US Data Center Fabric Market Size 2024-2028

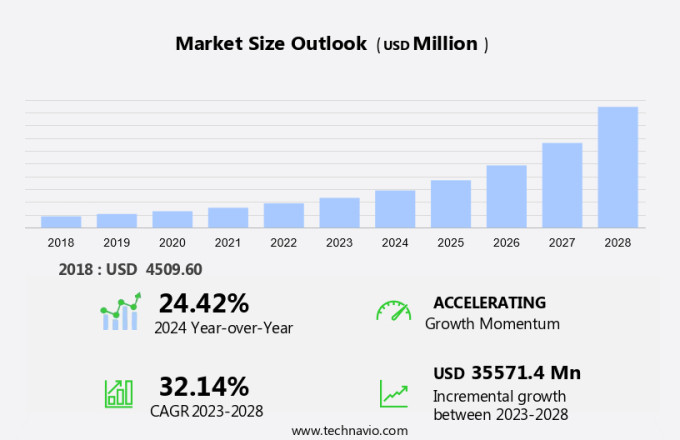

The US data center fabric market size is forecast to increase by USD 35.57 billion at a CAGR of 32.14% between 2023 and 2028. The market is experiencing significant growth due to several key trends. The increasing demand for cloud computing services is driving the market, as these provide the necessary infrastructure for building scalable and efficient cloud environments. Another trend is the growth of hyper-converged infrastructure (HCI), which simplifies management and reduces complexity. However, the high cost of implementation and maintenance remains a challenge for market growth. This offers a solution by enabling automation, simplifying network management, and reducing the need for manual intervention. Despite the initial investment, the long-term benefits of improved efficiency, scalability, and agility make fabrics an attractive option for US businesses.

What will be the Size of the Market During the Forecast Period?

The market is experiencing significant growth due to the increasing demand for IT and communication infrastructure in various industries, including healthcare, computing resources, and cloud computing services. The market is driven by the need for high-bandwidth communication and low-latency networks to support data-intensive applications, such as artificial intelligence and IoT. Routers and switches are the key components, providing logical unit connectivity and enabling high-speed data transfer between servers and storage systems. The adoption of software-defined networking (SDN) and network function virtualization (NFV) technologies is also fueling the market's growth, allowing for more efficient and flexible network management.

The shift towards virtualized and edge computing is also driving demand, as these architectures require high-speed, low-latency communication between virtual machines and cloud storage. The legacy three-tiered network architecture is being replaced by more agile and scalable fabric-based designs, offering improved performance and reduced complexity. Data storage and data-intensive applications are other major factors driving the market, as organizations seek to maximize their computing resources and minimize the risk of data loss or downtime. Overall, the market in the US is expected to continue growing as businesses increasingly rely on IT infrastructure to support their digital transformation initiatives.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- IT

- BFSI

- Retail

- Healthcare

- Others

- End-user

- Cloud service providers (CSPs)

- Enterprises

- Telecom service providers (TSPs)

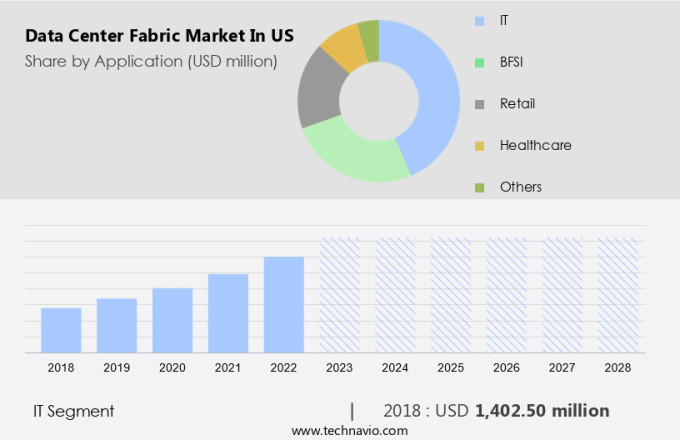

By Application Insights

The IT segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth due to the increasing adoption of software-defined networking (SDN) and network function virtualization (NFV) in data-intensive applications. These technologies enable high-bandwidth, low-latency communication, essential for handling large data transfer rates and complex data flows. Artificial intelligence (AI) and data analytics are also driving the market, as they require advanced network architectures to manage and protect sensitive information. Cybersecurity concerns are a major factor influencing the market, with the need for encryption, access controls, and network security equipment becoming increasingly important. Data protection laws and regulations are also shaping the market, as organizations seek to comply with these requirements.

Network architecture is evolving from conventional three-tiered designs to virtualized systems, which offer greater flexibility and scalability. Telecom service providers, cloud service providers, media and entertainment companies, IT services, servers, and storage area networks (SANs) are among the key users. Fifth-generation technology and multitiered architectures are expected to further boost the market, as they enable faster data transfer speeds and more efficient data management. Virtual machines, cloud storage, big data tools, and logical unit networking are also key trends in the market. Despite these opportunities, the market faces challenges, including the need for interoperability between different companies and the complexity of managing and securing virtualized environments.

Get a glance at the market share of various segments Request Free Sample

The IT segment was valued at USD 1.40 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

US Data Center Fabric Market Driver

Increasing demand for cloud computing is the key driver of the market. The usage of cloud computing continues to grow in popularity due to its convenience and flexibility in storing and managing data and applications online. This is a critical component of modern architectures, particularly in the context of cloud computing. With the increasing adoption of cloud services by businesses and organizations across various sectors, the demand for efficient and secure data transfer rates has grown significantly. Software-defined networking (SDN) and network function virtualization (NFV) are key technologies driving the evolution of fabrics, enabling high-bandwidth, low-latency communication between servers, storage area networks (SANs), controllers, switching, routers, and other network security equipment. Data-intensive applications, such as data analytics, artificial intelligence, and multimedia, require high data transfer speeds and minimal latency.

Cybersecurity concerns, data protection laws, and the need for access controls add complexity to data flows. Five-generation technology and virtualized are increasingly being adopted to address these challenges. Traditional three-tiered network architectures are being replaced by virtualized, multitiered architectures, which enable greater flexibility and scalability. Virtual machines, cloud storage, and big data tools require seamless integration with the network infrastructure. Telecom service providers, cloud service providers, media and entertainment, IT services, and servers all rely on the fabric to ensure secure and efficient transfer of sensitive information. Encryption, access controls, and management software are essential components of a strong solution. Legacy network architectures are being supplanted by more advanced, virtualized alternatives that can meet the demands of today's data-driven economy.

US Data Center Fabric Market Trends

The growth of hyper-converged infrastructure (HCI) is the upcoming trend in the market. The adoption of hyper-converged infrastructure (HCI) has been increasing due to its ability to simplify IT operations by combining compute, storage, and networking resources into a single solution, making it an attractive option for organizations seeking to streamline their IT environments. The market is expected to experience significant growth due to the increasing adoption of software-defined networking (SDN) and network function virtualization (NFV) in data-intensive applications. With the rise of fifth-generation technology and the need for high-bandwidth communication, architectures are evolving from conventional three-tiered networks to virtualized systems. This transition necessitates the deployment of advanced fabric solutions that enable efficient data transfer rates and minimize latency. Artificial intelligence and data analytics are driving the need for high-speed connectivity and low-latency networks. Cybersecurity concerns and data protection laws necessitate strong encryption and access controls, which are integral components of fabric solutions.

Telecom service providers, cloud service providers, media and entertainment companies, IT services, and servers all require high-performing solutions to manage and protect sensitive information. Data transfer speeds and data flows are critical factors in design. Storage Area Networks (SAN), controllers, switching, routers, network security equipment, and management software are essential components of solutions. Virtualized data centers, multitiered architectures, and cloud storage require efficient and seamless integration of compute and storage resources. Big data tools and virtual machines also necessitate high-performing data center fabric solutions. Legacy network architecture and conventional alternatives are being replaced by virtualized systems to ensure optimal performance and responsiveness.

US Data Center Fabric Market Challenge

The high cost of implementation and maintenance is a key challenge affecting the market growth. The expense associated with implementing and maintaining a system can be significant, requiring a substantial investment from organizations. The market is witnessing significant growth due to the increasing adoption of software-defined networking (SDN) and network function virtualization (NFV) in data-intensive applications. These technologies enable high-bandwidth, low-latency, and multitiered architectures, essential for handling large data transfer rates and complex data flows. However, the initial investments required for deploying data center fabric solutions, comprising high-speed switches, routers, storage area networks (SAN), controllers, network security equipment, and management software, can be substantial. This cost may deter smaller businesses with limited budgets from adopting or upgrading their data center infrastructure. Furthermore, ongoing expenses, such as maintenance checks, software updates, and the need for skilled IT personnel, add to the financial burden.

Cybersecurity concerns, data protection laws, and the need for encryption and access controls further increase the costs. Telecom service providers, cloud service providers, media and entertainment, IT services, servers, and sensitive information are some key industries driving the demand for data center fabric solutions. The benefits of data center fabric, including high-speed data transfer, improved network architecture, and efficient data management, can outweigh the costs for organizations investing in fifth-generation technology and virtualized data centers. Conventional alternatives, such as three-tiered networks and virtual machines, may not offer the same level of performance and flexibility. Cloud storage and big data tools are also increasingly relying on data center fabric solutions for high-speed data transfer and efficient data management.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Appian Corp. - The company offers data center fabric solutions such as De Silo.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Broadcom Inc.

- CDW Corp

- Cisco Systems Inc.

- Cologix Inc.

- CyrusOne LLC

- Cyxtera Technologies Inc.

- Dell Technologies Inc.

- Digital Realty Trust Inc.

- EdgeConneX Inc.

- Equinix Inc.

- EVODC LLC

- Expedient

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- KDDI Corp.

- Nippon Telegraph And Telephone Corp.

- Sabey Corp.

- TierPoint LLC

- Vantage Data Centers Management Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The data center fabric market in the US is witnessing significant growth due to the increasing adoption of IT and communication infrastructure in various industries, including healthcare, financial services, and computing resources. The demand for data center hardware, such as routers and switches, is increasing as organizations seek to enhance their networking capabilities and improve IT resource utilization. The shift towards software-defined networks (SDN) and hybrid cloud solutions is driving the adoption of switch fabrics in data centers. The semiconductor sector is also contributing to the market growth with the development of high-performance processors and Ethernet switches. The proliferation of cloud-based applications, big data, AI, machine learning, AR or VR, and IoT is leading to the deployment of high-bandwidth networking fabrics in data centers.

Real-time application solutions, flat network architecture, and on-premise migration are some of the key trends in the data center infrastructure market. Moreover, the increasing adoption of cloud services, big data storage, and colocation facilities is expected to boost the market growth. The emergence of hyperscale data centers and mobile broadband is also creating new opportunities for data center fabric providers. Big data analytics and edge computing are some of the emerging areas where data center fabrics are being deployed to support real-time processing and analysis of large data sets.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 32.14% |

|

Market Growth 2024-2028 |

USD 3.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

24.42 |

|

Key companies profiled |

Appian Corp., Broadcom Inc., CDW Corp, Cisco Systems Inc., Cologix Inc., CyrusOne LLC, Cyxtera Technologies Inc., Dell Technologies Inc., Digital Realty Trust Inc., EdgeConneX Inc., Equinix Inc., EVODC LLC, Expedient, Hewlett Packard Enterprise Co., International Business Machines Corp., KDDI Corp., Nippon Telegraph And Telephone Corp., Sabey Corp., TierPoint LLC, and Vantage Data Centers Management Co. LLC |

|

Market dynamics |

Parent market analysis, Market forecasting, market forecast, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch