Refrigerated Road Transportation Market Size 2024-2028

The refrigerated road transportation market size is forecast to increase by USD 4.37 billion at a CAGR of 7.3% between 2023 and 2028.

- The market is experiencing significant growth due to rising initiatives to promote the cold chain and ensure food safety. Advanced refrigerator monitoring systems are being adopted to minimize losses caused by temperature excursions, thereby enhancing the efficiency and reliability of the transportation process. The increasing demand for perishable goods, particularly in the food and pharmaceutical industries, is also driving market growth.

- Additionally, the implementation of stringent regulations to maintain the quality and safety of temperature-sensitive goods is further boosting market expansion. However, challenges such as high operational costs, lack of standardization, and the need for specialized infrastructure continue to pose significant hurdles for market growth. Despite these challenges, the market is expected to witness robust growth in the coming years due to the increasing consumer preference for fresh and high-quality products.

What will be the Refrigerated Road Transportation Market Size During the Forecast Period?

- The market is a significant segment of the cold chain logistics industry, focusing on the transportation of perishable goods such as dairy products, confectionery, frozen foods, and pharmaceutical items. Ensuring food safety and reducing waste are key priorities in this market. Eco-friendly solutions and sustainability are becoming increasingly important, with the use of renewable energy sources like electric power in transport refrigeration systems gaining popularity. Affordability and accessibility are crucial factors influencing market growth. Refrigerated trucks equipped with single temperature systems cater to specific commodities, while multi-temperature systems accommodate various temperature requirements. Product temperature control is essential to maintain the quality and integrity of perishable goods.

- Additionally, diesel-powered refrigerated trucks have traditionally dominated the market, but there is a shift towards electric refrigeration systems to reduce carbon emissions and improve sustainability. Fast food chains and quick service restaurants are significant consumers of refrigerated transport services due to their need for constant supply of fresh ingredients. Container-based refrigeration systems are also gaining traction, offering cost-effective and efficient solutions for long-haul transportation of perishable goods.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Refrigerated trailers

- Refrigerated vans

- Application

- Chilled food

- Frozen food

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

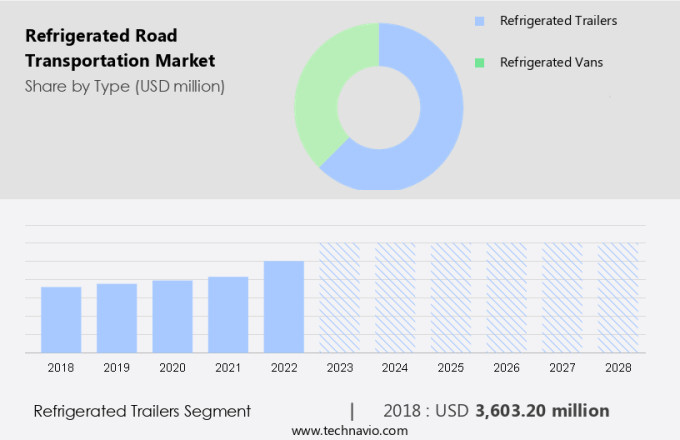

- The refrigerated trailers segment is estimated to witness significant growth during the forecast period.

The market plays a crucial role in ensuring the cold chain logistics of perishable goods, particularly in the food industry. These goods, including dairy products, confectionery, and frozen foods, require specific temperature conditions to maintain their quality, food safety, and reduce waste. Dairy products, such as cheese, butter, spreadable fats, cream, drinkable yogurt, dairy-based and soy-based desserts, quark, soymilk, and soy drinks, milk, and yogurt, are highly perishable and susceptible to microbial growth. As a result, they necessitate a low-temperature environment during transportation. Food manufacturers, fast food chains, and quick service restaurants rely on refrigerated transport to ensure the affordability and accessibility of these perishable items.

Additionally, energy costs and capital investments in advanced vehicles and system technologies are essential considerations for refrigerated transport. Fuel costs and fuel consumption management are also vital in minimizing operational expenses. Cold storage facilities, intermodal transport, rail shipments, reefer containers, and refrigerated rail transport are essential transport modes for perishable goods. Skilled labor, advanced vehicles, and system technologies are necessary to maintain the temperature conditions and ensure food quality and safety. Chilled food, convenience foods, semi-trucks, fish, meat, milk, and other perishable items are transported using evaporators and temperature control systems to maintain the required temperature conditions. Overall, the market is essential for the foodservice industry, focusing on sustainability, eco-friendly solutions, and reducing food loss.

Get a glance at the market report of share of various segments Request Free Sample

The refrigerated trailers segment was valued at USD 3.60 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

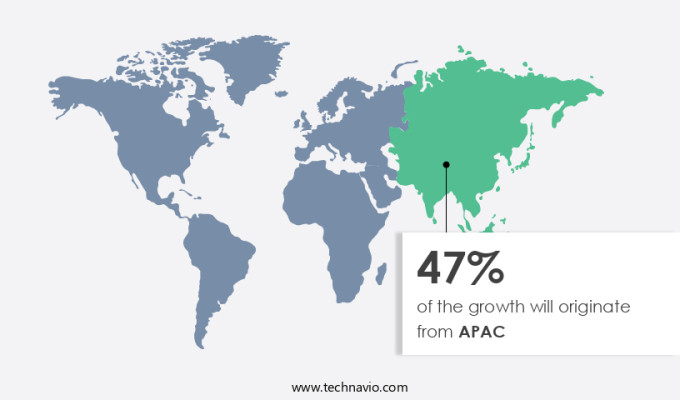

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Refrigerated road transportation plays a crucial role in ensuring the preservation of perishable goods, including frozen products, pharmaceutical items, and perishable foods, during transit. Vehicle refrigeration systems, comprising control equipment and containers, are integral to maintaining the desired product temperature. These systems can operate on diesel or electric power, with single temperature and multi-temperature systems available.

Additionally, single-temperature systems maintain a constant temperature, while multi-temperature systems cater to different temperature requirements. Transport refrigeration systems have come under scrutiny due to their greenhouse gas emissions, primarily from hydrofluorocarbons (HFCs) used in refrigerants. To mitigate this, heavy trucks are being retrofitted with more eco-friendly alternatives, such as natural refrigerants. The volume estimation for the market is expected to grow significantly, driven by the increasing demand for online groceries and the need to ensure the cold chain integrity of these perishable goods.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Refrigerated Road Transportation Market?

Rising initiatives to promote cold-chain are the key drivers of the market.

- The market, a crucial component of cold chain logistics, has gained significant traction in countries such as Brazil, China, India, and South Africa, which were in the nascent stage during 2005-2015. International regulatory bodies and governments worldwide have introduced stringent regulations to ensure food and drug safety, thereby driving the growth of the sector. For instance, the World Health Organization (WHO) formulated guidelines for maintaining and managing international packaging and shipping of perishable goods like vaccines. Similarly, the China Food and Drug Administration (CFDA) established a set of basic rules for good supply practices of pharmaceutical products.

- Additionally, the cold chain logistics market caters to various sectors, including dairy products, confectionery, frozen foods, and fish and meat, among others. Food manufacturers, fast food chains, quick service restaurants, and the foodservice industry rely heavily on refrigerated transport to ensure food quality, safety, and affordability. The use of advanced vehicles and system technologies, such as evaporators and fuel consumption management systems, help reduce waste and promote eco-friendly solutions and sustainability. Transport modes like semi trucks, rail shipments, intermodal transport, and refrigerated rail transport are increasingly being adopted to optimize energy costs and capital investments.

- In conclusion, the availability of skilled labor, cold storage facilities, and transport infrastructure are essential factors influencing the growth of the refrigerated transport market. Chilled food and convenience foods, such as milk, milk products, and fish, require specialized temperature-controlled transport to maintain their quality and safety during transit. Overall, the refrigerated transport market plays a vital role in reducing loss of food and ensuring the availability and accessibility of perishable goods to consumers.

What are the market trends shaping the Refrigerated Road Transportation Market?

Advances in refrigerator monitoring systems are the upcoming trends in the market.

- The market is a crucial segment of cold chain logistics that ensures the safe and efficient transportation of perishable goods, including dairy products, confectionery, frozen foods, fish, meat, milk, and chilled food. Food safety and waste reduction are key priorities in this market, driving the demand for eco-friendly solutions and sustainability. Food manufacturers, fast food chains, and quick-service restaurants rely on refrigerated transport to maintain food quality and safety, while minimizing energy costs and capital investments. Advanced vehicles and system technologies, such as evaporators and fuel consumption management systems, are essential for optimizing refrigerated transport operations.

- Additionally, intermodal transport modes, including refrigerated rail transport and reefer containers, offer cost-effective alternatives to semi trucks. The transport infrastructure, skilled labor, and regulatory compliance are essential considerations for refrigerated transport providers. Overall, the market is a dynamic and evolving industry that requires continuous innovation and improvement to meet the growing demands of the foodservice industry.

What challenges does Refrigerated Road Transportation Market face during the growth?

Losses due to temperature excursion are a key challenge affecting the market growth.

- The market plays a crucial role in ensuring the safe and efficient delivery of perishable goods, including dairy products, confectionery, frozen foods, and fish, meat, and milk. Cold chain logistics, a critical component of this market, prioritizes food safety and waste reduction through eco-friendly solutions and sustainability. Food manufacturers, fast food chains, and quick service restaurants heavily rely on refrigerated road transportation to maintain food quality and safety, as temperature excursions can lead to significant losses and increased energy costs. Capital investments in advanced vehicles, system technologies, and cold storage facilities are essential for reducing fuel consumption and managing fuel costs.

- However, intermodal transport, such as refrigerated rail transport, and transport infrastructure development are also vital for the growth of the market. Skilled labor is another essential factor, as handling and managing chilled food, convenience foods, and semitrailers requires expertise. Key challenges include the high cost of equipment maintenance and replacement, as well as the need for continuous innovation to meet evolving industry demands. Temperature control is paramount in the market, with evaporators and reefer containers playing essential roles in maintaining optimal temperatures. Overall, the market's success hinges on its ability to provide reliable, cost-effective, and sustainable solutions for the transportation of temperature-sensitive goods.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AP Moller Maersk AS

- Bay and Bay Transportation

- C H Robinson Worldwide Inc.

- Carrier Global Corp.

- CMA CGM Group

- CRST The Transportation Solution Inc.

- Daikin Industries Ltd.

- DB Schenker

- Deutsche Post AG

- FedEx Corp.

- GAH Refrigeration LTD.

- Great Dane LLC

- Knight Swift Transportation Holdings Inc.

- Mike Frost Trucking Inc.

- Unternehmensgruppe Theo Muller

- WEL Companies Inc.

- West Coast Carriers

- Witte Bros Exchange Inc.

- XPO Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a significant segment of the cold chain logistics industry, focusing on the transportation of perishable goods such as dairy products, confectionery, frozen foods, fish, meat, and milk. The market prioritizes food safety and waste reduction through eco-friendly solutions and sustainability. Food manufacturers, fast food chains, and quick service restaurants rely on to ensure food quality and safety during distribution. Affordability and accessibility are essential factors driving market growth. Advanced vehicles and system technologies, including evaporators, help minimize energy costs and fuel consumption.

Additionally, capital investments in cold storage facilities and intermodal transport, such as refrigerated rail transport and reefer containers, expand transport modes and improve infrastructure. Skilled labor and efficient transport management are crucial to maintaining food quality and safety. The market caters to various sectors, including chilled food, convenience foods, and the foodservice industry. Semi trucks and transport infrastructure play a vital role in the efficient and cost-effective movement of perishable goods.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2024-2028 |

USD 4.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.37 |

|

Key countries |

China, US, Japan, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch