Pearlescent Pigment Market Size 2024-2028

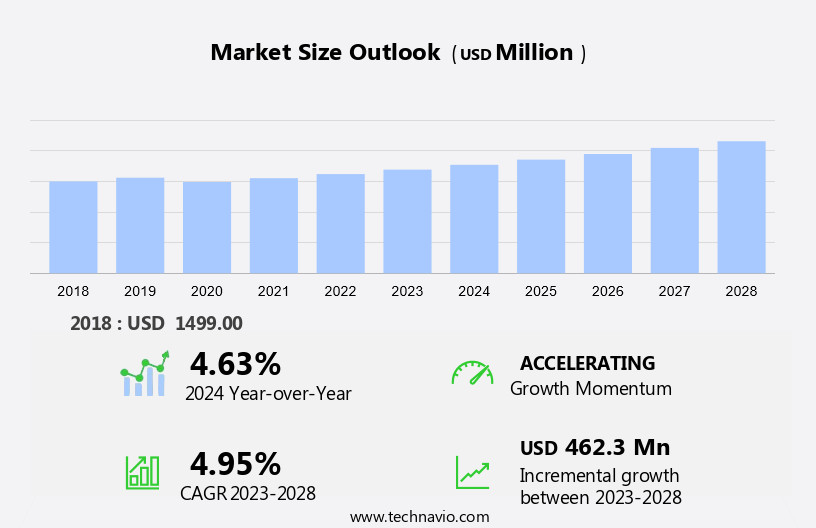

The pearlescent pigment market size is forecast to increase by USD 462.3 million at a CAGR of 4.95% between 2023 and 2028.

- The market is experiencing significant growth, driven by population growth and the increasing demand for urbanized areas. With the expansion of cities and the rise in infrastructure development, the demand for decorative and high-performance coatings, including those containing pearlescent pigments, is surging. However, the market faces challenges from stringent regulations on pearlescent pigments, particularly those related to their environmental impact and safety concerns. To mitigate these challenges, market players are investing in research and development to create eco-friendly and safe alternatives. Additionally, the increasing adoption of pearlescent pigments in various industries, such as automotive, packaging, and construction, is further fueling market growth. Overall, the market is poised for strong expansion in the coming years, with key trends including the development of sustainable and cost-effective solutions and the increasing use of advanced technologies to enhance product performance.

What will be the Size of the Pearlescent Pigment Market During the Forecast Period?

- Pearlescent pigments are specialty additives used to impart a shimmering, iridescent effect to various applications. These pigments find extensive use in automotive paints, industrial coatings, and printing inks. In the automotive sector, they add a premium look to vehicles, particularly in the production of luxury and sports cars. The industrial coatings industry also utilizes them to enhance the aesthetic appeal of architectural and protective coatings. These pigments are available in various bases, including mica and synthetic mica. Mica-based pearlescent pigments are derived from natural sources like Mother of Pearl and mica, while synthetic mica-based pigments are produced through chemical processes.

- The market is driven by the growing demand for premium vehicles and the increasing use of these pigments in industrial coatings and printing inks. The plastic industry is another significant end-user of pearlescent pigments, particularly in the production of packaging materials and consumer goods. In addition to automotive and industrial applications, they are also used in the personal care industry, particularly in cosmetics, nail polish, and buttons. Volatile Organic Compound (VOC) content is a critical factor influencing the demand for pearlescent pigments, with the trend toward low-VOC and zero-VOC alternatives gaining momentum. Metal-effect pearlescent pigments, which mimic the appearance of metals, are gaining popularity due to their versatility and cost-effectiveness compared to actual metal coatings. Bismuth oxychloride is a common metal-effect pearlescent pigment used in various applications, including cosmetics and industrial coatings. Titanium dioxide, another widely used pigment, is often combined with these pigments to enhance their opacity and durability.

How is this Pearlescent Pigment Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Paints and coatings

- Printing inks

- Plastics

- Construction materials

- Other

- Product

- Titanium dioxide coated mica

- Ferric oxide

- Natural pearl essence

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

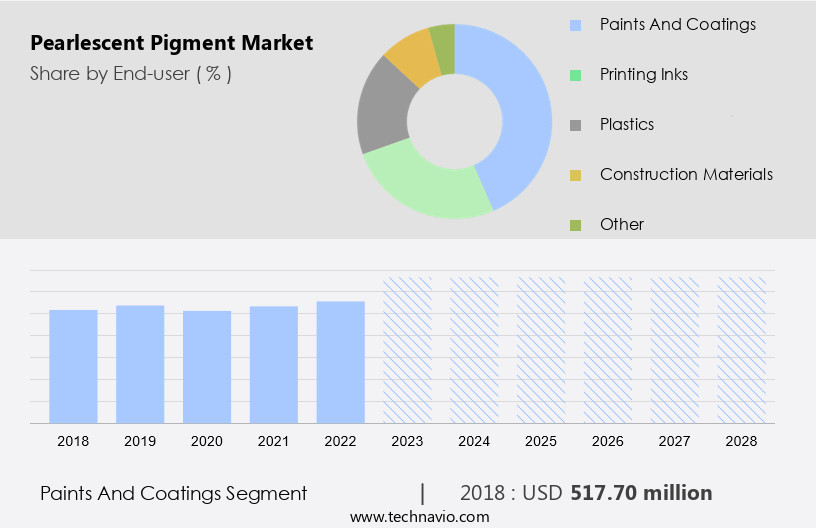

- The paints and coatings segment is estimated to witness significant growth during the forecast period. These pigments are essential components in various industries, including automotive paints and industrial coatings. The automobile sector's expansion and the construction industry's growth are significant drivers for the increasing demand for these pigments. These pigments offer desirable physical and chemical properties, such as a lustrous shine, making them an integral part of paints and coatings. In the automotive industry, they are used to enhance the appearance of premium vehicles. In addition to automotive applications, these pigments find extensive use in industrial coatings, plastics, printing inks, and consumer goods. The printing industry utilizes these pigments in various printing techniques, such as gravure, offset, and flexographic printing, to create metal-effect finishes.

- Mica-based pearlescent pigments, including those made from natural pearl, synthetic mica, phlogopite, and titanium dioxide (TiO2), are commonly used. Toxicology concerns have led to the phasing out of lead compounds in pearlescent pigments, and alternatives like bismuth oxychloride and titanium dioxide have gained popularity. These pigments are also used in various non-paint applications, such as plastics, electronics, medical devices, and cosmetics. In the plastics industry, they are used as masterbatches and additives to create various effects. In the cosmetics industry, they are used in sunscreens, cosmetics, nail polish, buttons, jewelry, and bismuth oxychloride powders. Borosilicate is another material used to produce pearlescent pigments.

Get a glance at the market report of share of various segments Request Free Sample

The Paints and coatings segment was valued at USD 517.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

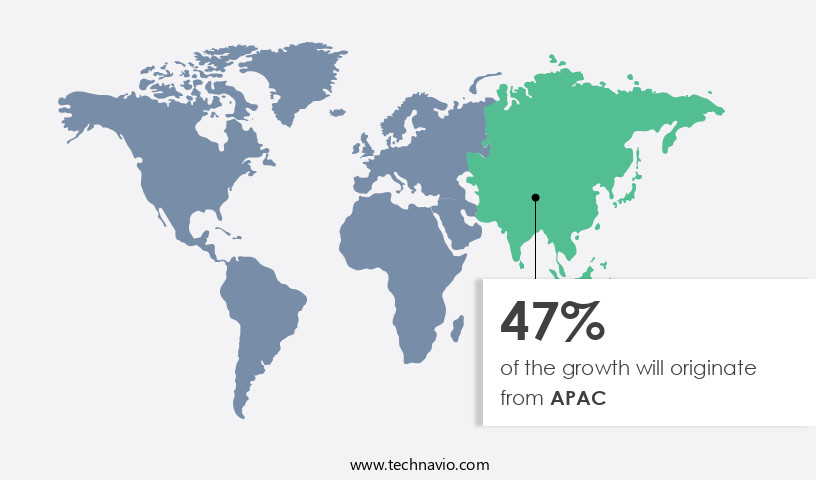

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing demand for architectural coatings that incorporate mother of pearl effects. These coatings, which are known for their lustrous and iridescent appearance, are often achieved through the use of fluoropolymers such as Polyvinylidene Difluoride (PVDF). Fluoropolymers offer superior durability and resistance to weathering, making them an ideal choice for exterior applications. Pearlescent pigments derived from mother of pearl and fluoropolymers, collectively referred to as pearlescent fluoropolymer pigments, are gaining popularity due to their ability to provide a unique and visually appealing finish. Architects and designers are increasingly specifying these coatings for their projects, leading to a flourishing market for pearlescent pigments.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pearlescent Pigment Industry?

- Population growth and demand for urbanized areas is the key driver of the market. The market has witnessed significant growth due to its extensive applications in various industries. In the automotive sector, these pigments are extensively used in producing eye-catching automotive paints, adding a premium look to vehicles. Similarly, in industrial coatings, these pigments enhance the visual appeal of products, making them more attractive to consumers. The cosmetics industry is another major consumer of pearlescent pigments, with applications ranging from personal care products to printing inks. These pigments are available in various forms, including mica base, titanium, ferric oxide, and synthetic mica. These pigments are used in gravure, offset, and flexographic printing inks to create metal-effect finishes.

- The VOC content of these pigments is a significant concern due to increasing VOC regulations. Plastic formulators and master batches use pearlescent pigments in consumer goods, electronics, medical devices, and the plastic industry. Natural pearl pigment, derived from mica, phlogopite, and other minerals, is increasingly being replaced by synthetic mica and metal-effect pearlescent pigments. Bismuth oxychloride powders, borosilicate, and titanium dioxide (TiO2) are commonly used synthetic mica alternatives. These pigments are also used in sunscreens, cosmetics, nail polish, buttons, jewelry, and other consumer goods. Toxicology concerns regarding lead compounds have led to the replacement of lead-based pearlescent pigments with safer alternatives.

- Overall, the market is expected to continue its growth trajectory, driven by increasing demand from various industries and consumer preferences for aesthetically appealing products.

What are the market trends shaping the Pearlescent Pigment Industry?

- Rising investment in infrastructure development is the upcoming market trend. The market encompasses a wide range of applications, including Automotive paints and Industrial coatings. Pearlescent pigments, primarily based on mica, titanium, and ferric oxide, offer a distinctive metallic sheen and are increasingly being used to enhance the visual appeal of these industries. In addition, Pearlescent pigments find extensive use in Personal care products, such as Gravure, Offset, and Flexographic printing inks. These pigments are also used in Plastics and Printing inks, with Master batches and Consumer goods being significant end-users. The Electronics, Medical devices, and Plastic industry also utilize Pearlescent pigments, particularly synthetic mica, metal-effect pearlescent pigments, and Bismuth Oxychloride powders.

- The VOC regulations have led Plastic formulators to explore alternatives to traditional lead compounds, such as Titanium Dioxide (TiO2), Phlogopite, Glitter, and Borosilicate. Pearlescent pigments are also used in Premium vehicles, Natural pearl pigment, Nail polish, Buttons, Jewelry, and Sunscreens. The global demand for Pearlescent pigments is expected to grow significantly due to their unique properties and increasing applications in various industries.

What challenges does the Pearlescent Pigment Industry face during its growth?

- Stringent regulation on pearlescent pigments is a key challenge affecting the industry growth. Pearlescent pigments, derived from mica base, titanium, ferric oxide, and synthetic mica, are widely used in various industries such as automotive paints, industrial coatings, plastics, printing inks, and consumer goods. These pigments are known for their ability to create a pearlescent or metallic effect. In the automotive industry, they are used to enhance the aesthetic appeal of premium vehicles. In the industrial coatings sector, they are utilized to add durability and resistance to coatings. The use of pearlescent pigments extends to personal care products, including cosmetics, sunscreens, and nail polish, where they add a shimmering effect. In the printing ink industry, pearlescent pigments are used in gravure, offset, and flexographic printing processes.

- The VOC content of these pigments is a concern due to VOC regulations, leading plastic formulators and master batches to seek alternatives with lower VOC content. Moreover, the use of toxic lead compounds in pearlescent pigments has been replaced by safer alternatives such as titanium dioxide (TiO2), bismuth oxychloride, and borosilicate. The plastic industry uses pearlescent pigments in various applications, including electronic components and medical devices. The use of natural pearl pigment, such as mica, phlogopite, and glitter, is also gaining popularity due to their eco-friendly and sustainable nature. Governments and regulatory bodies worldwide are imposing stringent rules and guidelines to ensure the safety and environmental sustainability of these coloring agents, including pearlescent pigments.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altana AG

- Asahi Kasei Corp.

- BASF SE

- Fujian Kuncai Material Technology Co. Ltd.

- Guangxi Chesir Pearl Material Co. Ltd.

- IFC Solutions

- Kobo Products Inc.

- Koel Colours Pvt Ltd.

- Kromachem Ltd

- L Arca Srl

- Merck KGaA

- Neelikon Food Dyes and Chemicals Ltd.

- Oxen Special Chemicals Co. Ltd.

- Pritty Pearlescent Pigments Co. Ltd.

- RIKA Technology Co. Ltd.

- Sinoparst Science and Technology Co. Ltd.

- Smarol Industry Co. Ltd.

- Sudarshan Chemical Industries Ltd.

- Yipin USA INC.

- Zhejiang Ruicheng New Materials Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pearlescent pigments are iridescent, reflective pigments that add a luxurious and aesthetic appeal to various industries such as automotive paints, industrial coatings, and printing inks. These pigments are primarily made from mica, Titanium, and Ferric oxide, but can also include synthetic mica, phlogopite, and other materials like bismuth oxychloride. In the automotive industry, these pigments are widely used in premium vehicles to create eye-catching, reflective finishes. In industrial coatings, they provide a protective layer with a decorative effect. In the realm of printing inks, gravure, offset, and flexographic printing techniques are commonly used to apply these pigments to consumer goods, plastics, and packaging.

Moreover, VOC content is a crucial factor in the production and application of pearlescent pigments. With increasing VOC regulations, the market is shifting towards low-VOC and VOC-free alternatives. Plastic formulators, master batches, and plastic industry players are adopting these solutions to cater to the changing market dynamics. These pigments are also extensively used in personal care products such as cosmetics, sunscreens, and nail polish. Metal-effect pearlescent pigments made from Titanium Dioxide (TiO2) and bismuth oxychloride powders are popular choices for their ability to create a shimmering, metallic effect. Additionally, these pigments find applications in the electronics, medical devices, and jewelry industries.

Furthermore, natural pearl pigment and synthetic mica are alternative options to traditional pearlescent pigments. Natural pearl pigment, derived from oysters, offers a unique, iridescent effect, while synthetic mica provides consistent quality and a wider range of colors. Glitter and phlogopite are other popular alternatives that cater to various industries and applications. In summary, the market is diverse and dynamic, with applications ranging from automotive paints and industrial coatings to printing inks, plastics, personal care, and various other industries. The market is driven by factors such as consumer preferences, VOC regulations, and the availability of alternative pigment types.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.95% |

|

Market growth 2024-2028 |

USD 462.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.63 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.