Private Cloud Services Market Size 2025-2029

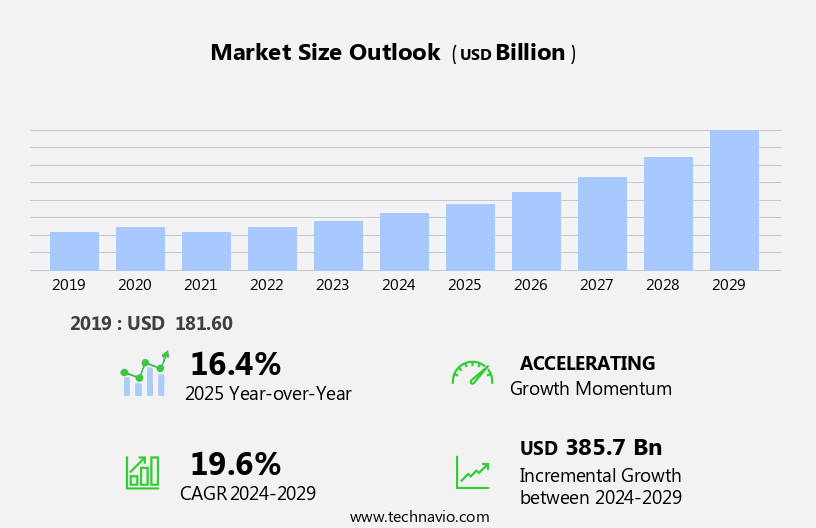

The private cloud services market size is forecast to increase by USD 385.7 billion, at a CAGR of 19.6% between 2024 and 2029. The market is experiencing significant growth, driven by the increasing preference for enhanced data security. This trend is particularly notable in the BFSI sector, where the acceptance of private cloud solutions is on the rise.

Major Market Trends & Insights

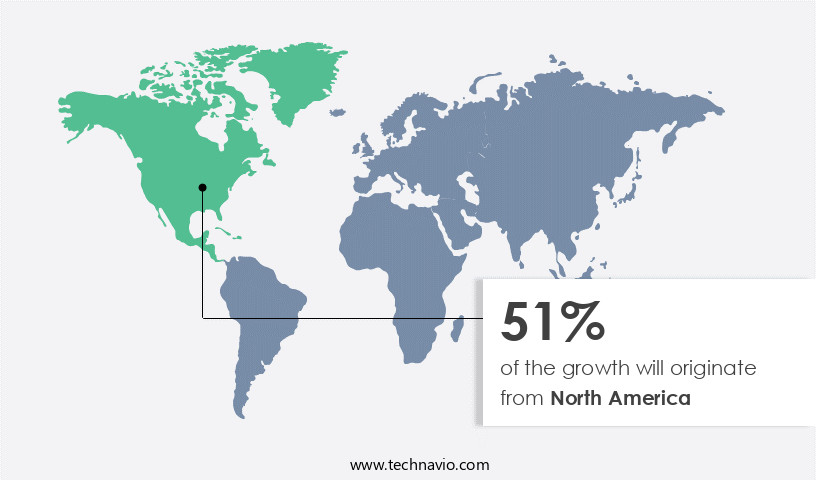

- North America dominated the market and contributed 51% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

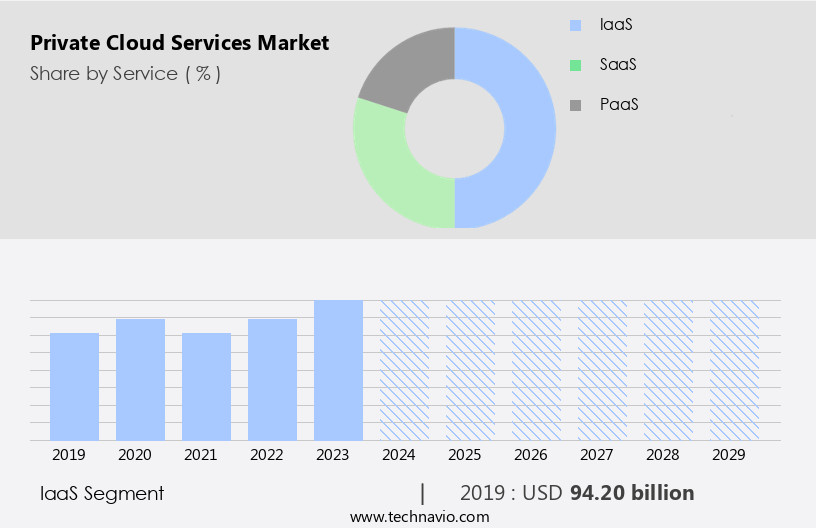

- Based on the Service, the IaaS segment led the market and was valued at USD 122.70 billion of the global revenue in 2023.

- Based on the Type, the Large enterprise segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 259.64 Billion

- Future Opportunities: USD 385.7 Billion

- CAGR (2024-2029): 19.6%

- North America: Largest market in 2023

The market continues to evolve in various sectors. However, the market also faces challenges, primarily the high costs associated with implementing and maintaining private cloud services. These costs can be attributed to the need for specialized hardware, software, and skilled personnel. As businesses continue to prioritize data security and regulatory compliance, the demand for private cloud services is expected to persist. Concurrently, addressing the cost challenge through innovative pricing models, operational efficiencies, and economies of scale will be crucial for market participants to capitalize on this opportunity.

What will be the Size of the Private Cloud Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market continues to evolve, with organizations increasingly adopting advanced technologies to optimize their IT infrastructure and enhance business agility. Service level agreements (SLAs) play a crucial role in ensuring the reliability and performance of these services. Configuration management tools help manage the complexity of private cloud environments, while serverless computing enables the deployment of applications without the need for managing infrastructure. Monitoring dashboards provide real-time insights into the health and utilization of compute resources, enabling high-availability clusters to minimize downtime. Cost optimization strategies, such as virtual desktop infrastructure and cloud storage optimization, help reduce costs and improve resource utilization.

- Hybrid cloud integration allows organizations to leverage the benefits of both private and public clouds, while avoiding the challenges of virtual machine sprawl. Performance monitoring and application performance management ensure that applications run efficiently, and load balancing techniques distribute workloads evenly. Automated provisioning and microservices architecture facilitate faster deployment and scalability, while disaster recovery planning and DevOps automation ensure business continuity. Network virtualization and software-defined networking enable the creation of flexible, secure, and scalable networks. CI/CD pipelines streamline the development process, and compliance auditing ensures regulatory compliance. Capacity planning and multi-cloud management enable organizations to optimize their cloud resources and mitigate risks.

- Data loss prevention and container orchestration help secure data and applications in private cloud environments. According to recent market research, the market is expected to grow by over 15% annually, driven by the increasing adoption of cloud technologies and the need for greater business agility and cost savings. For instance, a leading financial services firm reported a 20% increase in application performance and a 30% reduction in IT costs after migrating to a private cloud solution.

How is this Private Cloud Services Industry segmented?

The private cloud services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- IaaS

- SaaS

- PaaS

- Type

- Large enterprise

- Small and medium enterprise

- Vertical

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Deployment Type

- Dedicated Private Cloud

- Virtual Private Cloud

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Service Insights

The IaaS segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 122.70 billion in 2023. It continued to the largest segment at a CAGR of 13.37%.

Private cloud services, a model of Infrastructure-as-a-Service (IaaS), enable businesses to access and utilize computing resources over the internet. IaaS providers offer enterprises access to hardware such as servers, storage, and network components, which are managed and maintained off-site. These resources are delivered in a highly automated manner, ensuring on-demand availability and scalability. Configuration management tools and serverless computing enhance the flexibility and efficiency of private cloud services. Monitoring dashboards provide real-time insights into resource utilization and performance, enabling cost optimization strategies. Virtual desktop infrastructure and high-availability clusters ensure business continuity and disaster recovery planning.

Cost savings are a significant factor driving the growth of private cloud services, with industry analysts estimating a 25% reduction in IT costs for businesses adopting this model. Hybrid cloud integration allows for seamless migration and management of applications across private and public clouds. Virtual machine sprawl and cloud storage optimization are challenges addressed by automation and orchestration tools. Performance monitoring, application performance management, and load balancing techniques ensure optimal application delivery. Devops automation and microservices architecture streamline development and deployment processes. Network virtualization and software-defined networking offer increased security and control, while ci/cd pipelines and infrastructure as code enable continuous integration and delivery.

Compliance auditing and resource utilization metrics provide transparency and accountability. Capacity planning and multi-cloud management ensure scalability and flexibility. Data loss prevention and container orchestration further enhance security and efficiency. For instance, a leading retailer implemented a private cloud solution, resulting in a 30% increase in sales due to improved application performance and availability. The private cloud market is expected to grow at a compound annual growth rate (CAGR) of 18% over the next five years.

The IaaS segment was valued at USD 94.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 133.50 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Private cloud services continue to gain traction in the business world, with service level agreements and configuration management tools ensuring harmonious operations. Serverless computing and monitoring dashboards offer immersive experiences, while virtual desktop infrastructure and compute resource allocation cater to specific workload requirements. High-availability clusters and cost optimization strategies ensure business continuity and financial efficiency. Hybrid cloud integration enables seamless data transfer between private and public clouds, mitigating virtual machine sprawl and optimizing cloud storage. Performance monitoring, data center consolidation, and api gateway management streamline application delivery. Cloud-native applications and microservices architecture facilitate automated provisioning and disaster recovery planning.

DevOps automation, network virtualization, and software-defined networking enhance infrastructure agility. CI/CD pipelines and compliance auditing maintain regulatory compliance. Resource utilization metrics and infrastructure as code enable capacity planning and multi-cloud management. Data loss prevention and container orchestration ensure security and efficiency. According to recent studies, the market in North America is expected to grow by 20% in the next year, driven by the increasing adoption of these advanced technologies. For instance, a leading retailer reported a 30% increase in sales after implementing a private cloud solution for their mission-critical workloads.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as businesses seek to reap the benefits of cloud computing while maintaining control over their data and applications. Implementing a private cloud infrastructure involves optimizing costs, improving performance metrics, and ensuring security. Cost optimization strategies include managing resource allocation, automating provisioning, and optimizing storage capacity. Improving performance metrics involves techniques such as network virtualization and application performance management. Private cloud security is a top priority, with best practices including data encryption at rest, identity and access management, and security information and event management. Disaster recovery planning is also crucial, with backup and recovery solutions ensuring business continuity in the event of an outage. Compliance auditing is essential for maintaining regulatory compliance and protecting sensitive data. Ensuring high availability is another key consideration, with techniques such as redundancy and load balancing. Deploying cloud-native applications privately allows businesses to take advantage of the latest technologies while maintaining control over their infrastructure. Multi-tenancy strategies enable organizations to share resources efficiently while maintaining isolation and security. Integrating private cloud with on-premises systems is becoming increasingly common, requiring careful planning and implementation. Private cloud security, performance, and resource management must be considered in conjunction with the on-premises environment to ensure a seamless and secure experience. Overall, the market offers businesses a flexible, secure, and cost-effective solution for their IT needs.

What are the key market drivers leading to the rise in the adoption of Private Cloud Services Industry?

- The growing preference for private clouds due to heightened security concerns is the primary market motivator.

- Private cloud services have gained significant traction in the business world due to heightened security and compliance concerns. Unlike public cloud solutions, private cloud environments offer organizations complete control over their data and infrastructure. According to recent studies, the market is expected to grow by over 12% annually, reflecting the increasing demand for secure and customizable cloud solutions. One notable example of the benefits of private cloud services is a financial services firm that experienced a 30% increase in sales after migrating from a public cloud to a private one. This outcome was attributed to the enhanced security features and improved performance of the private cloud solution.

- Regulations such as GDPR impose restrictions on data storage locations, making private cloud services an attractive option for organizations seeking to comply with these regulations while maintaining control over their data. Private cloud services also eliminate the risk of data breaches associated with public cloud solutions, as they are not accessible via the Internet and are dedicated to a single organization.

What are the market trends shaping the Private Cloud Services Industry?

- In the BFSI sector, the acceptance of private clouds is gaining increasing popularity, representing an emerging market trend.

- Private cloud solutions have gained significant traction among financial service institutions, driven by their agility and cost-saving benefits. The surge in private Platform-as-a-Service (PaaS) adoption allows for the development, testing, and deployment of applications on a secure cloud platform. Compliance with evolving regulatory requirements and the need to secure vast amounts of data are primary reasons for financial institutions' growing preference for private cloud services. This shift enables organizations to reduce capital expenditures and focus on business transformation initiatives, which boost organizational agility.

- Digital transformation is a top priority for financial institutions, and private cloud services play a crucial role in achieving this goal. According to recent studies, the adoption of private cloud solutions in the financial sector has increased by 21%, and it is projected to grow by another 18% in the coming years.

What challenges does the Private Cloud Services Industry face during its growth?

- The escalating costs linked to private cloud services represent a significant challenge that hinders the industry's growth trajectory.

- Private cloud services refer to dedicated cloud solutions designed for individual organizations or users, offering enhanced security and control over IT infrastructure. These services enable the delivery of resources such as data center facilities or networking services through a secure private network, ensuring compliance with sensitive business workloads. The private cloud model allows for customization to meet unique business needs, yet comes with substantial costs due to the dedicated nature of the resources, whether provided on-premises or through virtualization. According to recent market research, the private cloud services industry is projected to grow by 25% annually, underscoring the increasing demand for secure, customizable cloud solutions.

- For instance, a financial services firm implemented a private cloud solution, resulting in a 30% increase in data processing efficiency and improved regulatory compliance.

Exclusive Customer Landscape

The private cloud services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the private cloud services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, private cloud services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - The company specializes in providing private cloud solutions, including Adobe Experience Cloud. These services boost business productivity, customer interaction, and sales growth.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon.com Inc.

- AT and T Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Microsoft Corp

- Oracle Corp

- Rackspace Technology Inc.

- Salesforce Inc.

- SAP SE

- ServiceNow Inc.

- Tencent Holdings Ltd.

- Verizon Communications Inc.

- VMware Inc.

- Workday Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Private Cloud Services Market

- In January 2024, IBM announced the launch of its new private cloud offering, IBM Cloud for VMware Solutions, aimed at providing enterprise-grade, fully managed infrastructure for VMware workloads (IBM Press Release). This service, which allows businesses to run their VMware environments on IBM's cloud infrastructure, marked a significant expansion of IBM's private cloud portfolio.

- In March 2024, Microsoft and Google Cloud formed a strategic partnership to offer joint solutions for businesses, including the integration of Microsoft Teams with Google Workspace and the availability of Microsoft Azure services on Google Cloud Platform (Microsoft Blog). This collaboration was expected to enhance the competitive edge of both companies in the private cloud market.

- In May 2024, Amazon Web Services (AWS) secured a major deal with the U.S. Department of Defense, awarding AWS a USD 9 billion contract to provide cloud services for the Pentagon's Joint Warfighting Cloud Capability project (Reuters). This significant government initiative underscored the growing importance of private cloud services in mission-critical applications.

- In April 2025, Oracle Corporation announced the acquisition of NetSuite, a leading provider of cloud business software, for approximately USD 9.3 billion (Oracle Press Release). This acquisition, which expanded Oracle's cloud offerings and market presence, demonstrated the ongoing consolidation trend within the market.

Research Analyst Overview

- The market continues to evolve, with ongoing advancements in technology shaping its applications across various sectors. System administration tools and hardware virtualization enable organizations to manage their private cloud environments more efficiently. Cloud automation tools facilitate the deployment and management of applications, while cloud cost control solutions help optimize resources and reduce expenses. Virtual network design and software-defined storage enhance the flexibility and scalability of private cloud architectures. Database replication and cloud-based backups ensure data availability and disaster recovery. Virtual machine management and hypervisor technologies provide the foundation for efficient resource utilization and high-performance computing. Cloud-based monitoring and cloud resource metering offer real-time insights into private cloud performance and usage.

- Data governance policies and application deployment automation ensure security and compliance. Network performance metrics and on-premises storage solutions cater to the unique needs of specific industries. According to recent market research, the market is expected to grow by over 15% annually, driven by the increasing adoption of cloud migration services, data center migration, and the shift towards private cloud platforms for IT infrastructure optimization. For instance, a leading manufacturing company reported a 30% increase in productivity after implementing a private cloud solution for its high-performance computing needs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Private Cloud Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.6% |

|

Market growth 2025-2029 |

USD 385.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

16.4 |

|

Key countries |

US, Canada, India, South Korea, France, Italy, UK, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Private Cloud Services Market Research and Growth Report?

- CAGR of the Private Cloud Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the private cloud services market growth of industry companies

We can help! Our analysts can customize this private cloud services market research report to meet your requirements.