Polymer Binder Market Size 2024-2028

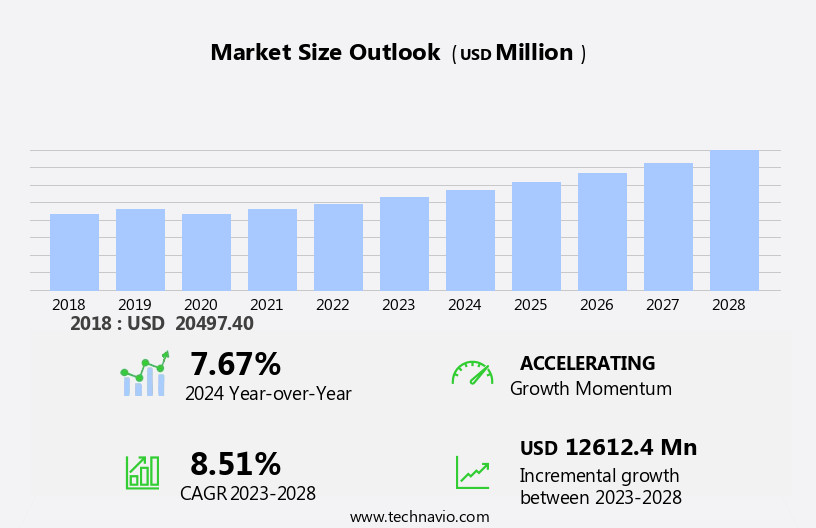

The polymer binder market size is forecast to increase by USD 12.61 billion at a CAGR of 8.51% between 2023 and 2028.

- The market is witnessing significant growth due to the expansion of industries such as textile and construction. The textile industry's increasing demand for polymer binders in manufacturing processes is a major growth driver. Additionally, the trend toward vertical integration among companies is boosting market growth. However, the decline In the growth of paper products may hinder market growth. In the industrial coatings sector, polymer binders are used in various applications such as paints and coatings, adhesives and sealants, and insulation. These binders are also essential In the production of switchgear, urban rail transit, transformers, and cable. In the field of renewable energy, polymer binders are used In the manufacturing of batteries and solar panels.

- Furthermore, In the production of footwear, plastic, cement, and concrete, polymer binders play a crucial role as adhesives and sealants. Key raw materials used In the production of polymer binders include ethylene, acrylonitrile, acrylic acid, starch, and protein. The market is also witnessing growth In the use of polymer binders In the production of insulation materials, concrete, and construction materials for urban infrastructure development. Overall, the market is expected to grow steadily due to its wide application in various industries and the increasing demand for high-performance and eco-friendly binders.

What will be the Size of the Polymer Binder Market During the Forecast Period?

- The market encompasses a range of products utilized in various industries, primarily the construction sector, to enhance the properties of cement, mortars, adhesives, coatings, sealants, and other building materials. Key segments include acrylic, vinyl acetate ethylene (VAE), latex, acrylonitrile copolymer, polyurethane, styrene acrylic, and sintering binders. Acrylic binders, with their water resistance and pigment binding ability, dominate the market. Vinyl acetate and VAE binders offer alkaline abrasion resistance and flexibility, while polyurethane binders provide superior adhesion and durability. The electrical industry also utilizes polymer binders for insulation applications. Traditional resins, such as those based on vinyl acetate and acrylonitrile copolymers, continue to face competition from these advanced polymer binders.

- Overall, the market is experiencing steady growth, driven by the increasing demand for high-performance construction materials and the need for improved product properties, such as durability and flexibility.

How is this Polymer Binder Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Architectural coatings

- Adhesives and sealants

- Textile and carpets

- Paper and board

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- Italy

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

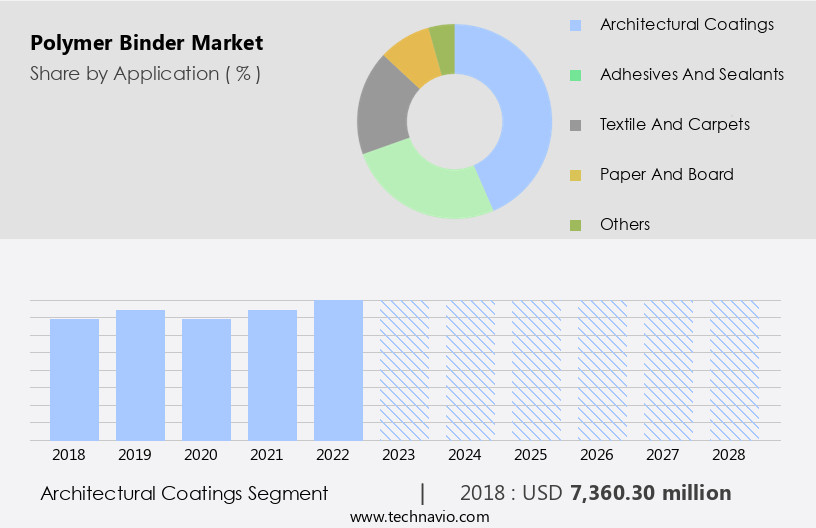

- The architectural coatings segment is estimated to witness significant growth during the forecast period.

Polymer binders play a crucial role In the formulation of coatings, offering superior adhesion and flexibility. Acrylic-based polymer binders, specifically, are widely used in architectural coatings due to their pigment-binding capacity and ease of availability. Architectural coatings provide both aesthetic appeal and protection for various surfaces, including concrete, metal, and wood, making them essential In the construction industry. The demand for architectural coatings is on the rise in countries like China, India, the US, and Germany, driven by their durability and ability to resist corrosion. Polymer binders also contribute to the construction sector by enhancing the properties of mortars, concrete, and reinforced concrete.

In the electrical industry, polymer binders offer water resistance and insulation properties, making them suitable for use in electrical components and insulation materials. Renewable resources, such as starch, cellulose, proteins, and mineral-based binders, are gaining popularity as sustainable alternatives to traditional resins In the market. The coatings sector, including paints and coatings, adhesives, sealants, and industrial coatings, is expected to grow significantly due to the increasing demand for advanced coatings in various industries. Polymer binders are also used in nonwovens, textiles, paper & board, and sports surfaces, among others. The market value for polymer binders is projected to increase as industries continue to seek sustainable and high-performance solutions.

Get a glance at the market report of share of various segments Request Free Sample

The architectural coatings segment was valued at USD 7.36 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

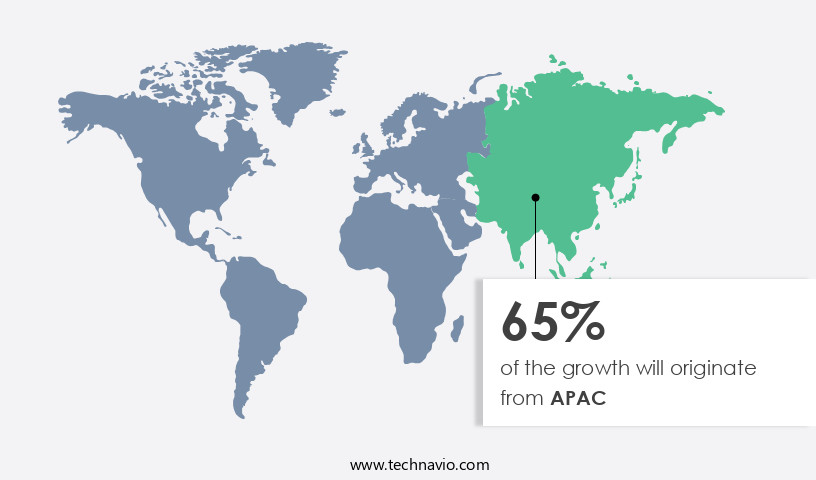

- APAC is estimated to contribute 65% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is driven by the increasing demand from various end-user industries, particularly construction, textiles, and packaging. The growth of these industries, notably in Asia Pacific countries like China, India, Japan, South Korea, and Indonesia, is expected to significantly impact market growth. Polymer binders are extensively used In the formulation of coatings due to their superior adhesion and durability properties. The expansion of the construction industry in APAC, fueled by ongoing projects such as the Shimao Shenzhen-Hong Kong International Centre and Shanghai Urban Rail Transit expansion in China, necessitates large quantities of binders for the production of construction additives.

Additionally, the electrical industry's demand for water resistance, alkaline abrasion resistance, and pigment binding ability in polymer binders is on the rise. The construction sector's shift towards advanced coatings, automotive components, and sustainable practices is further boosting market growth. Market value is anticipated to increase, with environmental concerns driving the adoption of water-based and bio-based alternatives, renewable sources, and sustainable practices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polymer Binder Industry?

Growth in textile industry is the key driver of the market.

- Polymer binders play a crucial role in various industries, including textiles, construction, and electrical, by enhancing the properties of materials and ensuring superior performance. In the textile industry, acrylic and latex polymer binders are commonly used for their excellent bonding capabilities and ease of availability. These binders provide water resistance, alkaline abrasion resistance, and pigment binding ability to textiles, making them suitable for apparel production and upholstery. The global construction industry utilizes polymer binders for their ability to improve the properties of mortars, concrete, and reinforced concrete. Vinyl acetate ethylene, acrylonitrile copolymer, styrene acrylic, and polyurethane are among the commonly used polymer binders in construction additives.

- Sintering is a process that uses polymer binders to fuse particles together, resulting in strong and durable materials. The electrical industry relies on chlorinated polymer binders for their insulating properties, while vinyl acetate is used for its adhesion and flexibility. In the coatings sector, polymer binders are used to enhance the durability, adhesion, and flexibility of paints and coatings, including acrylic, alkyd, epoxy, and acrylonitrile copolymers. The increasing demand for advanced coatings in various industries, such as automotive components, renewable resources, and infrastructure development, is expected to drive the growth of the market. Environmental concerns and sustainable practices are also influencing the adoption of water-based and bio-based alternatives to traditional resins.

What are the market trends shaping the Polymer Binder Industry?

An increase in preference for vertical integration among polymer binder vendors is the upcoming market trend.

- The market is experiencing increased competition among companies due to rising raw material prices. To mitigate this challenge, some companies are pursuing backward and forward integration strategies. Backward integration enables companies to secure a consistent supply of raw materials and gain a competitive advantage. For instance, Arkema invested approximately USD90 million to upgrade its acrylic acid plant complex in Texas, ensuring a steady supply of acrylic acid. Additionally, BASF and Adani Group signed an MoU in January 2019 to explore joint investments In the acrylics value chain. These strategic moves enhance efficiency and reduce operational costs for polymer binder manufacturers.

- The construction industry, particularly the acrylic segment, is a significant consumer of polymer binders. Applications include water resistance, alkaline abrasion resistance, and pigment binding ability in mortars, concrete, reinforced concrete, and architectural coatings. In the electrical industry, vinyl acetate ethylene, acrylonitrile copolymer, polyurethane, styrene acrylic, and chlorinated polymer binders are used for sintering, insulation, and coating applications. The coatings sector, including paints and coatings, adhesives, sealants, and industrial coatings, is another major consumer of polymer binders. With growing environmental concerns, there is a shift towards sustainable practices and water-based and bio-based alternatives. Renewable resources such as starch, cellulose, proteins, and mineral-based binders are gaining popularity due to their lower carbon footprint and biodegradability.

- Polyester, powder, liquid, high solids, and other advanced coatings are also being explored for their durability, adhesion, and flexibility. The automotive components, textiles, metals, and other industries also utilize polymer binders extensively.

What challenges does the Polymer Binder Industry face during its growth?

Decline In the growth of paper products is a key challenge affecting the industry growth.

- The market plays a crucial role in enhancing the properties of construction materials and industrial products. The acrylic segment, including acrylic latex, acrylonitrile copolymers, and styrene acrylic, dominates the market due to their excellent water resistance, alkaline abrasion resistance, and pigment binding ability. The construction industry, including mortars, concrete, reinforced concrete, and cement, is the largest consumer of polymer binders. However, the decline in demand for traditional resins in paper products, such as newsprint papers, printing papers, and writing papers, may negatively impact the market. Pulp, a primary raw material, faces challenges due to environmental concerns and decreasing availability from countries like China, Germany, the US, and Australia.

- Additionally, the electrical industry, roads, bridges, dams, pipelines, ports, trains, aqueducts, and various industries like paints and coatings, textiles, carpets, paper & board, adhesive & sealants, printing inks, wax & polishes, industrial coatings, nonwovens, sports surfaces, footwear, and coatings sector, use polymer binders. Market dynamics include high investments, fluctuating raw material costs, and the increasing use of plastics. To address environmental concerns, the market is shifting towards water-based and bio-based alternatives derived from renewable resources, such as acrylics, starch, cellulose, proteins, and mineral-based binders. Companies are also focusing on reducing their carbon footprint and improving biodegradability. Polyester, powder, liquid, high solids, and various types of paints & coatings, textiles, metals, and other industries utilize these advanced binders for durability, adhesion, and flexibility.

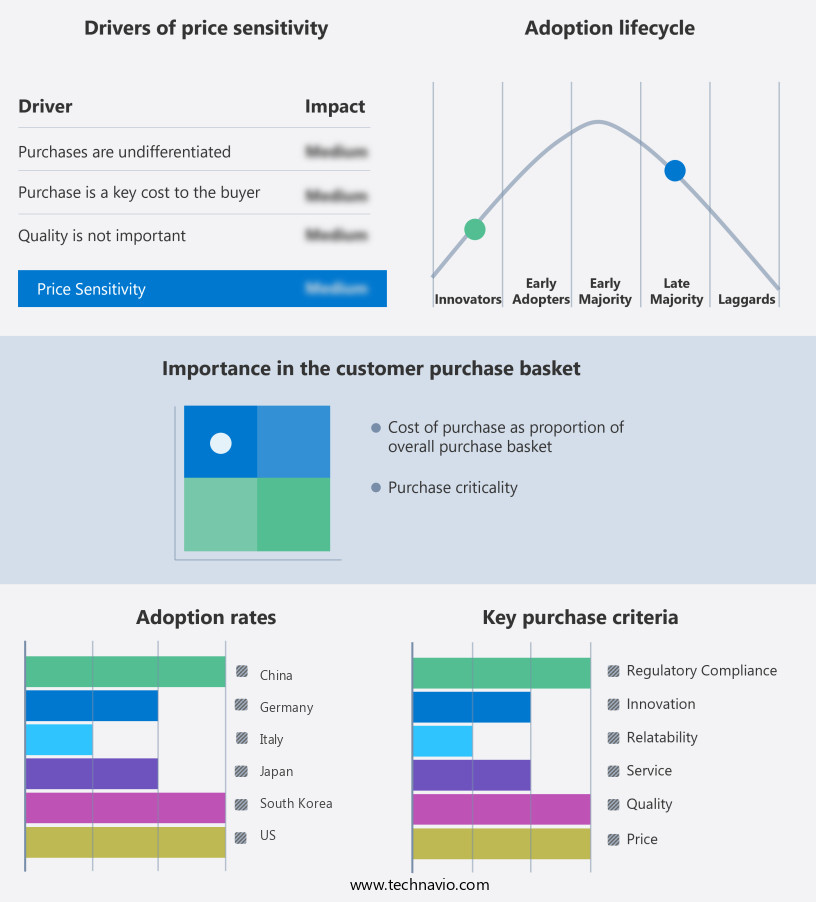

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polymer binder market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema Group

- APL

- BASF SE

- Celanese Corp.

- CH Polymers Oy

- Chang Chun Group

- D and L Industries Inc.

- Jesons Industries Ltd

- Mayfair Biotech Pvt. Ltd.

- OMNOVA Solutions Inc.

- Shandong Hearst Building Material Co. Ltd.

- Stahl Holdings B.V.

- Synthomer Plc

- Dow Chemical Co.

- Toagosei Co. Ltd.

- Trinseo PLC

- Visen Industries Ltd.

- Wacker Chemie AG

- Zydex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a significant role in various industries, particularly in construction and the electrical sector. These binders are essential components In the production of construction additives, such as mortars and concrete, enhancing their properties and improving their performance. Acrylic-based binders, including acrylic and vinyl acetate ethylene, are widely used due to their excellent water resistance and alkaline abrasion resistance. Acrylonitrile copolymers and styrene acrylics are other types of polymer binders that offer high durability and flexibility, making them suitable for reinforced concrete and architectural coatings. In the electrical industry, vinyl acetate and chlorinated polymer binders are commonly used for insulation purposes due to their excellent electrical insulation properties.

Moreover, these binders help increase the efficiency and lifespan of electrical components, such as transformers and capacitors. The construction sector relies heavily on polymer binders for the production of various building materials, including cement, mortar, and advanced coatings. These binders contribute to the durability and strength of the final product, ensuring long-lasting structures. The coatings sector, including paints and coatings, adhesives, sealants, and industrial coatings, also benefits significantly from polymer binders. These binders enhance the properties of the coatings, such as water resistance, pigment binding ability, and flexibility, making them suitable for various applications, including textiles, metals, and roads.

Furthermore, the use of renewable resources In the production of polymer binders is becoming increasingly popular due to environmental concerns and sustainable practices. Acrylics derived from renewable sources, such as starch, cellulose, and proteins, are gaining popularity as bio-based alternatives to traditional resins. These alternatives offer reduced carbon footprint and biodegradability, making them an attractive option for eco-conscious consumers and industries. The market value is expected to grow due to the increasing demand for advanced coatings, adhesives, and sealants in various industries, including the automotive components sector and the renewable energy sector. The development of water-based alternatives and bio-based alternatives is also expected to drive market growth, as these options offer environmental benefits and reduced production costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market Growth 2024-2028 |

USD 12.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Key countries |

China, US, Japan, Germany, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polymer Binder Market Research and Growth Report?

- CAGR of the Polymer Binder industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polymer binder market growth of industry companies

We can help! Our analysts can customize this polymer binder market research report to meet your requirements.