to exceed 164 exabytes per month by 2025, representing a 30% increase from 2019 levels. To meet the increasing demand for higher data rates, advancements in network architecture are essential. The growing adoption of cloud computing, video streaming, and Big Data applications further underscores this need.

- Consequently, the market for Optical Network Terminal Equipment (ONTE) is experiencing significant growth. ONTE encompasses various components, including optical amplifiers, transceivers, transmission fibers, tunable filters, termination devices, add-drop multiplexers, dispersion compensation, and dielectric protection. These components play a crucial role in maintaining signal quality and ensuring efficient data transmission over long distances. Lightweight, easy-to-install ONTE solutions are becoming increasingly popular due to their ability to support high-capacity access networks and metropolitan area networks. As data traffic continues to escalate, the demand for ONTE will remain strong, making it a promising investment opportunity for businesses.

What are the market trends shaping the Optical Network Terminal Equipment Market?

Rising internet penetration and telecom services with growing demand for bandwidth is the upcoming trend in the market.

- The market, comprised of Optical Network Terminals and Network Interface Devices (NIDs), has gained significant traction due to the increasing demand for high-speed Fiber Optic Links. The proliferation of digitization in various sectors, including Television, Voice Telephone, and Internet Access, has fueled the need for advanced network solutions. Power Delivery and demultiplexing technologies have become essential components of ONTs and NIDs to support the increasing bandwidth requirements. The Internet of Things (IoT) and cloud-based services have further boosted the growth of the ONT market. The integration of ONTs and NIDs with 5G infrastructure is a significant trend, as these technologies enable faster data transfer rates and lower latency.

- In the US, major network providers are investing heavily in 5G infrastructure to offer superior network services to their customers. For instance, in January 2020, Verizon announced the launch of its 5G Ultra Wideband network in several cities across the country. The increasing adoption of ONTs and NIDs in various applications, such as telemedicine, remote education, and smart cities, is expected to drive market growth. Additionally, the integration of these devices with advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), is expected to provide new opportunities for market participants. Overall, the ONT market is poised for significant growth in the coming years, driven by the increasing demand for high-speed network connectivity and the adoption of advanced technologies.

What challenges does the Optical Network Terminal Equipment Market face during the growth?

Limited infrastructure for fibre-optic networks is a key challenge affecting the market growth.

- Fiber optic technology has emerged as a preferred choice for network infrastructure deployment in various sectors, including data centers, Internet usage, and virtualization services. While copper cabling has been the traditional method for providing internet connectivity, fiber optics offers superior network performance with higher bandwidth and lower latency. However, the higher cost and complex installation process of fiber optics make it a less viable option for some organizations. Firms are increasingly adopting advanced technologies such as Artificial Intelligence and Wavelength Division Multiplexing to optimize their existing copper networks and extend their lifespan. Virtual machines (VMs) and virtualization services have also gained popularity, allowing organizations to consolidate their IT and telecom infrastructure, reducing costs and improving efficiency.

- Fiber optics are essential in various industries, including military and defense, oil and gas, and medical and healthcare, where high-speed data transfer and secure communication are critical. Fiber Channel, a widely used fiber optic technology, offers reliable and high-speed data transfer for IT and telecom applications. The market is expected to grow significantly due to the increasing demand for high-speed internet connectivity and the need for improved network performance. As businesses continue to adopt advanced technologies, the market for optical network terminal equipment is poised for steady growth.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adtran Holdings Inc.

- ADVA Optical Networking SE

- Allied Telesis Holdings KK

- Calix Inc.

- Cisco Systems Inc.

- FiberHome Telecommunication Technologies Co. Ltd.

- Fujitsu Ltd.

- Huawei Technologies Co. Ltd.

- Infinera Corp.

- Iskratel

- Nokia Corp.

- Ribbon Communications Inc.

- Shenzhen GCOM Technologies Co. Ltd.

- Tellabs Access LLC

- Verizon Communications Inc.

- ZTE Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Optical Network Terminal (ONT) equipment plays a pivotal role in modern network infrastructure, serving as the interface between fiber optic links and end-user devices. These network interface devices (NIDs) demultiplex television, voice telephone, and internet access signals for end-users. Power delivery is an essential feature of ONTs, enabling various devices' operation. The advent of digitization and the Internet of Things (IoT) has increased the demand for high-bandwidth connections. ONTs facilitate cloud-based services, 5G infrastructure, and network technologies, fueling internet penetration and telecom services. Bandwidth demand is escalating due to VoIP, videoconferencing, video on demand, and data transfers. Optical fiber is the backbone of these advanced networks, with optical transceivers, amplifiers, and transceivers ensuring seamless information transfer.

In addition, ONTs support 5G network projects, data center interconnect, and long-haul applications. Optical transceiver OEMs are innovating compact optical modules for easy installation and lightweight design. ONTs also cater to various verticals, including IT and telecom, military and defense, oil and gas, and medical and healthcare. Security concerns, such as hacking vulnerability and data theft, necessitate advanced features like AI and machine learning for data security. Optical networks continue to evolve, with quantum optics and virtualization services shaping the future of networking.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market Growth 2024-2028 |

USD 6.67 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.2 |

|

Key countries |

China, US, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.