US Cornmeal Market Size 2024-2028

The US cornmeal market size is forecast to increase by USD 42.8 million at a CAGR of 3.2% between 2023 and 2028.

- The cornmeal market in North America is witnessing significant growth due to several key factors. The baking industry's expansion is driving market growth, as cornmeal is extensively used in baked goods. Additionally, the increasing awareness of consumers towards gluten-free products is boosting the market's demand. Climate change poses a challenge to corn crop production, which may impact the market's supply and pricing. Despite these challenges, the market is expected to continue its growth trajectory, offering opportunities for stakeholders. The report provides a comprehensive analysis of these trends and growth factors, enabling market participants to make informed business decisions.

What will be the size of the US Cornmeal Market during the forecast period?

- The market is a significant sector within the broader grain-based foods industry, driven by its versatility and widespread use in various applications. Cornmeal, derived from corn grits or corn flour, is a staple food in American households and is essential in baking, particularly for items like cornbread, polenta, and tortillas. The market encompasses both stone-ground and steel milled varieties, catering to diverse consumer preferences. Beyond its traditional uses, cornmeal offers nutritional benefits, containing essential minerals such as manganese, copper, zinc, phosphorus, magnesium, and iron. Its high fiber content makes it an attractive option for consumers seeking healthier alternatives, especially for those with dietary restrictions or health conditions like atherosclerosis.

- Cornmeal's applications extend beyond the kitchen, with uses in the production of breadcrumbs and as a base for various sauces and soups. The market is populated by both organized and unorganized players, reflecting the diverse nature of the industry. Despite intense competition, the market continues to grow, driven by consumer demand for convenient, nutritious, and versatile food options.

How is this market segmented and which is the largest segment?

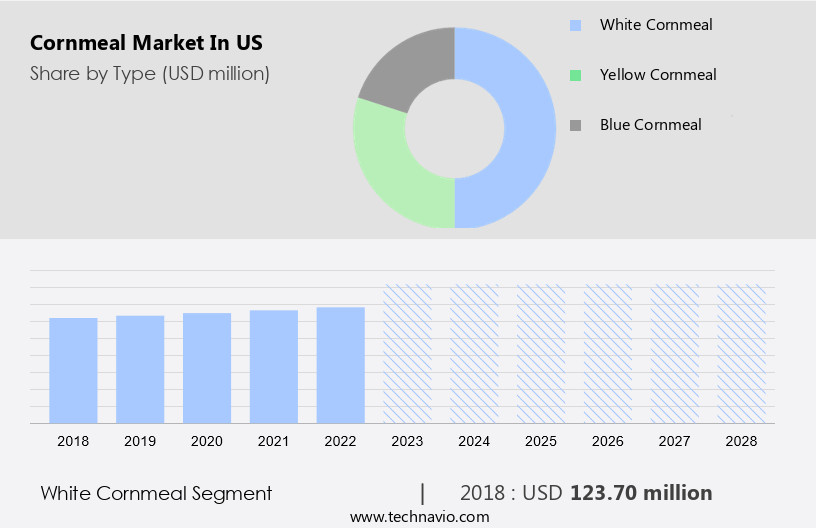

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- White cornmeal

- Yellow cornmeal

- Blue cornmeal

- Product

- Conventional

- Organic

- End-user

- Industrial

- Retail

- Foodservice

- Geography

- US

By Type Insights

- The white cornmeal segment is estimated to witness significant growth during the forecast period.

The market encompasses various types, including white and stone-ground cornmeal. White cornmeal, derived from white corn, holds a significant market share due to its versatility and nutritional benefits. Rich in fiber and selenium, it is a staple ingredient in American cuisine, primarily used for cornbread production. Moreover, its application extends to the food industry, where it is incorporated into cakes, pastries, and baked goods. The increasing preference for gluten-free options, fueled by the growing number of individuals with gluten intolerance in North America, further boosts the demand for white cornmeal. Additionally, it is utilized In the production of breadings, batters, and coatings for the foodservice industry.

Cornmeal, in its whole grain form, offers various health benefits, including the presence of essential minerals like manganese, copper, zinc, and phosphorus, making it a popular choice for health-conscious consumers.

Get a glance at the market share of various segments Request Free Sample

The white cornmeal segment was valued at USD 123.70 million in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of US Cornmeal Market?

Growth in the baking industry is the key driver of the market.

- The market is witnessing significant growth due to its extensive applications in various industries, including the baking sector. Cornmeal is a versatile ingredient used In the production of bakery items such as polenta, tortillas, cornbread, and gourmet food products like grits, cornflakes, chips, and snacks. The fiber content in cornmeal makes it an attractive option for consumers seeking healthier alternatives, particularly for those with dietary restrictions, such as atherosclerosis patients and individuals with osteoporosis. Cornmeal manufacturers produce various types, including stone ground cornmeal, steel milled, and determined. The market caters to household consumption as well as the food service industry, with end-use applications ranging from breadings, batters, coatings, and cereals to chips, grain alcohol, and corn syrup.

- The market is segmented based on grain type, including whole corn, bolted, and degerminated, and product forms, such as corn grits, corn flour, whole corn grain, corn mixes, and corn syrup. The baking industry's growth is a significant factor driving the market's expansion, with an increase in demand for fresh and frozen bread and rolls, cakes, pies, and other pastries, cookies, crackers, pretzels, and tortillas. The market's growth is expected to continue, with potential markets like the US reporting significant growth in recent years due to changing consumer diets and increasing health awareness. The cornmeal market is also influenced by strategic decisions In the food processing industry, transportation restrictions, and the supply chain. Minerals such as manganese, copper, zinc, phosphorus, and magnesium are essential nutrients found in cornmeal, making it a valuable source of essential minerals for consumers.

What are the market trends shaping the US Cornmeal Market?

Increasing awareness about gluten-free products is the upcoming trend In the market.

- The cornmeal market In the US has witnessed growth due to the increasing demand for gluten-free products. As cornmeal is naturally gluten-free, it has become a popular alternative to wheat-based flour. Gluten is a protein found in grains like wheat, barley, rye, and others, which forms a sticky network when water is added, making the flour elastic and chewy. Some individuals are intolerant to gluten, leading to celiac disease, a serious form of intolerance. Cornmeal finds extensive applications in various sectors, including bakery, foodservice, and household. In the bakery industry, it is used to make polenta, tortillas, cornbread, and gourmet food products.

- Cornmeal is also used as breading, batters, coatings, and fibre In the foodservice industry. Household consumption includes the use of cornmeal in making breadcrumbs, cereals, chips, and grits. The market is segmented into various classes, including whole grain, degerminated, self-rising, and enriched. The fiber content in cornmeal is a significant health benefit, as it aids in disease prevention, including atherosclerosis and osteoporosis. Cornmeal manufacturers produce various types, including bolted, degerminated, stone-ground, white, and blue cornmeal. The cornmeal market caters to various end-users, including millennials, traditional food products, and the foodservice industry. The food processing industry uses cornmeal to produce corn flour, whole corn grain, corn mixes, and corn syrup.

What challenges does US Cornmeal Market face during the growth?

Exposure of corn crops to climate change is a key challenge affecting the market growth.

- The market is significantly influenced by the production of corn crops, with applications ranging from bakery items like polenta, tortillas, and cornbread, to household uses such as breadings, batters, coatings, and fibre-rich cornmeal. Cornmeal manufacturers produce various types, including stone ground, steel milled, whole grain, gluten-free products, and cereals, transforming it into grits, corn flour, and corn syrup. The market caters to various industries, including foodservice, feed, and household consumption. Climatic changes pose a challenge to the cornmeal market In the US. Extreme weather conditions, such as heatwaves and unpredictable rainfall, can negatively impact corn yields. Corn plants are sensitive to heat and drought, which can lead to low yields and higher production costs.

- Additionally, increased pests and diseases due to changing climatic conditions can further reduce crop yields. Despite these challenges, the market remains diverse and segmented, with players offering organic, conventional, blue, bolted, degerminated, self-rising, and enriched cornmeal. The market is further categorized by end-use, including food processing, foodservice, and household consumption. Strategic decisions In the cornmeal market are influenced by factors such as nutritional value, fiber content, carbohydrate content, and health benefits. Cornmeal is a staple food In the US, with applications in various industries and consumer preferences. It is used In the production of gourmet food, snacks, taco shells, and breakfast foods.

Exclusive US Cornmeal Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anson Mills

- Archer Daniels Midland Co.

- Associated British Foods Plc

- Bobs Red Mill Natural Foods Inc.

- Bunge Ltd.

- C.H. Guenther and Son Inc.

- Cargill Inc.

- Continental Mills Inc.

- Dover Corn Products Ltd.

- General Mills Inc.

- Goya Foods Inc.

- Grain Millers Inc.

- Gruma SAB de CV

- Hometown Food Co.

- LifeLine Foods LLC

- Nunn Milling Co.

- PepsiCo Inc.

- SEMO Milling LLC

- The Kroger Co.

- The Raymond Hadley Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market In the global context encompasses a wide range of applications and product forms. Cornmeal, derived from corn, plays a significant role in various industries, including bakery applications, foodservice, and household consumption. The versatility of cornmeal is evident in its usage in various end-products such as polenta, tortillas, cornbread, and grits. Fiber content is an essential attribute of cornmeal, with whole grain and stone ground varieties offering higher fiber content compared to degerminated and self-rising types. The production process, including steel milling and stone grinding, influences the fiber content and nutritional value of cornmeal. Cornmeal's nutritional value extends beyond fiber, as it is rich in essential minerals like manganese, copper, zinc, phosphorus, and magnesium.

Moreover, iron is another essential mineral found in cornmeal, making it a valuable ingredient for individuals with dietary requirements. The food processing industry utilizes cornmeal extensively In the production of breadings, batters, coatings, and other food additives. Household consumption includes the use of cornmeal in baking, cereals, snacks, and as a staple food. The foodservice industry, particularly In the Western culture, uses cornmeal in various applications, including taco shells, gourmet food, and even In the fast-food sector. The cornmeal market is segmented based on end-use, with food processing and foodservice being significant contributors. The feed industry also utilizes cornmeal as a raw material.

Furthermore, the market is further segmented into business-to-business and business-to-consumer channels, with grocery retail and online sales channels being crucial distribution channels. The cornmeal market dynamics are influenced by various factors, including the nutritional benefits of whole grain cornmeal, the growing trend of clean labels, and the increasing demand for gluten-free products. The market is also impacted by supply chain considerations, such as transportation restrictions and raw material availability. The corn kernel is the primary raw material for cornmeal production. The market is influenced by the price and availability of corn, which can impact the profitability of cornmeal manufacturers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market Growth 2024-2028 |

USD 42.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch